Find Out About Your Medicare Eligibility

Determining your Medicare eligibility is sometimes tricky. We get many questions about how to qualify when to enroll in Medicare, and how to set up Medicare supplement insurance. Though the process may seem overwhelming to you, our experts deal with these processes every day. We can guide you easily through the process.

You are not alone let a Florida Medicare Agency licensed agent to assist you in making this entire process easier.

Get Your Free Copy of the Ultimate Medicare Quick Reference Guide from Florida Medicare Agency!

This guide helps you learn about the different parts of the Medicare program, including Medicare Part A and Part B , Part C and Part D .

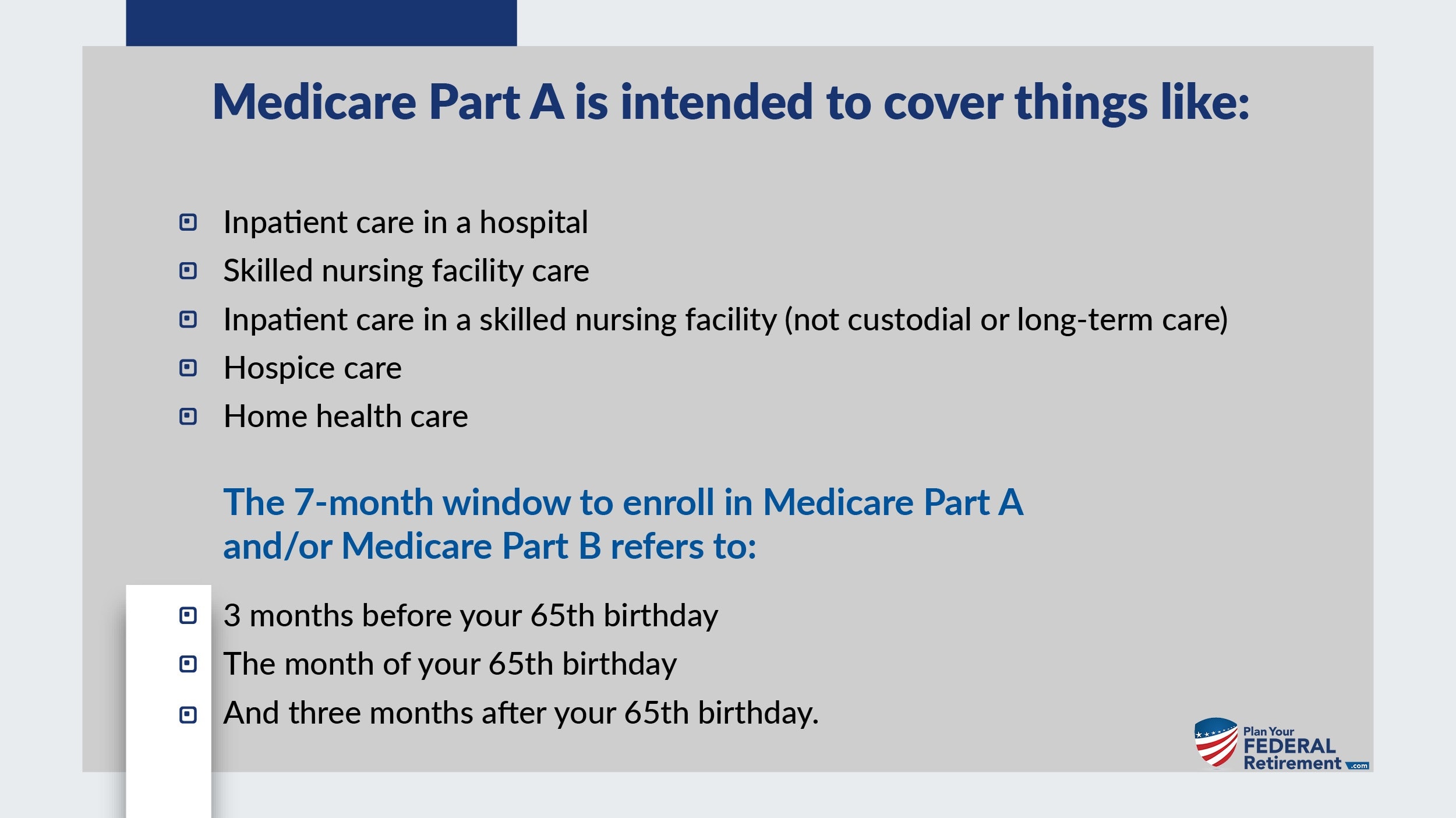

Eligibility For Medicare Part A

Medicare Eligibility begins at age 65 for most people.

You are eligible for Medicare Part A at age 65 if you or your spouse has legally worked for at least 10 years in the U.S. During those years, you paid taxes toward your Part A hospital benefits. This is why most Americans pay no Part A premiums when they become eligible for Medicare. Part A mainly covers your hospital stays. If you have worked and paid taxes in the US then you will be issued Medicare Part A automatically. Even if you are employed with a company with over 20 employees it makes perfect sense to have this benefit.

