Who Pays The High

If your adjusted gross income is more than $91,000 if youre single or $182,000 if youre married and filing jointly, you may have to pay a high-income surcharge, which adds $12.40 to $77.90 to your monthly Part D premiums in 2022.

The high-income surcharge is paid to Medicare. These premiums can be deducted automatically from your Social Security benefits, or Medicare can send you a bill. Another option is to sign up for Easy Pay and have the premiums automatically paid from your checking or savings account.

Even if youre satisfied with your coverage, its a good idea to go to Medicare.gov to compare the plans available in your area. Plans can change their coverage, costs and provider networks every year.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance Magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

You Do Need To Tell Your Medicare Advantage Plan You Want To Leave

Again, you do need to contact your plan provider directly to disenroll, but once you do, nothing more is required on your part. Once you contact your Medicare Advantage plan during Annual Enrollment to dis-enroll, your coverage will automatically revert to Original Medicare. You dont have to contact Medicare yourself. Your new coverage will begin on January 1.

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

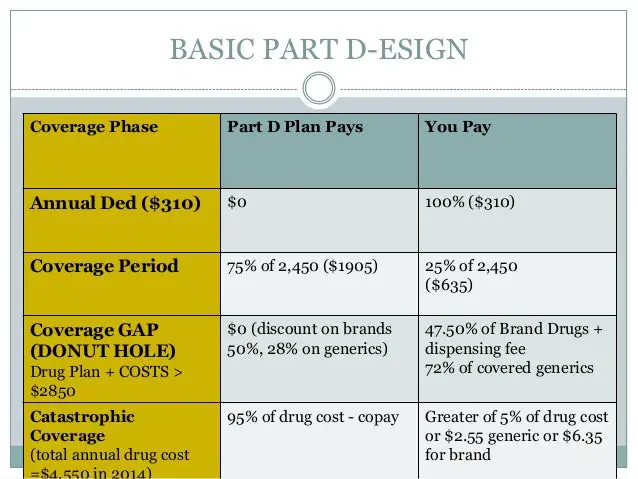

What You Need to Know Medicare beneficiaries still face a coverage gap…

Updated: December 21st, 2021ByKate Ashford×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

You May Like: Does Medicare Have A Limit

When To Enroll In Medicare Part D

When you first become eligible for Medicare, you get an Initial Enrollment Period. This is a seven-month timeframe for a new beneficiary to enroll in Original Medicare and Medicare Part D.

If you decide not to enroll in Medicare Part D during your Initial Enrollment Period and delay coverage, it is essential to have creditable drug coverage in place. If you delay Medicare Part D enrollment and do not have creditable drug coverage, you will be subject to the Medicare Part D late enrollment penalty when you do enroll in the future.

Get A Free Quote

Find the most affordable Medicare Plan in your area

The Medicare Annual Enrollment Period runs from October 15 to December 7 each year. This is the time for Medicare Part D beneficiaries to change their prescription drug plan elections. Also, during this time, those who delayed Medicare Part D without creditable coverage can enroll in a plan. The final change you make during the Annual Enrollment Period will take effect on January 1 of the following year.

Lastly, if you delayed Medicare Part D but had creditable drug coverage in place since becoming eligible for Medicare, you will get a Special Enrollment Period when you lose drug coverage.

Can I Get Medicare Supplement Plans Anytime

Generally, there is no type of Medicare plan that you can get âany time.â All Medicare coverage, including Medicare Supplement plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year. However, Medicare Supplement open enrollment is more limited.

Recommended Reading: What Does Part B Cover Under Medicare

Is Medicare Part D Optional

Summary:

Whether you qualify for Medicare by turning 65 years of age, through disability or by having a condition like Lou Gehrigâs disease, you may have the option to enroll into Medicare Part A and/or Part B. Then, you can enroll in Medicare prescription drug coverage under Medicare Part D if you want to.

Depending on your work history and how you qualify, you may be automatically enrolled or need to manually enroll. But one thing people often wonder about is how they obtain Medicare Part D, which is prescription drug coverage and doesnât automatically come with Original Medicare.

Medicare Part D benefits are available from either a stand-alone Medicare Prescription Drug Plan or a Medicare Advantage Prescription Drug plan, which combines Original Medicare benefits with prescription drug coverage. Both types of plans are administered by private insurance companies that have a contract with Medicare, and specific benefits and prices vary depending on the service area you live in.

