Dont Rely On Your Medicare Summary Notice

Most insurance companies will mail an Explanation of Benefits after each claim is submitted, But, this isnt the case with Medicare.

CMS mails your Medicare Summary Notice once a quarter. And, it doesnt provide important details about the Part B deductible. It will simply indicate if youve met the deductible. Which means you still need to make sure that you actually paid Medicares Part B deductible.

Now, its entirely possible to use the Medicare Summary Notice to help track the Part B deductible. You just have to cross reference it with payment information you have on file. The point is to make sure you dont pay more than the Part B deductible for that specific calendar year.

Documentation and cross referencing are the key to knowing how to track the Part B deductible. So, as soon as you start your Medigap plan, and at the beginning of each year, get your techniques in place so you dont accidentally overpay.

About REMEDIGAP

Give us a call at 888-411-1329 or simply click on our quote form for free Medigap quotes.

Thank you for reading our article How to Track the Part B Deductible. Please leave any comments below or email us your questions.

Find affordable Medicare Supplement Insurance plans in your area

How Did Medicare Part D Plan Costs Change In 2021

Although Part D plans are sold by private insurance companies, they must abide by certain cost rules determined by the CMS.

The CMS applied these rules for certain 2021 Part D costs:

- The maximum annual Part D plan deductible will be $445 in 2021 .

- The Part D plan initial coverage limit will be $4,130 in 2021.

- Once you and your Part D plan have spent $4,130 on prescription drug costs in 2021, you will enter the Part D donut hole coverage gap. During the coverage gap, your plan limits how much it will pay for your prescription drug costs.While you are in the donut hole in 2021, you will pay 25 percent of the cost of brand name drugs and generic drugs until you reach the catastrophic coverage stage.

- Once you reach the maximum annual out-of-pocket spending limit of $6,550 in 2021, you enter the catastrophic coverage stage. In this coverage stage, youll only pay a small coinsurance or copayment amount for your covered drugs.

Are you looking for Medicare prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

If Youre In One Of These 5 Groups Heres What Youll Pay In :

