How Part D Works With Other Insurance

The types of insurance listed below are all considered

. If you have one of these types of insurance, in most cases, it will be to your advantage to keep your current coverage.

| Note |

|---|

|

Keep any creditable prescription drug coverage information you get from your plan. You may need it if you decide to join a Medicare drug plan later. Don’t send creditable coverage letters/certificates to Medicare. |

How Medicare Recovers Conditional Payments

If Medicare makes a conditional payment, and you or your lawyer haven’t reported your settlement, judgment, award or other payment to Medicare, call the Benefits Coordination & Recovery Center at 1-855-798-2627 .

The BCRC will gather information about any conditional payments Medicare made related to your settlement, judgment, award or other payment. If you get a payment, you or your lawyer should call the BCRC. The BCRC will calculate the repayment amount on your recovery case and send you a letter requesting repayment.

Individual Or Marketplace Health Insurance Plan

Medicare pays first if you keep an individual health plan or Affordable Care Act marketplace health insurance plan.

However, there is no reason normally to keep an individual or marketplace plan once you have Medicare. Once you have Medicare, its illegal for someone to sell you a marketplace or individual market policy. Youre ineligible for tax credits or subsidies to help pay for an ACA plan, so if you were to keep that plan, it would be at full price. Marketplace plans generally has no COB with Medicare, so it wouldnt work as secondary insurance either.

You May Like: How Can I Contact Medicare By Telephone

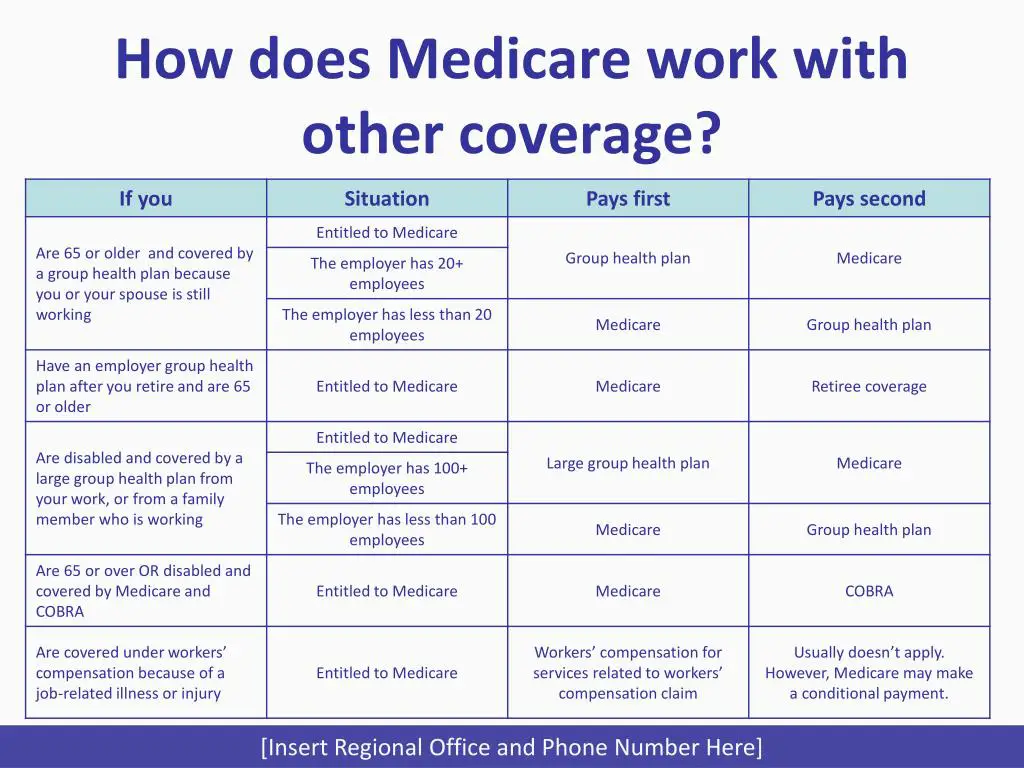

Medicare And Small Group Insurance: Who Pays First

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second.

If you have small group insurance, its HIGHLY recommended that you enroll in both Parts A and B as soon as youre eligible. If you dont, your employers group plan can refuse to pay your claims.

Your insurance might cover claims even if you dont have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs. Youll also have to pay the late penalty because your group insurance wont be considered .

If Your Or Your Spouse’s Employer Has 20 Or More Employees Then The Group Health Plan Pays First And Medicare Pays Second

If the

didn’t pay all of your bill, the doctor or

should send the bill to Medicare for secondary payment. Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You’ll have to pay any costs Medicare or the group health plan doesn’t cover.

Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65. If the employer offers coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65.

Also Check: Are You Automatically Enrolled In Medicare At 65

Does Medicare Work With Health Savings Accounts

When enrolled in any Medicare parts, you CANNOT contribute to a Health Savings Account . Your employer also cant contribute to your HSA once your Medicare is active. If you continue to add to your HSA, you could face tax penalties.

If your spouse has coverage on your group insurance, they can still contribute as long as their Medicare is not active. The good news is, you can use the funds in your HSA to pay for any medical expenses.

If The Employer Has 20 Or More Employees The Group Health Plan Generally Pays First

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You’ll have to pay any costs Medicare or the group health plan doesn’t cover.

Employers with 20 or more employees must offer current employees 65 and older the same health benefits, under the same conditions, that they offer employees under 65. If the employer offers coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65.

Recommended Reading: Are Doctors Required To Accept Medicare

What Happens If One Of You Becomes Eligible For Medicare Before The Other

Unless you and your spouse were born in the same month of the same year, one of you will become eligible for Medicare before the other. If you both are covered by your employer health insurance, and one of you turns 65, youll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age. Some employers may require spouses who are eligible to get Medicare to do so at age 65 in order to remain on the employer plan.

You can learn more about your potential options by talking with your employer benefits administrator.

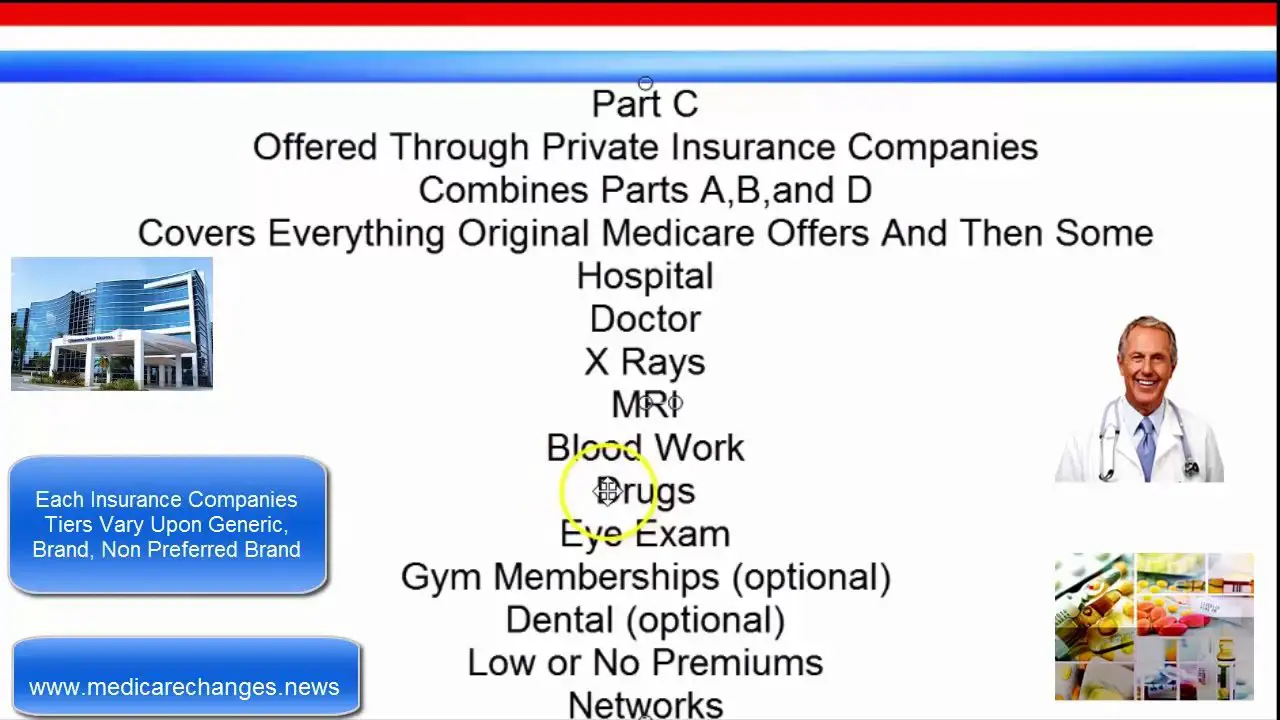

How Does Medicare Part D Prescription Coverage Work

Medicare Part D covers prescription drugs. You get it through a Part D prescription drug plan or through a Medicare Advantage plan. But it works differently from prescription coverage that comes with other health insurance plans.

