When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

How Does Anyone Earn Them

You can earn up to four credits per year, or one per quarter. Though, as mentioned above, you could earn enough for four credits in one quarter, or it could take all year. Either way, the maximum number of credits you may earn annually is four.

As general wage levels rise each year, the amount of earnings it takes to garner a work credit increases as well. In 2022, you must earn $1,510 in covered earnings to get one Social Security credit. That means to get all four work credits, you must show $6,040 in earnings for the year.

How Many Social Security Credits Do I Have

For each year you work you will collect social security credits. If you become disabled and you are unable to work for at least 12 months you can use these credits to access social security disability benefits , depending on how many you have accrued at the time.

SSDI is paid by contributions made by workers to the Social Security trust fund. These are called Social Security taxes and translate into Social Security credits.

You dont need to keep a record of your credits asthe Social Security Administration mails out a summary to you each year, about three months before your birthday. Your statement provides a record of your earnings history and the number of credits you’ve accumulated to date. Your Social Security Statement is available to view online by opening a my Social Security account.

You can create a my Social Security account today and it is a secure method you can use for several purposes including to requesting a replacement Social Security card, checking the status of a SSDI application, estimating your eligibility to future benefits, managing the benefits you already receive.

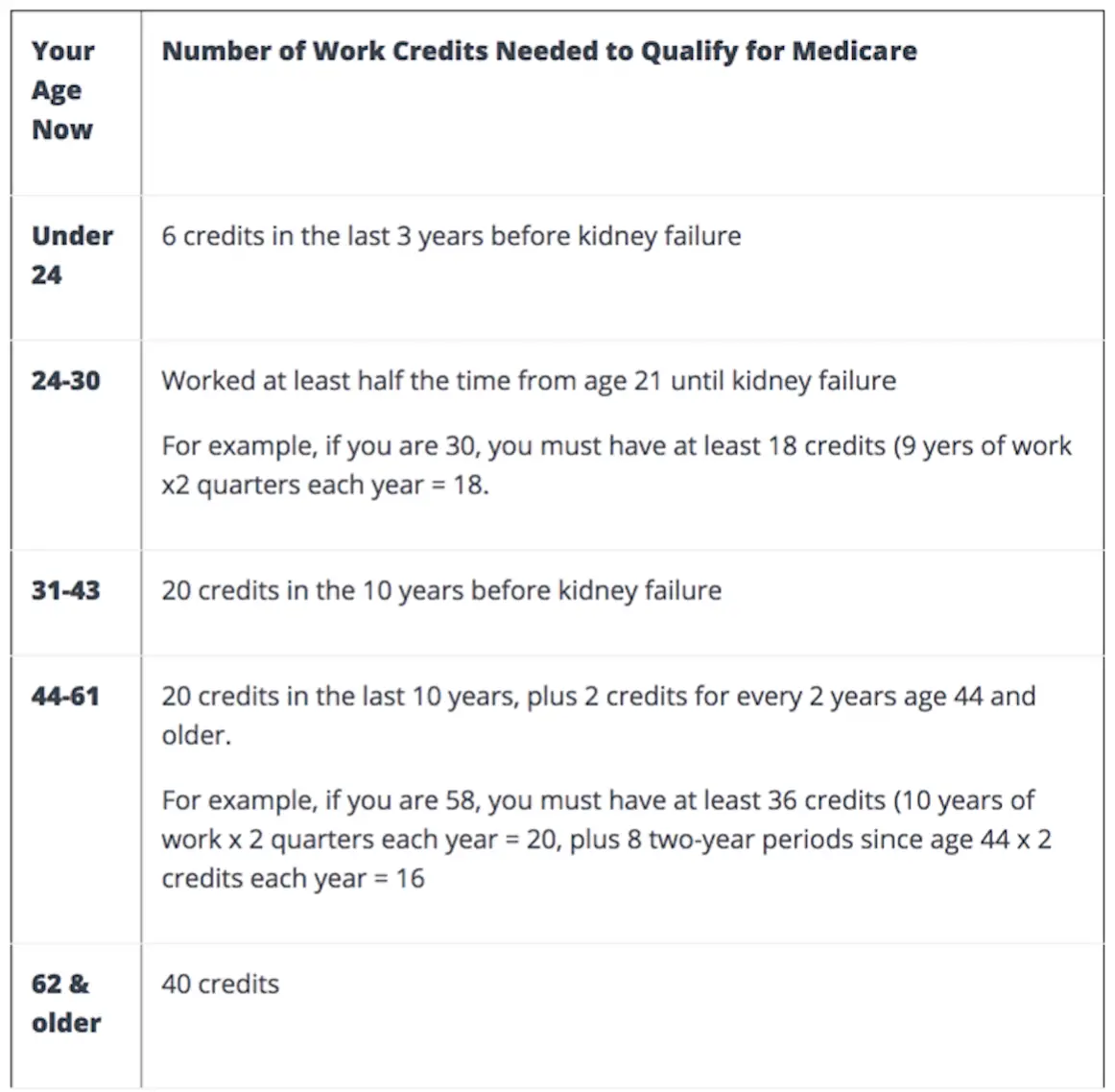

The number of work credits you need to qualify for disability benefits depends on your age when you become disabled. Generally, you need 40 credits, 20 of which were earned in the last 10 years ending with the year you become disabled The amount needed for a work credit changes from year to year.

Also Check: What Year Did Medicare Start

Protect Your Medicare Number Like A Credit Card

Only give personal information, like your Medicare Number, to health care providers, your insurance companies or health plans , or people you trust that work with Medicare, like your State Health Insurance Assistance Program .

Say no to scams

Medicare will never call you uninvited and ask you to give us personal or private information. Learn more about the limited situations in which Medicare can call you.

At What Age Do I Qualify For Social Security

You can begin collecting Social Security retirement benefits as early as age 62. Doing so, however, is often not advisable, since it means lowering your monthly benefits potentially for life.

