How Much Are The Premiums For Part B In 2023

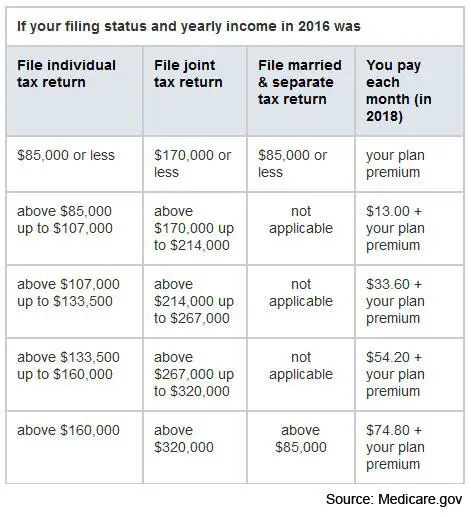

Most people pay $164.90 a month for Medicare Part B in 2023. This premium is paid to the federal government whether youre participating in original Medicare or a Medicare Advantage plan from a private insurer.

If youre receiving Social Security benefits, the monthly premium will be deducted from your monthly benefit payments. If not, Medicare will bill you quarterly or you can set up an electronic payment.

Positive Reviews From Aarp By Unitedhealthcare Customers

Positive reviews of UnitedHealthcare seem to come from a variety of sources. Reviews usually mention specific customer service representatives that were helpful or friendly. Words like positive and professional are used multiple times in Trustpilot reviews. Many other positive reviews simply have five stars but do not have actual comments. Its unclear whether most comments without text are left by customers or employees, as UnitedHealthcare employees do also leave many reviews commenting that they enjoy working there.

What Do Unitedhealthcare Medicare Advantage Plans Cover

Also called Medicare Part C, Medicare Advantage Plans combine Part A and B benefits with various extra services. Most UnitedHealthcare Medicare Advantage Plans include:

- Prescription drug coverage

- Wellness benefits, such as free gym memberships

- Medical transportation

- Wellness over-the-counter medications .

If you have certain chronic medical conditions, such as cancer or Alzheimers, you may qualify for a Medicare Advantage Special Needs Plan that serves a specific population group. With Medicare Advantage, you continue to pay your Original Medicare premiums. In many cases, theres no additional cost.

You May Like: Is Palliative Care Covered By Medicare

What Are The Ten Plans

Medigap plans are each given an identifying letter: A, B, C, D, F, G, K, L, M, and N. Each plan of the same letter must offer the same benefits across all the states, with the exception of Massachusetts, Minnesota, and Wisconsin.

However, costs can vary from state to state, and between the different insurance companies.

Medigap plans are guaranteed renewable, which means that if someone pays their monthly premium, the insurer cannot stop their plan. This applies even if someone becomes ill after purchasing a plan.

Not all plans are available in all states.

Some Medigap policies provide additional benefits, such as healthcare when traveling outside the United States.

Cost Of Aarp/unitedhealthcare Medicare Advantage

An AARP/UnitedHealthcare Medicare Advantage plan is a good deal, costing an average of $21 per month.

Looking only at the Medicare Advantage plans that include prescription drug coverage, this $21 per month average cost for UnitedHealthcare is cheaper than the $33 per month overall average across all companies.

However, UnitedHealthcare isn’t the cheapest overall provider. Companies like Aetna and Cigna have lower overall rates and a higher percentage of $0 plans.

Medicare Advantage plans from UnitedHealthcare are also a good value. With the many included add-ons, enrollees get more for their money. And there’s not a trade-off in coverage because the company’s average out-of-pocket maximum matches the industry as a whole.

Despite this, many other reviewers still say that UnitedHealthcare’s Medicare Advantage plans are expensive. This is because UnitedHealthcare has a reputation for being an expensive insurance company because of its individual health insurance plans, which can cost twice as much as what other companies charge.

However, when we look at the actual cost of its Medicare Advantage plans, we see that the pricing in this category is much different, and UnitedHealthcare has affordable Medicare Advantage plans.