Consider These 4 Advantages Before Canceling

Prescription drugs can be expensive without coverage. Before cancelling your plan, consider the following benefits that a Medicare Part D plan provides:

Variety of Plan Options

Since Medicare Part D is offered through private insurance carriers, there are a variety of plans to choose from. If you are unhappy with your current plan, compare other plans in your area to see if there is a better fit for your needs. Depending on your service area, plans can cost as little as $15 a month. If you rarely take medications it might be helpful for you to find a plan with a low monthly premium.

Saves Money

Prescription drugs can be expensive. Some specialty drugs can cost hundreds and even thousands of dollars a month without coverage. Medicare Part D protects beneficiaries from paying astronomically high prescription drug costs. With a Part D plan, your prescription drug costs will be considerably lower than retail prices.

Provides Protection for the Future

Your health can change in an instant and not having coverage for costly medications can be financially devastating. Prescription drug coverage provides protection for unforeseeable out-of-pocket prescription costs.

The benefit of Catastrophic Coverage

Don’t Miss: How To Submit A Medical Claim To Medicare

Does Having Parts A And B Mean Im Precluded From Coverage Under Part D

If you have only Part A coverage, you may be able to continue that coverage under Medicare Part D. However, if you also have Part B coverage, you will likely be precluded from receiving coverage through Part D. This is because Medicare Part D is a drug plan specifically for seniors and people with disabilities.

When Can I Join Switch Or Drop A Plan

You can join, switch, or drop a

with or without drug coverage during these times:

- Initial Enrollment Period. When you first become eligible for Medicare, you can join a plan.

- Open Enrollment Period. From October 15 December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 .

- Medicare Advantage Open Enrollment Period. From January 1 March 31 each year, if youre enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or switch to Original Medicare once during this time.

Learn more below about enrollment periods below.

Recommended Reading: Are Walkers Covered By Medicare

Changing Or Canceling Your Plan

Life is full of twists and turns. You could be faced with new health challenges. Your financial situation could change if you retire or lose your job. Your insurance company could make changes to your plan. All of these things could affect how much prescription drug coverage you need and how much you can afford.

You may need to consider changing your Part D plan. The good new is you are not stuck with the same Part D plan forever. You have choices. The trick is to know when to make those changes.

Staying With The Same Plan Every Year

We live in a world of convenience but health care is not one of the times to cut corners. Your Part D plan will approach you for renewal every year. Take a close look at your situation. Has anything changed in the past year? Do you take more medications now or anticipate taking more medications in the year to come? Will your plan cost you more the next year? Is it worth the added cost?

Just because your Part D plan worked well for you one year does not mean it will be the best plan for you the next. Do some research and make sure you pick the Part D plan that will give you the best coverage for your dollar.

Don’t Miss: Does Medicare Cover Dexcom G6 Cgm

Initial Enrollment Period For Part D

You can enroll in Medicare Part D coverage during your Initial Enrollment Period for Part D, which is the period that you first become eligible for Medicare Part D.

For most people, the IEP for Part D is the same as the IEP for Medicare Part B and begins three months before you turn 65 years of age, includes the month you turn 65, and ends three months after.

If you are not eligible to enroll in Medicare Part D because you do not live in a Part D-covered service area, your Initial Enrollment Period would not begin until three months before you permanently reside in the service area of a Medicare Part D Prescription Drug Plan or a Medicare Advantage plan that includes drug coverage.

If you enroll in Medicare Part D during your Initial Enrollment Period, your Medicare Part D coverage will begin on the first day of the following month that you apply for the plan.

If you enroll in one of the three months prior to turning 65 years of age, your Medicare Part D coverage begins on the first day of the month that you turn 65.

What Is The Late Enrollment Penalty

The Late Enrollment Penalty is a fee that is meant to encourage enrollment in a prescription drug plan at the point of eligibility. If you are enrolled in a Medicare prescription drug plan, you may owe a Late Enrollment Penalty, if for any 63 days or more after the Initial Enrollment Period, you went without 1 of these:

- A Medicare Part D Prescription Plan

- A Medicare Advantage Plan

- Another Medicare health plan that offers Medicare prescription drug coverage

The Late Enrollment Penalty is added to your monthly Part D premium for as long as you have Part D coverage, even if you change your Medicare Part D plan. The Late Enrollment Penalty amount changes each year. You may also have this penalty if you have a Medicare Advantage plan that includes prescription drug coverage . You can avoid the late enrollment penalty by making sure you enroll when you are eligible and keeping your coverage.

