What Is The Biggest Disadvantage Of Medicare Advantage

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Medicare Part D And Tricare

Medicare Part D prescription drug coverage is available to everyone with Medicare, including Tricare beneficiaries. Since you are required to sign up for Medicare Part B or risk losing your Tricare coverage, you may wonder if you should sign up for Medicare Part D since you already have prescription coverage under Tricare.

We will explain exactly what is covered under each program, the costs and limitations, and recommend what you should do.

Are You Required To Sign Up For Medicare Part D

You are not required to enroll in a Medicare Part D plan unless you are dual-eligible for Medicare and Medicaid. If you receive low-income subsidies, you are enrolled automatically in a Part D plan if you dont choose one on your own.

Suppose you choose not to enroll in a Part D plan when first eligible. If you dont have creditable drug coverage that is at least as good as standard Part D coverage, you could pay a late enrollment penalty if you enroll later. This penalty will be added to your premium as long as you have Part D coverage.

Also Check: Does Medicare Cover Home Delivered Meals

Is Part D A Requirement

Part D is a voluntary/optional part of Medicare it is not a requirement to have a Part D plan. You can certainly choose to not enroll in a Part D plan. If you dont have a Part D plan, you should understand that you would be responsible for any prescription medication costs that you incur. In addition to being responsible for all prescription costs, there are other implications that you should be aware of if you choose to not sign up for a Medicare Part D plan.

When To Sign Up And Apply For Medicare

Home / FAQs / General Medicare / When to Sign Up and Apply for Medicare

When you are new to Medicare, you probably have questions regarding when and how to apply for Medicare. Understanding when to sign up for Medicare and knowing the right way to enroll in Medicare coverage is important. Below, we tell you how and when to apply for Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: Does Medicaid Help Pay For Medicare Part B Premiums

You Can Sign Up For Medicare Part D During Fall Open Enrollment

You can generally sign up for Medicare Part D and make other changes during this period. Sometimes called the Fall Annual Enrollment Period, Part D enrollment happens each year from October 15 to December 7. During this time, you can usually make the following changes during the AEP:

Are Medicare Advantage Plans Cheaper Than Medicare

The costs of providing benefits to enrollees in private Medicare Advantage plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

Recommended Reading: What Is Medicare Plan F

What Is The Most Widely Accepted Medicare Advantage Plan

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

How Medicare Part D Works With Other Insurance

If you want to keep your prescription drug coverage from an employer or union, it must be whats called creditable prescription drug coverage to avoid the Medicare Part D premium penalty in the future. Your plan is required to notify you annually as to whether or not your coverage is creditable. If you dont receive word, contact the plan or your employee benefits department directly to find out.

Be aware that if you sign up for Medicare Part D and your spouse or dependents receive prescription drug coverage from your employer or union prescription drug plan, they may lose their coverage.

The following types of government-sponsored insurance are considered creditable coverage. If you have coverage from one of these sources, it may make sense to continue with it.

-

Federal Employees Health Benefits.

Recommended Reading: Will Medicare Pay For Breast Augmentation

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

How To Avoid Steep Part D Penalties

What’s a premium?

If you sign up for a Part D plan after your IEP or SEP, a permanent penaltyâpotentially adding up to thousands of dollars over your lifetimeâgets tacked on to your monthly premium. The penalty amount can change each year as well.

You can avoid the penalty if you show proof of during the time you were supposed to sign up. If you had acceptable coverage includes a prescription drug plan through an employer .

If you don’t sign up for a prescription drug plan on time, and you don’t have proof of creditable drug coverage, you also have to wait until the next open enrollment period to sign up. Your coverage starts shortly after you enroll and will include the premium penalty.

Read Also: Which Medicare Plan Is Free

D Late Penalty Could Get You If Enrolling After Age 65

Part D can catch you unawares if you work past 65. Even with employer health care coverage, some people still end up having to pay Part D late enrollment penalties. Lets look at a scenario to help us understand why.

Meet Mike. Hes just retired from work and is getting ready to enroll in Medicare at age 68.

