When To Enroll In Medicare If I Dont Want Medicare Part B

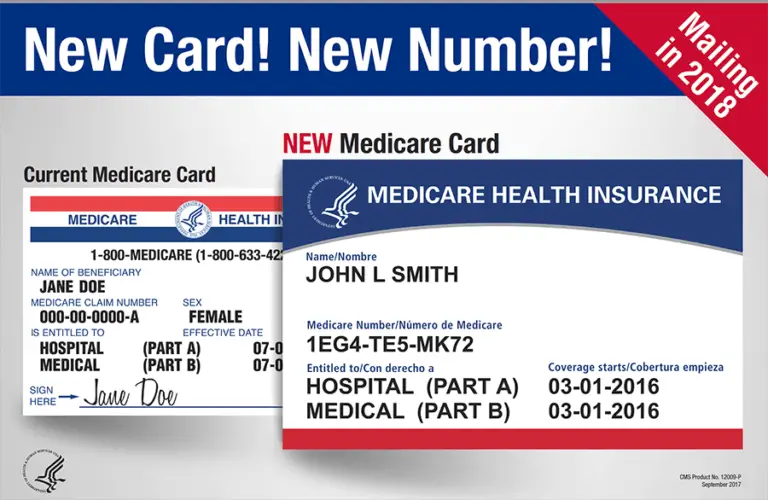

If youre automatically enrolled in Medicare Part B, but do not wish to keep it you have a few options to drop the coverage. If your Medicare coverage hasnt started yet and you were sent a red, white, and blue Medicare card, you can follow the instructions that come with your card and send the card back. If you keep the Medicare card, you keep Part B and will need to pay Part B premiums. If you signed up for Medicare through Social Security, then you will need to contact them to drop Part B coverage. If your Medicare coverage has started and you want to drop Part B, contact Social Security for instructions on how to submit a signed request. Your coverage will end the first day of the month after Social Security gets your request.

If you have health coverage through current employment , you may decide to delay Medicare Part B enrollment. You should speak with your employers health benefits administrator so that you understand how your current coverage works with Medicare and what the consequences would be if you drop Medicare Part B.

If You Are Under Age 65 And Disabled:

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare. Your Medicare card will be mailed to you about 3 months before your Medicare entitlement date. , you get your Medicare benefits the first month you get disability benefits from Social Security or the Railroad Retirement Board.) For more information about enrollment, call the Social Security Administration at 1-800-772-1213 or visit the Social Security web site. See also Social Security’s Medicare FAQs.

For more information, see Medicare.gov

Get Help Choosing The Right Coverage For You

For practical tips on choosing the right coverage, read Consider These 7 Things When Choosing Coverage on the Medicare website. For help choosing the right coverage plan for you, you can visit the Medicare Plan Finder on the Medicare website. You can also call the Medicare helpline at 1-800-633-4227 .

MMAP workers can also help answer your questions.

You May Like: How Much Does Medicare Pay For Inpatient Psychiatric Care

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

- Part A

- Part D

How Do I Enroll In Medicare In Michigan

The best way to see if youve already been enrolled in Medicare or to change your plan is to visit the Medicare website at Medicare.gov. By following the prompts on the website, you can learn more about your coverage options and enroll online. Because Medicare Supplement plans are not administered or paid for through Social Security, you will not be able to sign up for one of these plans through Medicares site and will need to go through a private insurer that offers Medigap coverage.

Read Also: How Much Copay For Medicare

How To: Enroll In Medicare Part A And Part B

Some people are automatically enrolled in Medicare Part A and Part B. Some people are not.

You’ll be automatically enrolled in Medicare Part A and Part B if:

- You’re receiving Social Security or Railroad Retirement Board benefits when you turn 65 or

- You’re eligible for Medicare because of a disability or medical condition.

You must enroll yourself in Medicare Part A and B if:

- You’re not receiving Social Security benefits when you become eligible for Medicare.

If You Already Receive Retirement Benefits Including Social Security Or Railroad Retirement Benefits At Age 65

your Medicare application is automatic. Youre enrolled in Medicare Parts A and B when you sign up for Social Security or Railroad Retirement Board benefits.If you dont live in the 50 states or in the District of Columbia, e.g. if youre a Puerto Rico resident, youre automatically signed up for Medicare Part A. You must apply for Medicare Part B, however.

You May Like: How Much Does Medicare Pay For A Doctors Office Visit

Original Medicare In Michigan

Enrollment in Original Medicare is the same in every state, and is done via the Social Security Administration. Medicare Part A and Medicare Part B benefits do not vary from state to state, and the coverage can be used anywhere in the country.

