How Do I Know If I Will Reach The Medicare Donut Hole

Your Part D company sends out a statement, or explanation of benefits , each month. This statement tells you exactly how much you have already spent on covered medications and how many dollars are left before you reach the coverage gap. Likewise, after you reach the gap, your insurance company will continue to send you notices that track your gap spending. They will calculate how many dollars are left before you reach catastrophic coverage.

Medicare Part D: A Brief Overview

Before we jump into the Part D donut hole, heres a quick rundown on Medicare Part D.

- You dont get this coverage automatically, in most cases. If you want Part D coverage, you need to sign up for it.

- You can get Medicare prescription drug coverage in two different ways.

- A stand-alone Medicare Part D prescription drug plan can work alongside your Original Medicare coverage.

- A Medicare Advantage prescription drug plan provides your Medicare Part A and Part B benefits, and prescription drug coverage as well.

Leaving The Part D Donut Hole

In order to leave the donut hole, your total out-of-pocket costs much reach $6,550. If you hit this number, then you enter the catastrophic payment stage. Your plan pays most of the cost for your drugs in the catastrophic stage. You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year.

Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits. Other amounts that contribute to reaching the limits include:

- What your plan pays for your drugs in the initial coverage stage

- Discounts provided by drug manufacturers in the coverage gap stage

- Amounts paid by others on your behalf, such as financial assistance programs, in any payment stage

Also Check: Who Is Eligible For Medicare In Georgia

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How You Can End Up In Medicares Donut Hole And How You Get Out

Medicare prescription drug plans can have a coverage gapcalled the “donut hole”–which limits how much Medicare will pay for your drugs until you pay a certain amount out of pocket. Although the gap has gotten much smaller since Medicare Part D was introduced in 2006, there still may be a difference in what you pay during your initial coverage compared to what you might pay while caught in the coverage gap.

