How A Csrs Retiree Can Have Medicare Premiums Withheld From Their Annuity Payment

If you are eligible for Medicare and not eligible for Social Security, you can have Medicare premiums withheld from your annuity payments. OPM must receive a request for the withholding from the Centers for Medicare and Medicaid Services. They cannot withhold premiums based on your direct request or even one from the Social Security Administration. The request must come from the Centers for Medicare and Medicaid Services to withhold Medicare premiums from annuity payments.

Your Existing Fehb Plan Has Good Medicare Coordination

Many FEHB plans will wraparound Medicare and pay your deductible and doctor and hospital co-pays if you have Medicare Parts A & B. As a result, youll have close to 100% coverage of almost all medical expenses, with the big exception of prescription drugs and a few other services such as acupuncture or chiropractor visits.

A few FEHB plans now offer partial Part B premium reimbursement, including two national plansBCBS Basic and GEHA High. Of course, if youre enrolled in a consumer-driven health plan or high-deductible health plan you can use the health reimbursement account or the health savings account to pay for Part B premiums.

If you decide to enroll in Part B, make sure you enroll in a plan that has wraparound benefits, which will greatly reduce your out-of-pocket expenses and helps offset the expense of paying a second premium.

Special Exception For Tricare Recipients

The final note that I do want to make is for any of our readers who are under the military health program called TRICARE. For those of you under TRICARE, you will be required to enroll in Medicare Parts A and B when you turn age 65. Its simply part of the requirement to retain TRICARE at 65 . I know I said it was a choice for everybody else earlier in this article, but if a TRICARE recipient fails to enroll in Medicare Part B at age 65, they will permanently lose TRICARE COVERAGE. Hopefully, that helps clarify things for this special audience.

Again, there are some big considerations with respect to Medicare and how it combines with your FEHB program. Be sure you have the right information about your FEHB and Medicare benefits, so you can make informed decisions regarding your health coverage in retirement.

Read Also: Is Social Security The Same As Medicare

Reasons Why You Should Enroll In Medicare Part B

The most common question we receive every Open Season from retirees and soon-to-be retirees is whether to take Part B and pay the extra premium. Given that there is a penalty if you delay Part B enrollment when you first become eligible to join, its important to make that decision before you retire.

