You Have A Part B Late Enrollment Penalty

If you didnt sign up for Part B when you were first eligible for Medicare, and you didnt have health insurance coverage through either your, or your spouses employer, then theres a good chance youll have a Part B penalty. Even if you had coverage through an employer group plan and there were less than 20 employees working at that employer, youll likely have a Part B penalty.

The longer you went without Part B coverage, the larger your penalty will be.

Why Is My Medicare Part B Premium So High

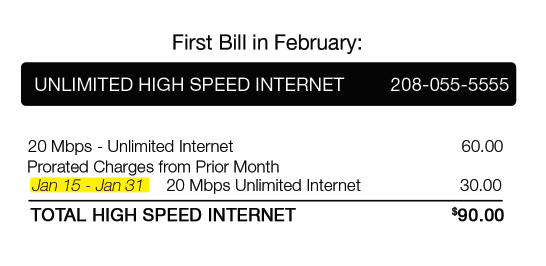

I paid my first Medicare premium for June-Aug 2016 of $365.40 and just received my bill for Sep-Oct-Nov in the amount of $1096.20 . It appears that they’ve billed my quarterly amount as monthly because even at the maximum income adjustment the monthly payment estimate is only $352.60 .

How much should I pay/What should I do???

I’m sorry, but I don’t have a good answer. It certainly appears as though a mistake has been made, so I would try resolving it by phone. The billing notice should show a phone number to call if you have questions about your bill, so I would start there. Don’t fail to pay at least your correct Medicare premiums timely, since that could result in cancellation of your coverage.

Best, Jerry

Do I Need Medicare Part B If I Have Other Insurance

If you work for a large employer and have employer coverage, you may choose to delay enrollment. When you delay enrollment because youre delaying retirement, you wont need to rush to sign up for Part B. Although you may choose to enroll in Part A, especially since, in many cases, its free.

Now, if you choose to enroll in Part A, you can no longer contribute to a Health Savings Account. When you retire, you can sign up for Part B and Part A if you chose not to collect before retirement.

Also Check: Does Medicare Cover Oral Surgery Biopsy

Can You Have A Medicare Advantage Plan And A Medicare Supplement Plan

No, you cant have both a Medicare Advantage plan and a Medigap plan. You have to choose one or the other. Since Medicare Advantage plans handle your claims instead of Medicare, the Medigap plan cant coordinate benefits with Part C.

If you have both, the Medicare Advantage plan will cover you, but the Medigap plan wont. Basically, youre wasting money on Medigap at that point. If you cant decide between the two, work with an agent near you to determine which option really makes the most sense.

What Will Happen If I Don’t Pay My Part B Premium

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you dont pay by that date, youll get a second bill from Medicare asking for that premium payment. That second bill will be due by the 25th of the following month in this case, April 25.

If your second bill remains unpaid by its due date, youll receive a delinquency notice from Medicare. At that point, youll need to send in the total overdue amount by the 25th of the following month to avoid losing coverage. In our example, that would put you at May 25.

All told, youll have a three-month period to pay an initial Medicare Part B bill. If you dont, youll receive a termination notice informing you that you no longer have coverage.

Now if you manage to pay what you owe in premiums within 30 days of that termination notice, youll get to continue receiving coverage under Part B. If you dont do that, your coverage will be discontinued. At that point, youll need to sign up for Part B once again during the general Medicare enrollment period that runs from January 1 to March 31 every year.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

What About Medicare Advantage

Medicare Part C, more commonly known as Medicare Advantage, is similar to Part D in that the plans are provided by private insurance companies. That means your monthly premiums vary depending on your plan and provider. However, Part C is optional. You will never owe late enrollment penalties for a Medicare Advantage plan.

However, signing up for an Advantage plan does not exempt you from the Medicare Part B premium. You’re also still responsible for any late enrollment penalties and the Income-Related Monthly Adjustment Amount, if either of those apply.

If you have a Medicare Advantage Prescription Drug plan and owe the Part D IRMAA, premium payments go to your plan provider you pay the surcharge to Medicare.

Compare your Medicare Advantage, Medigap, and Part D plan options with our Find a Plan tool. Just enter your zip code to begin reviewing Medicare plans in your area.

Medicare Part B Premium Bill

Medicare Part B comes with a monthly premium unless you qualify for financial assistance. If you get help with Medicare costs through a state Medicaid program, such as a Medicare Savings Program, then your Medicare premiums may be paid for by the state. However, if you dont qualify for Medicaid and enroll in Medicare Part B, you may receive a bill for your Medicare premiums, or it may be automatically deducted from your monthly benefits as described below.