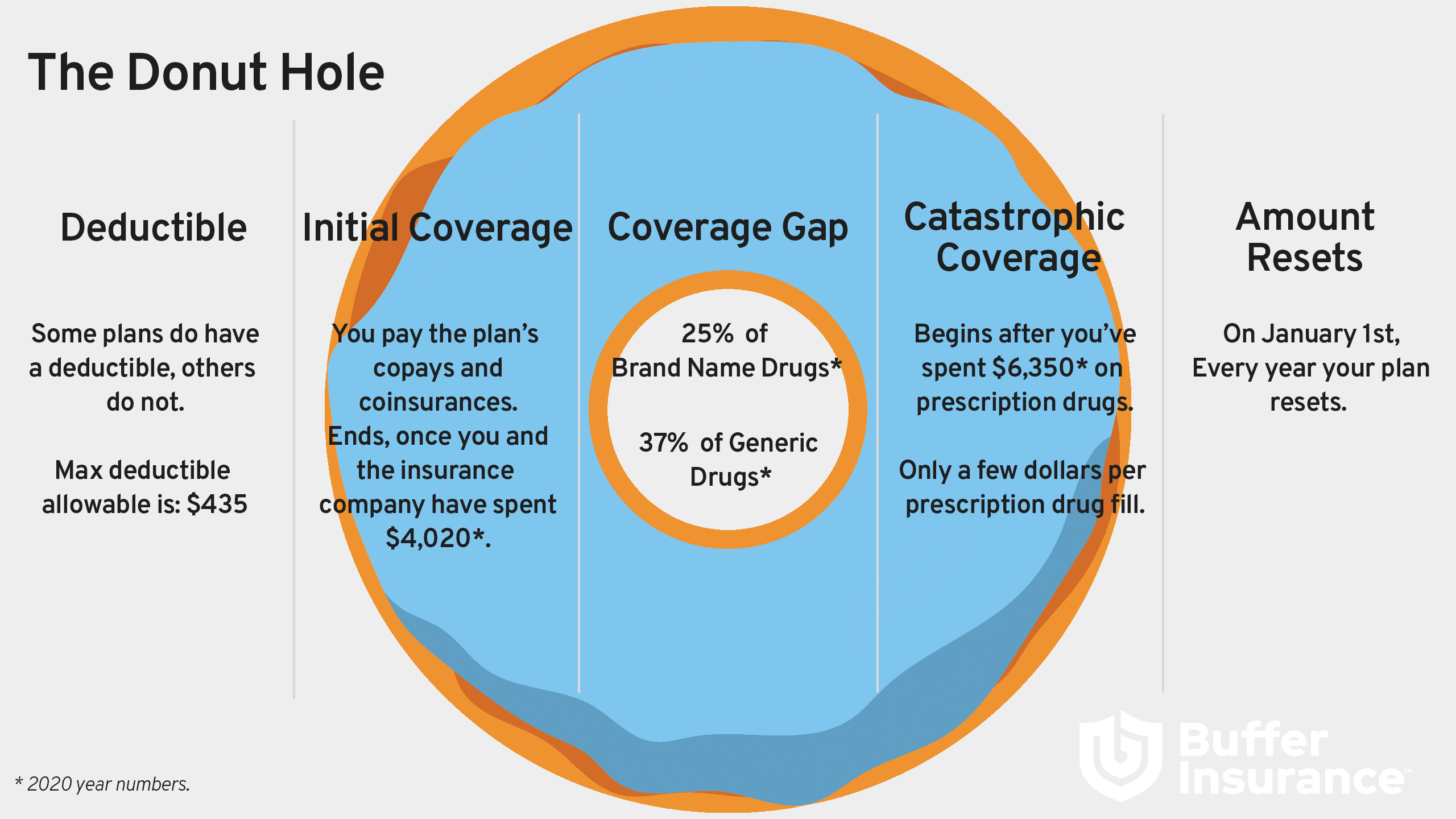

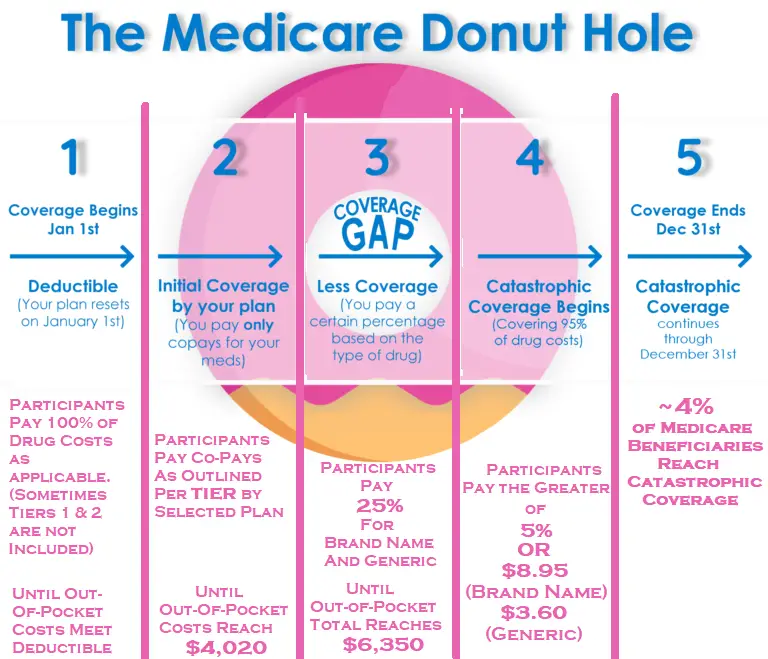

When you first sign up for a Medicare prescription drug plan, you will have to pay a deductible, which cant be more than $445 . Once youve paid the deductible, you still need to cover your co-insurance amount , but Medicare will pay the rest. Co-insurance is usually a percentage of the cost of the drug. If you pay co-insurance, these amounts may vary throughout the year due to changes in the drugs total cost.

Local Elder Law Attorneys in Your City

City, State

Once you and your plan pay a total of $4,130 in a year, you enter the coverage gap, aka the notorious donut hole. Previously coverage stopped completely at this point until total out-of-pocket spending reached a certain amount. However, the Affordable Care Act has mostly eliminated the donut hole. In 2021, until your total out-of-pocket spending reaches $6,550, youll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $6,550 , you are out of the coverage gap and you will pay only a small co-insurance amount. For more from Medicare on coinsurance drug payments, .

Read Also: Is Kaiser A Medicare Advantage Plan

What Happened In The Donut Hole Coverage Gap In 2020

The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We’ll explain more below about what this means for your coverage.

