Hypothetical Medicare Supplement Premium

- Premium for Plan G: $95.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B annual deductible: $233

Total: $3,414.20 per year.2

Plan G covers all of your medical expenses at 100%, except the Part B deductible. So you can expect this to be your total annual cost.

Example 2: Plan G High-Deductible

- Premium for Plan G high-deductible: $20.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B deductible: $233

Total: $2,514.20 per year.3

This is your best case scenario, which means you only pay the monthly premium assuming no other out-of-pocket medical expenses if you do not utilize medical services.

Your worst case scenario:

- $2,514.50 premium and Part B deductible

- + $2,490 annual high deductible

Total: $5,004.20 per year.

Comparison: Example 2 costs $1,590more over the course of a year if you meet the deductible. However, Example 1 will cost you $924.20 more in premium if you dont use any services or your medical needs are minimal.

In this example, you might want to consider taking the Plan G high-deductible option if you are healthy.

Why? Because you could save just over $900 a year if you have a good year. Over multiple good years, the savings could add up.

But the math flips if your health changes for the worse. In that case, you could find yourself paying the high deductible for multiple years. And in some states, you wont be able to change plans because you may not pass medical underwriting.

How Does Medigap Serve Or Help Me

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs. You decide how much you want to be covered and what premium you want to pay.

Whats The Most Popular Medicare Supplement Plan

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 46% of Medicare Supplement enrollees have chosen this plan. Plan G has 27% of the market, making it the most popular choice for those who are newly eligible for Medicare.

You May Like: Is In Home Health Care Covered By Medicare

Plan F Vs Plan G Comparison

We often get questions about Plan F vs Plan G. We compare prices for both Plan F vs Plan G for nearly all new clients.

Quite often, we find that our clients can sometimes save $200 -$300 per year by looking at Plan G options. So what is the difference between Medigap Plan F and G and which is better?

The coverage is very similar to Medicare Supplement Plan F with one minor exception: the Part B deductible. On Plan G, you pay the once-annual Part B deductible yourself. However the premiums can be quite a bit cheaper, and you pocket the savings.

Plan G might help you keep more of your money in your own pocket instead of an insurance companys coffers. We can demonstrate the savings for you get quotes for Plan F vs Plan G today. We can also provide quotes for Medicare Plan N, which is the third most popular Medicare Supplement plan.

Our agency works with about 30 carriers in every state except New York. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2023. Youll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

Can You Enroll In Medicare Supplement Plans At Any Time

Medicares open enrollment period, which runs from October 15 to December 7 annually, allows you to make changes to your health and drug coverage. However, 57% of Medicare enrollees dont take advantage of the potential money-saving option to compare their Medicare coverage choices, according to data from KFFFreed M, Koma W, Cubanski J, Fuglesten BJ, Neuman T. More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually. Kaiser Family Foundation. Accessed 09/22/2021. . Older enrollees are even less likely to review their plan choices, with 66% of those 85 and older not taking advantage of open enrollment at all.

If youre past the initial open enrollment period and are interested in a Medigap plan, Jacobson provides a warning: Medigap insurers dont have to sell you a plan that you want and can charge you higher premiums if they do choose to sell you a plan depending upon where you live, your health status and your age.

There are also scenariossuch as if youre already enrolled in Medicaid or have a Medicare Advantage planin which it might actually be illegal for an insurance company to sell you a Medigap policy, according to CMS.

Different insurance companies may charge you different premiums for the same exact Medigap policy, CMS also notes, so be sure to shop around and compare policies under the same plan type and focus on what matters most to you and your situation.

