Adjusting The Penalties For Socioeconomically Disadvantaged Patients

Medicare divided all U.S. hospitals into quintiles based on the percentage of dual eligible patients. Hospitals were only compared to other hospitals within the same quintile for the purposes of penalty calculation therefore, a hospital with a high percentage of dual eligible patients was held to a different readmission rate expectation than a hospital with a low percentage of dual eligible patients. In fiscal year 2019, the dual eligible adjustment went into effect and the effect of this on the Medicare readmission penalties has now been analyzed in an article in the June 2019 issue of JAMA Internal Medicine. Hospitals that were more likely to be classified in quintile 5 were more likely to be:

As one would expect, on average, hospitals in quintiles 1, 2, and 3 saw an increase in their readmission penalties whereas hospitals in quintiles 4 and 5 saw a decrease in their readmission penalties.

Balancing Index Length Of Stay With Readmission Risk

One of the more striking inter-hospital differences has been variation in the length of stay for the index hospitalization. This may relate to readmission. Countries with longer length of stay for heart failure hospitalizations appear to have lower rates of readmission within 30 days. In a large contemporary acute heart failure trial conducted across 27 countries, mean length of stay ranged from 4.9 to 14.6 days . There was an inverse correlation between country-level mean length of stay and readmission .39 Similar trends were observed across U.S. study sites. Longer index hospitalizations expend more resources and keep patients from being home yet, there appears to be a trade off in terms of readmission rates. Under the current system, IPPS-DRG-based reimbursement incentives are complemented by the HRRP, balancing a desire to limit unnecessarily long hospital stays while still discouraging unnecessary readmissions due to premature discharge.

How Your Assets Impact Eligibility

Besides income, your assets will be counted toward meeting eligibility requirements. Countable assets include checking and savings account balances, CDs, stocks, and bonds.

In most states, you can retain up to $2,000 as an individual and $3,000 for a married couple outside of your countable assets. However, these amounts may vary depending on the state in which you live.

Your home, your car, personal belongings, or your savings for funeral expenses remain outside of countable assets. If you can prove other assets are not accessible , they too are exempt. A house must be a principal residence and does not count as long as the nursing home resident or their spouse lives there or intends to return there.

Upon becoming eligible for Medicaid, all of the applicant’s income must be used to pay for the nursing home where the applicant resides. However, you may be allowed to keep a monthly “allowance” and a deduction for medical needs, such as private health insurance. The amount of the allowance varies depending on your living arrangements, type of nursing facility, and state rules. If you are married, an allowance may be made for the spouse still living in the home.

Recommended Reading: What Weight Loss Programs Are Covered By Medicare

How Much Do I Pay If Im In A Skilled Nursing Facility

The portion of the costs that you pay depends on the duration of your eligible stay in a skilled nursing facility. Youll have the following copayments for each benefit period:

- $0 for days 1 to 20

- $194.50 a day in 2022 for days 21 to 100

- All costs days 101 and beyond

A Medicare supplemental policy, better known as Medigap retiree coverage or other insurance may cover the copay for days 21 to 100 or add more coverage.

Keep in mind

Medicare doesnt pay for the considerable cost of long-term care in a nursing home or other facility. But you may have other options to help cover long-term care costs.

Private pay. Many individuals and families pay out of pocket or tap assets such as property or investments to pay for long-term care. If they use up those resources, Medicaid may become an option.

Long-term care insurance. Some people buy long-term care insurance that may pay for custodial care in a nursing home or assisted living facility or for a caregiver to come to their home. To qualify for payouts, you generally must need help with at least two activities of daily living or provide evidence of cognitive impairment.

Veterans benefits. Military veterans may have access to long-term care benefits from the U.S. Department of Veterans Affairs .

Ensuring Medicare Will Pay For Senior Rehab

There is so much room for interpretation surrounding the rules for Medicare coverage that it is easy for families to become confused on how to pay for care in SNFs. The bottom line is that vigilance and advocacy are necessary to ensure that aging loved ones receive the skilled care they need and the coverage they are entitled to.

