Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Read Also: Does Cleveland Clinic Accept Medicare Advantage Plans

What Is Medicare Part D

Also known as a prescription drug plan , Medicare Part D provides beneficiaries prescription coverage, which is not part of Original Medicare. You can only enroll in Part D if you already have Parts A and B. You may sign up for a plan during your IEP as well as during Annual Enrollment. However, you may pay a penalty for waiting to sign up.

Tricare Champva & Va Benefits With Medicare

If you have TRICARE or CHAMPVA coverage, you will need to see if you qualify for premium-free Part A. If you are eligible, you will be required to enroll in both Part A and Part B to keep TRICARE or CHAMPVA coverage. If you are not eligible, enrollment is optional, but you could face late enrollment penalties. Its best to talk with your TRICARE and CHAMPVA benefits administrator to learn more.

VA benefits alone will not qualify you to delay Medicare without penalty, so if you have VA health coverage and are still working past 65, you will need to enroll in Medicare during your Initial Enrollment Period.

Also Check: Does Medicare Pay For Yearly Physicals

Tricare And Medicare Turning Age 65 Brochure

This brochure provides information on how to remain TRICARE-eligible after becoming entitled to Medicare at age 65. It includes details on how Medicare affects TRICARE coverage, signing up for Medicare, provider options, prescription drug coverage, and more.

Audience: TRICARE beneficiaries eligible for Medicare Part A at age 65

- May be available in print at your local military hospital or clinic

- Date last updated: October 2021

Im Turning 65 What Do I Need To Do For Medicare Enrollment

Summary:

At 65 you may be looking forward to different things: having grandchildren perhaps, possibly retiring from your career, or taking a trip that youâve dreamed of your whole life. Sixty-five may also be a significant year for you as it may be the first year that youâre eligible for Medicare coverage options. Medicare coverage is the government health insurance program that provides hospital and medical insurance to people 65 and older and some under 65 who qualify because of a disability. Medicare Part A and Part B are called Original Medicare.

Read Also: Does Medicare Pay For Assisted Living In Ohio

Why Enroll In Medicare At Age 65

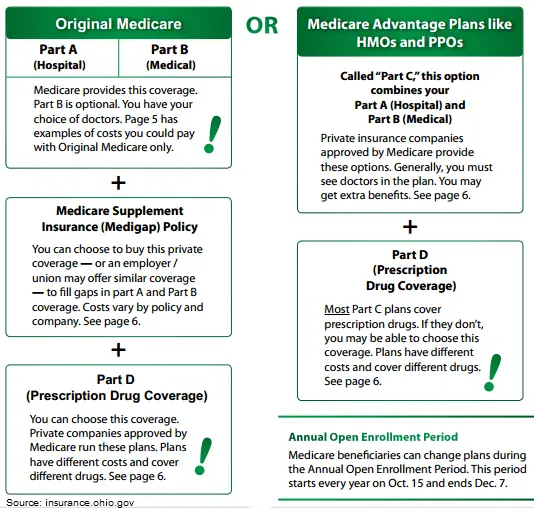

Once you reach the age of 65, you most likely qualify for Medicare. This means that you get access to federal health insurance. Medicare has four different service types:

- Part A: This covers hospital stays, care in a nursing facility, hospice, and some home health care.

- Part B: This is for medical insurance and covers some services from doctors, outpatient care, preventative care, and medical supplies.

- Part D: This is for prescription drugs, including some shots and vaccines.

Medicare Advantage is an option for those looking to get additional coverage private insurance companies approved by Medicare can offer prescription drug coverage, dental care, and more.

Most people qualify for parts A and B, and only have to pay monthly premiums for part B. For many, Medicare is an important benefit and a way to get medical coverage the toughest part is simply figuring out how to enroll in Medicare after 65.

How Do I Enroll In Medicare When I Turn 65

Medicare enrollment is managed by the Social Security Administration, and you can apply for Medicare during an initial period of seven months around your 65 birthday — the three months before your birthday month, your birthday month and the three months after.

After the initial enrollment period, you can enroll in Part A during the General Enrollment Period — Jan. 1 to March 31 — with no penalty if you qualify for premium-free coverage. If you need to pay a premium for Part A, you’ll pay a penalty for enrolling late .

If you don’t enroll in Part B during the initial period, you’ll also have to wait until that January to March General Enrollment Period, and you’ll pay a penalty that will last as long as you’re enrolled in Part B. Enrolling in Medicare during the General Enrollment Period also means that your coverage won’t start until July 1.

