Although Medicare Eligibility Has Nothing To Do With Income Your Premiums May Be Higher Or Lower Depending On What You Claim On Your Taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits. Known as the Income-Related Monthly Adjustment Amount, or IRMAA, Social Security will notify you if your income places you in this higher bracket.

Less than 5 percent of Medicare beneficiaries have to pay the IRMAA surcharge.

How Social Security Works With Magi And Obamacare

Taxable and non-taxable Social Security income is counted toward MAGI for ObamaCare and affects tax credits and Medicaid eligibility, but only if a person has to file taxes.

Social Security Income includes disability payments , pension, retirement benefits, and survivor benefits, but does not include supplemental security income . . In general, everything except for SSI counts toward MAGI for ObamaCare and Medicaid.

ObamaCare counts Modified Adjusted Gross Income of the head of household and spouse and the Adjusted Gross Income of tax dependents. However, if a tax dependent doesnt have to file taxes due to falling below the tax filing threshold, then their non-taxable social security income doesnt count toward MAGI. This is because nontaxable social security income doesnt count toward the tax filing limit. So if the only income of a tax dependent is nontaxable social security income, they may want to consider not filing to maximize cost assistance eligibility limits of the household. Or conversely, they may want to file to ensure the family qualifies for a Marketplace plan with cost assistance rather than Medicaid.

What is SSI?

What Is The Income

For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on your modified adjusted gross income.

Q: What does Original Medicare cost the beneficiary? A: Medicare Part A is free for most seniors. If you or your spouse worked at least 10 years in a job where you paid Medicare taxes, you’re eligible for free Medicare Part A when you turn 65. But Medicare Part B has a premium most beneficiaries pay $170.10/month for Part B in 2022.

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don’t pay anything to the insurance company each month for your coverage.

Read Also: When Can You Have Medicare

Does Social Security Count As Gross Income

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married

What Income Is Used To Determine Medicare Premiums

Your MAGI determines your monthly Medicare premium. If your MAGI is lower, you will remain in the low-income category and pay a lower premium. For example, if your MAGI in 2021 was less than or equal to $91,000 for an individual taxpayer and $182,000 for a married couple, the standard monthly premium will be $164.90 in 2023. The social security department receives the MAGI data and sends the individual a letter informing them of the allocated premium amounts.

Also Check: What Do The Different Parts Of Medicare Cover

How Do You Calculate Medicare Tax

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

How to calculate additional Medicare tax properly?

- How To Calculate Additional Medicare Tax Properly Additional Medicare Tax Example. You must combine wages and self-employment income to determine if your income exceeds the threshold. Net Investment Tax Example. In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over Adjustments to Net Investment Income.

How Does Social Security Determine Whether You Pay Extra

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income from two years ago. In 2023, that means the income tax return that you filed in 2022 for tax year 2021.

If Social Security determines you have to pay higher premiums, they send you a letter detailing what your premium will be and how they arrived at their decision. If you have both Part B and Part D, you’ll pay a higher premium for each. But if you only have one, you’ll only owe the adjusted amount on the “part” you have. If later in the year you sign up for whichever part you don’t currently have, the adjusted amount is automatically added and you will not receive a second notification.

Again, less than 5 percent of Medicare beneficiaries owe the IRMAA surcharge.

You May Like: Does Medicare Cover Ob Gyn

There Are 3 Things To Do To First:

How Are Medicare Premiums Calculated

Not all Medicare parts require a monthly premium payment. But for the ones that do, the plan premium amount will vary from year to year.

For example, the vast majority of Medicare Part B is funded by the U.S. income tax revenue. But the rest of your Part B expenses are paid by your plan premium, calculated according to your yearly income level.

Medicare premiums are determined based on the assumption that you have an average income. The average income amount is determined by the CMS and is updated and released annually.

For 2022, the average income threshold is $91,000 a year for individual filers and $182,000 for joint filers. If your income goes over that average a surcharge is applied, and your monthly premium may be higher.

The income-related monthly adjustment amount is an added surcharge determined by the Social Security Administration that you might have to pay in addition to your Medicare base premium if your modified adjusted gross income is over the average threshold.

The adjustment is based on the adjusted gross income amount you reported on your taxes two years prior.

Your MAGI is calculated by adding your AGI to any of your other income. This includes untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories not already included in your AGI. For most individuals, your MAGI will be the same as your AGI.