To collect the full monthly benefit your earnings record entitles you to, you must wait until full retirement age to sign up for Social Security. Depending on your year of birth, that age will fall out somewhere between 66 and 67. For each month you file for Social Security ahead of full retirement age, youll face a reduction in your monthly benefits that will likely remain in effect indefinitely, unless you manage to go through the motions of withdrawing your application soon after filing it.

Read Also: How To Get New Medicare Card Without Social Security Number

You May Like: How To Get Dental With Medicare

Social Security Credits Required For Retirement Benefits

The Social Security credits required for retirement benefits is the easiest to understand. If you were born after 1929, you must be fully insured for eligibility. In most cases, all 40 credits can be satisfied by 10 years of work.

If you do not have enough Social Security credits based on your work history, you may qualify for a benefit on a spouses work record.

Discover The Ahip Advantage

When it comes to professional education in health insurance, nothing compares to programs from AHIP Insurance Education. Developed by industry experts. Presented in an engaging format. Vetted regularly for updates. Make learning easy and convenient. See why AHIP is the right choice for your professional education.

- Advocacy

Also Check: Is Medicare Only For Us Citizens

How Do I Know If I Have Worked Enough To Qualify For Mediare

You earn 1 work credit for earning a specific amount of money from work in a 3-month quarter. The chart below gives a general guide to number of work credits needed to qualify for Medicare at a particular age. To find out how many work credits you have, call Social Security at 1-800-772-1213.

|

Your Age Now |

Eligibility Based On Age

Medicare was originally created for people over the age of 65, making age the most common factor for eligibility.

Youre eligible for Medicare based on age if:

- Youre turning 65 soon.

- You live in the U.S. lawfully .

You likely also qualify for premium-free Part A if youve accumulated enough Social Security work credits during the course of your working life. Remember that Original Medicare is made up of two parts, A and B.

Nearly everyone pays a premium for Part B, but very few people pay a premium for Part A. Thats because payroll taxes help fund Part A. So if you or your spouse has accumulated 40 work credits by the time youre eligible for Medicare, you wont pay a premium for Part A.

- Note: You can check the status of your work credits with Social Security directly. Its actually a good idea to do this before youre eligible for Medicare, just to make sure your records are correct. Just head over to mySocialSecurity to learn more about creating an account and what you can do with it.

For those who dont have enough work credits, you can still enroll in Medicare when you turn 65. But youll probably have to pay a premium for Part A, which varies each year. How much you pay depends on your work credits.

