What Is The Part B Premium Reduction Benefit

When youre enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

Even though youre paying less for the monthly premium, you dont technically get money back. Instead, you just pay the reduced amount and are saving the amount youd normally pay.

If your premium comes out of your Social Security check, your payment will reflect the lower amount. If you dont pay that way, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, youd only pay the amount with the giveback benefit included.

For example, if you typically pay $170.10 per month but your MA plans giveback benefit is $50, you dont get $50 back each month. Instead, youd only pay $120.10 per month, keeping that $50 in your wallet. If your plan offers a full $170.10 refund, you wouldnt have a Part B monthly premium to pay.

How To Set Up Medicare Easy Pay

Enrolling in Medicare Easy Pay and paying Medicare online is easy! All you need to do is fill out this Medicare Easy Pay form and submit it to the following address.

It can take up to 6-8 weeks to process, so make sure you continue to pay your bill until your Medicare Easy Pay becomes active.

Once its active, youll notice that your premium is deducted from your bank account on the 20th of the month. Youll see it on your bank statement as Automated Clearing House .

Mail your Medicare Easy Pay form to:

Medicare Premium Collection CenterSt. Louis, MO 63197-9000

What Are Medicare Advantage Part B Buy Back Plans

Medicare Advantage plans are additions to your existing Medicare coverage. They can vary greatly in coverage amounts and premium prices. Some Medicare Advantage plans can come with a $0 premium or a low premium in addition to a Part B buy back .

If you pay your Part B premium automatically out of your Social Security check, this could feel like a bonus added to your monthly checks! Youll start seeing a bit more coming in, which is nice, assuming the plan you choose has the buy back option.

You May Like: How Do I Get Dental And Vision Coverage With Medicare

When Do I Have To Pay Back Medicaid

For instance, if a Medicaid beneficiary is injured in a car accident, Medicaid will pay for the care and treatment of those injuries. However, if the beneficiary obtains an insurance settlement that pays compensation for those injuries, state law requires that the beneficiary pays back to Medicaid the amount of medical expenses paid for those auto injuries. If the beneficiary has a lawyer, state law requires that the lawyer notify Medicaid as soon as he or she is involved in the injury claim and to notify Medicaid as soon as a settlement is reached so that Medicaid is paid back from the settlement. If the beneficiary does not have a lawyer, the beneficiary must notify Medicaid either directly, or through the insurance company that will be paying the claim, that a claim is being made and that Medicaid will be paid back those medical bills paid on account of the injury.

- Need help paying back Medicaid? .

Can Medicare Take Your House After Death

Medicare, as a rule, does not cover long-term care settings. So, Medicare in general presents no challenge to your clear home title. … If you are likely to return home after a period of care, or your spouse or dependents live in the home, the state generally cannot take your home in order to recover payments.

You May Like: Is Tresiba Covered By Medicare

How To Drop Part A & Part B

Generally, you can only drop Part A if you have to pay a premium for it, also called Premium-Part A. You can choose to drop Part B .

There are some risks to dropping coverage:

- Your costs for health care: You may have to pay all of the costs for services that Medicare covers, like hospital stays, doctors services, medical supplies, and preventive services.

- Gap in coverage: If you change your mind and want to sign up again later, you may have to wait until the next General Enrollment Period to sign up. Your coverage wont start until July 1.

- Late enrollment penalty: If you dont qualify for a Special Enrollment Period to get Medicare later, youll have to pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you go without Part B coverage. If you have to pay a penalty for Part A, youll pay it for twice as long as you go without Part A coverage.

Get help with costs

What Debts Are Forgiven At Death

What Types of Debt Can Be Discharged Upon Death?

- Secured Debt. If the deceased died with a mortgage on her home, whoever winds up with the house is responsible for the debt. …

- Unsecured Debt. Any unsecured debt, such as a credit card, has to be paid only if there are enough assets in the estate. …

- Student Loans. …

Recommended Reading: Does Aetna Medicare Advantage Cover Silver Sneakers

What Law Gives Medicare Reimbursement In Personal Injury Cases

Under two federal statutes, 42 U.S.C. §1395y and § 1862/Section and § 1862 of the Social Security Act, the Medicare program may not pay for medical expenses for a tort victim when payment has been made or can reasonably be expected to be made under a workers compensation plan, an automobile or liability insurance policy or plan , or under no-fault insurance.