Americans who start receiving benefits from Social Security or the Railroad Retirement Board at least four months before turning 65 will automatically be enrolled in both Medicare Part A and Part B on the first day of the month they turn 65. If you want to delay Part B, you’ll need to contact Social Security before your coverage starts.

Also Check: Does Medicare Cover Air Evac

When Can You Sign Up For Medicare

The best time to sign up for Medicare is during your Initial Enrollment Period . This period lasts for seven months and includes the month you turn 65 plus the three months before and the three months after.

If you sign up before your birth month, your benefits will start the month you turn 65. If you dont, it starts up to three months later. That could mean you might not have health insurance for a short period of time.

Should I Sign Up During My Initial Enrollment Period

For most people, the answer is yes. They need to sign up for Medicare during their seven-month initial enrollment period , which starts three months before the month you turn age 65 and ends three months after your birthday month. If your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

If your birthday falls on the first day of a month, the whole initial enrollment period moves forward one month. For example, if your birthday is June 1, your IEP begins Feb. 1 and ends Aug. 31.

If you or your spouse is still working and you have health insurance coverage from that active employer, you may be able to wait. But otherwise, you need to sign up for Medicare during your IEP to avoid late enrollment penalties and delayed coverage.

The phrase active employer is key. If you have other insurance that isnt from your own or your spouses current employer, you will still need to sign up for Medicare during your initial enrollment period. You need to sign up during your IEP in all of these circumstances: If you have

- COBRA health coverage that extends the insurance you or your spouse received from an employer while working

- Health insurance that you bought yourself and no employer provided it

- No health insurance

- Retiree benefits from your own or a spouses former employer

- Veterans benefits from the Department of Veterans Affairs health system but no insurance from a current employer

You May Like: Who Do You Call To Sign Up For Medicare

I Want To Delay Part B

If you qualify and decide you want to delay enrolling in Medicare Part B, you should not face any late enrollment penalties for Part B. When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you havent done so already.

Youll also be able to enroll in a Medicare Advantage plan or Part D prescription drug plan in the first two months of this period. Note: if you enroll in Part C or Part Dafter the first two months of your Special Enrollment Period, you may face late enrollment penalties for Part D. Youll want to also ensure you provide proof of creditable coverage when you enroll in Part D.

You do not need to notify Medicare that you will be delaying Part B unless you are already receiving Social Security or Railroad Retirement Board benefits.

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

You May Like: Does Medicare Part A Cover Prescriptions

When Is My Initial Enrollment Period For Medicare Part D

You can enroll in a stand-alone Medicare prescription drug plan during your Initial Enrollment Period for Part D. You are eligible for prescription drug coverage if:

- You live in a service area covered by the health plan, and

- You have Medicare Part A AND/OR Medicare Part B.

Generally, your Initial Enrollment Period for Part D will occur at the same time as your Initial Enrollment Period for Medicare Part B.

Once you are eligible for Medicare Part D, you must either enroll in a Medicare prescription drug plan, Medicare Advantage Prescription Drug plan, or have creditable prescription drug coverage.).

You May Like: What Benefits Do You Get With Medicare

Can You Make Changes To Medicare After You Turn 65

Youre not locked into the Medicare plan for life. Instead, you can make changes each year during Annual Enrollment.

Medicare has an Annual Enrollment Period from October 15 to December 7 each year. During that time, you can:

- Move from Original Medicare to Medicare Advantage or vice-versa

- Sign up for a Part D plan

Theres a second open enrollment period from Jan. 1 to March 31, but youre limited to only changing Medicare Advantage plans or switch from Medicare Advantage to Original Medicare during this timeframe.

Another time when you can make changes to your Medicare insurance is if you experience a qualifying event for a special enrollment period. A special enrollment period could kick in if your spouse dies, you move to another state or you lose other health benefits.

Read Also: Who Has The Best Medicare Supplement

How Much Is Medicare Per Month For Seniors

Those who are enrolled in Medicare but aren’t yet collecting Social Security have to pay those premiums directly. Those who are receiving Social Security, meanwhile, have their Part B premiums deducted from their benefits. This year, the standard monthly Medicare Part B premium costs seniors $148.50 a month.

