Do Medicare Parts C And D Cover What Original Medicare Does Not

Because of the limitations of Original Medicare, many enrollees choose to boost their coverage by signing up for a Medicare Supplement plan. Supplements come in many different forms, each having their own levels of coverage and costs. Two options for covering services that Medicare Parts A and B do not cover are Medicare Parts C and D.

Are These Covered Options The Best Kind For Me

Pressure-reducing mattresses aren’t right for every patient, though. There are a very specific set of guidelines that determine if pressure-reducing mattress is right for a patient.

Answering yes to one of the following questions indicates that this specific type of mattress is right for you. If you can’t answer yes, then your best bet is to look at other affordable options.

- Do you have a medical condition that requires body positioning that is impossible with an ordinary bed?

- Do you require positioning that is not feasible with a regular bed to reduce pain?

- Do you require your head to be elevated more than 30 degrees due to a medical condition, and a normal pillow or wedge wonât work?

If you answered yes to any of these questions, then you should be eligible for a mattress or bed covered under medicare. You should talk to your doctor about getting a prescription.

What Is Medicare And What Does It Cover

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare is the government health care program for people 65 and over, and its coverage plays an important role in containing medical costs as you age. But Medicare benefits dont pay for everything.

As you approach age 65, youll need to decide how to deal with some of those coverage gaps. For now, knowing the basics of how Medicare works can help you understand some of the expenses youll face.

Read Also: Are Cancer Drugs Covered By Medicare

Initial Preventative Physical Examination

Medicare provides coverage for an Initial Preventive Physical Examination. It is also known by many as the Welcome to Medicare physical.

That said, this is NOT a physical exam. It is a consultation where you and the doctor will talk about promoting health behaviors as well as preventing and detecting disease.

Coverage for Initial Preventive Physical Examination falls under Medicare Part B. This exam is a one-time visit that you can take advantage of within 12 months of enrolling in Medicare. Some of the key things a doctor does during the Initial Preventive Physical Examination include:

- medical history reviews

If your healthcare provider accepts the assignment, this exam is free.

What Happens If Medicare Beneficiaries In Private Plans Need To Receive Care From Out

Plans that provide Medicare-covered benefits to Medicare beneficiaries, including stand-alone prescription drug plans and Medicare Advantage plans, typically have provider networks and limit the ability of enrollees to receive Medicare-covered services from out-of-network providers, or charge enrollees more when they receive services from out-of-network providers or pharmacies. In light of the declaration of a public health emergency in response to the coronavirus pandemic, certain special requirements with regard to out-of-network services are in place. During the period of the declared emergency, Medicare Advantage plans are required to cover services at out-of-network facilities that participate in Medicare, and charge enrollees who are affected by the emergency and who receive care at out-of-network facilities no more than they would face if they had received care at an in-network facility.

Part D plan sponsors are also required to ensure that their enrollees have adequate access to covered Part D drugs at out-of-network pharmacies when enrollees cannot reasonably be expected to use in-network pharmacies. Part D plans may also relax restrictions they may have in place with regard to various methods of delivery, such as mail or home delivery, to ensure access to needed medications for enrollees who may be unable to get to a retail pharmacy.

Also Check: Are Blood Glucose Test Strips Covered By Medicare

Can You Expand Your Medicare Coverage With A Medicare Supplement Insurance Plan

Your Medicare coverage generally comes with cost-sharing, as you read above. A Medicare Supplement insurance plan may pay some or all of the out-of-pocket costs of Medicare Part A and Part B.

These out-of-pocket costs may include deductibles, copayments, and coinsurance. Some Medicare Supplement insurance plans even cover emergency medical care during overseas travel .

Private insurance companies sell Medicare Supplement insurance plans. All Medicare Supplement insurance plans must provide basic benefits, such as Medicare Part A and Part B coinsurance amounts, blood, and additional hospital benefits not covered by Medicare Part A. Read more about Medicare Supplement insurance.

As youve seen, you may have several Medicare coverage options. To compare plans, type your zip code in the box on this page and press the button.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connected with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

What Kind Of Mattresses And Beds Are Covered

There are a few types of mattresses and beds covered by Medicare. If you are a Medicare subscriber, then it’s important to understand the guidelines and what qualifies to be covered. Essentially, you’ll need to make sure the mattress is classified as durable medical equipmentâsometimes referred to as “DME.”

For a mattress to be given a designation as durable medical equipment, it must be an essential part of a patient’s normal life. This designation can only be obtained from a doctor after they determine your bed is medically necessary. In addition to a DME classification, it must also meet 5 additional criteria.