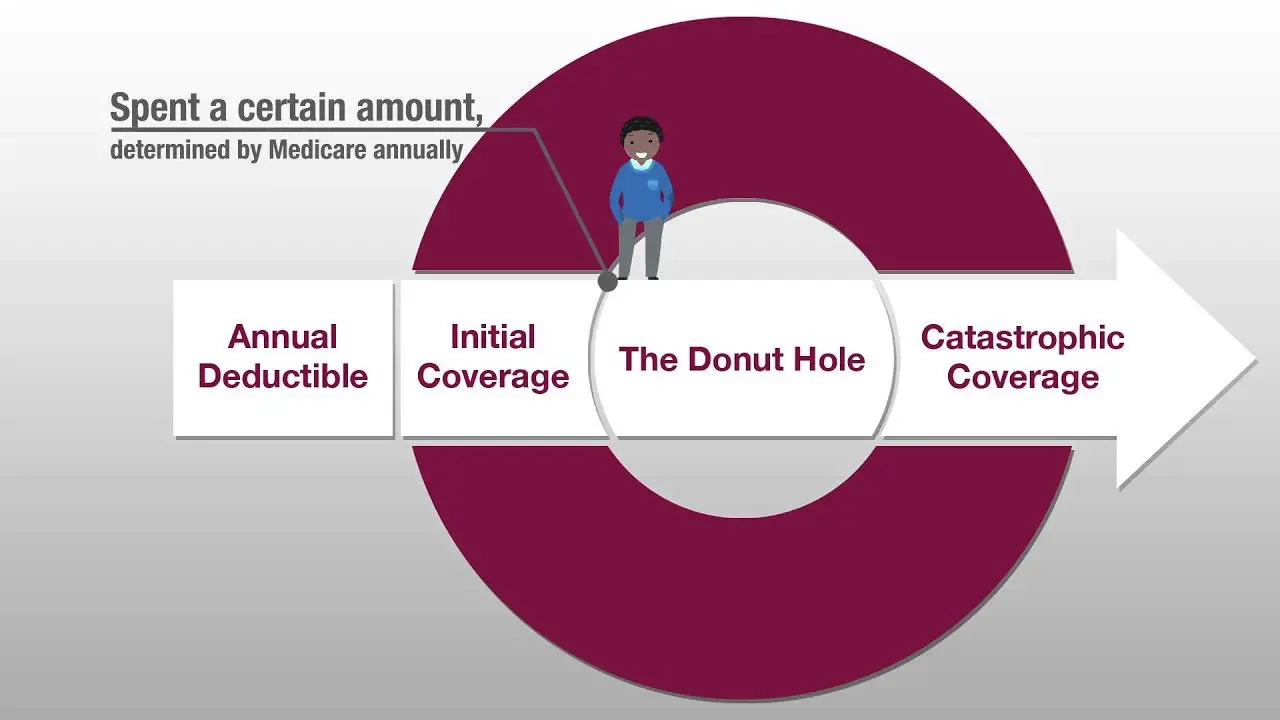

The Medicare donut hole is one of four coverage levels that are in a Part D prescription drug plan.

You enter the Medicare donut hole after your deductible period and your initial coverage period end and before you enter catastrophic coverage.

Extra Days For Inpatient Stays

You never know when you could need to stay at the hospital. One thing is certain, though: with a Medigap plan, youll have fewer financial worries than you would with Medicare alone. All Medigap plans cover Part A coinsurance, much like how they handle the costs for skilled nursing facilities.

On standard Medicare, each day in the hospital after the first 60 days costs hundreds of dollars in coinsurance. After 90 consecutive days, youll need to start using your lifetime reserve days, of which Medicare provides 60. All Medigap plans, however, cover up to 365 extra days of inpatient hospital costs beyond Medicares 60 lifetime reserve days.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Read Also: How To Choose Best Medicare Part D Plan

The Catastrophic Coverage Phase

You enter the catastrophic coverage phase once your total out-of-pocket spending reaches $7,050 in 2022. This includes money you paid for covered prescriptions during the deductible phase. In addition, the manufacturer discount on brand-name prescription drugs counts toward your total out-of-pocket for Part D coverage .

The monthly premium for your Part D or Medicare Advantage Prescription Drug plan does not count toward this total cost. Neither does the cost of over-the-counter medications.

Once you reach the catastrophic coverage phase, your Part D copayments for the rest of the year are only 5 percent of covered drug expenses. Your plan pays 15 percent and the government pays the remaining 80 percent of prescription drug costs.