Don’t Miss: Which Glucometer Is Covered By Medicare

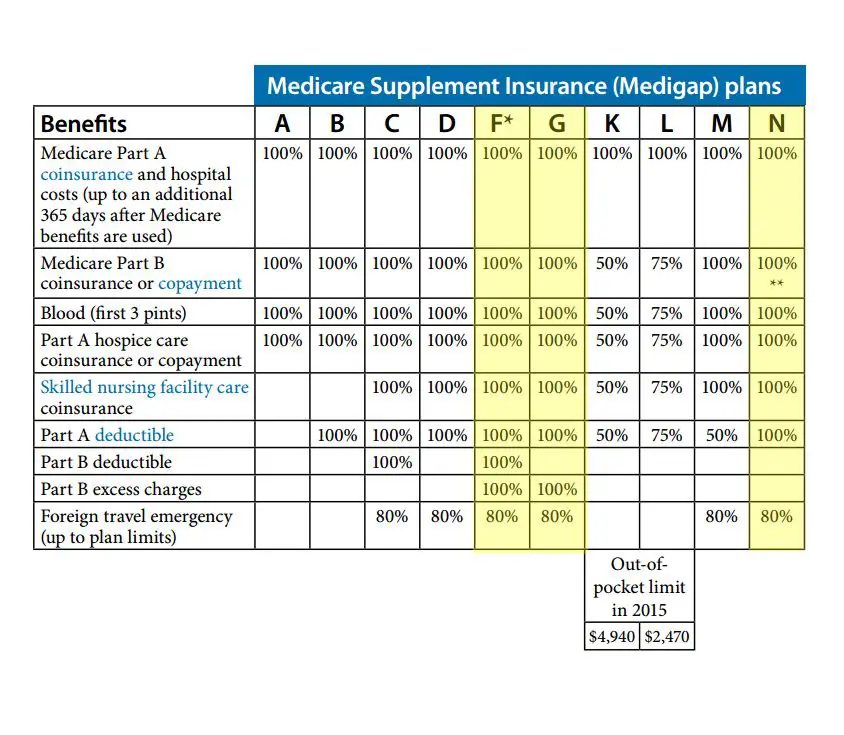

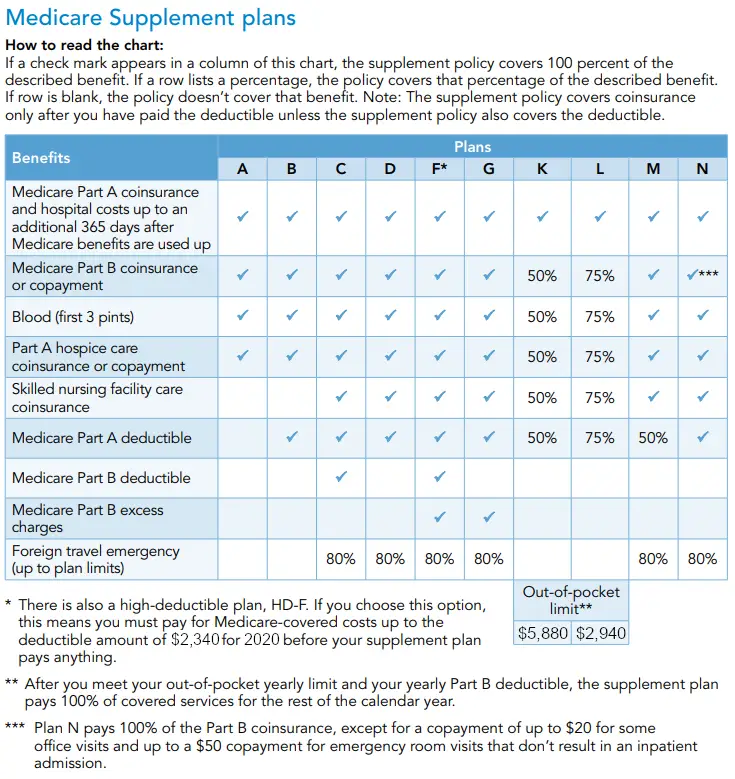

What Are The Types Of Medicare Supplement Plans

There are a wide range of Medicare Supplement plans. The different types of plans are named alphabetically, Plan A through Plan N.

Medicare Supplement plans range from those that offer basic coverage, to those offering a much higher level of coverage. Understanding your health care needs, as well as your financial situation, can help when choosing a Medicare Supplement plan.