You May Like: What’s The Medicare Deductible

The Secure Act And Irmaa

Further complications have been introduced as a result of the SECURE Act , which was enacted in late 2019. The SECURE Act has a number of different features such as allowing IRA contributions after age 70½ if youre still earning an income and it extends the minimum age that one must receive RMDs from 70½ to 72.

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in the tables above.

When people withdraw from qualified funds such as a 401, IRA, or 403, these funds are taxable once they are transferred to your individual checking, savings or brokerage account . The amount distributed is added to your taxable income, so exercise caution when youre receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Further, non-qualified funds must also be tracked because of the way that mutual funds capital gains and dividend distributions are made. At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums.

How Do I Calculate My Modified Adjusted Gross Income

Calculating your MAGI is important in determining if you qualify for a premium tax credit and other tax deductions.

Here’s a quick overview of how to calculate your modified adjusted gross income:

- Step 1: Calculate your gross income

- Step 2: Calculate your adjusted gross income

- Step 3: Calculate your modified adjusted gross income

Lets go over each step in more detail.

Don’t Miss: Does Medicare Cover Long Term Health Care

Keep An Eye On Capital Gains

If you have assets that could generate a taxable profit when sold i.e., investments in a brokerage account it may be worth evaluating how well you can manage those capital gains.

While you may be able to time the sale of, say, an appreciated stock to control when and how you would be taxed, some mutual funds have a way of surprising investors at the end of the year with capital gains and dividends, both of which feed into the IRMAA calculation.

With mutual funds, you dont have a whole lot of control because they have to pass the gains on to you, said ONeill, of Money Talk. The problem is you dont know how big those distributions are going to be until very late in the tax year.

Depending on the specifics of your situation, it may be worth considering holding exchange-traded funds instead of mutual funds in your brokerage account due to their tax efficiency, experts say.

For investments whose sale you can time, its also important to remember the benefits of tax-loss harvesting as a way to minimize your taxable income.

That is, if you end up selling assets at a loss, you can use those losses to offset or reduce any gains you realized. Generally speaking, if the losses exceed the profit, you can use up to $3,000 per year against your regular income and carry forward the unused amount to future tax years.

I Am About To Turn 65 And Go On Medicare And My Income Is $125000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $97,000 for individuals and $194,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2023 income-related premium, Social Security will use information from your tax return filed in 2022 for tax year 2021. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2023, you would pay around $4,735 in annual Medicare premiums combined for Part B and Part D .

Read Also: Do You Need A Referral For A Specialist With Medicare

How To Manage Your Magi To Keep Your Part B Premium Lower

- Maybe delay signing up for Medicare. If you are still working at 65, with health insurance, and your employer has at least 20 covered employees, you can delay signing up for Medicare. But be very very careful to confirm you are covered.

- Be careful with Roth conversions. With tax rates near historic lows, a popular tax strategy for people with sizable savings in traditional IRA accounts is to move the money into a Roth IRA. All money converted to a Roth counts as taxable income in the year you do the conversion. The payoff is that there are no required minimum distributions on Roth IRAs. s.) Roth conversions can be a smart move, but once you hit 63, you want to be extra careful deciding how much to convert in any given year. Its not just your tax bill for that year you need to manage. That taxable income is going to play into your age 65 Medicare Part B premium. And any conversions in other years could also impact your premiums. Thats not a reason to avoid conversions, but a reason to consider working with a financial planner to help figure out how best to manage a lot of income-related moving pieces in your 60s.

- Delay Social Security as long as feasible. If you retire in your 60s and can afford to wait until age 70 to start Social Security, academic research shows it pays to wait, assuming you do not have serious health issues.

The High Cost Of Medicare Part B And Part D

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage.

Part B has a standard premium amount that most people pay each month. That amount changes from year to year, but it’s generally consistent for most Medicare enrollees.

However, the premiums for Part B and Part D can vary between individuals based on their income level.

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount . Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

To determine IRMAA, Social Security looks at the modified adjusted gross income amount reported on your IRS tax return from 2 years ago to determine whether you’ll pay IRMAA. This charge may be applied to your Part B and Part D monthly premiums.