These 5 criteria are:

To summarize, if your mattress meets the following three criteria, Medicare covers the cost of up to 80% of the mattress price.

- DME Classification

Typically, the only types of mattresses that meet these specifications are pressure-reducing mattresses.

Read Also: Can I Switch Medicare Supplement Plans

What Does Medicare Cover For Smoking Cessation

Smoking cessation services fall under Medicare Part B, which covers a variety of preventive services.

Youre covered for up to two attempts at quitting each year. Each attempt includes four face-to-face counseling sessions, for a total of eight covered sessions per year.

Along with counseling, your doctor might recommend prescription medications to help you quit smoking. Medicare Part B doesnt cover prescriptions, but you can purchase this coverage with a Medicare Part D plan. A Part D plan will help you cover these costs.

You can get these services under a Medicare Advantage plan too. Medicare Advantage plans, also known as Medicare Part C plans, are required to offer the same coverage as original Medicare.

Some Advantage plans also include prescription drug coverage, as well as additional smoking cessation help that original Medicare doesnt cover.

During counseling sessions to help you stop smoking, a doctor or therapist will give you personalized advice on how to quit. Youll get help with:

- making a plan to quit smoking

- identifying situations that trigger your urge to smoke

- finding alternatives that can replace smoking when you have the urge

- removing tobacco products, as well as lighters and ashtrays, from your home, car, or office

- learning how quitting can benefit your health

- understanding the emotional and physical effects you might go through while quitting

You can get counseling in a few different ways, including by phone and in group sessions.

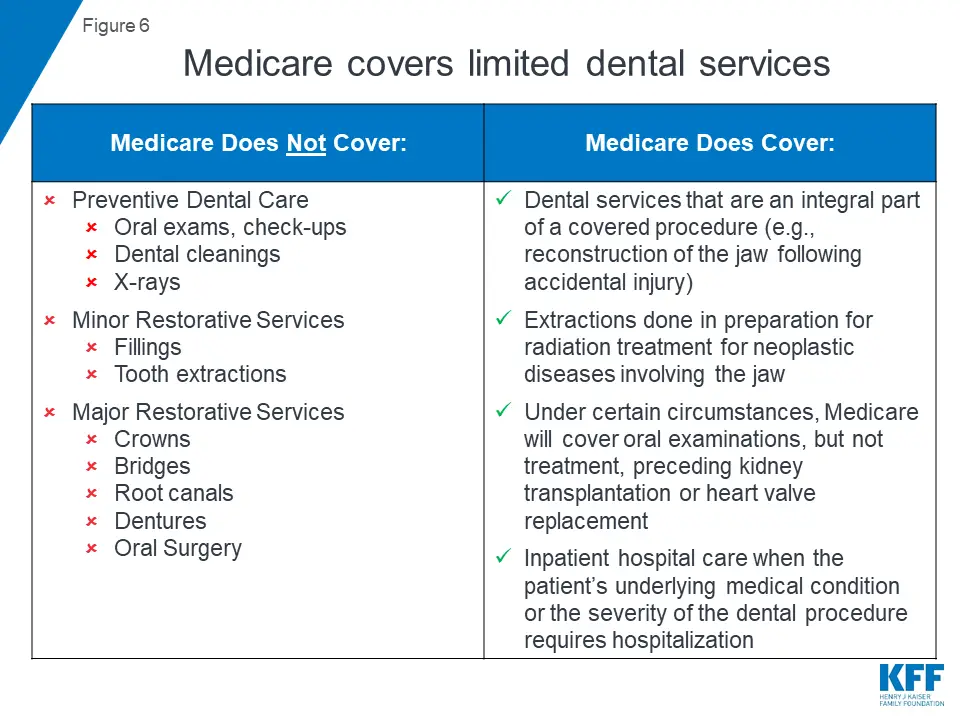

Medicare And A Lack Of Dental Coverage

Unfortunately, having Medicare doesnt always help with this issue. According to Medicare.gov, this federal health insurance program typically does not cover dental care, procedures, or supplies.

Medicare doesnt provide benefits toward regular cleanings or services designed to treat and/or correct problematic oral issues, such as fillings or tooth extractions.

Medicare also does not generally offer benefits for dental devices, including dentures and dental plates.

So, what does Medicare cover when it comes to dental health care?

Medicare will also contribute toward oral examinations needed before kidney transplants or heart valve replacements in certain situations.