Also Check: How Can I Change My Name On Medicare Card

What Medigap Plans Does Aarp Offer

AARP members can choose from 8 standardized Medigap plans offered through United Healthcare. These plans are A, B, C, F, G, K, L, and N.

Although all 50 states have at least one of these plans, people may not find all 8 plans offered in their state. A person can use this online tool to find a plan in their state.

In addition, if a person became eligible for Medicare on or after January 1, 2020, they cannot purchase Medigap plans C and F that pay for the Part B deductible.

Unitedhealthcare Medicare Advantage Plan Options

UHC provides several types of Medicare Advantage Plans, including HMOs, PPOs, and SNPs. Almost all of UHCs Medicare Advantage Plans are offered through AARP. The company has connections to over 1.3 million physicians in the U.S. and partnerships with 6,500 hospitals and health care facilities. UnitedHealthcare HMOs often offer zero premiums and copays, but youll need to use in-network doctors. If you use out-of-network physicians, youll have to pay the full cost of care.

The PPOs offered by UHC normally allow you to use both in-network and out-of-network doctors. UHC will still pay for an out-of-network doctor visit but usually at a much lower rate, and youll have to make up the difference. Telehealth visits are often covered regardless of the plan you choose, but it depends upon your states regulations.

UHC offers two types of SNPs. C-SNPs are for chronic conditions. D-SNPs are for anyone dual eligible for Medicare and Medicaid.

Compare UHC Medicare Advantage Plans before making a decision:

| Plan name |

|---|

| $6,700 in-network $10,000 combined in-and-out network |

*Based on pricing in Boston, MA in 2022

Also Check: What’s My Medicare Provider Number

Why You Might Choose Aarp Medicare Advantage

AARPs Medicare offerings have strong pros:

-

Backed by a solid company: UnitedHealthcare, which insures AARP Medicare Advantage plans, offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers

-

Highly rated plans: About 7 out of 10 AARP Medicare Advantage plans with star ratings are rated 4 stars or higher.

-

Low cost: Seventy percent of AARP Medicare Advantage plans offer a $0 premium.

-

Dental perks: Most plans have dental coverage, which comes with a $0 copay for covered dental care with in-network providers, including fillings, extractions and implants up to the plans annual limit. UHC also has the largest dental network.

What Are My Costs With Unitedhealthcare Medicare Advantage Plans

When you choose a UnitedHealthcare Medicare Advantage plan, you get all the same benefits as Original Medicare . Most plans include coverage for prescription drugs plus additional benefits not covered by Original Medicare, such as dental, vision, hearing, wellness programs and fitness memberships among other extra benefits and features. Your costs are based on the plan you choose. Most plans include some or all of the following expenses:

- Monthly premiums. No matter which Medicare Advantage plan you enroll in, you continue to pay your regular Part B premium to Medicare every month. Some plans have an additional monthly premium you pay UnitedHealthcare, although there may be $0 premium plans available in your area.

- Annual deductible. Some UnitedHealthcare Medicare Advantage plans have annual deductibles for certain services which you might pay each year. With Original Medicare, you have separate deductibles for Part A and Part B.

- Copayments. Many Medicare Advantage plans charge a copayment each time you see the doctor or get other health care services. A copayment is generally a flat fee. As an example, you might pay $10 to see your primary care doctor and $30 if you see a specialist.

- Coinsurance. Coinsurance is a percentage of the actual charge for the service. If you choose a PPO plan, for example, you might pay 30% coinsurance if you receive care outside your planâs network.

Recommended Reading: Does My Doctor Accept Medicare Advantage

Does Medicare Pay For Chemotherapy Drugs

Medicare covers chemotherapy if you have cancer. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers it if you’re a hospital inpatient. covers it if you’re a hospital outpatient or a patient in a doctor’s office or freestanding clinic.

Virginia Aarp Medicare Advantage Plans

AARP Medicare Advantage plans cover features and benefits in addition to those included in Original Medicare. Members in some areas may have different plans from which to choose. The plans often include an integrated Medicare Part D prescription drug benefit.

Health Maintenance Organization plans have a defined network of contracted local physicians and hospitals to provide member care. Generally, members must use these care providers to receive benefits for covered services, except in emergencies. Some HMO plans do not need referrals for specialty care.