Mike already has Medicare Part A . He signed up for premium-free Part A when he first became eligible for Medicare at age 65. He didnt get full Medicare coverage yet because he was still working and had employer health coverage. Mikes plan benefits manager at work confirmed that Mike had creditable coverage and would qualify for a Medicare Special Enrollment Period when he retired and his employer coverage ended. He was told he could get additional Medicare coverage then.

Now, Mike is at the start of his 8-month Special Enrollment Period. He has to complete his Medicare enrollment during this time or else he could face late enrollment penalties.

Mike enrolls in Medicare Part B right away and then starts shopping for a Part D prescription drug plan. He compares Part D and Medicare Advantage plans, finally chooses a plan. Mike is now in month 5 of his Special Enrollment Period.

Mike goes to enroll in the Part D plan. He feels satisfied and relieved that hes taken care of his Medicare coverage within his 8-month enrollment period limit.

What happened? Lets find out.

What If I Dont Sign Up For Medicare Part D When I Turn 65

Summary:

Medicare Part D is optional, but can help cover your prescription drug costs. There are certain times when you can sign up for it. If you delay signing up for Medicare Part D coverage at the Medicare age 65, you may be faced with a late enrollment penalty. When you enroll in Original Medicare , you may also want to decide if you want to sign up for prescription drug coverage under Medicare Part D. Since Original Medicare usually doesnât cover medications you take at home, you have the option of signing up for Medicare Part D coverage.

Read Also: Will Medicare Pay For Teeth Implants

How Part D Penalties Are Calculated

Medicare doesn’t charge a flat rate penalty for enrolling late. Instead, the amount is determined by multiplying the number of months an individual went without a Medicare drug plan by 1% of the national base premium, the premium rate Medicare establishes for Part D each year.

For example, if you delayed signing up for Part D for 5 years, you would face a 60% penalty . The penalty amount is rounded to the nearest $0.10 and added to your monthly Part D premium.3 There is no cap on the Part D penalty.

Since the national base premium changes every year, so does the Part D penalty. For more about Part D penalties, visit Medicare.gov.

When You Can Switch Part D Plans

In general, you may only switch plans during the Annual Election Period . This is between October 15 and December 7 each year. Coverage begins the following January 1. Outside of the AEP, you may change plans if you have a Special Election Period , such as if you:

- Move to another region outside the service areas of your plan

- Enter a nursing home

- Change nursing homes or other institutions

- Qualify for the extra help/Low-Income Subsidy program

- Lose your eligibility for extra help/LIS

- Lose your full Medi-Cal benefits

Recommended Reading: Does Medicare Pay For A Caregiver In The Home

Texas State Health Insurance Assistance Program

The State Health Insurance Assistance Program provides unbiased counseling and assistance with making decisions about Medicare. The program offers Medicare education, help with Medicare eligibility and enrollment, information about long-term care insurance, and more.

Contact the State Health Insurance Assistance Program

Texas Health Information, Counseling, and Advocacy Program Phone Number: 1-800-252-9240Directory of Services

What Is Medicare Called In Texas

Medicare is overseen by the Texas Health and Human Services Commission. The department offers Medicare Savings Programs, including the Qualified Medicare Beneficiary, Specified Low-Income Medicare Beneficiaries, the Qualifying Individuals Programs, and the Qualified Disabled and Working Individual Program.

Recommended Reading: Is Cigna A Good Medicare Supplement

Eligibility For Part D

Anyone with Medicare is eligible to enroll in a Part D plan. To enroll in a PDP, the individual must have Part A OR Part B. To enroll in an MA-PD, the individual must have Part A AND Part B.

Enrollees must live in their plans service area. In the case of homeless persons, the following may be used as a permanent residence: a Post Office box, the address of a shelter or clinic, or the address where the person receives mail such as Social Security checks.

PDPs are usually national plans, but MA-PDs have delineated regions, sometimes by state, sometimes by counties within states ). For this reason, MA-PDs may not be appropriate for those who travel a great deal or who maintain summer and winter residences in different areas of the country. NOTE: Some MA-PDs offer passport plans that allow members to obtain benefits outside their normal service areas.