If you receive benefits from the Social Security Administration, the Railroad Retirement Board, or the Civil Service, then your Medicare premiums will be deducted from your monthly benefit payment. Otherwise, you have several options when it comes to paying your Medicare premiums, including automated payments from a bank account or mailing a check or credit card payment to the Medicare Premium Collection Center. For more information, see this article on how to pay your Medicare premiums.

You may have to pay an additional premium if youre enrolled in a Medicare Prescription Drug Plan, Medicare Supplement plan, or Medicare Advantage plan. In this case, your Medicare plan will send you a bill for your premium, and youll send the payment to your plan, not the Medicare program. Some Medicare Advantage plans may offer premiums as low as $0. However, remember that regardless of whether you owe a premium for your Medicare plan, youll need to keep paying your Medicare Part B premium.

NEW TO MEDICARE?

Recommended Reading: How Can I Get My Medicare Card Number

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Manual For State Payment Of Medicare Premiums

On September 8, 2020, the Centers for Medicare & Medicaid Services released an updated version of the Manual for State Payment of Medicare Premiums . The manual updates information and instructions to states on federal policy, operations, and systems concerning the payment of Medicare Parts A and B premiums for individuals dually eligible for Medicare and Medicaid. The update to the manual is part of CMS Better Care for Dually Eligible Individuals Strategic Initiative aimed at improving quality, reducing costs, and improving customer experiences.

The prior version of this manual had not been fully updated since the 1990s. The updated manual clarifies various provisions of statute, regulation, and operations that have evolved over time. We redesigned the manual content to make it easier for states to discern federal requirements and find information, compliant with federal accessibility standards and fully available online for the first time.

The manual is part of the CMS Manual System, specifically Pub. 100-24. It is divided into the following sections:

Also Check: How To Get A Lift Chair From Medicare

What Is The Special Enrollment Period

The Special Enrollment Period applies to those who waited to sign up for Medicare because they had existing coverage through either their or their spouses employer or union.

You may enroll for Parts A and/or B through the SEP at any point while still employed or while still covered through your spouses employment. The SEP continues for eight months after either your coverage or employment ends, whichever comes first.

You may also qualify for and SEP if you have a health savings account with a high deductible health plan based on you or your spouses employment.

Please note that COBRA and retiree health plans do not qualify for SEP according to Medicare.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Also Check: How Much Is Medicare B Deductible

Where The Money Comes From

About 70 percent of Part B beneficiaries fall into the hold harmless category, so the extra money has to come from the other 30 percent, who include:

People who enroll in Part B in 2017.

People who are already on Medicare but either havent started getting Social Security yet or sign up during 2017.

Dual eligible people who get both Medicare and Medicaid because of income, disability, or both .

People with an income of more than $85,000 for individuals or $170,000 for a couple, no matter when they started Part B or Social Security. Only about 5 percent of Part B beneficiaries fall into this group, Cubanski says.

As a result, people in the hold harmless group are paying an average Part B premium of $109 in 2017, while everybody else is paying a base premium of $134. And high-income beneficiaries have monthly surcharges on top of that, ranging from $53.30 to $294.50 for the very wealthiest in this group.

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Original Medicare And Part D Irmaa

If you receive a Medicare bill for Part B premium and Part D IRMAA costs, you may pay it in these ways:

- Medicares Easy Pay system lets you pay your Part A or Part B premium electronically. You can pay manually or set up automatic payments to be taken directly from a checking or savings account.

- You can pay with a debit card or credit card by writing your card number directly on your bill and mailing it in.

- You can pay with a check or money order.

Keep Track Of Your Payments

Medicare eligibility begins at 65, whereas full retirement age for Social Security doesnt start until 66, 67, or somewhere in between, depending on your year of birth. Therefore, its common for seniors to enroll in Medicare without signing up for Social Security .

If thats your situation, and you cant have your premiums deducted from your Social Security benefits during the first year or two that youre enrolled in Medicare, automating the process via recurring debits or credit card payments is the best way to avoid accidentally falling behind on Medicare bills and putting your coverage at risk of termination.

Maurie Backman has been writing professionally for well over a decade, and her coverage area runs the gamut from healthcare to personal finance to career advice. Much of her writing these days revolves around retirement and its various components and challenges, including healthcare, Medicare, Social Security, and money management.