If you qualify for Extra Help due to a lack of income or resources, you can enroll late without a penalty. However, if you lose Extra Help, you may be charged a penalty if you have a break in coverage.

Medicare, not the Cigna Part D Plan, will determine the penalty amount. You will receive a letter from the plan notifying you of any penalty. For further questions or concerns about the Late Enrollment Penalty, call Medicare at 1 MEDICARE or visit www.medicare.gov

We were unable to load Plan finder tool, please try again later.

Medicare Advantage Policy Disclaimers

Exclusions and Limitations:

Also Check: Is Jakafi Covered By Medicare

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.16

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

When Can I Enroll In A Medicare Supplement Plan

The best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B.

For example, your birthday is August 31, 1953, so you turn 65 in 2018. You can enroll in Medicare Part B three months before your birthday, so you have Medicare Part B in May 2018. However in May 2018, youâre not 65 yet, so youâre not in the Medicare Supplement Open Enrollment Period. The first day of the month that youâre both 65 and older and enrolled in Medicare Part B will be August 1, 2018. Your Medicare Supplement Open Enrollment period would last until February 1, 2019.

The reason the Medicare Supplement Open Enrollment Period is important is that insurance companies that offer Medicare Supplement plans canât use medical underwriting during this time. Medical underwriting considers your health conditions and the costs to cover you and may reject you based on a health problem. During you Medicare Supplement open enrollment period, you could possibly have any health problem and still be accepted into a Medicare Supplement plan.

If you apply for Medicare Supplement after your Medicare Supplement Open Enrollment Period is over, the plan may reject your or charge you more based on your health history.

Also Check: Can A Person Get Medicare At Age 62

The Five Star Special Enrollment Period

Medicare Part D plans, along with Medicare Advantage plans and Medicare Cost plans, are rated on a scale of 1 to 5 stars based on quality and performance. A 5-star rating is the highest. If you want to switch to a 5-star plan, you can do so one time between December 8 and November 30 of the following year.

Find A Medicare Drug Plan In Your Area

Use the online Medicare Plan Finder tool for a list of the stand-along Part D plans and Medicare Advantage plans with drug insurance available in your ZIP code.15 The comparison tool shows the drugs covered by each plan, cost-sharing amounts, and whether you need prior authorization and preferred pharmacies.

Recommended Reading: Are Synvisc Injections Covered By Medicare

S To Sign Up For A Part D Plan

1. Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov.

You can log in to your Medicare account to get information about the plans in your area. You also can use the tool without logging in.

2. If you select Continue without logging in, youll be able to choose the type of coverage you want, such as a Part D drug plan. Enter your zip code and select your county.

3. Now indicate whether you get help with your medical expenses. If youre not sure, you can find out by logging in to your Medicare account.

4. If you dont receive any help, youll be asked if you want to see your drug costs when you compare plans. Click Yes so you can get a sense of how much you would spend with each plan.

5. Enter the names of your medications. Be sure to include ones you take regularly so that youll get a good estimate of ongoing costs. Youll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When youre finished, click Done Adding Drugs.

6. Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with the pharmacies and what your copayments would be for each one. Enter the names of pharmacies you use or search by your address or zip code.

For help signing up for a Part D plan, contact your State Health Insurance Assistance Program .

Failing To Read The Annual Notice Of Change For Your Current Plan

Your Part D formulary is not set in stone. Medications covered on your formulary change all the time. There will be times when new medications are added and times when medications you take are removed from the formulary.

This could result in you having to change medications or paying more to keep the same medication. Your Part D plan will notify you of changes to the formulary as they affect you. Generally speaking, you will have 60 days to decide whether to change your medication to one on the formulary or appeal to the insurance company to keep covering the medication. If your plan denies coverage and you need that medication, you may want to consider another Part D plan during the next Open Enrollment period.

At the end of the year, your plan will mail you an Annual Notice of Change. This document will outline changes to the formulary as well as changes to the plan that may include adjustments to deductibles, copays, coinsurance and premiums. It is important to take a close look at this information to see if you will get comparable coverage at an agreeable cost the following year. This is a good time to shop around to see if other plans have more to offer.

Don’t Miss: Does Medicare Pay For Breast Reconstruction