Individuals who reside outside the United States* are not eligible to enroll, but may do so upon their return to the country. Incarcerated individuals may not enroll in Part D, but they may enroll upon release from prison. Prior to 2021, people with end-stage-renal-disease could not enroll in an MA-PD. Starting in 2021, people with ESRD can enroll in Medicare Advantage plans during the annual Open Enrollment Period.

There are no other eligibility restrictions or requirements for Part D.

If You Already Have Prescription Drug Coverage

If you already have , you may be able to keep it without the risk of paying a late enrollment penalty if you decide to enroll in a Medicare prescription drug plan later.

Your options differ, depending on which type of existing drug coverage you have:

- Current employer plan, union plan or retiree plan

- TRICARE, Department of Veterans Affairs or the Federal Employee Health Benefits Program

If you are covered by a current employer, union or retiree plan and are about to become eligible for Medicare, you should receive a notice from the company explaining how your benefits will change and what your options are regarding Medicare Part D. If you are about to become eligible for Medicare and have not received a notice or did not understand the notice you received, call your former employer or the company that processes your claims.

If at some point in the future your employer, union or retiree plan stops offering prescription drug coverage, you will be able to join a Medicare drug plan without penalty as long as you join that plan within 63 days of the end of your current coverage.

Note: Keep any letter or notice from your employer, union or retiree plan stating that your prescription drug coverage is creditable to use for documentation if you apply for Part D drug coverage at a later time.

Talk to your plans benefits administrator to get more information. If your benefits are not creditable, you may still be able to:

Don’t Miss: What Is The Average Cost Of Medicare Part B

Signing Up For Medicare Supplement Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan anytime. However, your Medicare Supplement Open Enrollment Period is the best time to enroll.

You can enroll in any Medicare Supplement plan when you become eligible, with no health underwriting questions during the Medicare Supplement Open Enrollment Period. Thus, you will not face denial due to pre-existing health conditions. Read more about Medicare Supplement Open Enrollment.