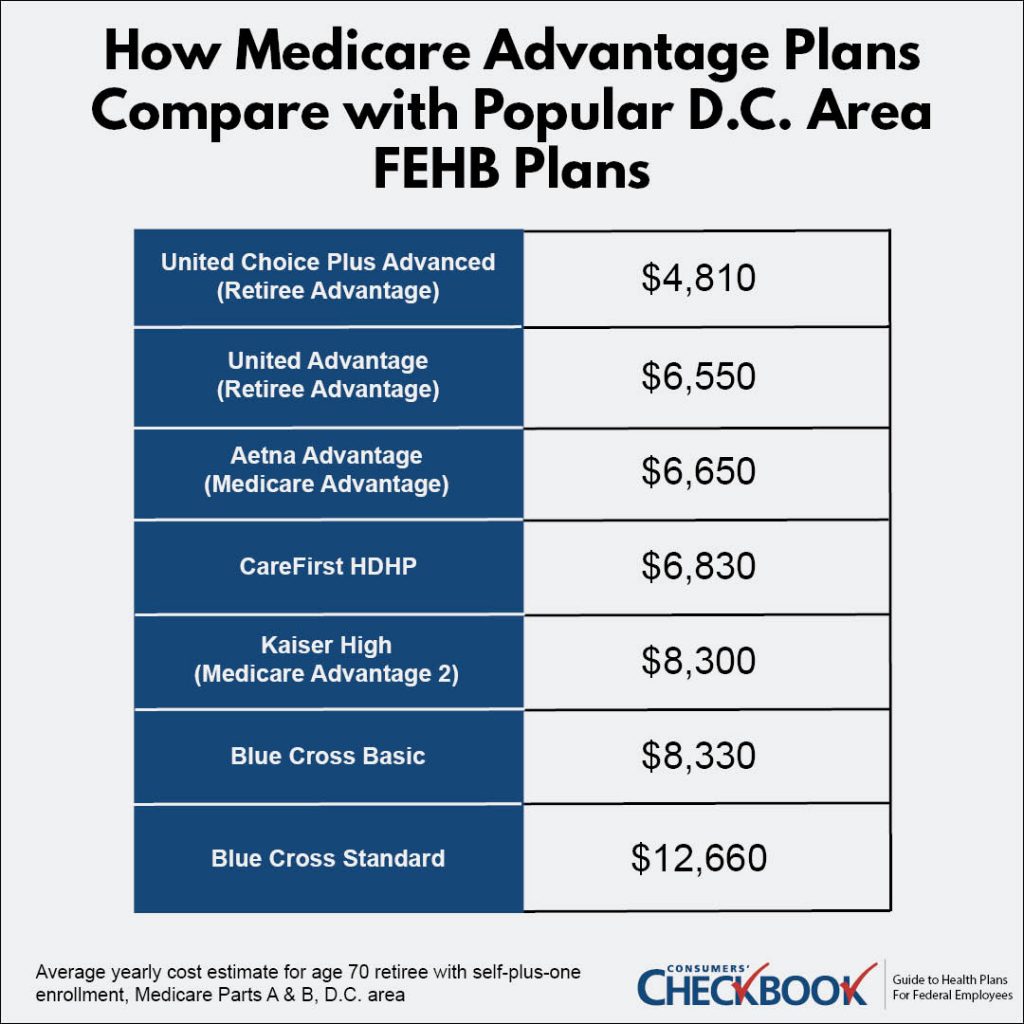

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits. It’s possible a future Congress might consider doing so as a cost cutting measure, however unlikely that may be. But there are other more relevant reasons to join Part B such as FEHB plan options that are less expensive to join with Part B then without Part B. Here’s what you need to know if you’re going to enroll in Part B to maximize your coverage and save the most money.

Which Is Better Medicare Or Fehb Coverage

The answer to which program is better isnt something that comes with a straightforward answer. It largely depends on the lifestyle you plan to lead after retirement and what sort of doctors you expect to be seeing.

For example, Medicare Part B covers a significant portion of the out-of-pocket costs for visiting an out-of-network healthcare professional. This can be extremely useful if you expect to be traveling a lot or live in a rural area with few options for general care.

On the other hand, FEHB covers the cost of most in-network care with pleasantly small copayments at the time medical services are rendered. Not to mention, some places simply dont accept Medicare.

This is just one of the lifestyle factors you have to take into consideration when choosing between FEHB coverage and Medicare coverage. Other issues you might have to take into account are your budget and whether you need to cover someone other than yourself. Additional fees apply for extra beneficiaries.

Also Check: How Do I Find Out My Medicare Number

Medicare 2022 Part B Premiums

The standard Part B monthly premium amount in 2022 is $170.10, a 14.5% increase from last year. Couples in the lowest catagory earning less than $182,000 a year will pay $4,082.40 a year for Part B coverage while the the highest income group pays $13,879.20 a year for the same Medicare Part B Coverage! Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

Your Medicare claim number is your Social Security number followed by one of the suffixes listed below. The suffix identifies your benefit status.

- A Primary Claimant

- B Spouse

- B1 Aged Husband, age 62 or over

- B2 Young Wife, with a child in her care

- B3 Aged Wife, age 62 or over, second claimant

- B5 Young Wife, with a child in her care, second claimant

- B6 Divorced Wife, age 62 or over

- C1-C9 Child

- D Aged Widow age 60 or over

- D1 Aged Widower, age 60 or over

- D2 Aged Widow

- D3 Aged Widower

- D6 Surviving Divorced Wife, age 60 or over

- E Widowed Mother

Are You Eligible For Medicare

Usually monthlypremiums for Medicare Part A are free if you or your spouse paid Medicare taxes while working. This is referred to as “premium-free Part A.” If you must buy Part A, it will cost you up to $411 each month.

Most people get Part A without having to pay a premium. Premiums for Part A are free at 65 if:

- You already get retirement benefits from Social Security or the Railroad Retirement Board.

- You’re eligible to get Social Security or Railroad benefits but haven’t filed for them yet.

- You or your spouse had Medicare-covered government employment.

If you’re under 65, you can get premium-free Part A if:

- You got Social Security or Railroad Retirement Board disability benefits for 24 months.

- You haveEnd-Stage Renal Disease and meet certain requirements.

