What Costs Count Toward The Catastrophic Coverage Threshold

You enter catastrophic coverage when your out-of-pocket costs for covered drugs hit $7,050 for 2022. Figuring out when youll hit that threshold can be a little complicated, though what counts as out-of-pocket spending most likely isnt equal to what you actually spend.

The good news: Your Medicare Part D statements should show you what phase you’re in, a running total of your drug costs and what it will take to move into the next phase

What counts toward your out-of-pocket total:

-

Your annual deductible, coinsurance and copayments.

-

95% of the cost of covered drugs you get during the coverage gap , except for dispensing fees.

-

25% of the cost of pharmacy dispensing fees for covered drugs you get in the coverage gap .

What doesnt count toward your total:

-

Part D drug plan monthly premiums.

-

The portion of the costs and pharmacy dispensing fees that your Part D insurance company pays for when youre in the coverage gap.

-

Anything you pay for drugs that arent covered by your plan, including the cost of covered drugs from pharmacies that arent in your plans network.

Reaching The Other Side Of The Medicare Donut Hole

Where the donut hole beginsGetting to the other side of the coverage gap

- The Part D planâs yearly deductible, coinsurance and copayments

- The discount received on the brand-name drugs while in the coverage gap

- What you pay in the coverage gap

donât

- The Part D plan premium

- Pharmacy dispensing fee, if any

- What is paid for uncovered drugs

Post-donut hole drug coverageLearn more about Medicare and avoiding the donut hole at a free seminar on Understanding How Medicare Works. To register, call or visit sharp.com/newtomedicare.

What Is The Prescription Drug Coverage Gap

Under Medicare Part D prescription drug coverage, policy holders with significant drug expenses often encounter a coverage gap or donut hole the point where their prescription drug expenses exceed the initial coverage limit of their Part D coverage but have not yet reached the catastrophic level of coverage.

Prior to 2011, enrollees were responsible for all drug costs while in the coverage gap, and didnt begin receiving drug benefits again until they reached the catastrophic coverage level. But the Affordable Care Act is slowly closing the coverage gap, and by 2020, Medicare Part D enrollees with standard plan designs will only pay 25 percent of the plans cost for drugs prior to reaching the catastrophic coverage level, which is the same as they pay during the initial coverage period, prior to reaching the donut hole.

As of 2019, the coverage gap has closed for brand-name drugs: Enrollees with standard plan designs pay 25 percent of the cost of brand-name drugs both before and during the coverage gap . This happened one year early, thanks to the Bipartisan Budget Act of 2018 . As of 2019, enrollees pay 37 percent of the cost of generic drugs while in the coverage gap, but that will drop to 25 percent in 2020.

You May Like: What Is The Advantage Of Medicare Advantage

Did The Donut Hole Close In 2019

The Medicare Part D donut hole has been closing in recent years due to provisions in the Affordable Care Act , also known as Obamacare.

The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump.

Are you looking for Medicare Part D prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Switch To Generic Brands

Generic medications must pass the same FDA approval process as name-brand drugs. Switching to a generic brand can save you money.

Bear in mind, however, that even those the active ingredients in generic and brand name medications are the same, the inactive ingredients may not be. Sometimes allergic reactions have been reported after a patient makes the switch to generic, so be sure to check with your doctor before you change your medication.

Also Check: Is Shingles Shot Covered Under Medicare

What Is The Medicare Part D Donut Hole

Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the donut hole.

The donut hole essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year , you reach the coverage gap and are considered in the donut hole.

Not everyone will enter the donut hole, and people with Medicare who also have Extra Help will never enter it.

When Do I Enter The Coverage Gap

There are four coverage stages with a Medicare Part D drug plan. Depending on the stage you are in, you will be responsible for different amounts of your drug costs.

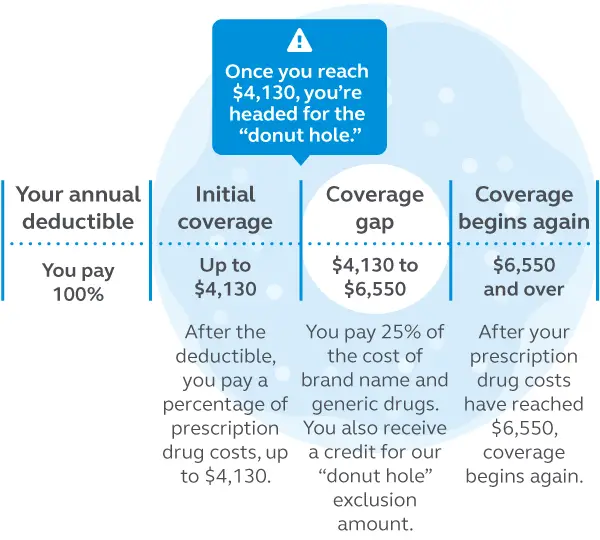

At the start of the year, you begin in the deductible stage . Once youve paid your deductible, you move to the initial coverage stage which includes the standard copays and coinsurance outlined in your plans benefits. After these stages, you enter the coverage gap stage. This happens once the costs your Medicare Part D costs reach $4,130, also known as the total drug spend. This includes anything you, your plan, and others have paid toward your Part D covered prescriptions. The Centers for Medicare and Medicaid Services sets the total drug spend amount for Medicare Part D plans annually.

