How Much Does Medicare Cost If You Are Still Working

Most people don’t pay anything for Medicare while they’re still working because if you have health insurance through a job, you can postpone enrolling in Medicare Part B without a penalty. In situations where you’re working part time or are self-employed, you’d typically pay $164.90 per month for Part B, plus any additional coverage options such as Medicare Advantage, Medicare Part D or Medicare Supplement.

Medicare Part A Premium

Medicare Part A premiums are based on the number of quarters an individual has paid Medicare taxes prior to enrolling in Medicare. Medicare taxes are part of the withholding taxes collected from every paycheck you receive.

If you havent worked a total of 40 quarters , here is how much the Part A premium will cost in 2022:

| Total quarters you paid Medicare taxes | 2022 Part A monthly premium |

|---|---|

| 40 or more | |

| < 30 | $499 |

When you enroll in Part A, youll receive a Medicare card in the mail. If you have Part A coverage, your Medicare card will say HOSPITAL and have a date when your coverage is effective. You can use this card to receive any services that are covered by Part A.

Wages Rrta Compensation And Self

Will an individual owe Additional Medicare Tax on all wages, RRTA compensation and self-employment income or just the wages, RRTA compensation and self-employment income in excess of the threshold for the individuals filing status?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income that exceed the applicable threshold for the individuals filing status. Medicare wages and self-employment income are combined to determine if income exceeds the threshold. A self-employment loss is not considered for purposes of this tax. RRTA compensation is separately compared to the threshold.

Is remuneration not paid in cash, such as fringe benefits, subject to Additional Medicare Tax?

Yes. All wages not paid in cash, such as noncash fringe benefits, that are subject to Medicare tax are subject to Additional Medicare Tax, if, in combination with other wages subject to Medicare tax , they exceed the individual’s applicable threshold. Similarly, all RRTA compensation not paid in cash that is subject to Medicare tax is subject to Additional Medicare Tax, if, in combination with other RRTA compensation, it exceeds the individual’s applicable threshold . Noncash wages and RRTA compensation are subject to Additional Medicare Tax withholding, if, in combination with other wages, or with other compensation in the case of RRTA compensation, they exceed the $200,000 withholding threshold.

Are tips subject to Additional Medicare Tax?

You May Like: How Much Does Medicare Cost For A Single Person

Dont Do This With Your Retirement Funds Unless You Want To Pay Tax

Moving funds from one retirement account to another using a paper check can be a recipe for a big tax bite.

Answer: Start by contacting the Taxpayer Advocate Service, which was created in part to help resolve problems like this.Youll find it at taxpayeradvocate.irs.gov.

Also consider reaching out to your congressional representatives, who have constituent services that may be able to help.

Liz Weston, Certified Financial Planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the Contact form at asklizweston.com.

What Are The Parts Of Medicare

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

Don’t Miss: Is There A Copay For Doctor Visits With Medicare

How Much Will A Medicare Plan Cost

If you choose a Medigap plan you will pay anywhere between $85-$150 per month, depending on where you live. This will provide you with nearly 100% coverage, protecting you against the high medical costs that come with just having Original Medicare and no plan.

If you choose a Medicare Advantage plan, expect a range between $0 $100 per month and these plans often include prescription coverage . Most plans are less than $50 per month and are often $0 premium.

Before you choose a plan it is important to compare rates. Contact us at for a no-obligation plan comparison. We offer both Medicare Advantage, Medicare Supplement plans and Part D plans.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Recommended Reading: When Do You Stop Paying Medicare And Social Security Taxes

How Does Medicare Work

With Medicare, you have options in how you get your coverage. Once you enroll, youll need to decide how youll get your Medicare coverage. There are 2 main ways:

- Original Medicare

-

Original Medicare includes Medicare Part A and Medicare Part B . You pay for services as you get them. When you get services, youll pay a

deductible

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan .

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn’t cover, like emergency medical care when you travel outside the U.S.

Skilled Nursing And Hospice Care

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services.

In 2022, these costs are:

- $0 coinsurance for days 1 through 20 for each benefit period

- $194.50 daily coinsurance for days 21 through 100 for each benefit period

- all costs for days 101 and beyond in each benefit period

Again, a benefit period resets after youve been discharged for 60 days or you begin inpatient care for a new diagnosis or condition.

Also Check: Do You Need A Referral For A Specialist With Medicare

Extra Help To Pay For Medicare Prescription Drug Costs

Extra Help is a Medicare program to help people with limited income and resources pay Medicare prescription drug costs. You may qualify for Extra Help if your yearly income and resources are below these limits in 2022:

- Single person – yearly income less than $20,388 and less than $14,010 in other resources per year

You may qualify even if you have a higher income . Resources include money in a checking or savings account, stocks, bonds, mutual funds, and Individual RetirementAccounts . Resources dont include your home, car, household items, burial plot, up to $1,500 for burial expenses , or life insurance policies.