Point of Service plans include all the features of HMO plans plus the ability to go outside the contracted network for certain health care services – typically at a higher cost. Some POS plans do not require referrals for specialty care.

Preferred Provider Organization plans offer members access to a network of contracted physicians and hospitals, but also allow them the flexibility to seek covered services from outside of the contracted network, usually at a higher cost. Members do not need a referral for specialty care.

PPO plans are available as either local PPO or regional PPO offerings. RPPOs serve a larger geographic area – either a single state or a multi-state area. RPPOs offer the same premiums, benefits and cost-sharing requirements to all members in the region.

Also Check: Does Medicare Pay For Hospice At Home

Dual Special Needs Plans

For people who qualify, these combine the benefits of Medicare Parts A and B with your states Medicaid benefits, for as low as a $0 premium.

We’re sorry. We were unable to complete your request. Please check your information and try again. Thank you!

** You must continue to pay your Medicare Part B premium if not otherwise paid for under Medicaid or by another party. Not all plans are available in all locations.

Aarp Medicare Supplement Plan F

Medigap Plan F is the most popular Medicare Supplement plan most likely because offers the most benefits of any available plan. Members of Plan F face little to no out-of-pocket Medicare expenses for their health care.

Federal legislation has made Plan F off-limits to anyone who became eligible for Medicare on January 1, 2020 or later. This means that if you became eligible for Medicare before 2020, you may still be able to apply for Plan F if its available where you live, and if you had Plan F before 2020, you can keep your plan. If you became eligible for Medicare after Jan. 1, 2020, however, you wont be able to purchase Plan F or Plan C, which is outlined below.

Recommended Reading: Will Medicare Pay For A New Mattress

How Do Aarp/unitedhealthcare Medicare Advantage Plans Work

Medicare Advantage, also called Medicare Part C, is a bundled insurance plan that’s administered by a private insurance company, in this case UnitedHealthcare.

Plans cover medical care, hospitalization services and usually prescription drugs.

You can sign up for Medicare Advantage when you first become eligible for Medicare, and then you can update your plan annually during Medicare open enrollment in the fall.

When comparing Medicare Advantage plans, we recommend you choose a plan based on the medical care you expect to need. If you’re in good health, a low-cost plan could be the most cost effective, even if you have to pay a little more for your medical care. However, if you have chronic health issues, it may be cost effective to sign up for a more expensive plan with better benefits. For example, paying $25 more per month is worth it if the more expensive plan will save you more than $300 per year in medical care.

Extra Perks And Benefits

With AARP Medicare Advantage plans through UnitedHealthcare you’ll have access to perks like the following:

- Free gym memberships and thousands of free workout videos

- Local health and wellness classes and events

- Health activities reward system

- 24/7 access to a nurse

- Annual at-home wellness visit

- Vision care, including free yearly eye exams, designer frames, and prescription lenses

- Free preventive dental care

- Hearing care, including free routine hearing exams and discounts on hearing aids

Did You Know: AARP also offers Medicare Supplement plans and ranks on our list of the best Medigap plans!

It is important to remember that many of the benefits listed above are not available with every AARP plan. You will need to check your individual plan to ensure you can access the best benefits for you.

Don’t Miss: Does Medicare Cover Rides To Medical Appointments

Aarp Medicare Supplement Plan G

Plan G is also highly popular among Medicare beneficiaries and will only continue to grow in popularity, as the share of people eligible for Plan F will go down over time.

Plan G includes all of the same benefits as Plan F with the only exception being coverage for the Medicare Part B deductible. In 2023, the annual Part B deductible is $226. This means that once you meet your Part B deductible for the year and if you have Plan G, you will typically face little or no out-of-pocket Medicare costs for the remainder of the year .

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are 2 other types of Medicare Advantage plans to consider.

Private Fee-for-Service plans

PFFS plans may or may not have a provider network, but they cover any provider who accepts Medicare. If the plan doesn’t include Part D prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any provider you choose. MSA plans don’t include Part D prescription drug coverage, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

Recommended Reading: Which Medicare Advantage Plans Cover Massage Therapy

Questions We’re Ready To Help

Call UnitedHealthcare at:FED TFN

8 a.m. – 8 p.m., 7 days a week.