Read Also: How Often Does Medicare Pay For Diabetic Foot Care

If I Keep My Work Insurance Do I Need To Enroll In Medicare

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Part A: For most people, Part A does not charge a premium. Typically, Part A pays after your work insurance. Part A probably wont pay much of the bill, but doesnt cost anything to have. For that reason, most individuals enroll in Part A at age 65.

Part B: Everyone pays a monthly premium for Part B. Part B typically pays after your work coverage and may not pick up much of the bill. Enrolling in Part B will also start your one-time guarantee to purchase a Medicare Supplement. Once this 6-month time frame starts, it cannot be stopped. For these two reasons, most people wait until their work coverage ends to enroll in Part B.

Part D: Everyone pays a monthly premium for Part D. As long as you have other “creditable coverage,” you do not have to enroll in a Part D plan. Creditable coverage means the insurance is as good as, or better than, a standard Part D plan. Check with your HR department to verify if your policy is creditable coverage. Typically, prescription insurance through work offers better coverage than what you can get through Medicare. For this reason, most people wait until their work coverage ends to enroll in Part D.

How Much Do Part A Premiums Cost

Once a person turns 65 years of age, they can enroll in Medicare even if they do not have the required 40 work credits to receive Social Security benefits. However, there may be additional costs, including Part A premiums.

If someone does not have 40 work credits, the only difference in their Medicare costs involves the Part A premium. All other costs will be identical to those of people who do have 40 work credits.

Recommended Reading: How To Get Medicare Part D Deducted From Social Security

How Can I Calculate The Number I Need Personally

There are couple ways to determine the amount of work credits you need to qualify for SSDI.

One trick is to subtract the year you turned 22 from the year you became disabled. For example, if you are 50 years old and became disabled in 2022, the equation would be:

2022-1994 = 28

In that case, you need 28 total work credits over the course of your working life to qualify for SSDI. And remember 20 of those work credits must be in the last 10 years to satisfy the recent work test.

Or, if math isnt your thing, you can also check out this handy chart created by the SSA.

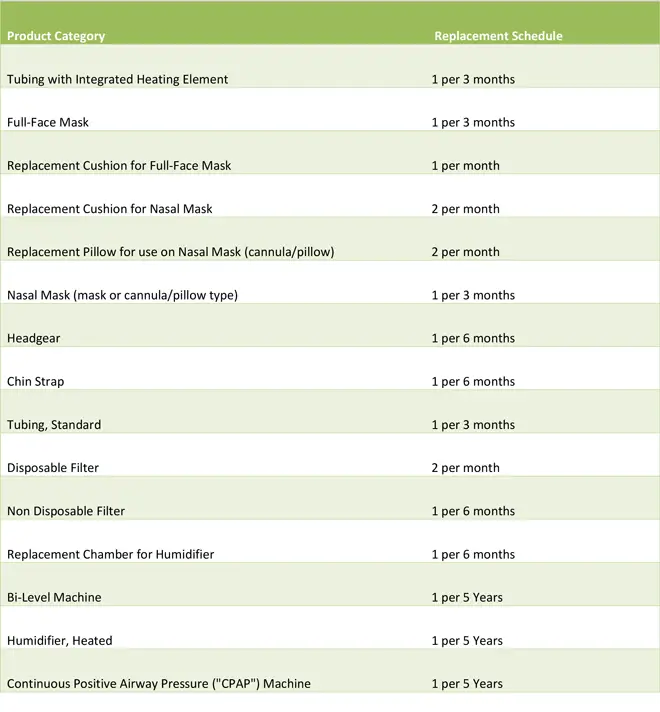

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Read Also: Can You Change Your Medicare Supplement Insurance Anytime

I Have Insurance Through The Affordable Care Act Marketplace Should I Apply For Medicare Too

If you have insurance through the ACAs marketplace, you do not need to sign up for Medicare unless you want to. You should evaluate your costs and coverage with the ACA plan vs Medicare. To help here is a Kidney Care Insurance Worksheet which is designed to help compare plans offered in the health insurance marketplaces established by the Affordable Care Act, so you can choose the most affordable and comprehensive plan. It is also important to note that if you apply for Medicare you will lose any subsidies you receive from your ACA Marketplace coverage. If you chose not to enroll in Medicare when your kidneys fail, you will have penalties with higher premiums if you chose to enroll later.