In most cases, if you opt to purchase Part A, you must also take Medicare Part B and pay a monthly premium for both.

Read Also: How Early Can You Get Medicare

How Much Does Health Insurance Cost When You Retire

The health insurance premiums remain the same both before and after retirement. However, federal employees pay their portion of the premium on a biweekly basis. Retirees pay their portion on a monthly basis. However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same.

It is important to note that part time federal employees typically have to pay more for their health insurance than full time employees. . However, upon retirement, part time and full time employees receive the same government contribution .

Another important fact is that you are not allowed to participate in flexible spending accounts, also called FSAs, upon retirement. The IRS has specified that FSAs are a salary benefit and therefore cannot be used by people receiving an annuity.

What Is A Primary Payer

An active federal employee is on a primary payer plan, meaning that any medical claims will first go to FEHB plans for payment consideration.

If a person works past the age of 65, FEHB continues to be the primary payer until retirement.

The primary payer also defaults to FEHB when the employee or a covered member has end stage renal disease. In this case, they pay first in the first 30 months of eligibility. FEHB is the primary payer when a person is:

- under the age of 65

- eligible for Medicare based on a disability

- covered under FEHB based on the person or personâs spouseâs employment

Medicare will become the primary payer after a person has retired or if a person no longer employed by the government is getting workersâ compensation.

A person may be retired, with Medicare, and covered by a spouseâs policy. In this case, the spouseâs policy is the primary payer. Medicare is the second payer, and FEHB pays third.

14 sourcescollapsed

- As an FEHB Program enrollee, am I allowed to participate in pharmacy sponsored incentive programs such as prescription discount copay cards or store rewards cards? .

Also Check: Are You Eligible For Medicare If You Never Worked

Things To Do Before Signing Up For Medicare

Navigating Health Care Benefits In Retirement

Health care, and medical expenses in general, are a major component of your retirement cash flow strategy. Navigating which plan is right for you can be a challenge. Working with a fee-only financial planner who is versed in FEHB coverage, and other federal government employee benefits can help. If youd like to speak to our team, and review your options, reach out! Wed love to hear from you and to help you build a holistic retirement strategy that meets your needs.

Also Check: Is Medicare Enrollment Required At Age 65

How To Withdraw From Medicare Part B After Signing Up

You can withdraw from Medicare Part B at any time if desired. Once you withdraw from Medicare B you would have to notify your FEHB provider, Blue Cross Blue Shield in your case, immediately because they would revert back to primary provider for medical services. To cancel Medicare Part B coverage you will have to use form CMS-1763. This form isnt available online and you must contact your Social Security Administration office to complete the form. They will discuss the consequences of canceling your coverage, including how penalties are accessed, and process the form for you over the phone. The Social Security FAQ titledHow do I terminate my enrollment with Medicare Part B when I have other health insurance explains the process in more detail. Typically your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didnt sign up for it.

Fehb Medicare And Retirement

All federal employees, currently working or retired, must look at their individual situation to determine if benefits should come from both FEHB and Medicare or just one.

All health and life circumstances are different. Health insurance benefits must reflect an individuals specific medical needs.

Understanding how FEHB and Medicare coverage work together or separate is essential for optimal health insurance benefits and coverage.

Contact your local health insurance agent to help with any questions you may have about your benefits and any available options.

Jagger Esch is President & CEO of Elite Insurance Partners & MedicareFAQ.com.

Recommended Reading: Is Dermatology Covered Under Medicare

Fehb With Medicare Part A

Those who have paid Medicare taxes for enough quarters are eligible to enroll in Medicare Part A, premium-free. Often, it is recommended that those who are eligible for premium-free Medicare Part A enroll in the coverage, even if they are still working. Although it will pay secondary to your FEHB, it is an earned benefit that you should take full advantage of.

Combo #: Keep Fehb Only But Do Not Enroll In Medicare Part B

There are different combinations for your FEHB and Medicare Part B coverage, and some advantages to having both programs in place. With the rising cost of health care and health insurance topping the list of concerns for retirees, I hope you can appreciate how important this decision is. Lets take a look at the three different combinations that you could have between Medicare Part B and FEHB. Combination number one is a retiree decides not to enroll in Medicare Part B and just keep FEHB exactly the way that it isso FEHB remains their primary coverage.