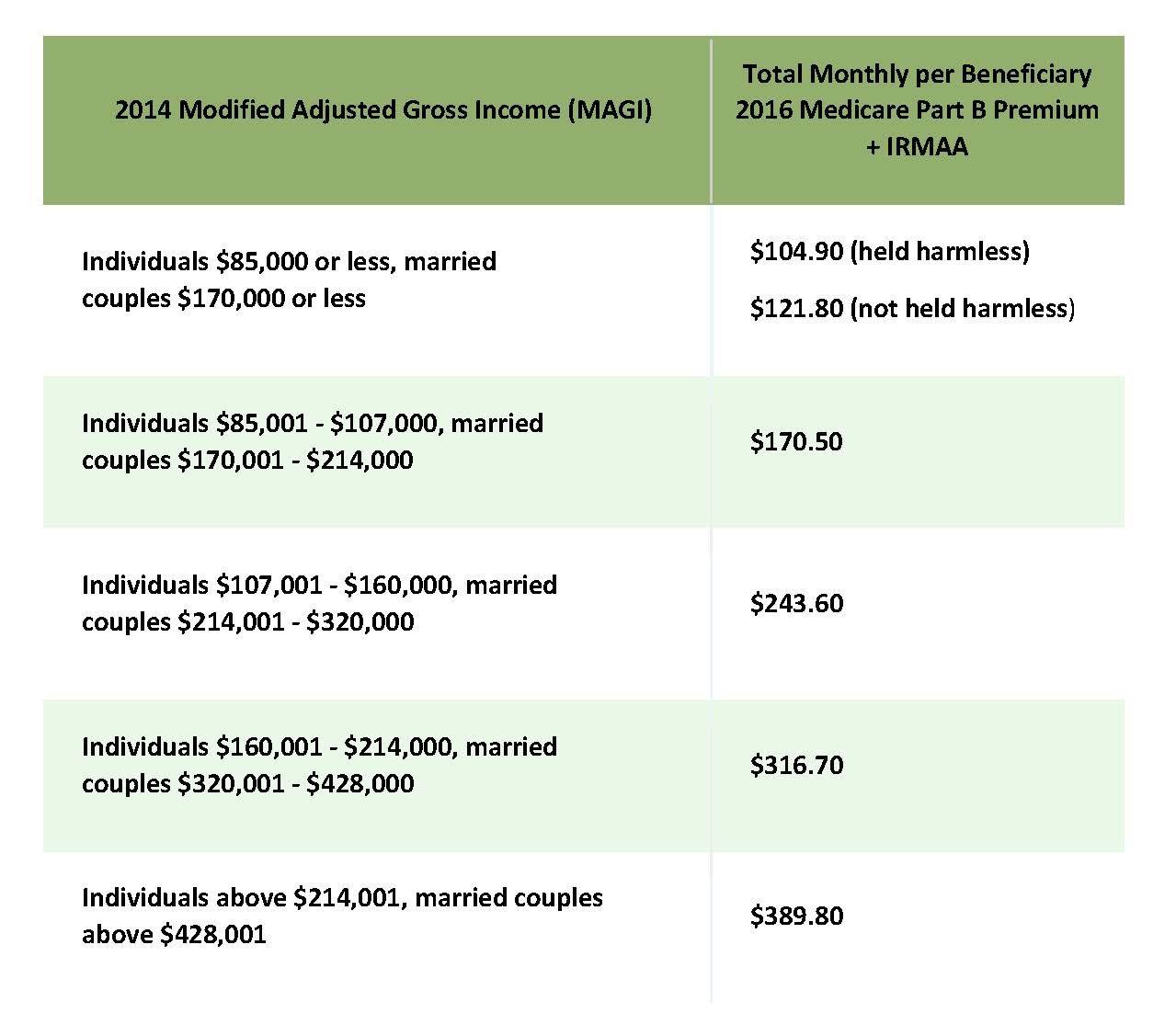

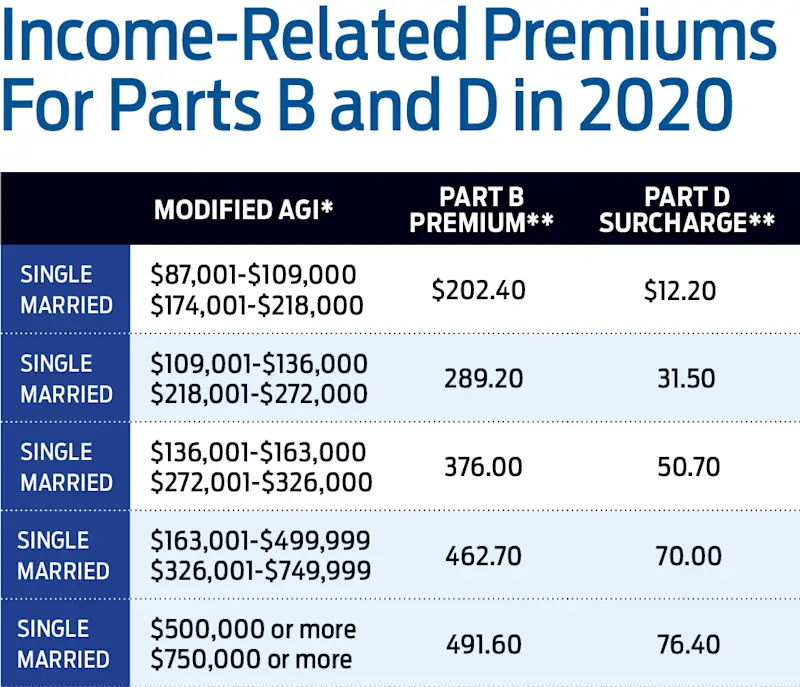

The following chart shows how Medicare calculates IRMAA based on income level:

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves. Part D monthly premiums can vary a great deal from one health insurance company to another.

To determine how much Part D plans may cost in your area, visit Medicare.gov to get the latest monthly premium costs for Part D plans. If you’re a high-income earner, your Part D IRMAA charge is added to the premiums you’ll see quoted on Medicare.gov.

Read Also: What Is The Medicare 100 Day Rule

Tax Deferral Is About More Than Asset Growth

Tax-deferred investments not only help clients grow retirement assets faster, they also may help clients reduce taxation on Social Security benefits and lower the cost of Medicare premiums.

To understand how this works, its important to remember that the degree to which Social Security benefits are taxed and the cost of Medicare premiums are both affected by taxable income.

- With taxable investments, such as mutual funds, clients have no control over when or how much dividend payments may increase their annual taxable income.

- With tax-deferred investments, earnings are not included in taxable income until a client chooses to withdraw them.

In other words, tax-deferred investments give clients greater control over their income and when taxes are applied. One advantage of deferral is that it can help clients stay below certain IRS thresholds, which, if exceeded, could cause taxation on Social Security benefits and increase the cost of Medicare premiums. To avoid exceeding those thresholds, clients with tax-deferred investments can choose not to withdraw from those investments or take a limited amount of withdrawals.

Calculate Your Gross Income

Your gross income is the simplest form of income. It includes all the money you earned without any tax deductions figured into the total amount.

Your GI can come from a lot of places, including taxable income you earned through:

- Wages, tips, and salary

- Alimony received from divorce agreements

- Retirement income