This federal law also unambiguously gives the Medicare program subrogation rights if it does make payments. The law provides: The United States shall be subrogated to any right under this subsection of an individual or any other entity to payment with respect to such item or service under a primary plan. 42 U.S.C. § 1395y.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Also Check: Does Medicare Cover Prrt Treatment

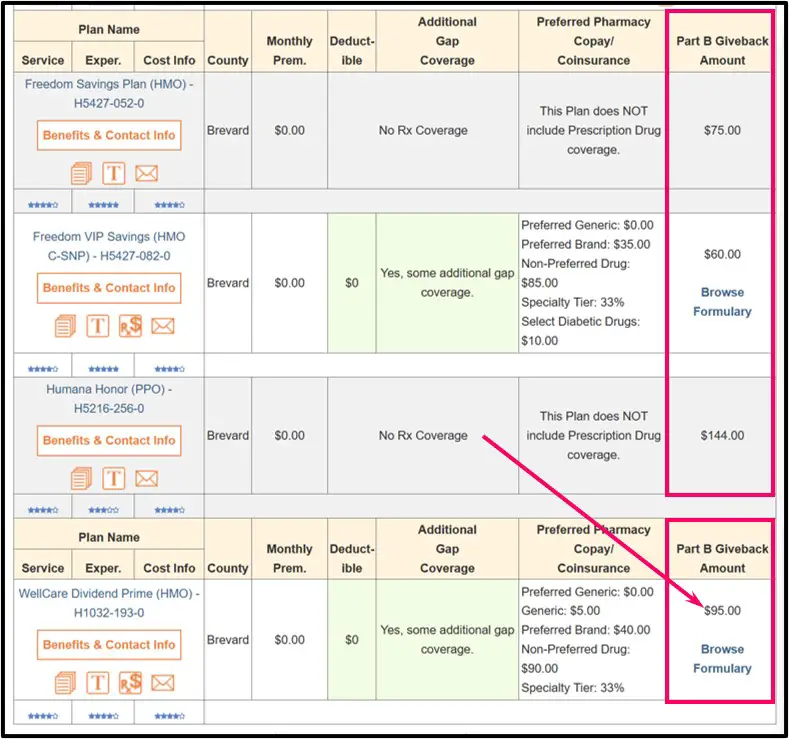

Who Is Eligible For The Part B Give Back Benefit

To be eligible for a give back plan, policyholders must meet specific criteria. First, you must be enrolled in Medicare Part A and Part B and pay your own premiums. This means that if your premiums are currently being covered by a state or local program, you will not qualify.

Additionally, you must live within the service area of a plan that offers a premium reduction plan. Currently, there are 48 states in the U.S. that offer this benefit.

Keep in mind, give back plans work directly with Social Security, so, no direct payments are sent to you by the carrier.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Read Also: Can You Get Medicare Part D Anytime

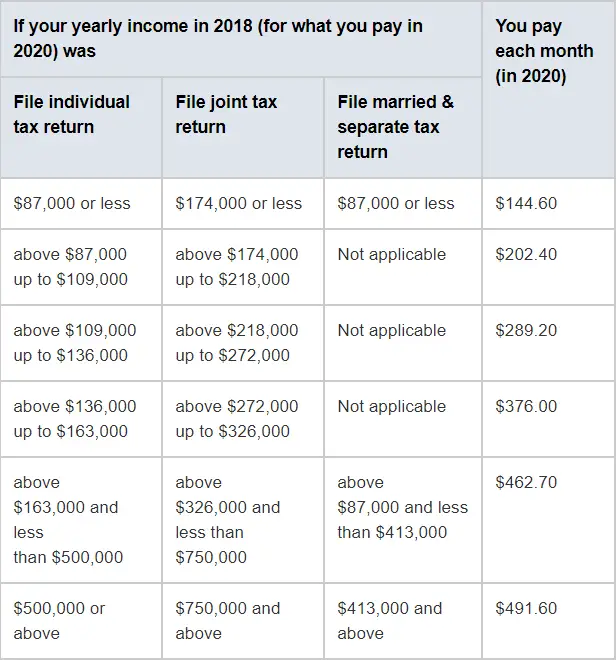

Do I Have To Pay For Medicare

We get this question a lot, and we understand why you may be confused or upset. If you were employed for any extended period of time in your life, youre probably thinking, I already paid for Medicare through taxes! Its true that most people paid Medicare taxes during their working careers, but there are still some costs involved in Medicare for most people.

Those Medicare taxes that you paid all those years certainly helped fund the Medicare program, but its not enough. Healthcare is expensive!

Medicare parts A and B are different. If you worked for at least 39 quarters, you may not have to pay a premium for Part A at all. However, anyone who does not qualify for financial assistance will owe a premium for Part B. The Part B premium can change based on income, but the standard in 2020 is $144.60/month.

- If you worked over 39 quarters , your Part A premium will be $0

- If you worked 30-39 quarters, your Part A premium will be $252 in 2020

- IF you worked for less than 30 quarters, your Part A premium will be $458 in 2020.

Is The Medicare Give Back Benefit The Same As The Medicare Part B Premium Reduction

Part B premium reduction is another term for the give back benefit. Depending on the region where you live, you may see slightly different names for the program.

However, the feature functions the same across plans. No matter what you call it, the give back benefit, or Medicare Part B Premium Reduction is put in place to save policyholders money on their health care costs.

Recommended Reading: What To Do For Medicare Before Turning 65

Whos Eligible For A Medicate Advantage Plan With A Part B Giveback Benefit

To be eligible, you must:

- Be enrolled Original Medicare

- Pay your own Part B premium

You are not eligible if you receive Medicaid or any government assistance that helps you pay your Part B premium. Also, the Part B Giveback is restricted to certain states and counties. Plans may not be available in your area.

