Speak To A Licensed Insurance Agent

Medicare Advantage plans do not cover Part B excess charges.

A Medicare Advantage plan, however, does include an annual out-of-pocket spending limit for covered Part A and Part B services. This could help protect you from paying Part B excess charges past a certain amount, if you face them and if they go beyond your plans annual out-of-pocket spending limit.

Medicare Advantage plans provide all of the same benefits provided by Original Medicare, and many Medicare Advantage plans include some additional benefits that Original Medicare doesnt cover.

These additional benefits may include things like:

- Routine dental and vision care coverage

- Health and wellness benefits, such as SilverSneakers membership

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelors degree in journalism.

Icipating Provider Vs Non Participating Provider

With Medicare, there are providers that are Participating and Non Participating. They both agree to accept payments from Medicare for the services they provide to patients.

Doctors and providers that are participating, accept Medicare and also Medicare Assignment.

If a doctor or provider is non participating, this means that they do accept Medicare payments, but not as payment in full. If they choose to, they can however, accept Assignment on a case by case basis.

For non participating providers that dont accept Assignment, Medicare placed a Limiting Charge of 15% for any Excess Charges over and above what Medicare approves. Non Participating provider payments are also reduced by 5% from whats on the Medicare Fee Schedule.

So the patient will be responsible to pay the Providers remaining charges up to 15% more, unless they have a Medicare Supplement plan that covers Excess Charges.

How Much Do Excess Charges Cost

Medicare Part B represents your outpatient coverage, like visits to your doctors office. Providers who bill Medicare Part B excess charges may require that you pay up to an additional 15% of the Medicare assignment amount. Lets look at a few examples:

- You receive a service that Medicare agrees to pay providers $300 to perform. Your provider doesnt accept Medicare assignment, and they bill you the maximum additional amount allowed, 15%. In this scenario, your excess charge would be $45.

- You receive another service that Medicare usually pays $100 for. Your provider doesnt accept Medicare assignment, but they only bill you an additional 6%. The excess charge in this scenario is $6.

Also Check: What Does Medicare Extra Help Pay For

How Common Are Medicare Excess Charges

Medicare excess charges are uncommon, mainly because most health care providers accept Medicare assignment. Just 1% of non-pediatric physicians have opted out of Medicare, according to 2020 statistics. In Alaska, Colorado and Wyoming, this figure is slightly higher at 2%.

Its illegal for health care providers to charge their patients Part B excess charges in the following eight states:

- Connecticut

File A Reimbursement Claim

Providers that accept Medicare insurance will fill out the proper paperwork to ensure Medicare is paying the full amount possible before the patient takes on excess charges. However, patients can also file a claim through the Medicare Patients Request for Payment Form if they want coverage from their secondary insurance for the charges.

Note: If feeling confused about Part B excess charges in relation to your insurance plan or recent medical service, one should speak with their insurance company or a licensed insurance agent for assistance.