How Can I Get Assistance Paying My Health Care Costs

If you have a limited income, you may be able to get assistance with your health care costs through certain programs:

- Medicaid: If you have a low monthly income and minimal assets, you may be eligible for coverage through Medicaid to pay Medicare costs, like copays and deductibles, and for health care not covered by Medicare, such as dental care and transportation to medical appointments.

- Medicare Savings Programs : If you do not qualify for Medicaid but still have problems paying for health care, you may qualify for an MSP, a government-run program that helps cover Medicare costs. There are three types of MSP, and all of them pay the monthly Medicare Part B premium. The Qualified Medicare Beneficiary program covers deductibles and coinsurances as well.

- Extra Help: Also known as the Part D Low-Income Subsidy , this is a federal program that helps pay for some to most of the costs of Medicare Part D prescription drug coverage. You may be eligible for Extra Help if you meet the income and asset limits. Also, in many cases, enrollment in an MSP automatically leads to enrollment in Extra Help.

- State Pharmaceutical Assistance Programs: SPAPs are offered in some states to help eligible individuals pay for prescriptions. Most SPAPs have income guidelines. Many also require you to enroll in a Medicare Part D plan and to apply for Extra Help.

Read Also: What Is The Last Day To Sign Up For Medicare

Signing Up For Medicare Supplement Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan anytime. However, your Medicare Supplement Open Enrollment Period is the best time to enroll.

You can enroll in any Medicare Supplement plan when you become eligible, with no health underwriting questions during the Medicare Supplement Open Enrollment Period. Thus, you will not face denial due to pre-existing health conditions. Read more about Medicare Supplement Open Enrollment.

Having Creditable Drug Coverage

Before you officially delay Medicare, make sure you have creditable drug coverage. This means your employer drug coverage is at least as good as the standard Medicare Part D plan coverage. If your employer’s drug coverage isn’t creditable, you will need to enroll in a Part D plan during your Initial Enrollment Period to avoid the Part D late enrollment penalty . Consequently, you’ll also need to get either Part A or Part B in order to get a Part D plan.

You May Like: Do You Have To Have Medicare At 65

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Dont Register For Medicare Alone

No one should have to enroll in Medicare alone. Licensed Medicare agents are available to you at no additional cost to help you enroll in the right plan and clear any confusion you may have. If youre uncomfortable with applying for Medicare, we can help!

When enrolling, an agent who understands different Medicare plan types and the coverage associated with Medicare is essential. Plus, when you enroll through an agent, you will never have to pay a fee or be charged extra for your monthly premium. Agents are paid directly by insurance companies.

- Was this article helpful ?

You May Like: Does Medicare Part B Cost The Same For Everyone

Read Also: What Is A Medicare Mapd Plan

Original Medicare Doesnt Cover Everything

Original Medicare doesnât cover prescription drugs, custodial care or most hearing, vision or dental care. Medicare only partially covers some services, such as hospitalization, ambulance services and nursing home care, which means you could be responsible for copays and deductibles.

There are ways to cover at least some of the gap, with Medicare Supplement Insurance plans, or by opting for the privately administered alternative to Original Medicare called Medicare Part C, or Medicare Advantage . You may also qualify for a state-sponsored Medicare Savings Program, which can help cover deductibles, copayments and more.

Donât Miss: Is Rollator Walker Covered By Medicare

Signing Up For Medicare Advantage Plans

If you choose to enroll in a Medicare Advantage plan, it is best to do so during your initial enrollment period. This same timeframe applies to Medicare Part A and Part B enrollment. Read more about Initial Enrollment period.

You can enroll in any Medicare Advantage plan available in your service area during this window. If you miss this enrollment period, you must wait until the Annual Enrollment Period to enroll in a plan. Read more about Annual Enrollment Period.

Keep in mind, when enrolling in a plan, it is essential to note that you cannot enroll in a Medicare Advantage plan and a Medicare Supplement plan simultaneously. So, before you enroll, it is necessary to compare all Medicare plan options available.

You May Like: What Does Original Medicare Not Cover

Are You Automatically Eligible Once You Turn 65

Age alone does not qualify you for Medicare. First, you must be either a natural-born American citizen or a permanent, legal resident who has lived here for at least five years. In addition, either you or your spouse must have worked and paid into Social Security for at least 10 years, which earns you the 40 credits necessary to receive Medicare Part A without paying a premium.

You may enroll in Medicare without having 40 credits, but you pay a premium based on the number of credits you have. In 2023, your Part A premium is $278 per month if you have between 30 and 39 credits. If you have fewer than 30 credits, your premium is $506 per month.