Remember Medicare only pays 80% of dialysis treatment so you will need a supplemental plan so you should also calculate this cost into your assessment. For people under 65 years old there may not be a supplement plan available in your state. To find out what supplemental policies are available in your state contact your State Health Insurance Assistance Programs .

You May Like: What Is The Best Medicare Advantage Plan In Arizona

How Do I Enroll In A Medicare Advantage Plan

Medicare Advantage Plans are health care options provided under Medicare Part C of the Medicare program. These plans are approved by Medicare but sold and serviced by private companies. There are several plan options available under Medicare Advantage such as managed care plans that involve a provider network to those that are specially designed for people with certain chronic diseases and other specialized health needs and some that may or may not have a provider network requirement. Most Medicare Advantage plans include Medicare prescription drug coverage.

For assistance with Medicare Advantage Plans comparisons and enrollments, please call our team of Medicare specialists at 1-855-408-1212 or you may log onto MyMedicare.gov to shop for Medicare Advantage Plans available in your area.

To enroll in any Medicare Advantage plan option you must have both Medicare Part A and Medicare Part B. Once you enroll into a Medicare Advantage plan, you will not use your Original Medicare card as your Medicare Advantage plan will replace Original Medicare. Instead the Medicare Advantage plan will provide you with a member ID card to use when visiting your medical provider. Please note, you will continue to pay the Medicare Part B premium, and you might also have to pay an additional monthly premium charged by the Medicare Advantage plan.

Recommended Reading: What Is Required For Medicare

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Is There Financial Help For Medicare Part D Coverage

Medicare offers Extra Help for Medicare enrollees who cant afford their Part D prescription drug coverage. If youre a single person earning less than $1,630 per month , with financial resources that dont exceed $14,790 , you may be eligible for Extra Help . The program will reduce or eliminate your Part D plans premium and deductible, and also lower the cost of prescription drugs to a very small amount.

Heres more information about Extra Help, including details about the type of notice you might receive from Medicare or Social Security, that you can then send to your Part D plan.

Also Check: Do You Get Medicare Or Medicaid With Disability

Medicare Coverage For People Who Never Worked

Your Medicare Part A coverage is essentially paid for while in the workforce since you pay taxes for Medicare while employed. If you never worked, you likely will not be eligible for premium-free Part A, which covers inpatient care and hospital stays.

You can still get Part A without any work history to do so, youll have to pay a monthly premium like any other form of insurance. That premium could be reduced if you spent some time in the workforce.

For example, if you were employed for years but put your career on pause to be a stay-at-home parent or for any other reason, you could be eligible for a reduced premium.

If you never worked, then your Part A premium for 2022 will be $499. But if you spent at least 30 to 39 quarters in the workforce and paid Medicare taxes, your premium could be reduced to $274.

Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

Read Also: What Is Oep In Medicare

Medicare When Your Non

Youll need to make some decisions about Medicare when you become eligible, whether or not you continue working past age 65.

Either way, your spouse will need health insurance until he or she is also eligible for Medicare. Here are some of the options:

- Your spouse may continue coverage through your employer plan if you keep working and keep the employer coverage.

- Your employer may offer COBRA coverage for your spouse if you retire.

- Your spouse may choose to buy individual health insurance until he or she turns 65.

Your employer benefits manager can help you and your spouse understand your choices.

Recommended Reading: How Do I Print My Medicare Card

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

How Do You Get Another Medicare Card

My card is lost or damaged Log into your secure Medicare account to print or order an official copy of your Medicare card. You can also call 1-800-MEDICARE to order a replacement card to be sent in the mail. TTY users can call 1-877-486-2048.

If you get Railroad Retirement Board benefits, you can call 1-877-772-5772 to get a replacement card. TTY users can call 1-312-751-4701.

My name changed Your Medicare card shows the name you have on file with Social Security. Get details from Social Security if you legally changed your name.

Protect your identity

Recommended Reading: How To Sign Up For Medicare At Age 65