Recommended Reading: Why Am I Paying For Medicare

Excess Charges And Medicare Supplement Insurance

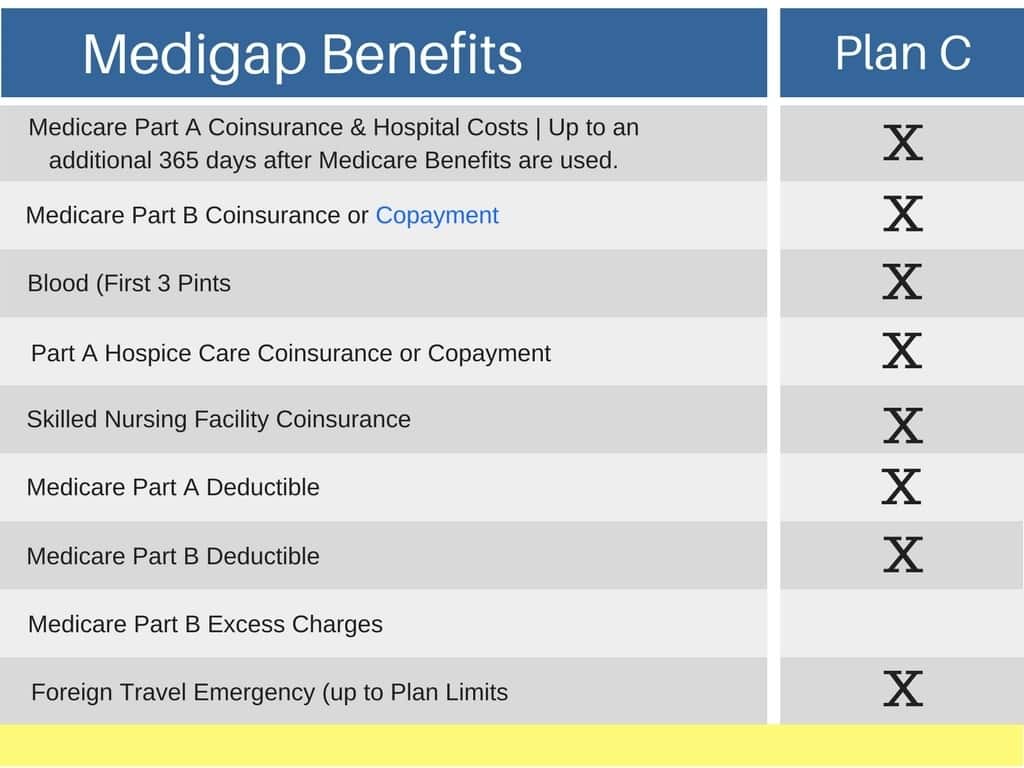

Excess charges are very important to keep in mind if you are interested in Medigap enrollment. Medigap plans, also known as Medicare Supplement plans, are private insurance plans that help pay for your out-of-pocket costs. Unlike traditional insurance plans, these plans dont directly cover medical services. Instead, they cover things like your Part B deductible, copayment, coinsurance, and so on.

Excess charges fall into this category. Not all Medicare Supplement plans cover the Part B excess charge. Its important to compare Medigap plan coverage before you choose which plan you buy. Even once you see a plan that you think is a good fit for you, the prices may end up pushing you in another direction in the end.

Because Medigap plans are offered by private insurance companies, the prices will vary. For this reason, plans that cover excess charges may end up being so much more expensive that it is better to just pay the excess charges out-of-pocket.

Compare Plan N Medicare Supplement Insurance Benefits & Quotes

If youre shopping for Medicare supplement insurance, you might be considering Plan N as your policy of choice. With all Medigap coverage, youre weighing benefits vs. premiums.

Its important to know that the gaps uncovered by Plan N are small. Rarely do they expose the insured to significant expenses.

There are three gaps Plan N does not cover. We will explain the out-of-pocket costs and exposure associated with each gap below.

Recommended Reading: Does Medicare Cover Breast Prosthesis

How Do You Pay An Excess Charge

You can pay the excess charge directly to your provider in whatever form of payment they accept. If the excess charge is larger than you were expecting, many providers are willing to take repayment in installments rather than all at once. You should contact your provider directly to see if this is something theyll agree to.

Although most doctors dont charge Medicare Part B excess charges, many people choose a Medigap plan that offers protection against them. Paying an excess charge on an occasional routine service may not amount to much, but frequent trips to the doctors office, outpatient surgery, or specialized care can add up quickly. And, instead of worrying about how much your treatment will cost, you can focus on finding the care thats right for you.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

About Part B Excess Charges

Medicare has a pre-approved amount they will pay for eligible treatment and services.

If a person has Medicare Part B, and the amount a physician or healthcare provider charges is higher than the Medicare-approved amount, the difference is called an excess charge.

An individual is responsible for payment of excess charges and these costs do not usually count toward an annual deductible.

Private insurance companies offer Medigap plans, also known as Medicare supplement insurance. Medigap plans aim to fill some of the gaps left by original Medicares out-of-pocket expenses.

Some plans even offer additional benefits, including emergency care provided outside the United States, and excess charges.

To be eligible for a Medigap plan, a person must have original Medicare parts A and B.

A separate monthly premium is payable to the private insurance company selling the Medigap plan.

If a person has Medicare Advantage , Medigap insurance cannot legally be sold to them.

Other Medigap eligibility requirements may apply, depending on the state in which an individual resides.

Each Medigap policy offers different benefits and levels of coverage.