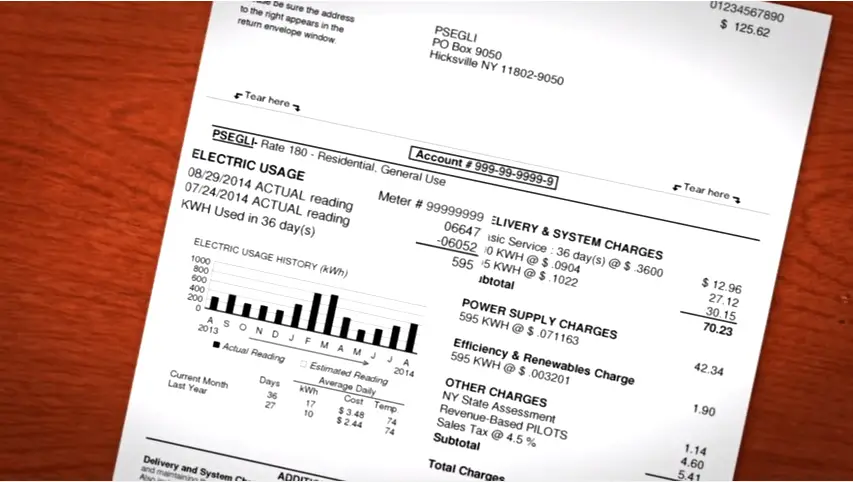

Reasons Why Your Electric Bill May Be So High

The average monthly residential electric bill was $115 in 2019, according to the latest data from the U.S. Energy Information Administration. If yours is much higher, here are possible reasons why your electric bill is jolting your budget other than seasonal heating or cooling changes and what to do about them.

Does My Current Health Insurance Status Affect Whether I Can Get Va Health Care Benefits

No. Whether or not you have health insurance coverage doesnt affect the VA health care benefits you can get.

Note: Its always a good idea to let your VA doctor know if youre receiving care outside VA. This helps your provider coordinate your care to help keep you safe and make sure youre getting care thats proven to work and that meets your specific needs.

What Are The Other Special Enrollment Periods

Medicare offers numerous Special Enrollment Periods besides the SEP mentioned above. These are similar to the change of life exceptions offered by many employer-sponsored insurance plans. If you meet one of these special circumstances, you may make changes to your Medicare coverage.

Qualifying circumstances, as of January 2021, include:

- You are eligible for or lose eligibility for a Special Needs Plan

- You are enrolled in or lose eligibility for a qualified State Pharmaceutical Assistance Program

- You are institutionalized

- You disenroll from your MA plan during the MA disenrollment period

- You enroll in or disenroll from Program of All-Inclusive Care for the Elderly

- You experience an exceptional circumstance

- You experience enrollment errors or contract violations

- You experience issues with Medicare eligibility

- You have a permanent change in your home address

- You have Medicaid, a Medicare Savings Program, or Extra Help

- You join or drop health or drug coverage offered by an employer, including retiree plans

- You lose creditable drug coverage through no fault of your own

- You qualify for a new Part D IEP

- You want to enroll in a 5-star Part C or Part D plan

- You wish to disenroll from your first MA plan

- Your MA or Part D plan no longer offers Medicare coverage

- Your MA plan stops contracting with many of its providers

- Your Part C or Part D plan is consistently low-performing

What Is The Annual Enrollment Period

The Annual Enrollment Period is Medicares annual opportunity to switch from Parts A and B to a Medicare Advantage plan . You can also choose a new MA plan. This is also the time when you can add, drop, or change your Medicare Part D Drug Plan.

AEP begins October 15 and ends December 7. Coverage begins January 1 of the following year.

More About How Va Health Care Works With Medicare And Other Insurance

This is your decision. You can save money if you drop your private health insurance, but there are risks. We encourage you to keep your insurance because:

- We dont normally provide care for Veterans family members. So, if you drop your private insurance plan, your family may not have health coverage.

- We dont know if Congress will provide enough funding in future years for us to care for all Veterans who are signed up for VA health care. If youre in one of the lower priority groups, you could lose your VA health care benefits in the future. If you dont keep your private insurance, this would leave you without health coverage.

- If you have Medicare Part B and you cancel it, you wont be able to get it back until January of the following year. You may also have to pay a penalty to get your coverage back .

Yes. We encourage you to sign up for Medicare as soon as you can. This is because:

Youll need to choose which benefits to use each time you receive care.

To use VA benefits, youll need to get care at a VA medical center or other VA location. Well also cover your care if we pre-authorize you to get services in a non-VA hospital or other care setting. Keep in mind that you may need to pay a VA copayment for non-service-connected care.