Also Check: Does Costco Take Medicare For Hearing Aids

How To Avoid The Coverage Gap

There are a few ways to avoid the coverage gap all together, primarily through keeping your prescription drug costs low. Here are a few ways you can avoid reaching the coverage gap threshold:

- Buy generic prescriptions. Generic drugs are typically less expensive, and in most cases the same as their brand-name alternative. They are required by the Food and Drug Administration to have the same ingredients, at the same dosage, be administered the same way, and have the same effect.

- Order prescriptions by mail. Many drug plans offer a discount if you order a three-month supply by mail instead of a 30-day supply from the pharmacy.

- Ask for drug manufacturer discounts. Some pharmaceutical companies offer products at a discount directly to consumers or through the doctors office. Ask your doctor when they prescribe a medication to you if there are any discounts available.

- Shop for a new Part D plan. Each year when you receive your Annual Notice of Coverage, check to see if your prescription drug coverage or costs have changed. Compare Part D plans available in your area to learn if another plan has better coverage or lower costs.

- Plan ahead. If you can, plan ahead and estimate your annual drug costs, as well as how you will pay for them if you do enter the coverage gap. This is especially important if you take a lot of brand-name or high-cost medications, or have chronic conditions that must be managed by medications.

Medicare Donut Hole 2022

The Medicare Part D donut hole is just a term coined by ordinary people for the stage of Medicare Part D that is officially called the coverage gap. The reason they call it the Medicare donut hole is because it used to be a hole in the middle of your drug coverage during a calendar year.

All Medicare Part D plans have four stages, and the third stage is the donut hole. However, you may have heard about the Medicare donut hole ending. The reason people used to say that the donut hole was ending is because the percentage that you pay for brand name drugs in the gap lowered.

Confusing, right? Keep reading and well break it down for you.

Read Also: Should I Give My Medicare Number Over The Phone

What Costs Dont Count Towards Getting Out Of The Coverage Gap

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs dont count towards getting you out of the coverage gap:

- The monthly premium for your Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan

- The costs you pay for prescription drugs that arent covered by your Medicare plan

Phase : The Donut Hole

In the coverage gap, or donut hole, you stop paying the coinsurance or copays you paid before. Instead, youre responsible for up to 25% of the price for all of your medications.

-

When it starts: After you and your plan have spent a combined total of $4,430 for 2022, including your deductible.

-

What you pay: Up to 25% of the cost of your covered prescriptions drugs, including any dispensing fees.

-

When it ends: Your qualifying out-of-pocket costs for covered prescription drugs reach $7,050 for 2022 .

Some plans offer gap coverage to reduce your out-of-pocket costs in the donut hole. However, gap coverage might apply only to certain drugs, and a plan with gap coverage might have higher monthly premiums.

Don’t Miss: Does Medicare B Cover Prescriptions

What Is The Donut Hole In Medicare

The donut hole is the coverage gap in Medicare prescription drug plans. During this period the beneficiary has a temporary limit on their Part D coverage. This means that after spending a specific amount on a drug plan, youre responsible for copayments for prescriptions. Then, youre responsible for costs up to a specific limit.

How Do I Get Out Of The Donut Hole

Once your costs for prescription drugs meet $7,050, you will move into the next coverage phase. When this happens, catastrophic coverage kicks in automatically.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

During the catastrophic coverage phase, you cover $3.95 for generic medications and $9.85 or 5%, whichever costs more, and your policy will settle 95% of the remaining costs until the end of the plan year. Then, the cycle repeats annually.

You May Like: What Is My Monthly Medicare Premium

Ask For Drug Manufacturers Discounts

Some pharmaceutical companies offer their products at a discount directly to consumers or through doctorâs offices. This is more common for brand-name and specialty drugs, which can be expensive. Ask your doctor or health-care provider when you get the prescription if any discounts are available or if there is a pharmaceutical assistance program. You can also search online as the drug manufacturerâs website may have more information.

