Determine If Medicare Or Group Insurance Is The Primary Insurer

The size of your employer often decides whether or not you can delay enrollment in Part B without paying a penalty. In companies with fewer than 20 employees, Medicare automatically becomes the primary insurer, with group insurance secondary. If you learn that your current insurance will become secondary to Medicare, then you should take Part A and Part B when you are first eligible. The reason for this is because secondary insurance only pays after the primary insurer pays, and pays very little. If you choose to delay Medicare, you will not have a primary insurer, and your out-of-pocket costs will be high.

On the other hand, if your employer has more than 20 employees and you learn that your group health insurance will remain the primary insurer with Medicare coverage second, then you may not need to enroll in Part B immediately as your current coverage will cover your needs.

How Does Medicare Work With My Job

Keep in mind that:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Read Also: How Can I Get My Medicare Card Number

Does Having Both Medicare And Employer Benefits Affect Spousal Coverage

Medicare is individual health insurance coverage, which means that it doesnt include coverage for spouses or dependents. Most group health plans, on the other hand, do include some sort of coverage option for dependents and spouses.

No matter what your group health plan offers, its important to understand that Medicare benefits arent extended to anyone other than the beneficiary.

This means that if the employee of the group health plan receives Medicare benefits along with their employer benefits, Medicare coverage applies only to the employee. Medicare does not pay out for services received by dependents or spouses, even if the original group health plan does.

Medicare has separate eligibility rules for spouses of beneficiaries. These eligibility rules, such as early eligibility and premium-free Part A, should be taken into consideration when considering overall health plan enrollment.

How Generously Subsidized Are My Employer Plan Premiums

Though Medicare Part A, which covers hospital care, is free for most enrollees, Part B, which covers outpatient care, is not. As such, it pays to compare your premium costs under Medicare with what you pay for your employer plan. The standard Part B premium is $144.60 a month right now, and it tends to rise from year to year. Many companies subsidize health insurance premiums generously for employees, and some even pay those premiums entirely. See which option leaves you paying more for premiums before making the call.

Also Check: Does Medicare Cover Oral Surgery Biopsy

Find Out If Your Group Insurance Changes After You Become Eligible For Medicare

After determining who will be the primary insurer, look to your benefits. In some cases, group insurance works differently once you become eligible for Medicare. Learn if your benefits will change, and then decide if its worth having both types of coverage or delaying enrollment in Part B. Unlike Part A, Part B isnt freeonce enrolled, everyone pays a monthly premium. Find out how your current coverage works once you or your spouse turn 65 and then decide if it makes sense to enroll in Part B or delay enrollment until a later date.