What Is A Time Limit Demand

demandcoupled with a short time limit for acceptanceis a classic tool used to pressure insurers to settle cases of questionable damages. The time-limit demand is a win-win for claimants’ counsel: If the insurer accepts the demand, then the claimant will recover the maximum amount available under the policy.

Recommended Reading: Do You Apply For Medicare Through Social Security

Will My Social Security Benefits Be Reduced If I Win The Lottery

If you are under your full retirement age and are collecting Social Security benefits while still earning an income, your benefits will be reduced.

However, lottery winnings are not subject to this rule. Your Social Security benefits will not be reduced as a result of winning the lottery, regardless of whether or not you have reached your full retirement age.

What Is The $144 Back On Medicare

The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

Also Check: How Soon Can You Enroll In Medicare

The 10 Standard Medicare Supplement Insurance Plans

There are 10 Medicare supplement insurance plans. Each plan is labeled with a letter of the alphabet and has a different combination of benefits. Plan F has a high-deductible option. Plans K, L, M, and N have a different cost-sharing component.

Every company must offer Plan A. If they offer other plans, they must offer Plan C or Plan F.

What To Do If You Have Medicaid And Inherit Money

You have limited choices if you receive Medicaid benefits and inherit money or assets.

If its a lot of money you are expected to inherit, you may decide that you dont want to be on government assistance anymore, in which case you will pay for your health care out-of-pocket or through another health insurance plan, Neeley says.

But if you want to preserve your Medicaid eligibility, you need to take extra steps to ensure that any inheritance isnt received outright.

The idea is to have the beneficiary receive the inheritance in a protected vehicle where it would be accessible with safeguards but not deemed an available resource or asset for the Medicaid recipient, Shah suggests.

Thats why the experts often recommend creating an irrevocable life insurance trust, pooled income trust, supplemental needs trust or a special needs trust outside of the estate to shield any inheritance assets. The rules and qualifications for each of these trusts and strategies can vary and be complex hence, consulting with an experienced attorney in estate planning is highly recommended.

Its best to plan in advance. Only an attorney who specializes in this area and has your best interests at heart will be able to guide you through this process to achieve the best results for you and your family, advises Neeley.

Recommended Reading: Does Medicare Require A Referral To See A Podiatrist

What’s The Difference Between Medicaid And Medicare

Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income. … They will work together to provide you with health coverage and lower your costs.

Medical Liens In Injury Cases

Most car and truck accident victims wisely use their PIP, Med-Pay, or health insurance to help with the costs of medical treatment. You are generally not obligated to pay back your health insurer, generally speaking.

If you break your arm playing with your kids in your backyard, your health insurance company is not looking to get paid back. But in many health insurance contracts your insurance company may place a lien on your personal case that allows them to be paid back out of any settlement.

Read Also: Will Medicare Pay For A Patient Lift

Does Medicare Have To Be Paid Back After Death

Asked by: Jerod Collier

When a Medicaid beneficiary dies, the value of their estate is used to pay back debts before transferring to any heirs. … If the person has no assets at the time of death, there is nothing else the state can do. The state cannot ask the beneficiary’s living heirs for repayment if there is no estate.

What Is A Medicare Demand Letter

When the most recent search is completed and related claims are identified, the recovery contractor will issue a demand letter advising the debtor of the amount of money owed to the Medicare program and how to resolve the debt by repayment. The demand letter also includes information on administrative appeal rights.

Also Check: Is Massage Covered By Medicare

How Do I Qualify For The Giveback

You may qualify for a premium reduction if you:

- Are enrolled in Part A and Part B

- Do not rely on government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

Because not all plans offer this benefit, it’s important to do your research and compare plans, benefits, and costs to ensure you’re making the best decision for you.

Will Medicare And Medicaid Affect My Personal Injury Settlement

Heres a question we get all the time at Patton and Patton, Will Medicare and Medicaid affect my personal injury settlement? The short answer is yes. Medicaid and Medicare are allowed to make a recovery against your personal injury settlement for reimbursement of medical bills they paid because of your injury.1 The right to recovery funds from your settlement is called a lien. Besides considering their recovery, you also have to consider Medicares future interest when you settle. Medicare is not responsible for paying for future medical care for your accident injuries if your settlement specifically included funds to pay for that future care. Lets unpack this and go through the details below.

Medicaid is a government program administered by individual states in which the government pays medical bills through a health plan for those who qualify based upon income. On the other hand, Medicare is a federal health insurance for people over 65 and for certain younger people with disabilities. If you were injured in an accident and your Medicaid or Medicare program paid for some of your medical bills, the law provides that they would have to be reimbursed out of your recovery. There are a few steps to take to resolve a Medicare or Medicaid lien or subrogation. We will discuss below some details involved in dealing with a Medicare lien.

Also Check: Does Medicare Part B Cover Long Term Care