If you have not worked and paid taxes the required 10 years, Part A may be available for you to purchase. You can call Social Security at 1-800-772-1213, or visit your local Social Security office for more information about buying Part A.

Find out about your Medicare Eligibility

Enrolling Your Newborn Baby

You can enrol your newborn baby by using the Newborn Child Declaration. Youll get the declaration from the hospital. Find out how to enrol your baby.

If youve adopted a child or your child was born overseas, youll need to give us extra documents. Read more about what to do:

You May Like: What Is The Cost Of Medicare Supplement Plan F

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

Register For Medicare Before 90 Days Past Your Date Of Birth

Hopefully, you are not more confused! Remember, the goal is to register for Medicare before the expiration date of 90 days past your date of birth.

If you do choose to have more than Part A, and have not yet begun receiving Social Security retirement benefits, the government will bill you quarterly. The cost is related to the amount of Adjusted Gross Income reported on your previous year tax return.

If you do not have continuing coverage from a group plan when you reach retirement, then you may want to consider buying a Medicare Supplemental policy.

However, these policies will be available to you when you actually retire so you do not need to buy one until your other medical coverage is no longer available.

If you do retire and do not have continuing coverage from your group plan, then absolutely consider buying the supplemental policy as it will pay the majority of the costs that Medicare does not cover.

As always, seek advice from a professional who is familiar with all of the government programs to give you proper guidance.

Are you turning 65 this year and ready to apply for Medicare? Or perhaps you have already done so. Do you think there are any simpler ways to get the application done? Anything to work around? Please share your experiences and tips below!

Let’s Have a Conversation!

Read Also: How Much Does Medicare Part B Cost At Age 65

Do You Have To Be On Medicare At 65

When you turn 65 years old, youâre eligible to sign up for Medicare.

Original Medicare is made up of 2 main parts: Part A and Part B .

As long as youâve worked at least 10 years and paid Medicare taxes, Medicare Part A is actually free to have, meaning that you donât have a monthly premium to pay. Thereâs really no downside to having Part A when you turn 65.

Do you have to have Part A when you turn 65? No. Is there any downside to having Part A when you turn 65? No. Thatâs why you donât actually have to sign up for Part A.

Three months before you turn 65, youâll be mailed your Medicare card, and youâre automatically enrolled in Part A. Youâll also be automatically enrolled in Part B unless you send the card back explaining that you donât want it.

Which brings us to our next question â is Medicare Part B mandatory at age 65?

Our team of licensed agents can help you determine which route would save you the most money, so if youâre not sure, be assured that we can help. Call us any time at 833-801-7999.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Don’t Miss: Does Medicare Pay For Ensure

What Is The Perfect Retirement Age

It may be the quintessential retirement question in all of human history, When should I retire? You ask the retirement gods of Valhalla to help you find the answer you seek. But the quest for the perfect retirement age only produces more questions.

It used to be that 65 was the magic retirement age. From the time President Franklin D. Roosevelt signed the Social Security program into law on August 14, 1935, until 1983, being 65 meant a full Social Security benefit. But in those days, life expectancy was much shorter and people lived, on average, 12 years after they retired.

People began living longermuch longer. The governments response was to raise the age at which retirees could receive a full Social Security payout. So, from 1983 to 2000, Full Retirement Age was raised to a minimum of 66 and a maximum of 67, all dependent on when you were born. Under the new regulations, if you claim Social Security before your Full Retirement Age, you receive a permanently reduced Social Security benefit.

There are also some key ages and events to factor in as you search for your perfect retirement age.

The reality is, there is no one-size-fits-all perfect age to hang up your career. But there are some things to consider:

Finding your perfect retirement age may also depend on where you live. A study by GoBankingRates found that in most states, people are leaving the workforce before they hit 67 years old.

Dont Register For Medicare Alone

If youre uncomfortable with applying for Medicare alone, we can help! Our services are completely free for you. If you would like an agent by your side when applying, contact us. We can walk you through setting up all your coverage, including Medicare, Medigap, Part D, and more.

Plus, when you use us to apply, you get unlimited support from our Client Service Team. That means if you have any issues with claims or appeals, we can help at no additional cost. You can compare rates online or give us a call today at the number above.

- Was this article helpful ?

Don’t Miss: What Is Blue Cross Blue Shield Medicare Advantage

How To Apply For Medicare Through The Rrb

If you worked for the railroad, call the Railroad Retirement Board at 877-772-5772 or submit an online service request through the RRB website.

The best time to apply is during the Medicare Initial Enrollment Period. Or, you can sign up during the Medicare General Enrollment Period.

Note: If you are still working, you can still sign up for RRB Medicare coverage when you turn 65. No need to retire.

If you, or a family member, are already receiving a railroad retirement annuity, you will automatically be enrolled in Medicare Part A and B. Coverage begins when you turn 65.