Rather than doing the math yourself, you can find your GI on line 7b of IRS form 1040. Your GI will be the basis for your adjusted gross income calculation, which well cover in the next section.

You May Like: Can You Get Medicare Part D Anytime

How To Calculate Magi

As stated earlier, different government programs evaluate your MAGI differently. The good thing is that they use your MAGI income, not your gross income, which is usually much higher than your MAGI. So it’s good to calculate your MAGI even though you worry that you’re not eligible because you ‘earn too much,’ you might still qualify for the benefit. Therefore, every MAGI calculation has its instructions.

According to the Internal Revenue Code, you should add the following to your AGI to determine your MAGI:

- Any amount excluded from gross income in section 911 .

- Any amount of interest received or accrued by the taxpayer during the taxable year is exempt from tax.

- Any amount equal to the portion of the taxpayer’s social security benefits, which is not included in gross income for the taxable year.

Some of the common examples of how to calculate MAGI are as follows:

student loan interest deduction:

Affordable Care Act Subsidies

If you purchase health insurance through the ACA, you may be eligible for premium tax credits if your household MAGI is below 400% of the federal poverty level . For coverage in the continental U.S., the amount is $54,360 for an individual and $111,000 for a family of four.

MAGI for the purposes of the ACA adds back non-taxable Social Security benefits, deducted foreign income and tax-exempt interest.

Congress passed the American Rescue Plan Act in March of 2021. This legislation made health insurance coverage through the ACA more affordable. It did so by temporarily eliminating the income cap for premium subsidies. The result is that no one will have to pay more than 8.5% of their household income for the ACAs benchmark plan. In addition, the legislation provides larger subsidies for ACA buyers at all income levels.

If youre interested in learning what an ACA plan might cost, you can use the calculator at HealthCare.gov.

Read Also: How Much Does Medicare Cover For Home Health Care