How Do I Choose A Nursing Home

This is an extremely important decision that should not be taken lightly. You should consult multiple resources before making this decision. First, tour the facilities to get an idea of where you feel most comfortable. Next, consult your doctor for his or her opinion of the facilities that you are considering. Finally, check with your insurance company or Medicare to determine the costs of each. Weigh all the factors appropriately before making the final decision on which facility to choose as this decision can have lasting impacts for years to come.

What Do Medicare Part A And Part B Have In Common

Medicare Part A and Part B share some characteristics, such as:

- Both are parts of the government-run Original Medicare program.

- Both may cover different hospital services and items.

- Both may cover mental health care .

- Both may cover home health care.

- Both have annual deductibles, as well as coinsurance or copayments, that may apply to certain services.

- Both have monthly premiums, although many people dont have to pay the Part A premium .

Some Extra Help With Costs

To protect people from the costs, the government worked with private insurers to come up with a set of plans that are designed to help with some of the costs associated with Original Medicare. By paying a monthly premium for a Medicare Supplement plan, you can get financial help with:

- Paying for your Part A deductible and the share of inpatient care costs not covered by Part A

- Paying for your doctor bills for Part B services

- Paying the costs of hospice care not handled by Original Medicare

These benefits mean that if you have a Medicare Supplement plan, you can:

- Pay a predictable up-front premium for your coverage

- Reduce the amount that you have to pay if you have a long inpatient hospital stay or repeat visits to a specialist.

Recommended Reading: When Does Medicare Coverage Start

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

How Does One Pay For Assisted Living

Unfortunately, Medicare does not cover these costs. People typically pay for assisted living through savings or with money from retirement accounts. Purchasing long-term care insurance can be a good way to help pay for these facilities. However, you must plan early and purchase this insurance before the need for care arises. Most people purchase a policy like this while in their 40s or 50s.

Also Check: How Much Medicare Is Taken Out Of Social Security Check

Looking For Help With More Than Costs

Original Medicare doesnt cover things like prescription drugs, dental services, vision and hearing. To get prescription drug coverage, you need to purchase a Medicare Part D plan. Part D plans are sold by private insurance companies. Theyre specifically designed to help pay the cost of prescription medications. Learn more about Medicare Part D here. An additional way to get drug coverage is to purchase another part of Medicare, called a Medicare Advantage plan. Medicare Advantage plans are sold by private insurance companies and are also known as Medicare Part C.

Medicare Advantage plans often include additional coverage, like dental, vision and hearing. There are some important similarities and differences between Medicare Supplement plans and Medicare Advantage plans.

While both are provided by private insurance companies, there are some key differences between Medicare Supplement plans and Medicare Advantage plans:

- Medicare Advantage plans often provide prescription drug coverage. Medicare Supplement plans dont.

- Medicare Supplement plans work together with Parts A and B. Medicare Advantage plans include all the benefits of Part A and B but you work with a private company, not the federal government.

What Is The Difference Between Assisted Living & Nursing Homes

The main difference between assisted living and a nursing home is the level of care required by its residents. Assisted living facilities usually resemble high-end apartments. Its residents do not typically require constant care and monitoring. On the other hand, a nursing home has more of a hospital feel. Its residents usually require constant care and help with medications or daily activities. Residents of assisted living are much more independent, which nursing home residents are typically unable to care for themselves.

Also Check: When Can You Apply For Part B Medicare

How Much Medicare Pays For You To Stay In A Hospital

Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness.

For the first 60 days you are an inpatient in a hospital, Part A hospital insurance pays all of the cost of covered services. After your 60th day in the hospital and through your 90th day, each day you must pay what is called a “coinsurance amount” toward your covered hospital costs, and Medicare will pay the rest of covered costs. In 2020, this daily coinsurance amount is $352 it goes up every year.

If you are in the hospital more than 90 days during one spell of illness, you can use up to 60 additional “lifetime reserve” days of coverage. During those days, you are responsible for a daily coinsurance payment of $704 per day in 2020. Medicare pays the rest of covered costs.

You do not have to use your reserve days in one spell of illness you can split them up and use them over several benefit periods. But you have a total of only 60 reserve days in your lifetime.

What Is Original Medicare Part A And B

Friday, January 31, 2014 8:10 AM

Part A and Part B are often referred to as Original Medicare. Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare. You can go to any doctor, supplier, hospital, or other facility that is enrolled in Medicare and accepting new Medicare patients. It is fee-for-service coverage, meaning that, generally, there is a cost for each service.

You generally pay a set amount for your health care before Medicare pays its share. Then, Medicare pays its share, and you pay your share for covered services and supplies. You usually pay a monthly premium for Part B.