How Do I Sign Up For Medicare

If you already get Social Security benefits, well automatically enroll you in Medicare Hospital Insurance and Medical Insurance . Well mail you all the information you need a few months before you become eligible.Note: Residents of Puerto Rico or foreign countries wont automatically receive Part B. They must elect this benefit.If you dont get Social Security benefits and are not ready to apply for them yet, you should sign up for Medicare three months before your 65th birthday.The easiest way to apply for Medicare is by using our online application.If you dont wish to apply online, make an appointment by calling us at 1-800-772-1213 , 8:00 am 7:00 pm, Monday through Friday.Important Information about Medical Insurance CoverageBecause you must pay a premium for Part B coverage, you can turn it down. However, if you decide to sign up for Part B later, your coverage can be delayed and you may have to pay a late enrollment penalty for as long as you have Part B coverage. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it unless you qualify for a special enrollment period.More Information

Recommended Reading: Which Insulin Pumps Are Covered By Medicare

After You Apply For Medicare

No matter how you applied, once your application is complete, the Social Security office will send you a copy of the information it has on record regarding your application. Be sure to double-check this document for any mistakes, as this is your chance to correct it.

Some time later, youll get your Medicare card via mail, so be on the lookout for envelopes from the Social Security office.

You May Like: When Can You Get Medicare Health Insurance

Do You Have To Sign Up For Medicare When Youre 65

As long as you have creditable coverage, you dont have to enroll in Medicare when you are 65. Technically, you dont have to sign up for Medicare at all if you dont want to. Medicare is not mandatory, but it is important to be aware that if you choose to sign up later without creditable coverage, youll incur penalties that you may be stuck with for the rest of your life.

The most common reason a new beneficiary may delay enrolling in Medicare is that they have coverage through their employer. However, not all group coverage is creditable coverage. The size of your employer will determine if the coverage is creditable.

Recommended Reading: What Is The Difference Between Medicare

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Once you apply for Part B, give us a call so we can help you choose a supplement plan to cover what Medicare doesnt.

If youre not comfortable applying for Medicare online, you can do so over the phone.

During Your Initial Enrollment Period

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.

Don’t Miss: How Soon Before Turning 65 Do You Apply For Medicare

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

When Should You Apply For Medicare

In most cases, you should apply for Medicare as soon as you’re eligible. The initial enrollment period starts three months before the month you turn 65, includes your birth month, and extends three months past the month you turn 65, giving you a seven-month window to apply. Your Part B coverage will likely be delayed if you enroll the month you turn 65 , so apply early to avoid a gap in coverage.

Medicare imposes a hefty late enrollment penalty if you enroll in Part B or D after the initial enrollment period and don’t qualify for a special enrollment period .You might qualify for a SEP if you have coverage, including creditable drug coverage from an employer or a union . Medicare does not charge a late enrollment penalty for enrolling in a Medicare Advantage plan or Medicare Supplement plan after IEP. But it’s best to apply for Medigap as soon as you’re eligibleif you apply within the first six months of having Part B coverage, you can’t be denied a Medigap policy or be required to pay more because of health conditions. Here’s how enrollment works depending on whether or not you already receive Social Security benefits.

If you already receive Social Security benefits:

You should also check out the Medicare Enrollment Booklet which contains clear, concise information about both Medicare Part A and Part B.

If you are not yet receiving Social Security benefits:

When to get prescription drug coverage:

Recommended Reading: Does Medicare Pay For A Caregiver In The Home

When Should You Apply For Medicare If You Have Employer Health Coverage

Most people should sign up for Medicare Part A when theyre first eligible because it rarely costs anything. But some people delay enrolling in Part B because they dont want to pay the monthly premium. The decision usually depends on the type of health coverage you already have.

You can put off enrolling in Part B at age 65 if you have group health coverage through your or your spouses job and the employer has at least 20 employees.6 Youll be able to enroll with no penalty during the Special Enrollment Period that follows the end of your employers insurance. You can also choose to enroll in Part B while still insured and pay the premium.

If your employer has fewer than 20 employees, you should apply for Part A and Part B as soon as youre eligible.7

Be sure to talk to your employers benefits administrator about how signing up for Medicare will affect your coverage or Health Savings Account .8 You cannot contribute to an HSA if you have Medicare Part A. Your administrator can help you time the beginning and end of your coverage through work and your new health insurance so theres no gap in your coverage.

When your group coverage is ending, youll need to complete documentation and submit it to your Social Security office. If you have questions, ask Social Security.

Also Check: Does Cigna Have A Medicare Supplement Plan

Can I Continue To Work After Full Retirement Age

Yes, and you can earn as much as you want without facing any penalties or negatively affecting the amount youll receive in Social Security benefits when you do decide to take them.

Since your benefits are based on your 35 highest-earning years, working after full retirement age could actually increase your benefits if you are a high-earner. Even if you begin collecting benefits, the Social Security Administration will recalculate your average wage to account for any new income.

Those who began collecting Social Security benefits prior to full retirement age but then decided to continue working will be subject to the retirement earnings test . This test checks to see if your earnings exceed a limit. If your earnings exceed the current limit, you will temporarily lose some or all of your Social Security benefits. At the time you reach full retirement age, those benefits are recalculated, and youll receive most of that money back.

Recommended Reading: How To Qualify For Extra Help With Medicare Part D