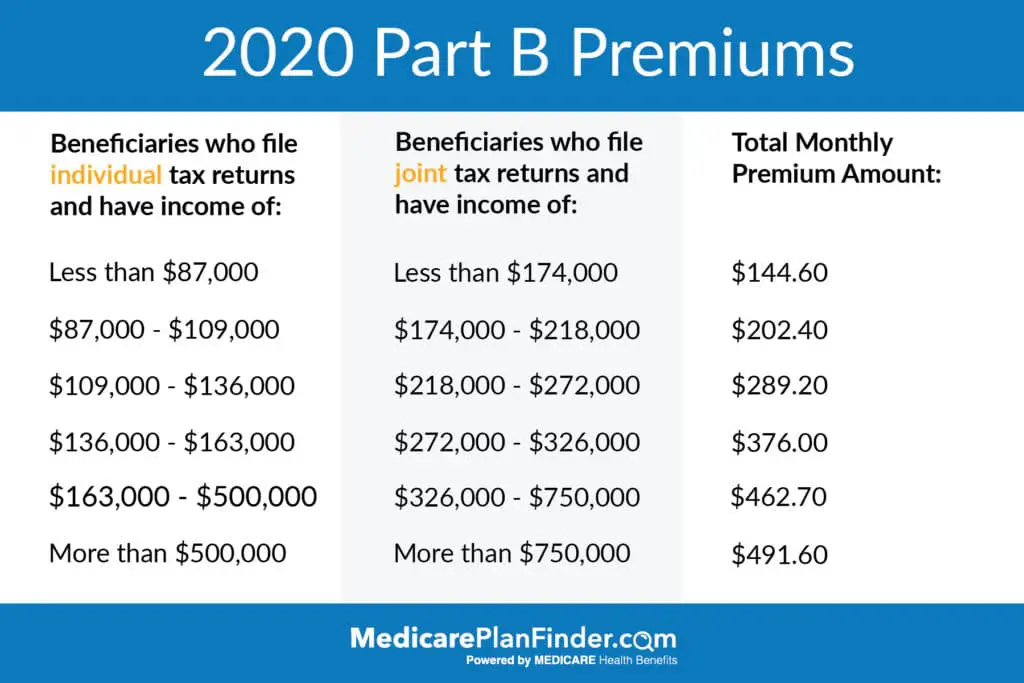

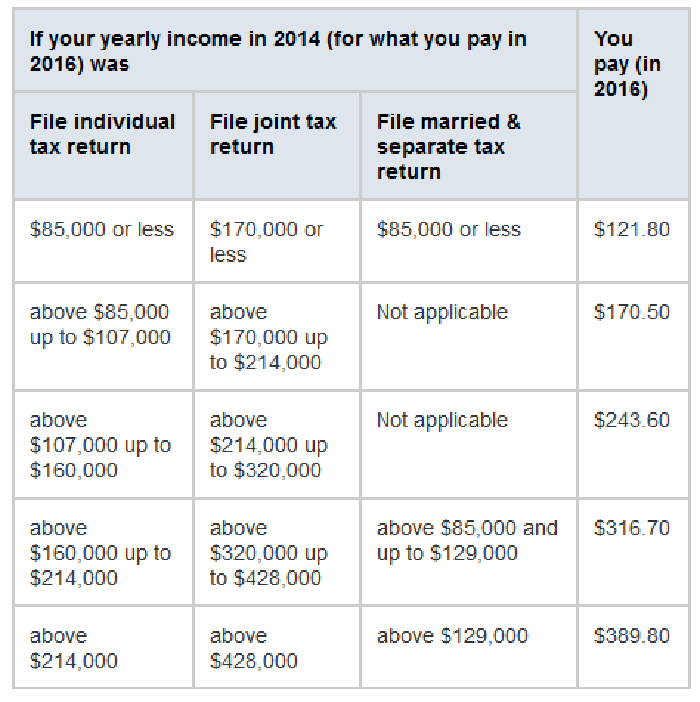

2021 Medicare Part B IRMAA chart

Get more Medicare help on our Facebook community page.

The Medicare Cost for some people in higher income brackets went up in 2018 and 2019 due to the MACRA legislation passed a few years ago. Its a good idea to keep an eye on these Medicare income limits in the future because they may be adjusted every few years.

Read Also: How To Get A Lift Chair From Medicare

What Are Lifetime Medicare Reserve Days

Medicare lifetime reserve days refers to the 60 days a Medicare beneficiary may use once they exhaust the first 60 days of Part A and the additional 30 days with the $371 co-insurance.

The patient dips into the lifetime reserve days Medicare provides. These days, however, are not free. The coinsurance is $742 per day. Once these 60 lifetime reserve days are exhausted, the patient assumes all costs in the hospital, assuming there is no other insurance.