If you qualify for Extra Help and join a Medicare drug plan, you’ll:

- Get help paying your Medicare drug plan’s costs.

- Have no late enrollment penalty.

You automatically qualify and will receive Extra Help if you have Medicare and meet any of these conditions:

- You have full Medicaid coverage.

- You get help from your state Medicaid program paying your Part B premiums .

- You get Supplemental Security Income benefits.

Drug costs in 2022 for people who qualify for Extra Help will be no more than $3.95 for each generic drug and $9.85 for each brand-name drug.

How Much Will Medicare Cost Me Per Month In 2022

Do you know how much Medicare will cost you each month in 2022?

Planning for retirement is really important, and if youâre going to be living off of a fixed income, you need to be aware of your expected insurance costs.

So, how much will Medicare cost you in 2022?

Don’t Miss: Do You Pay For Medicare After 65

Faq: Do You Need To Enroll In Medicare Part B If You Enroll In Part A

When you enroll in Part A, you will also need to enroll in Part B. Medicare Part B covers outpatient healthcare services like doctors appointments.

You will pay a separate monthly premium for this coverage. The standard Part B premium amount in 2022 is $170.10, and most people who have Part B will pay this amount.

How Much Will Medicare Cost In 2023

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies. The good news in 2023 is the cost of Medicare Part B was reduced to $164.90 per month.

Don’t Miss: Is Your Medicare Number Your Social Security Number

Total 2022 Monthly Medicare Costs

When we total up all of your monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B â

- Get a quoteâ¯for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

What Does Medicaid Cover

- If you have Medicare and full Medicaid coverage, most of your health care costs are covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

- If you have Medicare and/or full Medicaid coverage, Medicare covers your Part D prescription drugs. Medicaid may still cover some drugs that Medicare doesnt cover.

- People with Medicaid may get coverage for services that Medicare doesnt cover or only partially covers, like nursing home care, personal care, transportation to medical services, home- and community-based services, anddental, vision, and hearing services.

PACE is a Medicare and Medicaid program offered in many states that allows people who otherwise need a nursing home-level of care to remain in the community. To qualify for PACE, you must meet these conditions:

- Youre 55 or older.

- You live in the service area of a PACE organization.

- Youre certified by your state as needing a nursing home-level of care.

- At the time you join, youre able to live safely in the community with the help of PACE services.

Also Check: How Do I Replace A Lost Medicare Card

Recourse When The Irs Goofs

Dear Liz: Is there a court of last resort when dealing with the IRS and the Treasury Department? I tried to buy an I bond using my tax refund. My tax preparer checked the appropriate box on the 1040 and submitted the form 8888. No bond was sent to me and I have been sent back and forth between the Treasury and the IRS multiple times. Finally the IRS admitted it did not notify the Treasury like it should have to generate the bond and it did apologize.

The Treasury says it cant issue the bond without the notification from the IRS, and the IRS claims there is nothing it can do to fix the problem now. Is there any recourse whereby I can get my bond? I followed all of the rules, the 1040 was correct and to tell you the truth, I am unhappy that there does not seem to be a way of righting a wrong not of my making.

Does Medicare Cover Stair Lifts

Mobility is an issue for many seniors, and mobility issues really create a problem when you live in a home with stairs. As such, many seniors explore the option of having a stair lift installed in their homes. These devices can be quite expensive, so insurance coverage could be a big help to people who need to install a stair lift. If you are a Medicare beneficiary, you might wonder whether your Medicare coverage will help pay for a stair lift. Keep reading as we give you all the details about Medicare coverage of stair lifts for seniors, plus some other ways to get help paying for one.