Recommended Reading: How Can I Get My Medicare Card Number

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

How Does Medicare Cover Cataract Surgery

Medicare covers cataract surgery to implant an intraocular lens, including hospital and doctor services during and after your operation and corrective lenses after your surgery. If you have the procedure as an outpatient, Medicare Part B will cover your treatment, and you may be responsible for any applicable deductibles, copays and/or coinsurance costs. If you are admitted to the hospital for surgery, youll be covered under Medicare Part A, and your coverage and costs will be different. Since your costs will vary depending on the specific services you receive and whether youre covered under Part A or Part B, its important to talk to your doctor beforehand to get a better estimate of how much your cataract surgery may cost.

After your surgery, Medicare Part B covers corrective lenses after youve had a cataract surgery to implant an intraocular lens. In this instance, Medicare may pay for one pair of glasses or contact lenses if you get them through a Medicare-enrolled supplier. You may owe a 20% coinsurance for the glasses or contact lenses, and the Part B deductible applies. Keep in mind that Medicare doesnt otherwise cover most routine vision services, and youll be responsible for paying for the cost for upgraded frames or additional vision care unrelated to your cataract surgery.

Also Check: Does Medicare Pay For Foot Care

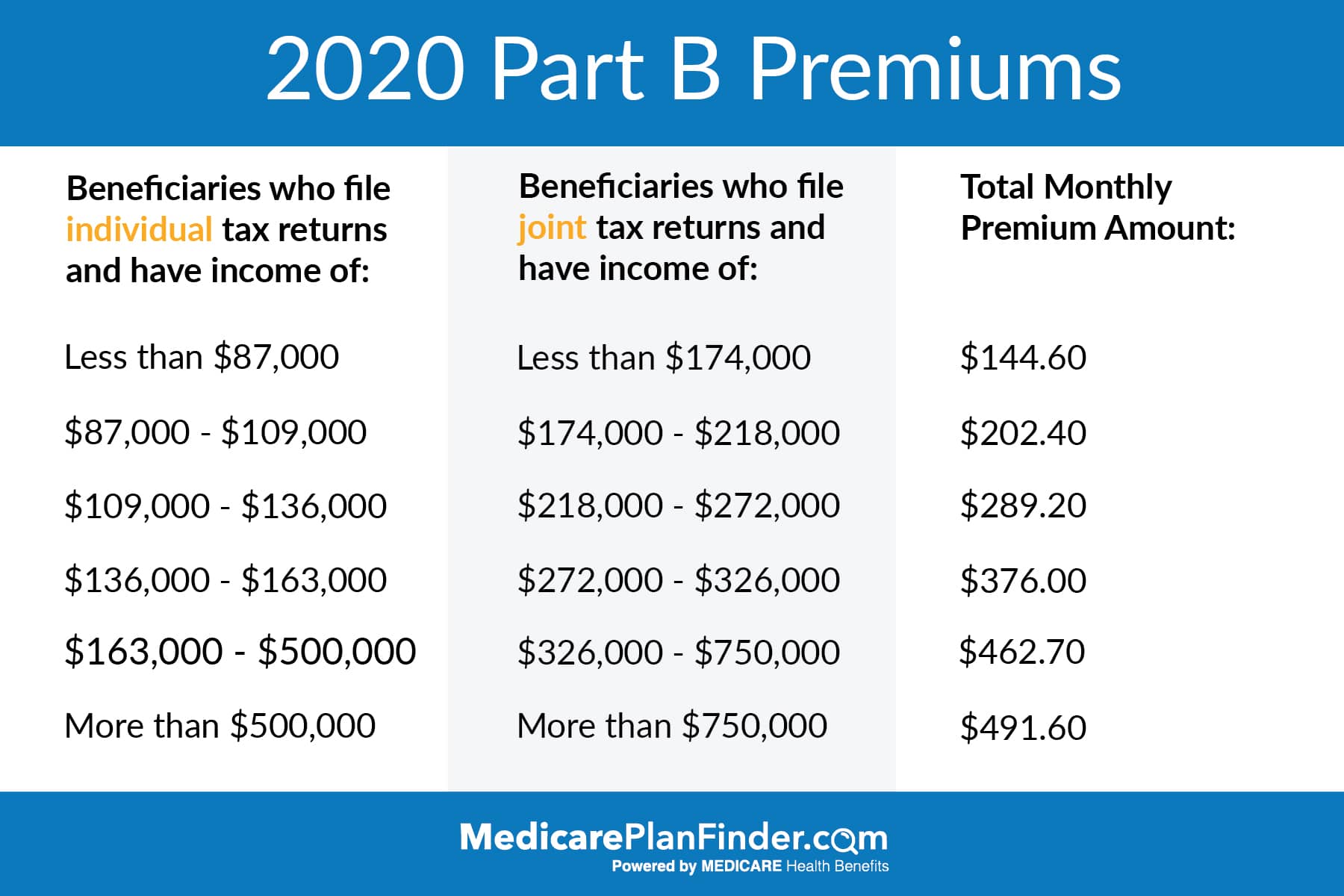

Higher Premiums For Enrollees With High

Since 2007, people who earn more than $85,000 have paid higher Part B premiums based on their income.