Donât Miss: How Old To Get Medicare Benefits

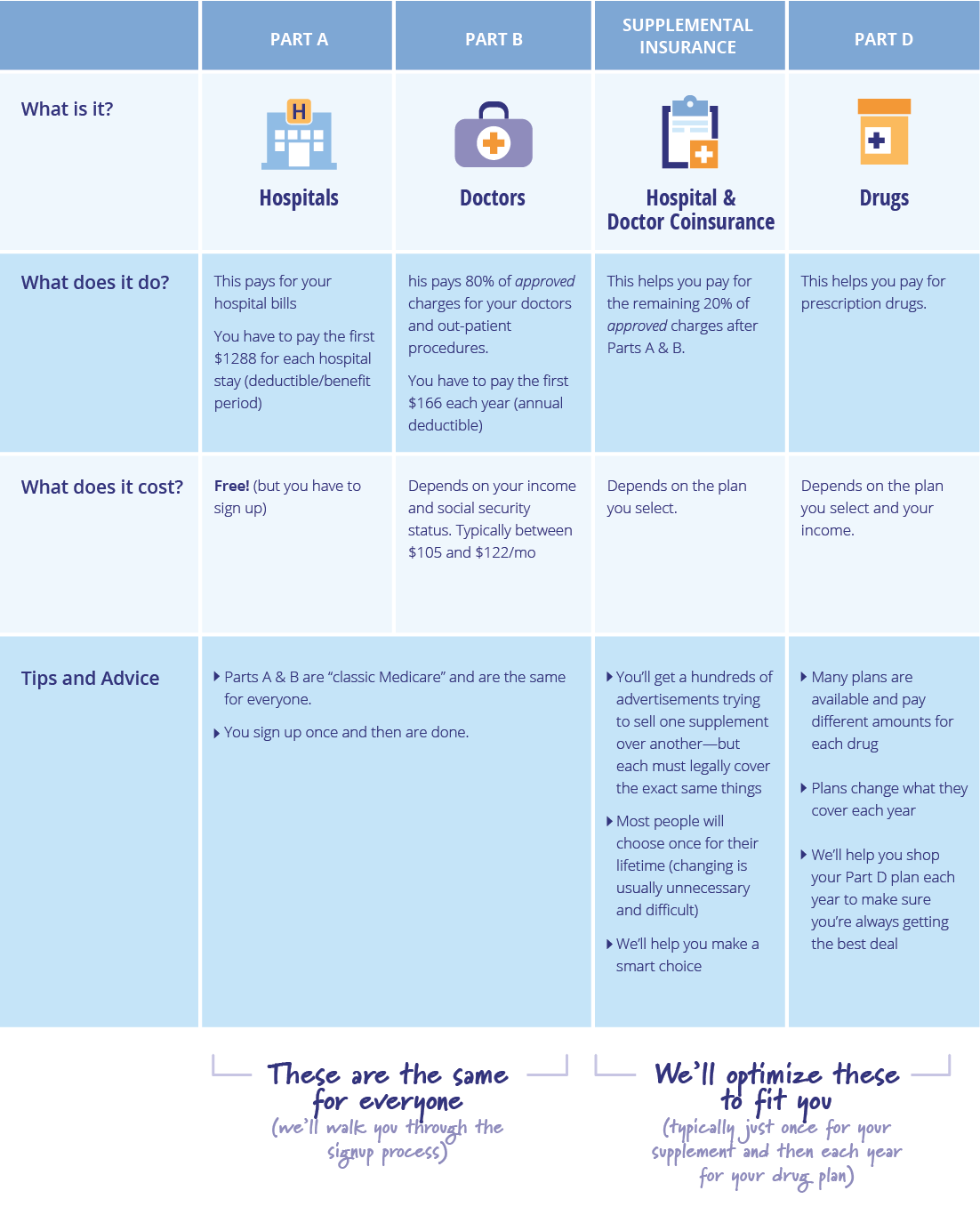

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

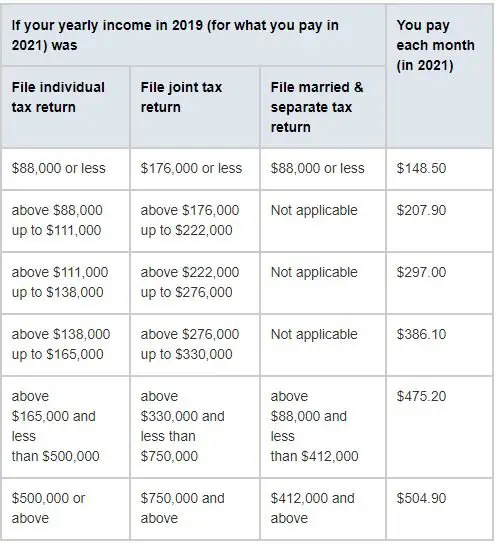

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Also Check: Does Medicare Pay For 100 Days In A Nursing Home

How To Pay For Part D

After youve signed up, youll pay monthly Part D premiums to the insurance company. You may either receive bills or sign up for automatic payments. You also may be able to request that your premium be deducted from your monthly Social Security or Railroad Retirement Board payment.

Medicare beneficiaries with low incomes and few assets may qualify for the federal Extra Help program that givesfinancial assistance to pay for Part D premiums, deductibles and copayments.

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

What Does Medicare Part D Cover

Medicare Part D plans are regulated by the Centers for Medicare and Medicaid Services . All Part D plans must cover a wide selection of medications that people with Medicare take. Each plan must include generic and brand-name drugs on its formulary and cover at least two drugs in every category. There are six protected classes of drugs that must be covered:

Part D plans must also cover:

- Drugs for medication-assisted treatment for opioid use disorders

- Free Medication Management Therapy for people with complex health needs

- All commercially available vaccines, such as the COVID vaccine, when medically necessary to prevent illness, unless they are covered under Medicare Part B.

Don’t Miss: How Much Is Medicare A And B

Open Enrollment Period For Part D

You can make including your Part D prescription drug planduring the Medicare Annual Election Period . This is sometimes called the Open Enrollment Period or Fall Open Enrollment. It runs from Oct. 15 to Dec. 7 each year. During the Medicare AEP, you can add, switch or drop your Part D coverage. Any changes you make will take effect on Jan. 1 the following year.4