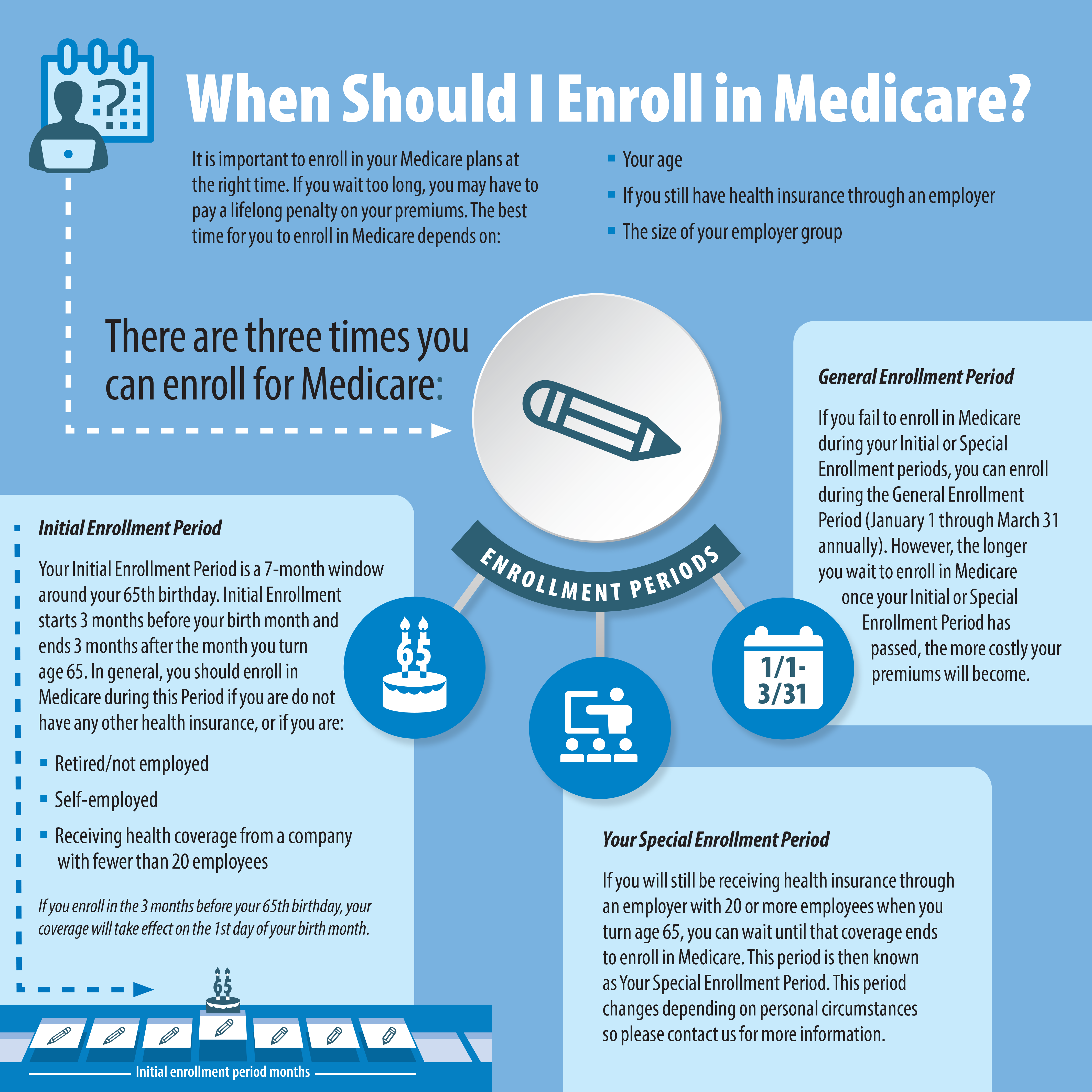

With Group Coverage, You Qualify for a Special Enrollment Period to Enroll in Medicare

The good news is, if you have group coverage and missed your Medicare Initial Enrollment Period, you can still enroll in Part B without paying a penalty. As long as you have group coverage, you qualify for a Special Enrollment Period. And, you have an additional 8 months after losing group coverage to enroll in Medicare without paying a penalty. Youll also get a guaranteed right to buy Medicare Supplement Insurance for six months after enrolling in Medicare Part B.

Jenn, Thank you for helping me with this, what I thought was a confusing task, you have made it simple and very pleasant. You are an excellent professional. Once again, you are absolutely the best. Thank you for making it so easy and solving a very unsettled status in my life.S. Randall, Refugio

Medicare And Employer Coverage: Coordination Of Benefits

Lets say youre going to keep your employer coverage and also apply for Medicare. Medicare coordinates benefits with your employer coverage. Which insurance pays first? That is which is the primary payer?

The size of the employer helps determine who pays first.

- If you work for a company that employs 20 employees or more, your employer coverage usually pays first. Medicare is the secondary payer, paying its portion for covered services your employers group health coverage did not pay. You might still have to pay a deductible and/or copayment or coinsurance amount.

- If you work for a small company of fewer than 20 employees, Medicare usually pays first and your employer coverage is the secondary payer. Be mindful, however, of employer coverage that has a Health Savings Account feature you typically can only contribute to your HSA for the portion of the year when you arent covered by Medicare.

Do you have questions about your Medicare coverage options and how to compare costs with your employer coverage? You can call us and speak with a licensed eHealth insurance agent. You can also begin exploring your Medicare plan options right now by clicking Browse Plans on this page.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

Also Check: Why Is My First Medicare Bill So High

What Happens When I Retire

It’s best to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage. If you have group retiree health coverage, you’ll need to contact the plan’s benefits administrator to learn about how the coverage works with Medicare and what you need to do.