This is the status quo option that allows retirees to just keep the program that they have right now and simply decline Medicare Part B. Remember, theres no penalty for not enrolling in Part B, unless later you decide you want to join Part B.

Recommended Reading: Does Medicare Part A Cover Doctors In Hospital

Fehb With Medicare Part B

For Medicares Part B outpatient coverage, youll need to pay a monthly premium no matter how many quarters you pay Medicare taxes. Additionally, youll still have to pay the FEHB premium. So, if you have FEHB, you can delay Medicare Part B for as long as youre working and may save money by doing so.

When deciding whether to pick up Medicare Part B, calculate what youd pay in Medicare Part B premiums for the year . Then, calculate your best estimate for the dollar amount youd need to pay in copayments for outpatient services on FEHB.

If you find that you would pay more in premiums, youll indeed save money by delaying Medicare Part B. Yet, those whose copays on FEHB in an average year outweigh their would-be Medicare Part B premiums should consider enrolling in Medicare Part B. Remember, once you enroll in Medicare Part A and Part B, Medicare will become your secondary coverage while FEHB acts as primary while you are still working.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

With this combination of coverage, you can see any practitioner who accepts Medicare and receive benefits through Medicare Part B that FEHB doesnt provide.

Is It Beneficial To Have Both Medicare And Fehb Coverage

FEHB, or Federal Employee Health Benefits, coverage is something that all government employees are given the option to enroll in. For those who take advantage of it, a small fee is automatically deducted from their paychecks each pay period to cover the premium.

At retirement, all federal employees have the option to continue their FEHB coverage. However, they must continue to pay the monthly premium costs on their own.

Should they choose to do so, the FEHB will become backup coverage for their emergency care at the very least. According to OPM , once Medicare goes into effect automatically, it is treated as your primary coverage at all times. Then, if there are things that Medicare doesnt cover or wont pay for entirely, your FEHB insurance can kick in at that point.

For some employees, this could save money. For most, however, paying the FEHB premium expense is a waste of retirement earnings. In fact, most federal retirees find that theres no benefit at all to paying both the Medicare Part B and FEHB premiums.

Also Check: Does Medicare Cover Aba Therapy

Which Is Primary Coverage Medicare Or Fehb

A FEHB plan must pay benefits first when an individual is an active federal employee or rehired annuitant and either the individual or the individuals spouse has Medicare. Medicare must pay benefits first when an individual is an annuitant, unless the individual is a reemployed annuitant and either the individual or the individuals covered spouse has Medicare.

FEHB premiums will not be reduced when an employee or annuitant enrolls in Medicare. Annuitants pay the same FEHB premium for the same FEHB plan as active employees. However, once Medicare becomes the primary payer of an individuals healthcare related expense, the individual may find that a lower cost FEHB plan is adequate for their needs, especially if the individual is currently enrolled in a FEHB plans high option. Also, some FEHB plans waive deductibles, coinsurance, and copayments when Medicare is primary.

Since enrolling in Medicare is considered a life event, an annuitant or employee can change their FEHB plan to any available plan or option at any time beginning 30 days before becoming eligible for Medicare and ending 30 days after the day the individual becomes eligible for Medicare. Changes to ones FEHB plan can also be made during the annual FEHB open season.

FEHB and Medicare Primary Payer Chart

Do Retired Federal Workers Need To Sign Up For Medicare Part B

Medicare Part B is optional medical insurance coverage, and it comes with a standard premium of $170.10 per month in 2022. If you are entitled to FEHB and Medicare benefits, Medicare Part B would serve as the primary payer and FEHB would act as the secondary insurance payer.

Your decision to enroll in Part B may depend on the benefits offered in your FEHB policy. Some of the things to consider include:

- Part B may provide coverage for goods and services for which FEHB give zero or limited coverage.

- Part B allows you to seek care any health care providers in the U.S. who accepts Medicare, while FEHB policies generally restrict you to a network of participating providers.

- Because Medicare coordinates benefits with FEHB, you may be able to further reduce your out-of-pocket health care spending by pairing Part B with FEHB and taking advantage of the double coverage.

- If you wish to join a Medicare Advantage plan that offers dental or vision coverage , you must be enrolled in Part B.

Read Also: What Is The Best Secondary Insurance With Medicare