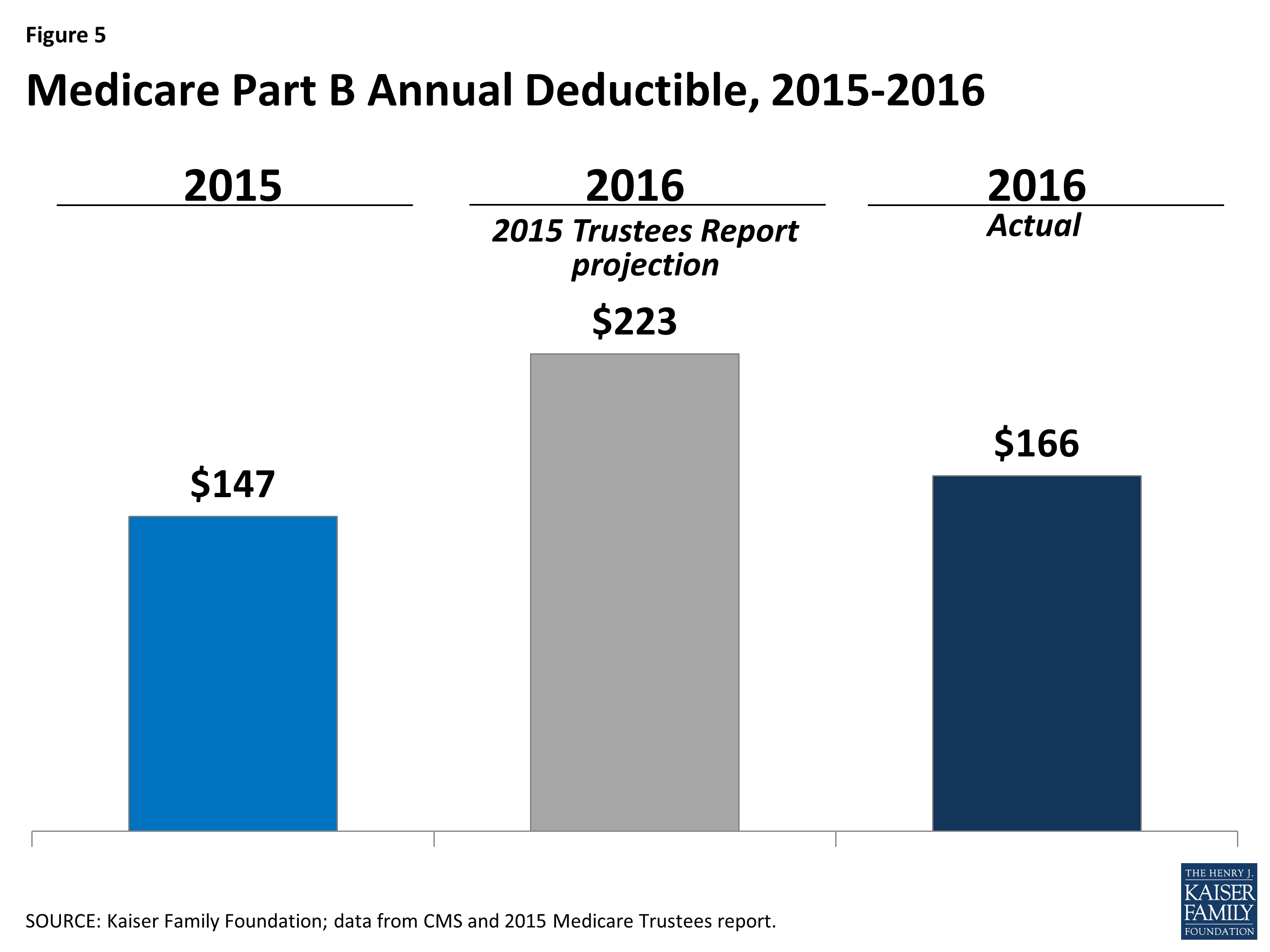

How Much Is The Medicare Part B Deductible In 2020

Lets get right to the point. In 2020, the Medicare Part B deductible came in at $198. This is a $13.00 increase from where we were in 2020. Thats a 7% increase year over year and a very similar increase to what we saw with the Medicare Part A deductible.

If you remember, the Medicare Part B premiums came in up 6.7% from where we were in 2019.

Now a lot of people would stop right there and not really think about this much more. But here at Max out of Pocket, we like to dig a bit deeper. So lets make sure we completely understand the ins and outs of the Medicare Part B deductible and review a little bit of its history. I sometimes wonder if I am the only one keeping track of this stuff.

Read Also: How Much Medicare Is Taken Out Of Social Security Check

Medicare Deductible: Part B

Medicare Part B benefits include doctors office visits, preventive screenings, and durable medical equipment. For some of these services, a deductible will apply . Often, you will pay 20% of the Medicare-approved amount for a health-care service after this deductible is met. Make sure to check with your doctor and Medicare because each benefits coverage is different.