Family caregivers must make sure that the hospital staff and SNF staff give detailed orders and reasons for the skilled services that are needed to promote their loved ones health and safety. Carefully tracking the days within a benefit period can be confusing, but this is essential to prevent surprises regarding non-coverage.

Hiring a geriatric care manager to track the nursing home chart and timeline and accompany you to care plan meetings may be a wise investment. GCMs have a great deal of experience with seniors, various types of elder care providers and Medicare. Even if your loved one has run out of Medicare coverage during their benefit period, a GCM can help you find and access other sources of financial assistance and alternative types of care.

Read:Geriatric Care Managers Can Help Busy Caregivers

Don’t Miss: Must I Sign Up For Medicare At 65

When Medicare Is Exhausted

Asked by: Jamel Champlin

When a patient receives services after exhaustion of 90 days of coverage, benefits will be paid for available reserve days on the basis of the patient’s request for payment, unless the patient has indicated in writing that he or she elects not to have the program pay for such services.

What Is The Medicare 14 Day Rule

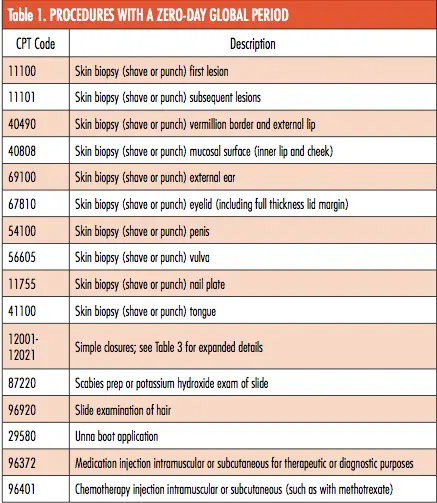

The 14 Day Rule is a regulation set forth by the Centers for Medicare & Medicaid Services that generally requires laboratories, including Agendia, to bill a hospital or hospital-owned facility for certain clinical and pathology laboratory services and the technical component of pathology services provided to …

Read Also: How Do I Add Prescription Coverage To Medicare

Qualifying For Medicare Part A Coverage

Medicare Part A covers the rehabilitation stay so long as certain prerequisites are met:

the admission to the facility is within 30 days of the date of the hospital discharge

the prior hospitalization must be for at least three consecutive days, excluding the day of discharge

the doctor concludes the patient needs daily skilled nursing care or rehabilitative services and

the medical condition relates to the condition treated by the hospital during the qualifying 3-day inpatient hospital stay.

Is A Rehab Considered A Skilled Nursing Facility

When someone suffers a devastating injury or has a surgical procedure such as an amputation, an inpatient rehabilitation center can provide them with acute care. The therapies performed in a skilled nursing facility, on the other hand, are similar to but less intensive than those provided at an inpatient rehabilitation facility.

Also Check: What Walkers Are Covered By Medicare

Days 21 100 Skilled Vs Custodial Care

Coverage for rehabilitation under Medicare Part A is intended to be short-term. The goal is improvement of acute conditions through rehabilitation and skilled nursing care. As mentioned, the first 20 days in the rehabilitation facility are covered in full by Medicare. Some Medigap/Supplemental co-insurance policies will cover all or part of the $194.50 daily co-pay for days 21-100. But patients rarely qualify for 100 days of rehabilitation. After admittance to a facility, the patient is evaluated periodically. Once the facility determines that the patient no longer needs skilled care, coverage under the Medicare program ends. The most important piece to understand is the difference between killed care and custodial care. Medicare does not cover custodial care.

Skilled nursing care includes nursing and therapy care that can only be performed by registered nurses, licensed practical and vocational nurses, physical and occupational therapists, speech-language pathologists, and audiologists. Custodial care is help with activities of daily living, such as getting in and out of bed, eating, bathing, dressing, toileting and grooming. Custodial care is traditionally provided in a nursing home.