Also Check: Do Permanent Residents Qualify For Medicare

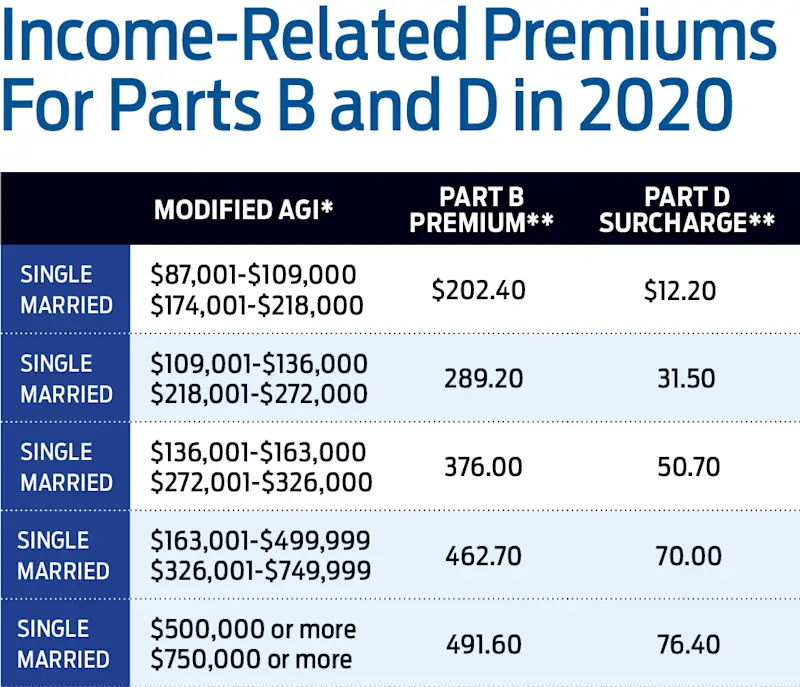

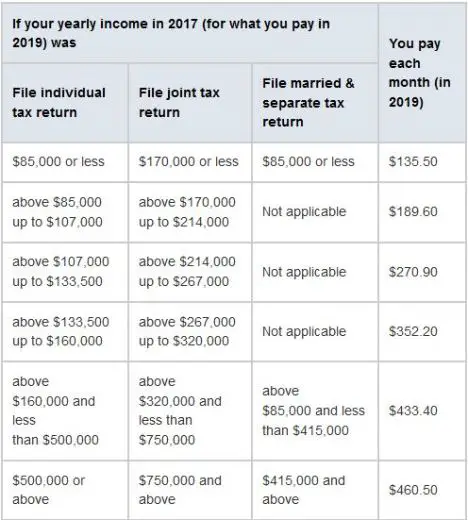

Cost Of Medicare Part B

- Standard cost in 2023: $164.90 per month

- Annual deductible in 2023: $226

For most people, the cost of Medicare Part B for 2023 is $164.90 per month. This rate is adjusted based on income, and those earning more than $97,000 will pay higher premiums.

For high earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $560.50 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2023, the Medicare Part B deductible is $226, which means you would need to pay $226 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Medicare Costs Terms Explained

Whether youre new to Medicare or could use a refresher, here are some common Medicare terms explained:

Coinsurance is a percentage of your medical and drug costs you may be required to pay as your share of costs for medical services or supplies .

Copayment is a specific dollar amount you may be required to pay as your share of the cost for medical services or supplies .

Deductible is the amount you pay for medical services or prescription drugs in a plan year before your plan begins to pay for benefits.

Premium is the amount you are required to pay each month to Medicare or your private insurer for your healthcare coverage.

To learn more, check out our list of

Don’t Miss: Does Medicare Accept Pre Existing Conditions

How Do I Sign Up For Part A

In most cases, youll be automatically enrolled in Medicare Part A. Youre automatically enrolled in original Medicare which is made up of parts A and B starting on the first day of the month you turn 65 years old.

If youre under age 65 and receiving Social Security or RRB disability benefits, youll automatically be enrolled in Medicare Part A when youve been receiving the disability benefits for 24 months.

If youre not automatically enrolled, you can through the Social Security Administration.

Questions And Answers For The Additional Medicare Tax

On November 26, 2013, the IRS issued final regulations implementing the Additional Medicare Tax as added by the Affordable Care Act . The Additional Medicare Tax applies to wages, railroad retirement compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

Also Check: Does Blue Cross Blue Shield Offer A Medicare Advantage Plan

What’s Not Covered By Part A & Part B

Medicare doesn’t cover everything. If you need services Part A or Part B doesn’t cover, you’ll have to pay for them yourself unless:

- You have other coverage to cover the costs.

- You’re in a Medicare Advantage Plan or Medicare Cost Plan that covers these services. Medicare Advantage Plans and Medicare Cost Plans may cover some extra benefits, like fitness programs and vision, hearing, and dental services.

Some of the items and services Medicare doesn’t cover include:

- Most dental care

- Hearing aids and exams for fitting them

- Covered items or services you get from an opt-out doctor or other provider

Medicare Part D Extra Help

Medicare Part D Low Income Subsidy , which is also known as Extra Help, helps pay for Medicare Part D monthly premiums, deductibles, copays and coinsurance.

You can apply for Extra Help online on the Social Security website you can get help apply by calling the Senior LinkAge Line at 800-333-2433, Monday Friday between 8:00 a.m. – 4:30 p.m.

The Senior LinkAge Line is Minnesotas federally designated State Health InsuranceAssistance Program and provides free help with all issues related to Medicare.

Recommended Reading: How To Apply For Medicare Supplemental Insurance