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Recommended Reading: Does Medicare Cover Oral Surgery Biopsy

How Can I Reduce My Medicare Premiums And Costs

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

For those seeking additional help paying for Medicare, here are a few resources and programs dedicated to helping those who need financial assistance. If you find yourself in this situation, you might consider one or more of the following options:

Medicare Part B Premiums In 2022

A basic understanding of Medicare helps you get the most out of your health care coverage. The first thing you need to understand is that there are two different parts to Original Medicare: Part A and Part B.

Medicare Part B covers medical services and supplies considered medically necessary to treat your health condition. This includes outpatient services, preventive care, ambulance services, and durable medical equipment.

Some preventive services are also included within Medicare Part B, including a one-time preventive visit, flu, cardiovascular screenings, hepatitis B shots, cancer and diabetes screenings, and other services.

Medicare Part B is an automatic enrollment for some, and others will need to sign up.

You May Like: How Can I Get My Medicare Card Number

Medicare Supplement Insurance May Help Cover Deductibles

You can buy private Medicare Supplement insurance to cover Medicares out-of-pocket expenses, including the hospital deductible.

However, if you’re in a Medicare Advantage Plan, you can only purchase a Medicare Supplement plan if your Medicare Advantage plan coverage is ending.

Explore Medicare

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Humana is a Medicare Advantage HMO, PPO and PFFS organization and a stand-alone prescription drug plan with a Medicare contract. Humana is also a Coordinated Care plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in any Humana plan depends on contract renewal.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

B Late Enrollment Penalty 2022

If you enroll in Part B after you have passed the Initial Enrollment Period, the monthly premium is multiplied by 10% for every 12 months you miss the deadline.

For example, if you delay signing up for six years, your monthly premium would be 60% higher for as long as you have Medicare. So, for the Part B premium in 2022 , your monthly premium with the penalty will be $253.60 .

Factors That Affect Cost

There are a few different factors that can affect the cost of a Medicare Part C plan.

- CarrierMedicare Part C is sold by private insurance companies who are free to set their own prices according to market competition.

- LocationIts not uncommon for a Medicare Part C plan to cost more in a big city than in a rural area, just as the overall cost of living will often be different between the two locations.

- Coverage levelPlans that include stronger coverage and more benefits will typically come at a higher price than more basic plans.

- Cost-sharingPlans with higher deductibles and coinsurance or copayments may have a lower monthly premium as a tradeoff while plans with higher monthly premiums may come with lower deductibles and cost-sharing requirements.

- Plan typeMedicare Part C plans come in several different forms such as HMO or PPO. HMO plans generally have lower premiums due to having more restrictions about where the plan can be used.

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $371 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $742 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $185.50 per day.4

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

A Brief History Of The Medicare Part B Deductible

Way back in 1966 when Medicare first showed up on the radar, the Medicare Part B deductible came in at $50. It hung out around there for seven years or so before it saw an increase to $60 in 1973. Then, it stayed at $60 for another 9 years until 1982 when it got another bump to $75. It hung out there until 1991 when it got a $25 bounce up to $100.

From there, nobody touched the Medicare Part B deductible for 14 years. It held at $100 from 1991 until 2004. Take that inflation.

After that, we started seeing this number move around pretty regularly. I summarized those amounts below in a nice easy to understand table. It looks like it was held flat during the recession years at $135. Things crept up from there but were reset in 2012 back down to $140 which is the only year we ever saw a reduction. Max predicts we are set to break $200 in 2021, and Ill wager $200 on that if there are any takers out there.

I suppose we shouldnt complain too much. According to this random inflation calculator from the internet, $50 in 1966 would be worth about $406 in 2020. So we have it easy compared to our 1966 counterparts.