You May Like: What Medications Are Covered By Medicare

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

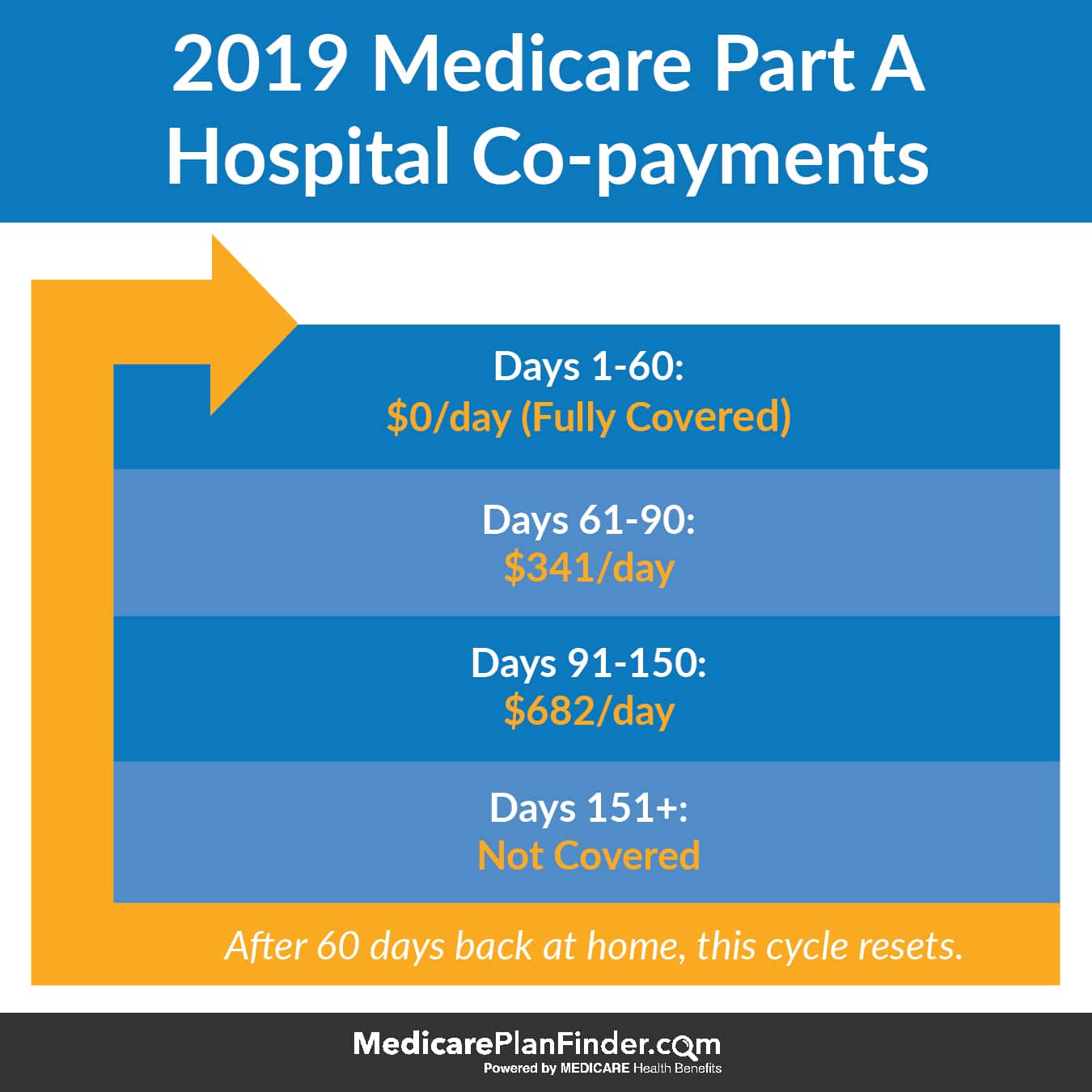

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. Here’s a closer look at what isn’t covered by Medicare, plus information about supplemental insurance policies and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

What Medicare Doesnt Cover

While Medicare covers a wide range of care, not everything is covered. Most dental care, eye exams, hearing aids, acupuncture, and any cosmetic surgeries are not covered by original Medicare.

Medicare does not cover long-term care. If you think you or a loved one will need long-term care, consider a separate long-term care insurance policy.

Read Also: Where Do I File For Medicare

Does Medicare Cover These Services

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare Advantage plans Summary of Benefits to learn whats covered.

Medicare doesnt cover acupuncture. Some Medicare Advantage plans have benefits that help pay for acupuncture services.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare has some coverage for chiropractic care if its medically necessary. Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Some Medicare Advantage plans have benefits that help pay for these other chiropractic tests or services.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2021 Part-B premium is $148.50 per month

Also Check: Should I Get Medicare Supplemental Insurance

What Does Medicare Cover

If you will soon be eligible for Medicare, you may be wondering, What does Medicare cover? The good news is that Medicare provides broad health-care coverage. Also, the Medicare program gives you the flexibility to choose how you get your Medicare coverage.