Compare Medicare Supplement plans

What Does Medicare Supplement Insurance Cover

Medicare Supplement Insurance helps cover some costs not paid by Original Medicare Part A and B. These plans help pay copays, coinsurance, and deductibles for your Part A and Part B , as well as additional out-of-pocket costs for things like hospitalization, doctors services, home health care, lab costs, durable medical equipment, and more.

Medicare will pay its share of the Medicare-approved amount for covered health costs. Then, your Medicare Supplement Insurance plan will pay its share of the costs it covers.

There are a wide range of Medicare Supplement plans that differ in coverage and costs, from basic to extensive. Compare Medicare Supplement plans

VIDEO

You May Like: How Much Does Medicare Pay For Inpatient Psychiatric Care

Types Of Medicare Health Plans

People in Medicare are either in Original Medicare, or fee-for-service Medicare, or theyre in a Medicare Advantage plan, says Gretchen Jacobson, Ph.D., vice president of Medicare at The Commonwealth Fund, a foundation that supports independent research on health care issues and makes grants to improve health care practice and policy.

Generally, you need to pay a portion of the cost for each service Original Medicare covers out of pocket. And, according to the U.S. governments official Medicare handbook for 2022, theres no limit to what you may pay in a year unless you have other coverage, such as a Medicare Supplement, Medicaid or employee or union coverage, or you enroll in a Medicare Advantage plan.

Confused About Medicare Supplement Insurance Options?

Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option.

Where Do You Live

Where you live plays an enormous role in Medigap pricing. Thats nothing new most of us are used to costs being higher in certain parts of the country. But with Medigap premiums, theres a second reason location makes a difference: state laws.

The Medicare program is run on a national level. The Centers for Medicare & Medicaid Services manage the program, operating under federal guidelines. Medicare Supplement Insurance, although monitored by CMS, is not actually part of the Medicare program. The plans are sold by private insurance companies. And because private insurers provide the plans, they must operate within state laws regarding the sale of insurance.

Some states offer no consumer protections beyond the federal level. Most, though, have additional guidelines. The most common is a requirement for Medigap insurers to make at least one plan available to people who qualify for Medicare due to a disability instead of age. Other Medigap consumer protections may include providing additional guaranteed issue rights and prohibiting age-based pricing.

Read Also: When Should I Expect My Medicare Card

Read Also: How Much Money Can I Make On Medicare

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Underwriting And Medigap Guaranteed Issue Rights

Depending on when you sign up for a Medicare Supplement Insurance plan, you may be subject to medical underwriting.

Underwriting is the process by which an insurance company assesses your current health and your health history to determine your Medigap plan costs. If you are in poor health, the insurance company may deem you to be a higher risk, and they may charge you more for your Medigap plan. If your health history is too high risk for the insurance company, they may choose to deny you coverage.

If you enroll during your Medigap Open Enrollment Period , Medicare Supplement Insurance companies cannot use medical underwriting to determine your plan costs.

Your Medigap Open Enrollment Period is a six-month period that begins when you are at least 65 and enrolled in Medicare Part B. If you enroll in a Medigap plan after your Medigap Open Enrollment Period, insurance companies reserve the right to utilize medical underwriting to determine your plan premium or if they will offer you coverage at all.

The ability to enroll in a Medigap plan without medical underwriting is called a Medigap guaranteed issue right. In addition to your Medigap OEP, there are several Medigap guaranteed issue rights that allow you to sign up for a Medigap plan without medical underwriting.

Recommended Reading: Do You Get Automatically Enrolled In Medicare

When Can I Enroll

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions. At any other time, you would have to qualify for a Special Enrollment period to have the same rights.

Except in a few states, if you apply outside this period, you will undergo underwriting by the insurance company. The insurer could then exclude, refuse or charge more for a policy due to your existing health conditions. Again with the exception of some states, this also happens if you change from one Medigap plan to another later.