Monthly premiums may vary depending on:

- the private insurance provider

- the state in which a person lives

- when an individual becomes eligible for Medicare

With these considerations in mind, a person may have up to ten different Medigap policies to compare, including plans A, B, C, D, F, G, K, L, M, and N.

Recommended Reading: How Can I Sign Up For Medicare Part B

Shopping Medicare In The Digital Age Is As Simple As You Make It

These plans, which are offered by private insurers, come in 10 varieties and are standardized across most states .

So the coverage you get with any Medicare Supplement Plan G policy, for example, will be identical to what youd get with any other, although your monthly premium could vary by provider.

Buying a Medicare Supplement plan that covers Medicare Part B excess charges may be a smart idea if you know that your current doctor or hospital doesnt accept assignment. It may also make sense if you want the flexibility later to see doctors that dont accept Medicare-approved amounts.

Medicare Supplement plans F and G cover 100% of Part B excess charges. With a Plan F, youll pay higher premiums than you would with Plan G, but the plan will also cover the Part B deductible . Part F, currently the most popular Medicare Supplement plan, is scheduled to be phased out starting in 2020.

What Are Excess Charges Which States Do Not Allow Medicare Excess Charges

-

Medicare with Melissa

If youre looking at purchasing a Medigap policy, you may find that some of the Medigap plans do not cover excess charges. Doctors who accept Medicare assignment have agreed to accept the Medicare approved amount as payment. When a doctor doesnt accept Medicare, excess charges may occur doctors can only charge 15% above the Medicare approved assignment. Always ask your doctor if they accept Medicare assignment. Recent studies have shown that only about 5% of doctors do not accept Medicare assignment. There are some states that do not allow Excess Charges:

- Connecticut

Also Check: Does Medicare Pay For Home Health Care For Elderly

Which States Allow Medicare Part B Excess Charges

Certain states have passed laws that make it illegal for healthcare professionals to charge Medicare Part B excess charges. These states are:

- Connecticut

If you live in any of these eight states, you dont have to worry about Part B excess charges when you see a doctor in your state. You can still be charged Part B excess charges if you receive medical care from a provider outside your state who doesnt accept assignment.

What Are Limiting And Excess Charges

As we stated, the costs of services given that are covered by Medicare are generally controlled by CMS, as long as the doctor accepts Medicare assignment. This simply means that the doctor or health care provider has agreed to be paid by Medicare and to charge patients within the allowed amount. While the majority of doctors accept Medicare assignment , not all health care providers do. There are two categories of health care providers who donât accept Medicare. These are non-participating, which means they donât have an overall agreement to accept assignment on all Medicare-covered services, and opting out, which means they wonât accept assignment on any services. For doctors that opt out, youâll be responsible for costs out-of-pocket. Non-participating doctors is where limiting and excess charges can come into play.

Luckily, the health care provider can only charge a maximum of 15 percent more than the Medicare-approved amount.

There are a few ways that a doctorâs non-participation in Medicare assignment influences your costs. The most common of these is that you may have to pay for your costs up front. Once you pay, you or your doctor may submit a claim for reimbursement with Medicare. The other way is that your doctor can charge you more than the Medicare-approved amount for a service. Luckily, the health care provider can only charge a maximum of 15 percent more than the Medicare-approved amount. These are the limiting and excess charges.

Recommended Reading: Does Medicare Cover Erectile Dysfunction Pumps

B Excess Charges Typically Only Apply If You Visit Providers Who Don’t Accept Medicare Or The Medicare

Part B excess charges are important to understand on their own but are also an essential thing to keep in mind when shopping for Medigap plans. When it comes to excess charges, you have to understand what they are, how much you can expect to pay, and how to avoid them as much as possible. Well cover all of that information here, so you can fully understand how your relationship with your doctor works while limiting any unwanted fees.

Doctors Can Charge An Extra 15% On Top Of The Assigned Rate

This is completely at the discretion of the doctor whether you will be billed for excess charges.

Lets say that the assigned rate for your state is $500 and the doctor doesnt accept the assignment. Your total bill can be up to $575 . Medicare will pay for $500 and you would be required to pay $75. You may pay out of pocket or pay through your Medigap insurance if you are enrolled.