A Note About Medicare Rehab Coverage During The Covid

Medicare has made some changes to their coverage requirements for senior rehabilitation services during the coronavirus pandemic. Medicare beneficiaries may be able to qualify for senior rehab in a skilled nursing facility without starting a new benefit period. Others who are unable to remain in their own homes or are otherwise affected by the pandemic may be able to get care in a SNF without first having a qualifying hospital stay.

Additional information about Medicare coverage during the coronavirus pandemic is available here.

You May Like: Do Retired Federal Employees Get Medicare

Can Medicare Kick You Out Of Rehab

Generally speaking, standard Medicare rehabilitation benefits expire after 90 days each benefit term. In the event that you enroll in Medicare, you will be granted a maximum of 60 reserve days during your lifetime. You can use them to make up for any days spent in treatment that exceed the 90-day maximum each benefit period.

What Happens When You Run Out Of Medicare Days

During your benefit period, if you reach the end of your days of coverage, Medicare will stop paying for your inpatient-related hospital charges . You must be out of the hospital or skilled nursing facility for 60 consecutive days in order to be eligible for a new benefit period and extra days of inpatient coverage.

Don’t Miss: Does Medicare Cover Recliner Chairs

What Are The Rules For Medicare Rehab

To be eligible for Medicare coverage of rehab in a skilled nursing facility, you must be admitted to the hospital as an inpatient for at least three days while receiving care. Keep in mind that you must be officially admitted to the hospital by a doctors order in order to be deemed an inpatient, so be aware of this restriction.

Does Medicare Pay For Nursing Homes

En español | No, Medicare does not cover any type of long-term care, whether in nursing homes, assisted living communities or your own home.

Medicare does cover medical services in these settings. But it does not pay for a stay in a long-term care center or the cost of custodial care help with the activities of daily living, such as bathing, dressing, eating and using the bathroom if that is the only care you need.

Recommended Reading: How To Sign Up For Aetna Medicare Advantage

Stopping Care Or Leaving

If you stop getting skilled care in the SNF, or leave the SNF altogether, your SNF coverage may be affected depending on how long your break in SNF care lasts.

If your break in skilled care lasts more than 30 days, you need a new 3-day hospital stay to qualify for additional SNF care. The new hospital stay doesnt need to be for the same condition that you were treated for during your previous stay.

If your break in skilled care lasts for at least 60 days in a row, this ends your current benefit period and renews your SNF benefits. This means that the maximum coverage available would be up to 100 days of SNF benefits.

Also Check: How Much Medicare Pays For Home Health Care

Article: How To Get The Most From Medicares Limited Nursing Home Coverage

Q. My wife and I do not have long-term care insurance. We hear that Medicare coverage for nursing homes is limited. Do you have any tips on how to make the most of it?

A. Sure. Medicare coverage for nursing home stays is really designed for short-term convalescence following a hospital stay. But if you know the rules you can get the most out of this limited coverage:

Basic rule: Not To Exceed 100 Days: Medicare will only cover up to 100 days in a nursing home, but only after a 3-day hospital stay. Days 120 are covered 100%, while days 21100 have a patient co-pay of $144.50 per day . Coverage is available only if you are discharged to a skilled nursing facility , so if you are discharged to an assisted-living facility the cost of care is your own responsibility. Many clients misunderstood this 100 day rule: It is a maximum number of days, and most individuals actually receive LESS THAN 100 days of Medicare Coverage. New Development on 03/13/2020. As a result of the COVID-19 Pandemic, the Center for Medicare and Medicaid Services issued guidance relaxing the 100 day limit and, in effect, extending an additional100 days for nursing home residents. Click here for the Guidance Letter from Seema Verma, Administrator of CMS.

Article Categories

Read Also: What Age Is For Medicare

What Is A Skilled Nursing Facility

Skilled nursing facilities provide the highest level of medical care outside of a hospital, with specialized staff and equipment. Because skilled nursing care is mainly for recovery and rehabilitation, most people stay in an SNF for a short amount of time. The average stay is 37 days . While many nursing homes provide short-term skilled nursing care, some only provide custodial care for their long-term residents, which includes help with daily activities such as eating, bathing, or dressing.