How Does It Work

Here is an example of process of how a Medicare user crosses the donut hole and reaches catastrophic coverage in 2020.

An individual and their insurance company have spent $4,020 on medications since the start of their plan. That person is now in the donut hole. The person pays 25% of their medication costs. For example, if they have a medicine that costs $100, they will pay $25. The pharmaceutical company then discounts the medication by $70, and the insurance company pays the remaining $5. The person continues paying 25% out of their own money until they have spent $6,350. When this occurs, they are out of the donut hole. A person is now in the catastrophic coverage portion of their coverage. They will pay either a minimum copay or 5% of the drugs cost.

According to the most recent statistics from the Kaiser Family Foundation, an estimated 4.9 million Medicare Part D enrollees reached the catastrophic coverage portion of Medicare Part D in 2017.

You May Like: What Is The Best Supplemental Insurance For Medicare

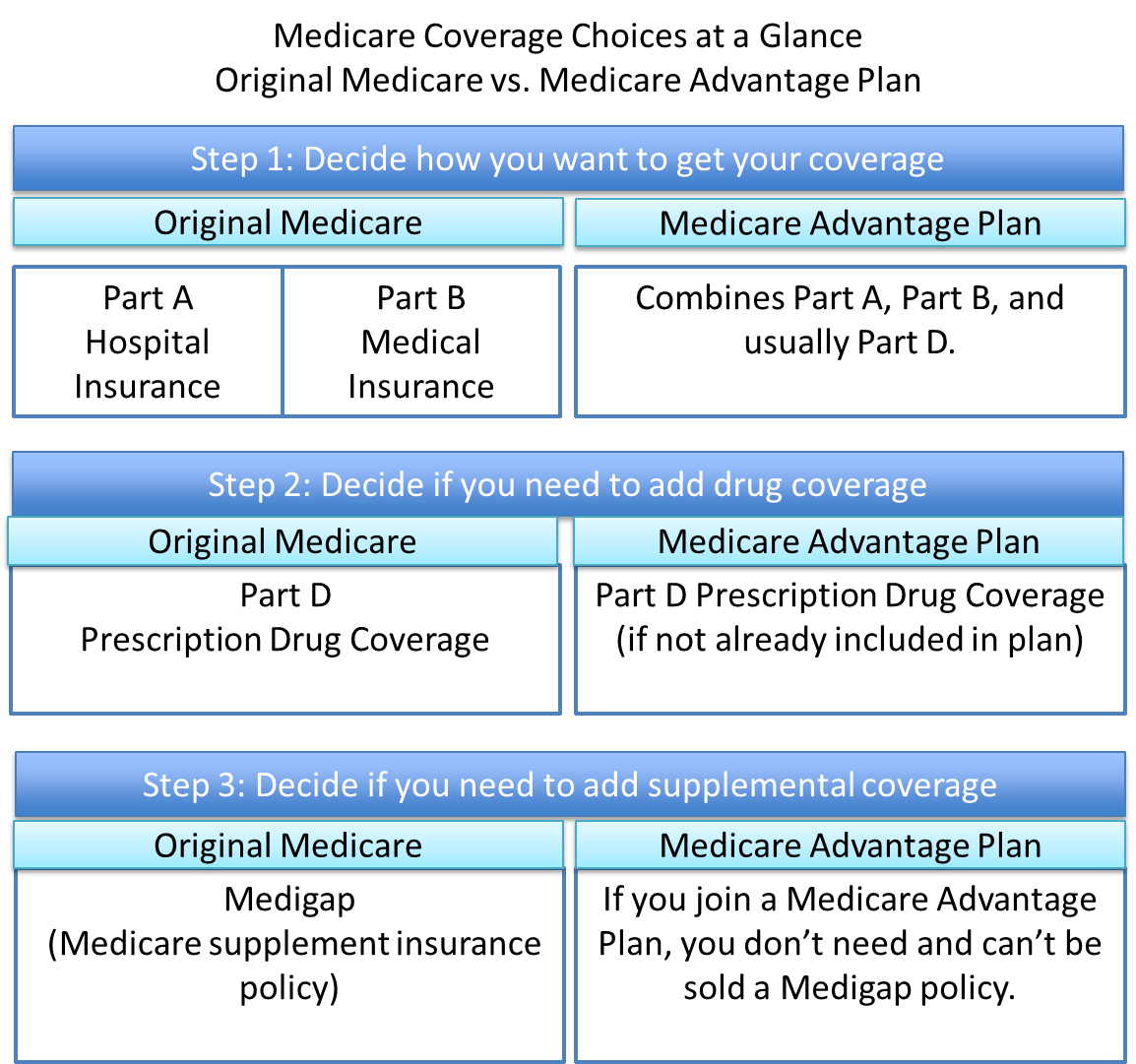

What Is Medicare Part D

Medicare Part D Prescription Drug plans are part of the governments Medicare program, but they are offered and managed through approved private insurers, like Cigna. These plans help lower the cost of prescription drugs that can prevent complications from disease and help keep you healthy.