Find affordable Medicare plans in your area

Heres a quick rundown of the parts of Medicare, and the choices you may have about your Medicare coverage.

Medicare Part A and Part B make up Original Medicare. Many people are automatically enrolled in Part A and Part B. You may be automatically enrolled if youre receiving Social Security retirement or disability benefits when you qualify for Medicare.

Where Can I Find A Great Affordable Mattress

If you’re searching for an affordable mattress that offers a wide range of comfort and pressure relief, we’ve compiled a list of mattresses for you to consider:

Read our short, well-researched 10 Best Mattresses of 2021, here. Our ultimate goal is to help you pick your perfect mattress online, today!

Read Also: When Can You Apply For Part B Medicare

Can Medicare Beneficiaries Get Extended Supplies Of Medication

The Department of Homeland Security recommends that, in advance of a pandemic, people ensure they have a continuous supply of regular prescription drugs. In light of the coronavirus pandemic, a provision in the CARES Act requires Part D plans to provide up to a 90-day supply of covered Part D drugs to enrollees who request it during the public health emergency.

According to CMS, for drugs covered under Part B, Medicare and its contractors make decisions locally and on a case-by-case basis as to whether to provide and pay for a greater-than-30 day supply of drugs.

How To Apply For Medicaid

Because Medicaid is administered through the state and states determine eligibility, you will need to visit your state’s Medicaid office or website to apply. When applying you will need proof of income, residency, age, citizenship and/or immigration status for every member of your household.

Contact your state Medicaid office . Getting approved for Medicaid can take time, so start the application process as soon as there is a clear need. Most offices allow you to apply or at least start your request online. You may need to go into one of their offices for an interview as part of the application process. Have all your needed verification documents ready.

Medicaids Eligibility factors include income, residency, age, citizenship, immigration status, household composition, and pregnancy.

The exact verification documents you will need will vary based on what state you are in. However, be prepared to have any proof of income, proof of residency, your social security card, and immigration status confirmation documents on hand . Generally, household composition and pregnancy status do not require formal verification.

Also Check: Does Medicare Cover Chronic Pain Management

What Is The Medicare Part B Penalty

If you dont sign up for Medicare Part B at 65 and later decide you need it, youll likely pay a penalty of 10% of the premium for each 12-month period that you delayed. You will pay this penalty for life, basically, since few people drop Medicare Part B once they have it.

You can avoid the penalty if you had health insurance through your job or your spouses job when you first became eligible. You must sign up within eight months of when that coverage ends.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How Much Is Medicare Copay For A Doctor’s Visit

How Do I Enroll In Medicare

If youre receiving Social Security benefits when you turn 65, you will be enrolled automatically in Medicare Part A, which covers hospital costs, and Part B, which covers doctor visits. If you want Medicare Part D prescription drug coverage youll need to enroll yourself thats not automatic.

If youre not receiving Social Security benefits, youll sign up through the Social Security Administration website. You typically should do so in the seven-month window around your 65th birthday to avoid permanent penalties.

If you want Medicare Supplemental Insurance , you would sign up during the six-month Medigap enrollment period, which starts the month you turn 65 and are enrolled in Medicare Part B. The private insurers who provide Medigap plans are required to take you if you sign up during that period. Otherwise, there is no guarantee they will sell you a Medigap plan.

If you miss your initial window, or want to switch plans later, there are several annual Medicare open enrollment periods.

When Original Medicare Might Be Sufficient

For many low-income Medicare beneficiaries, theres no need for private supplemental coverage. Almost one in five Medicare beneficiaries are dual eligible for both Medicare and Medicaid.

This includes Medicare enrollees who are eligible for full Medicaid as well as those who qualify for Medicare Savings Programs that help low-income seniors pay premiums and cost-sharing under Original Medicare.

For dual-eligible enrollees who qualify for full Medicaid, that coverage picks up where Medicare leaves off, covering coinsurance and deductibles, as well as services not covered at all by Medicare . For Medicare beneficiaries who qualify for Medicare Savings Programs but not full Medicaid, there are varying levels of assistance available depending on the enrollees income.

Those who receive the least assistance might find a Medigap plan to be beneficial, but most Medicare Savings Program enrollees do not have additional coverage under a Medigap plan.

Don’t Miss: How To Apply For Medicare By Phone