Good News For The Donut Hole

Well, the Affordable Care Act, AKA Obamacare, takes into account this coverage gap/donut hole. It makes sure that by 2020, if the act stays in effect, that the donut hole will be completely gone. That means that starting in 2020 you will only ever have to pay the 25% coinsurance on your prescriptions. Once you reach your limit, you will then go to the 5% payment option. So, good news is on the horizon for everyone who is worried about the donut hole. However, there are many politicians who want to remove or amend Obamacare so you will have to keep checking back here to find out the latest news about Medicare Part D.

Don’t Miss: Does Medicare Pay For Blepharoplasty

Medicares Donut Hole Has Shrunk But A Gap Remains

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you have a Medicare prescription drug plan, theres a gap in coverage after youve spent a certain amount on covered drugs the so-called Medicare “donut hole.” While potential costs associated with the donut hole went down substantially in 2020, there remains a coverage gap that may affect what you pay for prescription drugs.

About 48 million people covered by Medicare are enrolled in Part D drug plans.

How Can I Avoid The Donut Hole

There is no such thing as Medicare Part D plans with no donut hole, so you have to just do your best to stay under the threshold. The best way to avoid the donut hole is to take generic medications whenever possible. You can also work with your doctor on reducing your drug spending.

Show your doctor which drugs are costing you the most on your Part D plan and see if he/she can recommend any cheaper alternatives. Some medications may not have a generic equivalent on the market yet, but there may be other similar medications that are cheaper that achieve a like result.

Don’t Miss: Is Medicare Medicaid The Same

D Information For Pharmaceutical Manufacturers

This page provides important information related to Part D program for Pharmaceutical companies.

The Medicare Coverage Gap Discount Program makes manufacturer discounts available to eligible Medicare beneficiaries receiving applicable, covered Part D drugs, while in the coverage gap. In order to participate in the Discount Program, manufacturers must sign an agreement with CMS to provide the discount on all of its applicable drugs . Beginning in 2011, only those applicable drugs that are covered under a signed manufacturer agreement with CMS can be covered under Part D.

CMS has provided on the download section of this page information about the Discount Program contracting process, the list of participating manufacturers, Labeler Codes and associated Labeler Codes Firm Names.

Please click the selection that best matches your area of interest and check back, as we will continue to update these resources regularly.

What Are Gaps In Coverage With Medicare

ANSWER

Medicare is a federal health insurance plan for people 65 and older, or with certain disabilities. The main Medicare plans are called A, which covers hospital services, and B, which pays for doctor visits, lab tests, and other outpatient services.

- Original Medicare doesn’t cover some essentials. For instance, it does not pay for most prescription drug costs.

- Even when Medicare covers a treatment, you still have to pay copays and coinsurance .

- Most people have to pay a monthly fee, called a premium, for Medicare Part B.

Centers for Medicare and Medicaid Services: “What Medicare Covers,” “What’s not covered by Part A & Part B?” “Supplements & other insurance,” “What’s Medicare supplement insurance?” “Your Medicare Coverage: Hospital Care,” “Medicare Coverage of Durable Medical Equipment and Other Devices,” “Decide how to get your Medicare,” “Medicare Advantage Plans,” “Catastrophic coverage,” “How do Medicare Advantage Plans work?” “Medicare & You,” “How to Get Drug Coverage,” “Save on Drug Costs,” “Medicaid,” “Medicare Advantage Plans Cover All Medicare Services,” “Medicare Savings Programs,” “What is Long-term Care?” “Help with Medical and Drug Costs,” “Part B Costs,” “Prescription drugs limited coverage,” “Medicare Prescription Drug Coverage.”

Social Security Administration: “Income and resource requirements for the Extra Help with prescription drug costs.”

Families USA: “Stand Up for Health Care: Filling the Financial Gaps in Medicare Coverage.”

Recommended Reading: Does Medicare Pay For Teeth Implants

What Are The Rules About The Medicare Donut Hole For 2022

Originally, being in the donut hole meant that you had to pay OOP until you reached the threshold for more drug coverage. However, since the introduction of the Affordable Care Act, the donut hole has been closing.

There are several changes for 2022 aimed to limit your out-of-pocket costs in the coverage gap. These include:

- You will pay no more than 25 percent of the price for brand-name drugs.

- The nearly full price of the drug will count toward getting you out of the coverage gap.

- You are responsible for a dispensing fee for your medicine. Your plan pays 75 percent while you pay 25 percent.

- The fees that dont count toward your OOP spending include the 5 percent your plan pays plus the 75 percent toward the dispensing fee your plan pays.