For the first time, the threshold for what counts as high income was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple. And it increased again for 2021. Harry Sit, of The Finance Buff, explains how the inflation indexing works here.

Indexing the high-income threshold: The math The indexing is based on the percentage by which the average of the Consumer Price Index for Urban consumers for the 12-month period ending in the most recent August exceeds the average of the 12-month period that preceded that. So for 2021, we look at how the average CPI-U from September 2019-August 2020 exceeded the average CPI-I from September 2018-August 2019.

On this page, you can pull up the data for CPI-U and manually calculate how the average CPI-U has changed. Youll add up all the numbers from September 2019 through August 2020 , and divide by 12 to get the average . Then youll do the same thing for September 2018 through August 2019 . The difference between those two numbers is 3.705, which represents a 1.46% increase from the 254.016 average CPI-U for September 2018 to August 2019.

So as Sit explains here , we increase 87,000 by 1.46% which results in 88,270 and then round to the nearest $1,000. That gives us an income threshold of $88,000, which is the lower bound of high-income as of 2021.

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

You May Like: How Do I Get Dental And Vision Coverage With Medicare

What Are Cataracts And How Do They Affect Vision

According to the National Eye Institute, a cataract occurs when the lens of your eye becomes cloudy. The lens is the clear part at the front of the eye that helps you to focus on an image. When functioning normally, light enters your eye through the lens and passes to the retina, which then sends signals to your brain that help you process what you see as a clear image. When the lens is clouded by a cataract, light doesnt pass through your eye to your retina as well, and your brain cant process images clearly, resulting in blurry vision.

Cataracts can occur in one or both eyes, but they cannot spread from one eye to the other. Your chances of developing cataracts increase significantly with age.

Some people develop cataracts at a much younger age, such as in their 40s or 50s. However, these cataracts tend to be smaller in size and do not usually affect vision. In general, people dont experience vision problems from cataracts until they reach their 60s.

How To Sign Up For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically be enrolled. Youll receive your Medicare card the month before your birthday. If youre not collecting Social Security benefits, youll need to enroll yourself. You can apply online, over the phone, or in-person.

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after. If you dont enroll during your Initial Enrollment Period and dont have , you could be subject to a penalty.

You wont pay the penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. An example would be if you continued working past 65 and had creditable coverage through an employer group health insurance.

Read Also: Does Medicare Cover Oxygen At Home

How Much Does Medicare Part B Coverage Cost

Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing.

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount.

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021.

After you pay your deductible, you generally pay a 20% coinsurance for most covered services.

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover tele-health services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

You May Like: How Old To Be Covered By Medicare

Medicare Part A Will Pay For Most Of The Costs Of Your Hospital Stay After You Pay The Part A Deductible

By Bethany K. Laurence, Attorney

Medicare Part A is also called “hospital insurance,” and it covers most of the cost of care when you are at a hospital or skilled nursing facility as an inpatient. Medicare Part A also covers hospice services. For most people over 65, Medicare Part A is free.

The following list gives you an idea of what Medicare Part A pays for, and does not pay for, during your stay in a participating hospital. However, even when Part A covers a cost, there are significant financial limitations on the length of coverage, as you’ll see below.

Can You Ever Get Both Part A And Part B Coverage At The Same Time

When youre an inpatient in a hospital, its possible to get Part A and Part B coverage at the same time. For example, while Part A generally covers medically necessary surgery and certain hospital costs, Part B may cover doctor visits while youre an inpatient.

Did you know that theres another way to get your Part A and Part B coverage? A Medicare Advantage plan delivers these benefits, and often more. Most Medicare Advantage plans include prescription drug coverage. Learn more about Medicare Advantage plans. You must pay your Medicare Part B premium when you have a Medicare Advantage plan, as well as any premium the plan might charge.

This information is not a complete description of benefits. Contact the plan for more information. Limitations, copayments, and restrictions may apply. Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year.

Also Check: Is Medicare Advantage A Good Choice

When Can I Enroll In Plan A And Plan B

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period The Initial Enrollment Period is the seven-month period around your 65th birthday when most people are eligible for the first time to enroll in Medicare.. To figure out your IEP, follow the seven-month rule your enrollment window includes the three full calendar months before the month you turn 65. It remains open during your birth month, and the three months after. For example: If your birthday is in June, your seven-month window will open Mar. 1 and close Sept. 30.

3 months before your 65th birthday: May, April, Mar.Your birth month: 3 months after you turn 65: July, Aug., Sept.

If you missed your IEP, there are other enrollment periods available. You may be eligible for a Special Enrollment Period due to a Qualifying Life Event Qualifying Life Events are life changes that allow you to enroll in a new health insurance plan during a Special Enrollment Period. These include having or adopting a child, losing other coverage, marriage, a change of income and moving.. There is also a designated time to change your Medicare plan. Learn all about Medicares different enrollment periodsand how GoHealth can help you.