Medicare Part D prescription coverage has something called the coverage gap, or donut hole. The coverage gap is a stage in which you pay much more out of pocket for your prescription drugs. It’s not based on a time period. It’s based on how much you spend.

You can find out more about the donut hole and how Medicare part D works in our Help Center.

Recommended Reading: Does Medicare Cover Gastric Bypass Revision

You Have A Medicare Msa Plan And Have Or Want To Buy Other Insurance

In general, you can’t have other insurance that would cover the cost of services during your Medicare MSA Plan’s yearly deductible.

However, you can buy some limited benefit policies in addition to your Medicare MSA Plan coverage, like dental, vision, or long-term care. Call the State Health Insurance Assistance Program in your area for more information about these types of private insurance policies.

Is Medicare Primary Or Secondary To Employer Insurance

When you receive medical services, your primary insurance pays out first. This insurance is known as the primary payer.

If theres anything that your primary insurance didnt cover, your secondary insurance pays out next. This insurance is known as the secondary payer. The secondary payer generally covers some, if not all, of the remaining costs.

Heres how to know who the primary and secondary payers are in your situation:

- Medicare is generally the primary payer if the company you work for has fewer than 20 employees. But Medicare becomes the secondary payer if your employer is part of a group health plan with other employers who have more than 20 employees.

- Medicare is typically the secondary payer if the company you work for has 20 or more employees. In this case, your group health plan is the primary payer and Medicare pays out only after your employers plan has paid their portion.

The rules above are for general circumstances and may change depending on your specific situation. If youre not sure whether Medicare will be the primary or secondary payer in your situation, you can call 855-798-2627 to speak to someone at Medicares Benefits Coordination & Recovery Center.

Read Also: What Is Medicare For All

How Do You Know If Medicare Is Primary Or Secondary

Medicare and your other insurance plans coordinate their benefits to avoid duplicate payments. If Medicare is your primary payer, it will pay first and your private plan will kick in to cover some or all of the costs not covered by Medicare. If Medicare is secondary, the opposite will occur.

Typically, whether Medicare is primary or secondary to your existing insurance will depend on how you get your other insurance policy. If you work for a large employer , your workplace insurance is your primary policy. The same rule applies if you get insurance through your spouses large employer. Similarly, if youre on active-duty military and get insurance through Tricare, Medicare will be secondary.

However, if you work for a small company or get health insurance from a former employer, Medicare pays first.

In any case, even if both insurers pay a portion of the costs, you may still end up owing money for your treatment if the two insurers dont completely cover your copayment or deductible.

And Older And Receiving Retiree Health Benefits

Many people are eligible for retiree health benefits once they reach age 65. In this case, Original Medicare is always primary to coverage from a former employer or union. Your retiree health benefits act as a secondary payer to your healthcare expenses, perhaps covering some of the costs that Medicare didnt pick up or helping with out-of-pocket expenses.

In some cases, retiree health plans may even provide drug coverage. If this coverage is deemed creditable by Medicare, you may be able to hold off on enrolling in Medicare Part D without having to face late enrollment penalty fees in the future.

You May Like: How To Apply For Help Paying Medicare Premiums

Signing Up For Medicare Part B At 65 If Youre Still Working

If youre still working at age 65 and youre not claiming Social Security benefits, the government will not automatically enroll you in Medicare Part B, which covers doctors visits, diagnostic tests, medical equipment, ambulance transportation, and mental health care.

If you work for a company with 20 or more employees and youre enrolled in your employers health insurance plan, you dont have to enroll in Part B. You also might not want to because it isnt free.

Can You Use Medicare While You Are Working

You can, but you dont have to. Your initial Medicare enrollment period begins 3 months before your 65th birthday and lasts for 7 months, but you can enroll after that period ends if you have an employer-sponsored plan. Just be sure to inform Medicare of your other coverage in order to avoid owing a Part B late-enrollment penalty. However, if you work for an employer with fewer than 20 employees, you must sign up for Medicare during your initial enrollment period.

Even if youre working, Medicare requires that you have creditable drug coverage. If your existing plan does not qualify, you must purchase a Part D plan, or youll owe a late-enrollment penalty an ongoing penalty that youll have to pay every month that you have Medicare Part D.

Recommended Reading: Do I Have To Sign Up For Medicare Part D

How Tricare Works With Other Types Of Medicare Coverage

Below is how TRICARE For Life works with other types of Medicare.

