Medicare Supplement Insurance Plan Eligibility For People Under 65

In some states, insurance companies may voluntarily sell Medicare Supplement insurance plans to people under 65, even though they are not federally mandated to do so. The insurance policies might cost more than the plans sold to people 65 and over, and the insurance company may be able to use medical underwriting . This means that any health condition could result in a premium increase.

You can apply for a Medicare Supplement insurance plan anytime once youâre enrolled in Medicare Part A and Part B â youâre not restricted to certain enrollment periods as you are with other Medicare enrollment options. However, there are only certain periods or situations when you have guaranteed issue rights to enroll in a Medicare Supplement insurance plan. One such period is described below.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

After You Apply For A Medicare Supplement Plan

Following your acceptance for a plan, youll get your Medigap card in the mail. Be sure to keep your Medicare and Medigap cards together in a safe place.

Your Medigap plan will be guaranteed renewable if you apply within your window of guaranteed issue rights. Guaranteed renewable means that as long as you continue to pay your premiums, youll keep your plan for as long as youd like.

Read Also: Does Southeastern Spine Institute Accept Medicare

How Medicare Supplement Insurance Works

Medicare Supplement Insurance covers common gaps in Medicares standard insurance plans. People who apply for Medigap coverage must take part in Medicare Parts A and B. Medigap plans supplement, but do not replace, primary Medicare coverage.

The Medigap Open Enrollment Period is six months from the first day of an individual’s 65th birthday month. These plans may also have open enrollment for six months after signing up for Part B coverage.

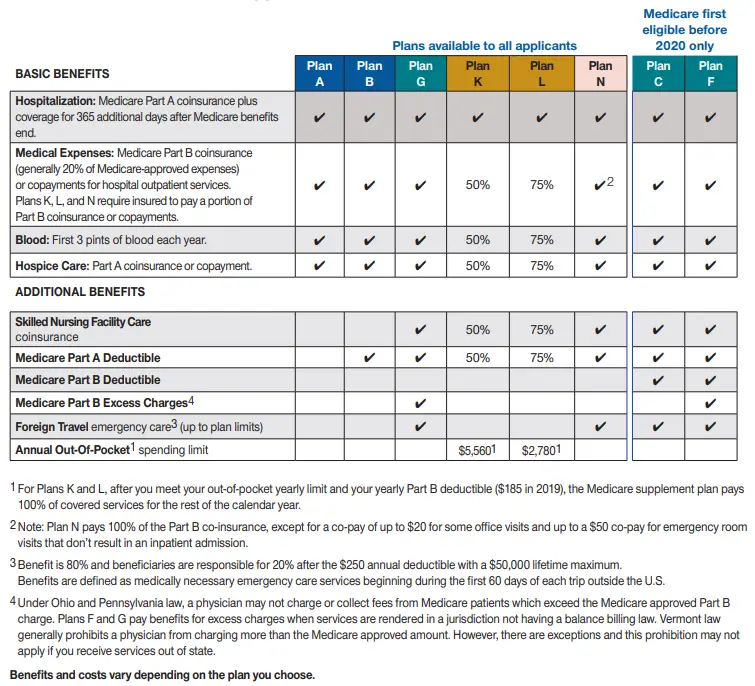

There are 10 Medigap plans, from Plan A to Plan N.

Insured individuals pay monthly premiums for private Medigap policies directly to the insurance provider. These premiums exist above and beyond the premiums paid for Medicare Parts A, B, and D. That means someone with Medigap will pay one premium for Part B and another for the plan offered by the private company. Although private insurance companies offer Medigap plans, the federal government requires companies to standardize policy coverage. This standardization means that Medigap Plan C from provider Z provides the same coverage as Plan C from provider Y.

All Medigap plans must cover preexisting conditions after a six-month waiting period. However, those who have continuous medical coverage for six months before enrolling may be able to avoid this and get immediate coverage.

Ask If Your Doctor Accepts Assignment

Assignment is an agreement between doctors and other health care providers and Medicare. Doctors who accept assignment charge only what Medicare will pay them for a service. You must pay any deductibles, coinsurance, and copayments that you owe.

Doctors who dont accept assignment may charge more than the Medicare-approved amount. You are responsible for the higher charges. You also might have to pay the full cost of the service at the doctors office, and then wait to be reimbursed by Medicare.

Use your Medicare Summary Notice to review the charges. You get a Medicare Summary Notice each quarter. If you were overcharged and werent reimbursed, follow the instructions on the notice to report the overcharge to Medicare. The notice will also show you any deadlines to complain or appeal charges and denied services. If you are in original Medicare, you can also look at your Medicare claims online at MyMedicare.gov.