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

Recommended Reading: What Does Medicare Supplement Cover

Why Choose A Medicare Supplement Plan

As you prepare for the next chapter of your journey, having a flexible and reliable health plan with the benefits you value is more important than ever. Whether you need medical care while traveling, you prefer to connect with your doctor in the comfort of home, or you want the flexibility to see any medical doctor or specialist that accepts Medicare, a Medicare Supplement plan may be just what you need. But, before we dive into the benefits a plan like this can offer, lets review exactly what a Medicare Supplement plan is, and how it differs from other Medicare coverage options.

Why Buy Medicare Supplement Plan K

One of the features that makes Medicare Supplement Plan K different from most other Medigap options is the yearly out-of-pocket limit.

With original Medicare, there is no cap on your annual out-of-pocket costs. Purchasing a Medicare Supplement Plan K limits the amount of money you will spend on healthcare during the course of a year. This is often important for people who:

- have high costs for ongoing medical care, often due to a chronic health condition

- want to avoid the financial impact in case of a very expensive unexpected medical emergency

Recommended Reading: Will Medicare Pay For Palliative Care

What Are The Differences Between Medigap And Medicare Advantage Plans

A Medigap plan is different from a Medicare Advantage plan . MA plans are a way to get Medicare benefits, while a Medigap only supplements your Original Medicare benefits.

A comparison of Medigap and Medicare Advantage plans|

Where you can get care |

Works in any state |

Works only in your state, by region |

|---|---|---|

|

Provider network |

Don’t need a provider network |

Must use a provider network |

|

Prescription drugs |

Medicare Part D not included |

Medicare Part D usually included |

Original Medicare May Not Be Enough

Though Original Medicare provides some health coverage, you should know that it does not pay for everything. This is where a Medicare Supplement plan can help it can help cover the health care costs not covered by Original Medicare, including some copayments, coinsurance, and deductibles. Medicare Supplement plans ensure you have the long-term health coverage you need and can help save you money.

Read Also: How To Apply For Medicare In Ga

Guide To Medicare Supplement

To purchase Medicare Supplement Insurance you must be enrolled in Medicare Part A and Part B. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

The California Department of Insurance regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies. The Consumer Hotline 800-927-4357 is serviced by experienced professionals who will answer your questions, or assist you in filing a complaint.

To find information on Medicare Supplement Insurance, the names of companies authorized to sell it and compare premiums, please visit our Guide to Medicare Supplement page.

How Does Medigap Work

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan.

The provider bills Medicare first, then bills your Medigap plan. Depending on the plan, the provider then bills you for what remains, such as the Part B deductible, and your check goes to the provider.

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

State-by-state differences exist in some guarantees and limitations.

Read Also: Does Medicare Pay For Home Care After Surgery

Can I Buy Medicare Supplemental Plan Anytime

Medicare beneficiaries can apply for a Medicare supplement insurance plan at any time. There is no annual Medigap Open Enrollment period like there is with a Medicare Advantage Plan. As long as you have both Medicare Part A and B, you can apply for a Medicare supplement.

During your first six months of having Medicare Part B, you can choose any supplement available to you without any medical health questions or qualification. After the first 180-days, you can still apply for or switch Medigap plans, but you may have to qualify medically to be accepted for a new plan.

If you have a Medicare Advantage plan, you must wait for the Annual or Open Enrollment or a Special Enrollment period to change to a supplement.

Some states have special rules that allow for annual open enrollment periods. Check with your state or a licensed insurance agent for the rules in your state.

You can find more information in the free Medicare guide titled Choosing A Medigap Policy.

What Isnt Covered In My Medicare That Is Covered By Medigap

You may want to buy a Medigap policy because Medicare does not pay for all of your health care. There are gaps or out-of-pocket costs that you must pay in the Original Medicare Plan. Some examples of costs not covered are hospital stays, skilled nursing facility stays, blood, Medicare Part B yearly deductible and Medicare Part B covered services. A Medigap policy will not cover long-term care, vision or dental care, hearing aids and private-duty nursing.

Also Check: How Is Medicare Cost Calculated