So your Medicare eligibility in Michigan will follow the same federal guidelines that are used nationwide. But if you want supplemental coverage or would prefer to get your primary Medicare coverage from a private health insurance company, your options for Medicare Advantage plans, Medicare Part D plans , and Medigap plans do vary from one state to another.

What Are Important Medicare Decisions

Applying for Medicare Parts A and B is the first step. Other decisions related to Original Medicare can be made in the same timeframe:

- Should you enroll in Medicare Part D, which will cover the cost of your medications?

- Should you buy Medicare Supplement to cover expenses that arent included in Original Medicare?

- Should you replace Original Medicare with Medicare Part C ?

You May Like: How Do You Pay Medicare

What Michigan Medicare Plans Are Available

If you live in Michigan, you are eligible for Medicare Part A, Medicare Part B, Medicare Advantage and Medicare Part D. You can also enroll in a Medicare Supplement plan, referred to as Medigap. Medicare is paid for in part by Social Security, which means that a portion of your premiums come from the federal government. It is important to know what the cost of your coverage will be and what your out-of-pocket costs will be so you can make informed choices regarding the Medicare plans you decide to enroll yourself in. Following are the available plans in Michigan.

Original Medicare is only slightly more popular in Michigan than Medicare Advantage plans. In 2020, 1.1 million residents in the state enrolled in traditional Medicare plans compared to 947,000 who chose Medicare Advantage. The plan that is best for you will depend on your medical needs and ability to afford medical care. If you believe that you will need financial assistance to cover the cost of your copayments and deductible each year, it is a good idea to enroll in a Medicare Supplement plan.

Do You Need To Apply For Medicare

Most people do need to apply for Medicare. But if you reach age 65 and youre already receiving retirement benefits from Social Security or the Railroad Retirement Board, youll be signed up for Medicare Part A and Part B automatically.

And if you arent receiving retirement benefits and you dont have health coverage through an employer, you will need to apply for Medicare as you approach age 65. If you need to apply, Medicare gives you several options.

You May Like: What Does Original Medicare Not Cover

How Many People Are Enrolled In Expanded Medicaid In Michigan

Sign up for the program began April 1, 2014 , and enrollment in expanded Medicaid stood at nearly 652,000 people at the start of 2020. But enrollment climbed significantly in 2020, likely due in large part to the COVID-19 pandemic and the resulting job/income losses. As of the end of June 2020, there were 749,547 Michigan residents enrolled in Healthy Michigan.

As of April 2018, some Healthy Michigan enrollees were transitioned to private plans . This includes people with income above the poverty level who had been enrolled in Healthy Michigan coverage for 12 or more consecutive months, and who did not participate in the Healthy Behaviors Incentives Program or receive a medical exemption.

By March 2020, total enrollment in Medicaid in Michigan stood at 2,317,725, which was a 21% increase over the enrollment total at the end of 2013. This total includes people who were already eligible for Medicaid based on the pre-ACA guidelines, as well as the more than 650,000 people who had enrolled as a result of Medicaid expansion . The increase in total Michigan Medicaid/CHIP enrollment from 2013 to early 2020 was only about 406,000 people, however, which is considerably less than the total number of people covered under Medicaid expansion. But that has to be considered in light of the fact that traditional Medicaid enrollment declined between 2013 and 2015 due to an improving economy.

As of May 2021, 2,733,485 people are enrolled in Medicaid/CHIP programs in Michigan.

Tell Ors Your Medicare Number And Effective Dates For Parts A And B

If your new 11-digit Medicare card arrives after you apply to retire, tell ORS your Medicare number as soon as you receive your card.

You can submit your Medicare enrollment information one of the following ways:

When ORS receives the Medicare number and effective dates for parts A and B, we will send it to your insurance provider and adjust your insurance rate. ORS will change your enrollment to the Medicare plan offered by the carrier you chose on your retirement application.

Recommended Reading: How Do I Change Medicare Supplement Plans

Medicare Opens Up Access To Free At

WASHINGTON The Biden administration, seeking to fill a frustrating gap in coverage for COVID-19 tests, Thursday announced that people with Medicare will be able to get free over-the-counter tests much more easily in the coming weeks.

The Centers for Medicare & Medicaid Services said Medicare will cover up to eight free tests per month, starting in early spring. The tests will be handed out at participating pharmacies and other locations. They’ll be available to people who have Medicare’s Part B outpatient benefit, which about 9 in 10 enrollees sign up for.

Last month, the administration directed private insurers to cover up to eight at-home tests a month free of charge to people on their plans. Officials said at the time they were still trying to figure out what to do about Medicare, which covers more than 60 million people, most of them age 65 or older and more vulnerable to severe illness from coronavirus infection.