Medicare has a directory of doctors, hospitals, and suppliers that work with Medicare. The Physician Compare directory also shows which providers accepted assignment on Medicare claims.

Recommended Reading: Does Medicare Cover Prolia Injections

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

What Medicare Does Not Cover

You may not know that private provider Part D prescription benefits are suspended after you reach a certain dollar amount. This interrupted period is referred to as the Medicare donut hole.

After you reach your plan’s deductible for prescription expenses, Medicare will pay for a certain percentage of your prescription drug costs. They cover a portion of the costs until you reach the donut hole level of costs. The donut hole is when Medicare Part D stops paying for prescription care and the level when your prescription costs reach catastrophic levels. Once you reach the catastrophic level, Medicare will pay 95% of prescription drug costs.

Seniors might stop taking their medications once they reach this gap in coverage, making them more susceptible to illness and even death. Seniors should never be put in the position of having to choose between medicine and other necessities. You do not have to worry about being without life-sustaining prescription medications if you have proper Medicare gap coverage.

Another flaw of Medicare is that it leaves seniors without important coverage for other essential services such as vision and hearing. A large percentage of all seniors who are on Medicare have vision or hearing problems. Again, here is another way where Medicare gap coverage can make the difference for seniors to be able to afford the health care services they really need.

Recommended Reading: What Eye Care Does Medicare Cover

Medicare Supplement Plans: How To Apply

Medicare can cover a wide range of medical costs, but like anything else, its not perfect. We would all like a bit more coverage than Original Medicare can offer, especially when we know we’ll be in more need of the benefits later in life. Luckily, Medicare Supplement plans provide a solution, helping boost your Medicare coverage and potentially save you thousands.

This guide will cover how to apply for a plan and, most importantly, when to apply so you can ensure valuable federal protections.

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Also Check: What Are The Types Of Medicare Advantage Plans

Do Some People Get A Second Open Enrollment Period For Medigap

There are very few situations where a beneficiary will get a second Medigap Open Enrollment Period. Below is a list of a few.

- If you retire, enroll in Medicare Part B, then go back to work and join your employers group health care coverage, youll get a second Medicare Supplement Open Enrollment Period when you retire again and enroll back into Medicare Part B.

- If you get Medicare due to a disability when youre under 65, youll get two Medigap Open Enrollment Periods. The first will start with your Original Medicare Part B effective date before you turn 65. The second will begin when you turn 65.

One reason a beneficiary on Medicare due to disability would choose not to enroll during their first Medigap Open Enrollment Period is due to the minimal Medigap plan options available to them. Only certain states require Medicare Supplement carriers to offer Medigap plans to people under 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In fact, most states only offer Plan A to those under 65. Because of this, someone qualifying due to disability may not have many options when first eligible. Allowing for a second Medicare Supplement Open Enrollment Period gives these beneficiaries access to all plans in their area.

Medicare Supplement Plans: How Do I Buy One

If you want to buy a Medicare Supplement plan, you probably already know that these plans may help cover some of your out-of-pocket costs. Medicare Part A and Part B coinsurance, copayments and deductibles are common examples of these costs.

Buying a Medicare Supplement plan can be easy.

Important: Applying for a Medicare Supplement plan is usually easy. Getting accepted by the plan? Not so much, in some situations. Learn about the best time for buying a Medicare Supplement plan below.

Recommended Reading: Does Medicare Pay For Insulin

What Are My Rights With Medigap

You need to know that under Federal law, you have rights and protections regarding your Medigap coverage. These include your right to buy Medigap coverage, protections if you lose or drop your health care and your protections for people with Medicare under the age of 65. You should know it is illegal for anyone to pressure you into buying a Medigap policy, lie or mislead you to switch to another company or sell you a second Medigap policy when they know that you already have one. It is also illegal to sell you a policy that cannot be sold in your state. Call your State Health Insurance Assistance Program to better understand these rights and protections.

Medicare Supplement Plans: When Can You Get One

Itâs easier to buy a Medicare Supplement plan during certain time periods. Usually, your best bet is to buy a plan during your Medicare Supplement Open Enrollment Period . This is the six-month period that starts the month youâre both at least 65 years old and enrolled in Medicare Part B.

Why is this OEP possibly the best time to buy a Medicare Supplement plan? Because if you apply for a plan during your OEP, the plan has to accept you in spite of any health problems you might have. It canât charge you more because of your health conditions. Once youâre signed up, if your health problems continue or you develop new ones, the plan canât drop you for that reason.