Im Turning 65 Soon But I Like My Current Insurance Do I Have To Enroll In Medicare Will There Be Penalties If I Dont

It depends on how you are receiving your current insurance. If you are receiving employer-sponsored health insurance through either your or your spouses job when you turn 65, you may be able to keep your insurance until you retire. You will need to contact your employers benefits representative to find out whether they will continue your coverage when you turn 65. Since Medicare Part A is premium-free for most beneficiaries, you may want to enroll in Part A as soon as you are eligible , even if you will continue to receive employer-sponsored insurance at that time. If you are covered under an employer plan, you may want to delay signing up for Part B until you retire. However, it is a good idea to check with Social Security or Medicare to confirm you will not face a penalty for late enrollment. Similarly, unless you have drug coverage that is as good as what Medicare drug plans offer, you will need to sign up for a Medicare prescription drug plan when you enroll in Medicare or you may face a late enrollment penalty.

If you decide to drop your Marketplace coverage when you become eligible for Medicare, make sure your Medicare coverage has started before you cancel your Marketplace plan so that you avoid any gaps in coverage. You can start signing up for Medicare three months before your 65th birthday.

Recommended Reading: How Much Is Medicare B Deductible

Enrolling In Medicare Part A At 65

Many people who are covered by a spouses employer plan choose to either wait to enroll until they lose their spouses employer coverage or choose to only enroll in Part A since Part A usually has no premium. You can enroll in Medicare Part A only and choose to delay Part B and Part D, but youll need to ensure you have creditable coverage to avoid paying late premium penalties for Part B and/or Part D.

Can I Keep My Employer Health Insurance With Medicare

If youre receiving health insurance coverage from your current place of work but also qualify for Medicare, you may find yourself choosing between Medicare and your group health plan. In most cases, the size of the company where you work determines whether youll face penalties for choosing not to enroll in Medicare when youre eligible.

Here are the rules for choosing employer health benefits instead of Medicare:

- If your employer has fewer than 20 employees, you must sign up for Medicare when youre eligible or you may face a late enrollment penalty for Part B when you sign up later.

- If your employer has 20 or more employees, you can delay signing up without any late enrollment penalties in the future.

If youre under age 65 and eligible for Medicare because of a disability, youre not required to sign up until you turn 65 years old. But if youre still receiving group health insurance coverage at that time, the same rules listed above apply.

Once you retire and give up your employer health benefits, you will have a special enrollment period of 8 months to enroll in Part A and Part B, if you havent enrolled already. This special enrollment period begins the month after your employment or group health plan ends.

There is no late enrollment penalty for enrolling in original Medicare during this special enrollment period if the rules above were followed.

Don’t Miss: How To Get A Lift Chair From Medicare

Is Part B Worth It

Another mistake we see is people who thought they didnt need Part B because they are healthy. Ive seen a number of individuals who said they didnt get sick often so they opted to only enroll in Part A. Every one of these people assumed that Part A Hospital benefits cover everything in the hospital. So they decided to skip Part B thinking that they didnt mind paying out of pocket for an occasional doctor visit. They didnt realize Part B covers many things that occur in a hospital.

Usually they discover their error when they are sent for an MRI or a surgery and find out they now owe thousands or tens of thousands of dollars. Be sure you dont make the same mistake. If you are unsure, ask your insurance agent: Do I Need Medicare Part B?

If he or she tells you no, be sure you get a full explanation on why you are able to delay your. Get a second opinion if you are unsure, and never rely on Social Security to give you the right answer. Weve seen too many people get wrong answers from inexperience government employees.

Related Article: 7 Medicare Mistakes That Could Cost You

You Need Part B If Medicare Is Primary

What is Medicare Part B? It is your outpatient coverage.

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. Part A pays for your room and board in the hospital. Part B covers most of the rest.

The Medicare definition for Part B is outpatient coverage. However, Part B covers many things that happen both in and out of the hospital. Part B provides 80% coverage for doctor visits, labwork, physical therapy, medical equipment, diabetes supplies, surgeries, chemotherapy, radiation, dialysis and much more.

Is Medicare Part B optional? Yes, because some people who are still working may wish to delay it until they retire.

However, it is a critical component of your overall health package when Medicare is primary.