Some plans offer even deeper discounts when youre in the coverage gap. Its important to carefully read your plan to see if this is true for you.

Lets see how this works in some examples below.

Ask For Drug Manufacturers Discounts

Some pharmaceutical companies offer their products at a discount directly to consumers or through doctors offices. This is more common for brand-name and specialty drugs, which can be expensive. Ask your doctor or health-care provider when you get the prescription if any discounts are available or if there is a pharmaceutical assistance program. You can also search online as the drug manufacturers website may have more information.

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental

Coverage Gap Discount Program

Since the Coverage Gap Discount Program began on January 1, 2011, CMS has been analyzing Prescription Drug Event data to understand how many discounts have been provided in the coverage gap and for which classes of prescription drugs. We have created four documents illustrating our findings. Under “Downloads,” the link titled “Coverage Gap Discount Data Spreadsheet” contains three documents. The first document shows the total number of beneficiaries receiving a gap discount, the total gap discount amount, the average gap discount amount by beneficiary, and the count of PDEs with a gap discount. The second document shows the year-to-date coverage gap discount data by zip code with the city name, county name, and state included. The third document shows the year-to-date coverage gap discount data by county code with the state and county names included. The final document “Total Coverage Gap Discount Amount by Drug Therapeutic Use” under “Downloads” is a pie chart showing the total coverage gap discount amount by drug therapeutic use.

Did The Donut Hole Close In 2019

The Medicare Part D donut hole has been closing in recent years due to provisions in the Affordable Care Act , also known as Obamacare.

The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump.

Are you looking for Medicare Part D prescription drug coverage?

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

You May Like: Does Medicare Cover Ambulance Transport

What Are The Medicare Donut Hole Rules For 2022

Previously, being in the donut hole indicated you need to pay out-of-pocket costs until you reached the threshold value for more drug coverage. Nevertheless, the donut hole has been closing due to the introduction of the Affordable Care Act.

Several changes are planned for 2022 to reduce your out-of-pocket costs during the coverage gap. It includes:

- You will spend no more than 25% of the cost of brand-name medications.

- The nearly total price of the medicine will count toward closing the coverage gap.

- You must pay a dispensing fee for your medication. Your plan will cover 75% of the cost, while you will cover the remaining 25%.

- Fees that do not count toward your OOP funding include 5 percent that your coverage pays and 75 percent that your plan spends toward the dispensing fee.

Some programs even offer significant discounts when youre in the coverage gap phase. Its critical to carefully read your plan to see if this applies to you.

Lets look at the examples to see how this works.

Is There Any Insurance That Covers The Donut Hole

There is no insurance that provides coverage exclusively for the Part D donut hole.

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help .

Also Check: Can I Transfer My Medicare To Another State

What Changed In 2020

When Medicare Part D was rolled out in 2007, users paid 100% of drug costs during the coverage gap until their out-of-pocket costs qualified them for catastrophic coverage.

The Affordable Care Act included a provision to require drug manufacturers to provide a 50% discount on the cost of brand-name drugs in the coverage gap and to require plans to pay a gradually increasing share of drug costs. The final phase of the plan was implemented in 2020, and users are now responsible for 25% of the cost of both brand-name and generic drugs.

How Does The Affordable Care Act Affect The Coverage Gap

The Affordable Care Act gradually reduced the amount of money you may have to pay for covered prescriptions. As of 2020, the coverage gap is considered closed. However, if you and your plan spend past the initial coverage limit, youll still enter this coverage phase.

- In 2020, youll pay up to 25% for generic prescription drugs and covered brand-name drugs.

Also Check: Does Medicare Rated Assisted Living Facilities

Thanks To The Affordable Care Act The Donut Hole Closed Completely In 2020 Leaving You Paying The Same 25% Of Prescription Drug Costs As You Paid Before You Entered The Coverage Gap

The donut hole is the coverage gap that occurs when you and your Medicare drug plan have reached a pre-determined spending limit for covered drugs. For example, in 2022, once you have spent $4,430 on covered drugs, you enter the coverage gap.

While in this coverage gap, you will pay no more than 25 percent out-of-pocket for the cost of both brand-name drugs and generic drugs until you reach the catastrophic coverage phase. This amount changes every year. In 2022, once your out-of-pocket spending reaches $7,050, you leave the donut hole and enter catastrophic coverage. Once you reach this point, you pay only a small coinsurance or copayment for each covered prescription until the end of the year.