You can apply for a Medicare Supplement plan anytime, as long as you have Medicare Part A and Part B. But if itâs after your OEP, the insurance company can look at your medical history and ask you questions about your health conditions. The company can charge you more, or even reject you, if you have a health problem.

There may be other times when you have âguaranteed issue rightsâ to buy a Medicare Supplement plan.

Remember, you can click the Browse Plans button on this page anytime you want to start comparing plans. Of course, you can also contact us to reach a licensed eHealth insurance agent.

Also Check: What Are Medicare Parts A B C D

Can I Be Dropped From My Medigap Policy

If you bought your policy after 1990, the policy is guaranteed renewable. This means your insurance company can drop you only if you stop paying your premium, you are not truthful about something under the policy or the insurance company goes bankrupt. Insurance companies in some states may be able to drop you if you bought your policy before 1990. If this happens, you have the right to buy another Medigap policy.

Compare The Features Of Colonial Penn’s Medicare Supplement Insurance Plans

To help you pay for out-of-pocket medical costs that Medicare may not cover, we offer Medicare Supplement insurance plans A, B, C¹, D², F, F with high deductible, G, G with high deductible, K, L, M and N. Our knowledgeable agents/producers can help explain how each plan works and answer your questions related to Medicare or Medicare Supplement insurance.

| Plan | PLANN | |

|---|---|---|

| To help you pay for out-of-pocket medical costs that Medicare may not cover, we offer Medicare supplement insurance plans A, B, C, D, F, FH, G, GH, K, L, M, & N. | ||

| Medicare Part B coinsurance | ||

| Parts A Hospice care coinsurance or copayment | 50% | |

| Skilled Nursing facility care coinsurance | ||

| Medicare Part B deductible | ||

| Medicare Part B excess charges | ||

| Foreign travel emergency | UP TO80% |

¹Plan C is offered in: Arizona, Delaware, Georgia, Iowa, Illinois, Maryland, Nebraska, Nevada, New Jersey, Ohio and South Carolina

² Plan D is not offered in: Connecticut, Florida, Maine, Minnesota, New York, Pennsylvania, Vermont, and Wisconsin.

³ The High-Deductible Plan F and the High-Deductible Plan G pay the same benefits as Plan F and Plan G after one has paid a calendar year deductible . Benefits from the High-Deductible Plan F and the High-Deductible Plan G will not begin until out-of-pocket expenses exceed this calendar-year deductible.

Plan N requires a copayment of up to $20 for doctors visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.

Recommended Reading: Is Bevespi Covered By Medicare

What’s New For Medicare Beneficiaries Under Age 65

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability.

North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020. This change took place due to changes in federal legislation regarding Medigap Plans A, C, and F.

Below is the link to review the new regulation.

Learn When & How To Apply For Medicare Supplemental Health Insurance

How to Apply for Medicare Supplement Insurance1) In order to apply for a Medicare Supplement Insurance Plan, you must first know which plan you would like to purchase. If you are not sure which plan to purchase you can compare supplement plans on our website, or speak with one of our Expert Medicare Advisors who can assist you with the selection and application process. Call toll-free: 949-0698

2) Once you have decided on which plan you would like to purchase, then it comes down to selecting the best company, and best price. You can compare all rates and companies on our website as well by visiting our online quote comparison page.

3) The third and final step necessary to apply for Medicare Supplement Insurance is to either enroll online or speak with a licensed agent who will complete an application for you. In either method, you will need to physically speak with an agent first who will get the application process started for you. Currently, there are no Medicare Supplement Companies that will allow you to apply un-assisted. You must first speak with an agent to verify your authenticity and have him/her either send an application to you to complete, or they may be able to complete the application for you, and simply send it to you to sign, either via U.S. mail, or via email, using an online application.

You May Like: When Do I Qualify For Medicare Insurance

When Is The Best Time To Buy A Plan

The Medicare Supplement Open Enrollment period starts on the 1st day of the 1st month in which youre age 65 or older and enrolled in Medicare Part B. In some states, you can buy a plan on the 1st day youre enrolled in Medicare Part B, even if youre not yet 65.

If you meet certain criteria, such as applying during your Medicare Supplement Open Enrollment Period, or if you qualify for guaranteed issue, a company cant use your medical history to determine your eligibility. Rules in some states may vary.

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

You May Like: Is Victoza Covered By Medicare