- Medicare AdvantageTRICARE works with Medicare Advantage plans in the same way that it works with Original Medicare as described above. Medicare Advantage plans offer the same benefits covered by Original Medicare, and some Medicare Advantage plans may also offer additional benefits such as dental, vision and hearing care, as well as prescription drug coverage.

- Medicare Part DTRICARE includes prescription drug coverage. In many cases, it isnt necessary for TRICARE beneficiaries to enroll in a Medicare Part D prescription drug plan.

- Medicare Supplement InsuranceTRICARE acts as supplemental coverage and picks up the cost of many of the same out-of-pocket Medicare costs as Medicare Supplement Insurance, such as Medicare coinsurance and deductibles. For this reason, its not typically necessary for TRICARE beneficiaries to enroll in a Medicare Supplement Insurance plan .

Medicare Pays First When It Serves As Your Primary Payer

If you have Medicare as well as another type of insurance, your coverage is provided through a coordination of benefits. In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer.

In the following situations, Medicare acts as your primary payer:

Also Check: Is Obamacare Medicare Or Medicaid

To Be Eligible For Extra Help For Your Prescription Drugs You Must:

- Live in the United States

- Qualify for Part A and be enrolled in Part B

- Have less than $20,385 in annual income /$15,510 in assets .

- Have less than $27,465 in annual income /$30,950 in assets .

*Income thresholds may change year to year as dictated by state and provided by ssa.gov. The social security office will have the latest figures when you apply.

How Does Medicare Work With Employer Insurance

Original Medicare offers comprehensive hospital and medical coverage, much in the same way that most employer health plans do. One type of plan is not intended to replace the other. Instead, they can work in conjunction.

Medicare is meant to work together with employer benefits to cover your healthcare needs and help pay for most, if not all, of your medical expenses.

Recommended Reading: Does Medicare Have Long Term Care Insurance

Esrd Beneficiary And Receiving Coverage From A Group Health Plan Or Cobra

If you are eligible for Medicare because you suffer from End-Stage Renal Disease , meaning that you receive dialysis or have undergone a kidney transplant, your employer group health plan or COBRA pays first during a coordination period of up to 30 months. This happens regardless of how many employees your employer has. This is also true if you are covered under retiree insurance.

If you are only eligible for Medicare because you suffer from ESRD , this coordination period begins when you become eligible for Medicare. While your group health plan/COBRA coverage will be billed first for Medicare-covered services, including ones that are outside of ESRD-related medical costs, Medicare may pay second for other Medicare-approved medical expenses.

You Have A Medicare Msa Plan & A Medicare Supplement Insurance Policy

If you join a Medicare MSA Plan and already have a

, you can keep your policy. However, you’ll have to keep paying your premiums and may get little or no benefit from having it while you’re in a Medicare MSA Plan. It won’t cover any part of your deductible.

If you drop your Medigap policy, you may not be able to get it back, except in certain situations. For example, you may be able to get your Medigap policy back if you drop it to join a Medicare MSA Plan for the first time, and you stay in the MSA Plan for less than a year.

Read Also: Can I Change Medicare Plans Anytime

Primary Payer Vs Secondary Payer

Lets talk about what it means to be aprimary payer and a secondary payer. Primary insurance pays up to its coverage limit. The primary payer always pays first. Then, the secondary payer only pays if there are some costs that the primary payer didnt cover. You should know that your secondary insurance may not pay all expenses that were not covered by the primary payer.

What all this means is that while the primary and secondary payer can potentially cover all expenses related to a medical bill, it is still possible that there will be some costs leftover that neither payer is obligated to cover and you will be responsible for paying.

What Other Types Of Coverage Can You Have With Medicare

There are several different situations when you may have private insurance and Medicare at the same time. This can happen if you have:

- Coverage through an employer. Its possible that youll still have private insurance through your employer when youre eligible for Medicare.

- Coverage under your spouses private health insurance. You can have Medicare and also be covered on a group plan provided by your spouses employer.

- COBRA.COBRA allows you to temporarily keep private insurance coverage after your employment ends. Youll also keep your coverage if youre on your spouses private insurance and their employment ends.

- TRICARE.TRICARE provides coverage for active and retired members of the military and their dependents. You can have both TRICARE and Medicare if you:

- are age 65 or over and enrolled in Medicare Part B

- have a disability, end stage renal disease , or amyotrophic lateral sclerosis and are enrolled in both Medicare Part A and Part B

- have Medicare and are a dependent of an active duty service member with TRICARE

Now that weve seen when you may have both Medicare and private insurance, lets discuss who pays first in each situation.

You May Like: What Are The Guidelines For Medicare