Some common scenarios where Medicare is primary are:

- When you are 65 or older and have employer coverage at a company with less than 20 employees

- When you are under 65 on Medicare due disability and work for an employer with less than 100 employees

- If you have retiree coverage from a former employer

- With COBRA insurance, you must enroll in Part B by the 8th month of COBRA

- When you are turning 65 with Tricare for Life or CHAMPVA

- When you are 65 or older and enrolled in Medicaid

Employer coverage, retiree coverage, COBRA, TFL and Medicaid all function as your secondary insurance only if do your part and first enroll in Part B. Failure to enroll in Part B means you will also owe a penalty if you decide to enroll later on.

You May Like: How Much Medicare Is Taken Out Of Social Security Check

How Does Medicare Compare With Employer

Although all employer-sponsored plans are different, they typically cover both inpatient and outpatient care, as well as prescription drugs. The following chart shows the main differences between Original Medicare, Part A and Part B, and most employer health plans.

| Medicare | ||

| Minimal coverage unless you sign up for prescription drug coverage under Medicare Part D | Typically covers prescription drugs with a copayment or coinsurance amount | |

| Skilled nursing home care | Up to 100 days for qualified stays you pay $0 for first 20 days and $185.50 per day for days 21-100 in 2021 all costs for days 101 and beyond | Varies some plans may cover skilled nursing home care. You may pay a copayment or coinsurance amount |

*Most people dont pay a premium for Medicare Part A. You generally dont have to pay a premium if youve worked at least 10 years while paying taxes.

Can My Medicare Part B Enrollment Start The Day My Work Coverage Ends

Yes, you should be able to enroll in your Medicare Part B a few months in advance and select a future Part B start date. That way you can time it that when your work coverage ends, your Medicare Part B all start at the same time. You should not have a gap when your work coverage has ended but your Medicare has yet to begin.

Learn About Your States Rules On Leaving Employer Coverage Voluntarily

Every state has different rules that apply to leaving employer coverage. In some states, you are afforded guaranteed Issue rights whether your coverage ended voluntarily or not. This is especially critical for those people with a chronic illness who wish to purchase a Medicare Supplement. The only time you may qualify for a plan may be during your initial open enrollment when you get your Part B Medicare. If your state does not allow Guaranteed Issue rights for a voluntary loss of coverage, you may find yourself without the ability to get coverage. Learn more about Medicare in your state here.

Going Back To Work After Turning 65

The above scenarios apply to people who are still working when they turn 65 and become eligible for Medicare. But what if youre already retired and enrolled in Medicare but then return to a job that has employer health coverage?

If you return to work, the same rules apply according to the size of your employer. If you enrolled in Medicare Part B, you may cancel it upon enrolling in the employer coverage under no penalty.

When you retire again, you will be granted a Special Enrollment Period if you wish to re-enroll in Part B.

Should I Sign Up For Part A If I Have Employer Insurance

If you have qualifying work history , you are usually eligible for premium-free Part A. It costs you nothing to take advantage of your Medicare Part A benefits. In this case, it is usually a good idea to enroll in Part A when you first become eligible.

One exception: if you have a high-deductible plan with a health savings account through your employer. If you enroll in Part A, you can no longer contribute to your account without tax penalties. Talk to your plan administrator if you have questions about your HSA and Medicare.

Finally, depending on your employer plan, your insurance benefits may change once you become eligible for Medicare. Its a good idea to check with your plan administrator before you sign up.

What Factors Affect Your Medicare Enrollment Status If You Are Working

Medicare is the federal health insurance program that covers people age 65 and older as well as some younger people with disabilities or specific health conditions. If youre still working at 65 and covered by your employer plan, several factors will affect your Medicare enrollment status:

-

The size of your employer: If your company has fewer than 20 employees, youll need to sign up for Medicare during your initial enrollment period.

-

Whether you have spousal coverage: If you get insurance through your spouses employer, the same employer-size rule applies.

-

The quality of your drug coverage: If your health insurance doesnt include , as defined by Medicare, youll need to purchase a stand-alone drug plan that meets those standards. Going without this level of prescription drug coverage for more than a few months will cause Medicare to charge you a late enrollment penalty on top of your Part D premium after you sign up.