Already a member? Call the number on the back of your member ID card.

MO10050ST

7 a.m. – 11 p.m. ET, Monday – Friday 9 a.m. – 5 p.m. ET, Saturday.

Already a member? Call the number on the back of your member ID card.

MO10050ST

Get plan information, forms and documents you may need now or in the future.

What Are My Costs With A Unitedhealthcare Medicare Supplement Insurance Plan

Medicare Supplement insurance plans can cover some of your out-of-pocket costs with Original Medicare. Some plans have more complete coverage: They may pay 100% of your Part A and Part B deductibles, coinsurance, and Part B excess charges. Others pay only some of your out-of-pocket costs.

You pay a monthly premium to UnitedHealthcare for your Medicare Supplement insurance plan, and the plan pays your share of your covered medical expenses directly to the doctor or hospital. Plans that cover more of your Medicare costs may have higher premiums than ones that protect against catastrophic health expenses.

You canât use a Medicare Supplement insurance plan with a Medicare Advantage plan or for costs of your stand-alone Part D prescription drug coverage. It only covers charges under Original Medicare.

Keep in mind that UnitedHealthcare can change its premiums, deductibles, and copayments each year. Be sure to watch for your Annual Notice of Change each year so you know what to expect.

To find a Medicare plan in your area, enter your zip code on this page.

Medicare beneficiaries may also enroll in a UnitedHealthcare Medicare plan through the CMS Medicare Online Enrollment Center located at http://www.medicare.gov.

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the planâs contract renewal with Medicare.

Also Check: How Do You Pay Medicare

Benefits Of Aarp By Unitedhealthcare Medicare Supplements

- Clear Sales Materials: The language that companies use to advertise their insurance policies often leads to confusion for customers. Explanations of plan details can be complicated and tiresome to read. AARP by UnitedHealthcare strives to make its sales materials extremely accessible to its customers, however. The website offers a very plainly worded, common-sense selection of educational materials. You can get state-specific, downloadable/printable forms that include simple explanations of insurance terms. These downloadable documents, which are typically titled Your Guide to AARP Medicare Supplement Insurance Portfolio of Plans or just Your Guide are a great resource for making your choice.

- The At Your Best Program: AARP by UnitedHealthcare has recently sought to add value to its Medicare Supplement policies through a new program called At Your Best. This program, which began in 2020, includes free access to gyms, programs for brain health, and expert advice from nurses and health coaches. The program also includes some access to discounts on products or services from other companies. This suite of extra benefits sets the AARP by UnitedHealthcare plans apart from other companies that may not offer as many perks.

No Surprises Just Great Coverage

Medicare Parts A and B only cover some of your health care costs. That’s where Medicare Supplement Insurance comes in. Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, copayments and deductibles.

94% of members surveyed are satisfied with the customer service.2

Endorsed by AARP

The only Medicare Supplement plans endorsed by AARP.

3 These offers are only available to insured members covered under an AARP Medicare Supplement Plan from UnitedHealthcare. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time. None of these services should be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. Note that certain services are provided by Affiliates of UnitedHealthcare Insurance Company or other third parties not affiliated with UnitedHealthcare.

Peace of mind, choice of my own doctors, reasonable cost.

Hugo H., AARP Medicare Supplement Planholder

Recommended Reading: Does Medicare Cover Bone Marrow Transplant

Aarp Medicare Star Ratings

Average star rating, weighted by enrollment: 4.28

The Centers for Medicare & Medicaid Services maintains its own database of star ratings on every Medicare Advantage and Medicare prescription drug plan, ranging from best to worst . The agency bases these ratings on plans quality of care and measurements of customer satisfaction, and ratings may change from year to year.

All Medicare Advantage plans are evaluated on health plan measures, and Medicare Advantage plans that include prescription drug coverage are also evaluated on drug plan measures.

Based on the most recent year of data and weighted by enrollment, UnitedHealthcare Medicare Advantage plans, which include AARP plans, get an average rating of 4.28