Importantly, Medicare only covers skilled nursing care for up to 100 days in a certified SNF and does not cover custodial care. If a Medicare patient needs nursing home services after 100 days, the patient can pay out of pocket or by using long-term care insurance. If the patient exhausts assets and becomes eligible for Medicaid, the nursing home stay can be covered by Medicaid as long as the individual receives services in a Medicaid-certified nursing home.

In 2019, there were 2 million Medicare-covered SNF stays. Ninety-six percent of these were at freestanding SNFs, while the remaining 4 percent were at hospital-based SNFs. Seventy-one percent of those facilities are for-profit businesses. Twenty-three percent are nonprofit and 6 percent are owned by the government.

Medicare Coverage For Nursing Home Care

If a patient has spent 3 days in the hospital, Medicare may pay for care in a Skilled Nursing Facility:Days 1 20: $ zero co pay for each benefit periodDays 21 – 100: patient pays $194.50 coinsurance per day during 2022 and $200 per day in 2023.Days 101 and beyond: patient pays all costs

Do you know your rights to nursing home coverage under Medicare? Medicare Part A pays for inpatient hospital care, and then for care in a skilled nursing facility IF the patient has a “qualified” hospital stay of at least 3 days before being admitted to the skilled nursing facility.

Medicare also pays for home health care, and the amount of reimbursement to home health care agencies depends on whether the patient was admitted to a hospital before returning home. Patients who were put on Observation Status in the hospital end up paying out-of-pocket if they are discharged to a nursing home care:

Observation Status

Congress voted to require hospitals to tell Medicare patients when they are under observation care and have not been admitted to the hospital. The NOTICE law requires hospitals to provide written notification to patients 24 hours after receiving observation care, explaining that they have not been admitted to the hospital, the reasons why. The Notice must also disclose the financial implications for cost-sharing in the hospital and the patient’s subsequent âeligibility for coverageâ in a skilled nursing facility .

Recommended Reading: Will Medicare Pay For Massage

What Is The Medicare Benefit Period

The Medicare benefit period for Part A is the period of time your deductible will cover your care in a hospital or skilled nursing facility . In 2023, the Part A deductible is $1,600. Any healthcare provider fees, however, will be charged to Medicare Part B and are not included as part of the Part A benefit.

Most health insurance plans have you pay a deductible once a year. With Medicare, you could face multiple Part A deductibles over the course of the year depending on your need for hospital care.

It is important to understand that the Medicare benefit period applies to inpatient hospital stays only. Staying overnight or even several days in a hospital does not necessarily qualify as an inpatient stay.

You could be placed under observation during that time, and Medicare Part B would be used for coverage. Be sure to ask your healthcare provider what orders are in place whenever you stay in the hospital.

Unlike Part A, Medicare Part B does not have benefit periods. With the exception of certain preventive care tests, you would be expected to pay 20% of all Part B costs. Also, any days you are in the hospital under observation do not count toward your Medicare Part A benefit period.

In order to understand the Medicare benefit, you need to understand the following four rules.

Does Medicare Cover Long

Medicare is the federal health insurance program for people age 65 and over, some younger individuals with disabilities, and some individuals with end-stage renal disease. Like other health insurance plans, Medicare does not cover long-term care services.

Medicare only covers short-term stays in Medicare-certified skilled nursing facilities for senior rehab. These temporary stays are typically required for beneficiaries who have been hospitalized and are discharged to a rehab facility as part of their recovery from a serious illness, injury or operation. A few of the most common medical issues that require senior rehabilitation include pneumonia, stroke and injuries caused by serious falls.

A serious health setback that initially requires short-term care in a SNF often leads to the realization that long-term placement is in fact necessary. Since Medicare coverage is only offered for a limited time, families are often confused and frustrated when they receive notice that their loved ones must either pay for ongoing care privately, apply for Medicaid or be discharged.

Read Also: Do You Have To Take Medicare