Statistically, 95% of primary care providers accept assignments. Only about 5% of non-participating doctors and health providers charge Medicare Part B excess charges. But, take note that there is no limit to the number of times a non-participating doctor can add excess charges to your bill. So if you see a doctor regularly who is a non-participant, expect to possibly pay a lot of excess charges every year.

Also Check: How To Decide Between Medigap And Medicare Advantage

Ask Your Doctor If He Or She Accepts Medicare Assignment

If you currently have Medigap Plan A, B, C, D, K, L, M, or N, then you are responsible for paying any excess charges billed to you. Ask your doctor if he or she accepts Medicare Assignment. If the answer is yes, and they absolutely accept Medicare Assignment, then you will not have to pay an excess charge.

Is Excess Charge Coverage Worth It

The answer to this question depends on how much you spend on excess charges each year. This can be confusing to understand for a few reasons.

If you are newly enrolled in Medicare, then you may not know how relevant excess charges will be to you. If you have just moved and dont know if your new doctor will accept assignment, then the situation can be similarly confusing. Lastly, even if you do know that your doctor doesnt accept assignment, excess charges will not be a uniform fee from year to year.

If you know roughly how much you expect to pay in excess charges, you can subtract your yearly premiums from that amount to see how much you will save. For example, if you pay roughly $200 in excess charges yearly, but pay $100 in premiums, then you will save $100.

This calculation gets more complex because you have to calculate your total out-of-pocket costs covered by that plan together, not just your excess charge amount. In the same example above, it could be that you pay $200 for excess charges yearly, but a total of $700 on Medigap-covered out-of-pocket costs in a year on average. In this case, $100 yearly in premiums for a Medigap plan would save you $600 per year.

Recommended Reading: Where To Send Medicare Payments

States With No Excess Charges

In some states, doctors are not allowed to charge excess charges. These states are:

- Connecticut

- Rhode Island

- Vermont

This is especially relevant if you are looking for Medigap plans. If you live in one of these states, it will be a waste of money to buy a Medigap plan that covers excess charges. Well discuss excess charges under Medigap in more detail below.

Plan N Medicare Supplement Has Doctors Office Copays

Plan N is unique in that its the only Medicare supplement with doctors office and emergency room copays. This means you may be responsible for a small copy when you visit your primary care doctor or nay specialist. In this way, Plan N is much like most traditional, under age 65 health plans that require copays at the doctors office.

The Plan N copay is $20 for a doctors office visit and $50 for the emergency room. These fixed amounts have not increased or decreased since the inception of Plan N in the summer of 2010. Medicare could choose to change these amounts in the future, but its unlikely they will. If they do, it will affect all N plans both new and old.

Its interesting to note that your doctors office copay could be less than $20, but never more. It depends on the billing practices of your doctors office. Specialist visits are also $20 they are not allowed to charge more. You should also know there is no special copay for Urgent Care. It would be $20 as well.

If you visit several doctors on a monthly/regular basis, then Plan N may not offer significant savings over a Plan G or Plan F. But for most, this supplement can reduce premiums on an ongoing basis.

Recommended Reading: Does Medicare Cover 24 Hour Care

It Does Not Cover The Small Medicare Part B Deductible

Like Plans G and D, Medicare supplement Plan N does not cover the Part B deductible. Of the two Medicare deductibles this is the smaller one Part A is the larger one. Part B applies to doctors visits and outpatient procedures. Part A occurrences are for hospital and inpatient procedures.

For 2022, the Part B deductible is only $233 which is $30 more than it was in 2021. It was $198 in 2020, $185 in 2019, $183 in 2017-18 and $166 in 2016. As you can see, it usually does not move much. This is because its tied to inflation. The increases are not arbitrarily set rather they are tied to inflation metrics which usually move slowly.

If the Part B deductible does increase significantly, you should know that Medicare supplements covering this gap will just increase their premiums in kind. They will not absorb this cost. It will be passed on to you. One way or the other you are paying for it. At least with Plan N, you have some control over it.

And as you may have heard, no new supplements can be sold after 2020 that cover the Part B deductible. This will force consumers to have a little more skin in the game when it comes to their Medicare coverage. These changes will make Plan N even more attractive. It may end up being the Medigap policy with some of the smallest rate increases.