Medicare benefits are governed by a host of arcane laws and regulations, and officials said Thursday they were able to arrange for coverage of over-the-counter COVID-19 tests by using the program’s legal authority to conduct demonstration programs on innovative ways to deliver health care. This is the first time Medicare has covered an over-the-counter test at no cost to recipients.

Timely Application And Proofs

If you have Medicare, we need your application and proofs more than one month prior to your retirement effective date. If your last day of work is in June and you want your insurance coverage to start July 1, your retirement effective date, we need your required proofs before June 1. If we get the request and proofs after the first of the month, one month prior to your retirement, but before the end of the month, you will not be enrolled until a month later.

For example, if you submit your application and proofs on June 1, for a retirement effective date of July 1, your actual insurance effective date will be Aug. 1.

Also Check: What Is The Difference Between Medigap Insurance And Medicare Advantage

Tips For Enrolling In Medicare In Michigan

Choosing a Medicare plan in Michigan is a big decision. Here are some things you may want to think about as you shop around:

- Provider network. If you choose to enroll in a Medicare Advantage plan, you generally need to get your care from in-network providers. Before you sign up, find out if the doctors, hospitals, and facilities you visit are part of the plans network.

- Service area. Original Medicare is available nationwide, but Medicare Advantage plans serve smaller service areas. Find out what each plans service area is, as well as what coverage you have if you go outside of the service area.

- Out-of-pocket costs. You may need to pay premiums, deductibles, or copayments for your Medicare coverage. Medicare Advantage plans have an annual maximum out-of-pocket cost. Make sure the plan you choose will fit into your budget.

- Benefits. Medicare Advantage plans need to cover the same services as original Medicare, but they may offer extra benefits, such as dental or vision care. They may also offer perks such as wellness programs and over-the-counter drugs.

- Your other coverage. Sometimes, signing up for a Medicare Advantage plan means losing your union or employer coverage. If you already have coverage, find out how itll be affected by Medicare before you make any decisions.

What Other Times Can You Sign Up

You may also become eligible for Medicare for other reasons. If youre eligible due to a disability, you qualify after youve received Social Security disability or certain Railroad Retirement Board disability benefits for 24 months.

If you have end-stage renal disease , youre eligible in the fourth month of dialysis treatment, possibly earlier.9 And if you have ALS, you qualify the same month your disability benefits begin.10

Don’t Miss: Does Medicare Pay For Eyeglasses For Diabetics

When Can You Sign Up Outside Of The Initial And General Enrollment Periods

You could qualify for a Special Enrollment Period and avoid the penalty for enrolling late. SEPs are typically granted if you or your spouse are still working when you turn 65 and you have group health insurance through an employer or union.

In that case, youre allowed to enroll in Part B at any time you have qualified group health coverage and youve turned 65. Once you no longer have coverage, you can enroll during the eight-month SEP period that starts the month after you lose the job or the coverage, whichever comes first.

If You Receive Social Security Disability Benefits Or Railroad Retirement Board Disability

theres no need to apply for Medicare. In this scenario, youre automatically signed up for Original Medicare when youve received 24 months of disability benefits in most cases.:

- In some instances, qualifying for Social Security Disability means you re automatically enrolled in Medicare right away, e.g. when end-stage renal disease is present.

- If the recipient has ESRD, ALS , needs kidney dialysis or receives a kidney transplant, he or she is Medicare-eligible when the disability benefits begin.

Although you will automatically get Medicare Part B, you dont have to keep it. You may drop this coverage:

- If Medicare benefits havent started yet and you receive the Medicare card, follow the instructions in the envelope and return the card to CMS.

- If you dont return the card to Medicare, you must pay premiums for Medicare Part B.

- Contact Social Security to drop the Part B coverage.

- If Medicare benefits have started, call Social Security to learn how to send your written request. Your coverage for Part B will end on the first day of the month after which Social Security receives the request.

You may elect to delay applying for Medicare Part B if you already have health insurance from an employer or from a spouses health plan.If you dont enroll in Medicare Part B at this time, you may be charged a late enrollment penalty:

Recommended Reading: Are Pre Existing Conditions Covered Under Medicare

When Is The Medicare Advantage Plan Annual Election Period

You can also add, drop, or change your Medicare Advantage plan during the Annual Election Period , which occurs from October 15 to December 7 of every year. During this period, you may:

- Switch from Original Medicare to a Medicare Advantage plan, and vice versa.

- Switch from one Medicare Advantage plan to a different one.

- Switch from a Medicare Advantage plan without prescription drug coverage to a Medicare Advantage plan that covers prescription drugs, and vice versa.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Also Check: What Is Medicare Part A B C And D