If you are entitled to Original Medicare Part A and/or enrolled in Medicare Part B, there are 2 ways you can get Part D Prescription Drug coverage.

- Enroll in a separate, or standalone, Medicare Part D Prescription Drug plan .

- Choose to join a Medicare Advantage plan that includes drug coverage. Not all Medicare Advantage plans include drug coverage. Review the details of any plan before you enroll.

Part D plans are part of the governments Medicare program, but theyre offered and managed through approved private insurers, like Cigna. Enrollment in a separate Part D plan is not automatic. You need to select and enroll in a plan.

What Are The Pros And Cons Of Part D Prescription Drug Plans

Advantages of Medicare Part D Prescription Drug plans include:

- Cost protection: Part D plans help protect against high-cost prescription drugs by offering various levels of cost coverage for different tiers of drugs.

- Low premiums help make these plans affordable.

- Flexible plan options: Part D plans offer you choices in cost and benefit levels depending on your needs and other coverage you may have.

- Works with Medicare Part A and Part B , or may be included in a Medicare Advantage plan .

Disadvantages of Medicare Part D Prescription Drug plans include:

- Need to anticipate your prescription drug needs for the year: Part D plans differ in the types of drugs they cover. Knowing your medical situation can help you select a plan that is right for you and covers the prescription drugs you expect to need.

- Plans differ from insurer to insurer: Part D plans must offer a minimum amount of coverage per Medicare, but otherwise plans can differ. This means you need to shop around and educate yourself on what each plan covers.

- Not all drugs are covered: Each plan has its own drug list , level of cost coverage, and monthly premium.

- Late Enrollment Penalty : Fail to enroll in a Part D plan when you are eligible and you may end up paying a late enrollment penalty. For every month you delay enrolling, Medicare will charge you a small fee, which is added to your monthly premium.

Learn more about Medicare Part D Enrollment and the LEP

Recommended Reading: Does Medicare And Medicaid Cover Dentures

How You Can End Up In Medicares Donut Hole And How You Get Out

Medicare prescription drug plans can have a coverage gapcalled the donut holewhich limits how much Medicare will pay for your drugs until you pay a certain amount out of pocket. Although the gap has gotten much smaller since Medicare Part D was introduced in 2006, there still may be a difference in what you pay during your initial coverage compared to what you might pay while caught in the coverage gap.

When you first sign up for a Medicare prescription drug plan, you will have to pay a deductible, which cant be more than $445 . Once youve paid the deductible, you still need to cover your co-insurance amount , but Medicare will pay the rest. Co-insurance is usually a percentage of the cost of the drug. If you pay co-insurance, these amounts may vary throughout the year due to changes in the drugs total cost.

Local Elder Law Attorneys in Your City

City, State

Once you and your plan pay a total of $4,130 in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole. In 2021, until your total out-of-pocket spending reaches $6,550, youll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $6,550 , you are out of the coverage gap and you will pay only a small co-insurance amount. For more from Medicare on coinsurance drug payments, .

What Happens If My Prescription Drug Isnt Covered

Medicare mandates that there be at least two drugs from every therapeutic class in a formulary. But in some instances, you may need a drug that just doesnt make the list. If that happens, your doctor can contact the insurance company to request whats called a formulary exception. Your plan will review the request to see if they’ll cover it. Typically, if the drug is approved, it will be provided to you at the cost found in one of the top tiers, such as tier 4 or 5, which means you will usually be responsible for a higher percentage of the cost than if the medicine was included on a lower tier.

Also Check: How Do I Apply For Medicare In Arizona

Final Tip: Its Helpful To Understand The Medicare Part D Payment Stages

The donut hole can seem overwhelming, but its just one of four payment stages with Medicare Part D. The payment stage youre in determines the amount you pay when you fill a prescription. You always begin each year in the deductible stage or the initial coverage stage, depending on your plan. A final helpful tip is to learn about each of the Part D payment stages and understand how your financial responsibilities will change in each.

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $77.10 |

Drug Tiers

| Tier 1 | |

| $65 | 33% |

The Donut Hole

TrOOP

Once beneficiaries reach their out-of-pocket threshold costs), they move out of the Donut Hole and into Catastrophic Coverage.

EOBs

The Donut Hole Discount

| 63% | 75% |

Read Also: Why Am I Paying For Medicare