How Much Does Medicare Cost Per Month

The amount that you will pay for Medicare each month will vary based upon your income and the kind of supplemental coverage you choose.

An example would be the base Part B premium of $148.50/month plus a Medigap Plan G monthly premium of $125/month plus a Part D premium of $27/month your total would be $300.50/month in premiums.

With this example you can be sure your additional out-of-pocket spending would be minimal as Plan G would pick up the majority of your out-of-pocket costs.

There are many different Medicare plan options to choose from so that you can have a monthly premium within your budget.

Find Affordable Medicare Supplement Plans

How to Track the Part BDeductible The Medicare Part B deductible is an annual medical deductible. Everyone with Original Medicare is responsible for the Part B deductible.

However, Medigap Plan G and Plan N require you to pay the deductible out of your pocket. And, most Medicare beneficiaries meet the Part B deductible over one or two doctor visits. But do you know how to track the Part B deductible, so you dont accidentally overpay?

In this article well discuss:

Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. Both policies will not cover the Part B deductible however, Plan N will not pay for expenses related to the Medicare Part B excess charges. Excess charges can occur when there is a difference between what is billed to Medicare for your treatment and what is actually paid by Medicare. This difference would be paid for you out of pocket if you had Plan N, for example.

However, since Plan N has less coverage, the monthly premium for the policy will be less than Plan G. For 2020, Plan N will cost between $149 and $289 per month.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Medicare Supplement Insurance Plan Deductibles

To get help paying for your Medicare deductibles, you might consider a Medicare Supplement insurance plan. If you have Original Medicare, you can get this additional insurance to help cover some of your Medicare expenses. There are 10 standardized Medigap plans that are available in most U.S. states Massachusetts, Minnesota, and Wisconsin have their own types of Medicare Supplement insurance plans. Not every Medigap plan covers the Part A and/or Part B deducible, but most of the standardized plans cover at least one of these deductibles in full or partially.

If youre concerned about Medicare deductibles and planning for future costs, you may want to consider all your options, including Medicare Supplement insurance plans. To get help finding a Medicare insurance plan, you can type your zip code into the form on this page to see a list of Medicare plans in your vicinity.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

NEW TO MEDICARE?

What Happens Once You Reach The Deductible

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and items for the remainder of the year.

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent.

Its worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

The Medicare-approved amount is the maximum amount that a health care provider is allowed to charge for a service or item as determined by Medicare.

Lets use the broken leg scenario from above and say that the cost of the pair of crutches was $80.

- If the injury happened before reaching your Medicare Part B deductible, you would be responsible for the full $80 .

- If you had already met the Part B deductible prior to the injury happening in this hypothetical situation, you would only be responsible for $16 . Medicare would then pay the remaining $64.

How Much Does Medicare Advantage Cost

Medicare Advantage plans, otherwise known as Medicare Part C, are offered through private insurers and have their own costs. However, because you must first enroll in Medicare Part A and Part B before you can enroll in Medicare Advantage, you still need to pay the costs associated with those two parts of Medicare.

Medicare Advantage plans may have their own premiums, but many do notin fact, nearly two-thirds of Medicare Advantage enrollees pay no additional premium . Its important to double check premium costs before enrolling in any plan. Some Medicare Advantage plans may even help pay your Part B premium, but you need to read the details carefully or speak with an expert to understand how much is covered.

Depending on the coverage included within your Medicare Advantage plan, you may have to pay higher out-of-pocket fees. Plans that include vision, dental, hearing, and Part D coverage may have higher costs. These costs vary depending on the type of Medicare Advantage plan you choose.

Heres a rundown on the types of Medicare Advantage plans available:

Medicaid can help cover Medicare Advantage costs as well. Medicaid is a joint federal and state program that helps with medical costs for those with limited income and resources. Even if you think you dont qualify for Medicaid, there are circumstances that let you access it through spending down and subtracting medical costs from your income, which is worth looking into.