Basics Of Social Security Withholding

If you work for an employer, your paycheck will likely show an amount withheld for FICA, the Federal Insurance Contributions Act. FICA includes both Social Security and Medicare, the federal health insurance program for Americans 65 and over.

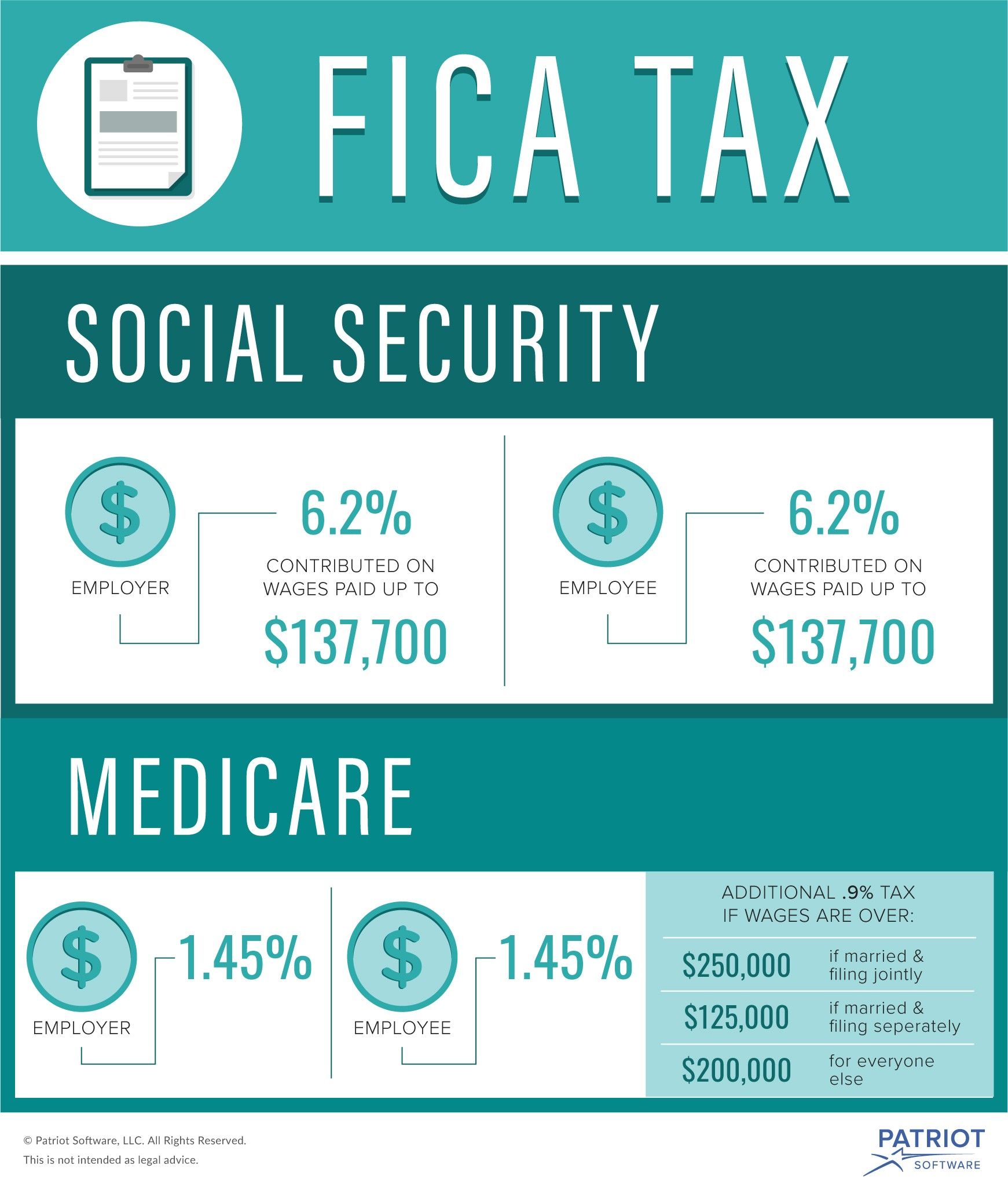

As of 2021, your wages up to $142,800 are taxed at 6.2% for Social Security, and your wages with no limit are taxed at 1.45% for Medicare. Your employer matches those amounts and sends the total to the government.

If you work for yourself, you have to pay both halves because you are, in effect, both employee and employer. This is known as SECA, or the Self Employed Contributions Act, tax.

Social Security Tax / Medicare Tax And Self

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

In general, U.S. social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer. In limited situations, these taxes apply to wages for services performed outside the United States. Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Social Security Taxes And Benefits

Social Security benefits provide partial replacement income if youre a qualified retiree or disabled person, as well as for spouses, children, and survivors.

The Social Security Administration tracks your earnings throughout your career. It uses the 35 highest-earning years to calculate the monthly Social Security benefit you will collect when you reach full retirement age.

In order for you to qualify, you must accrue 40 credits. The benefit amount you receive is based on your earnings history, your full retirement age, and the age when you start to claim Social Securitywhich can begin as early as age 62.

Also Check: What Is Uhc Medicare Advantage

Social Security Tax Rate

The Social Security tax rate is 12.4 percent. For employee income, 6.2 percent of the tax is paid by your employer and 6.2 percent is withheld from your paycheck. If youre self-employed, you pay the entire 12.4 percent because youre both the employee and the employer.

However, the tax code does contain two ways to make sure youre not paying more in total as a self-employed person than you would pay as an employee. First, the Social Security tax only applies to 92.35 percent of your net self-employment income to make up for the fact that employees dont have to pay taxes on the portion of FICA taxes that their employer pays on their behalf. Second, when you compute your income taxes, you can deduct the employer portion of the Social Security tax because employees dont have to count the portion of FICA taxes their employer pays for them as taxable income.

Read More:Social Security Benefits and Tax Thresholds

Will Payroll Taxes Go Up In 2021

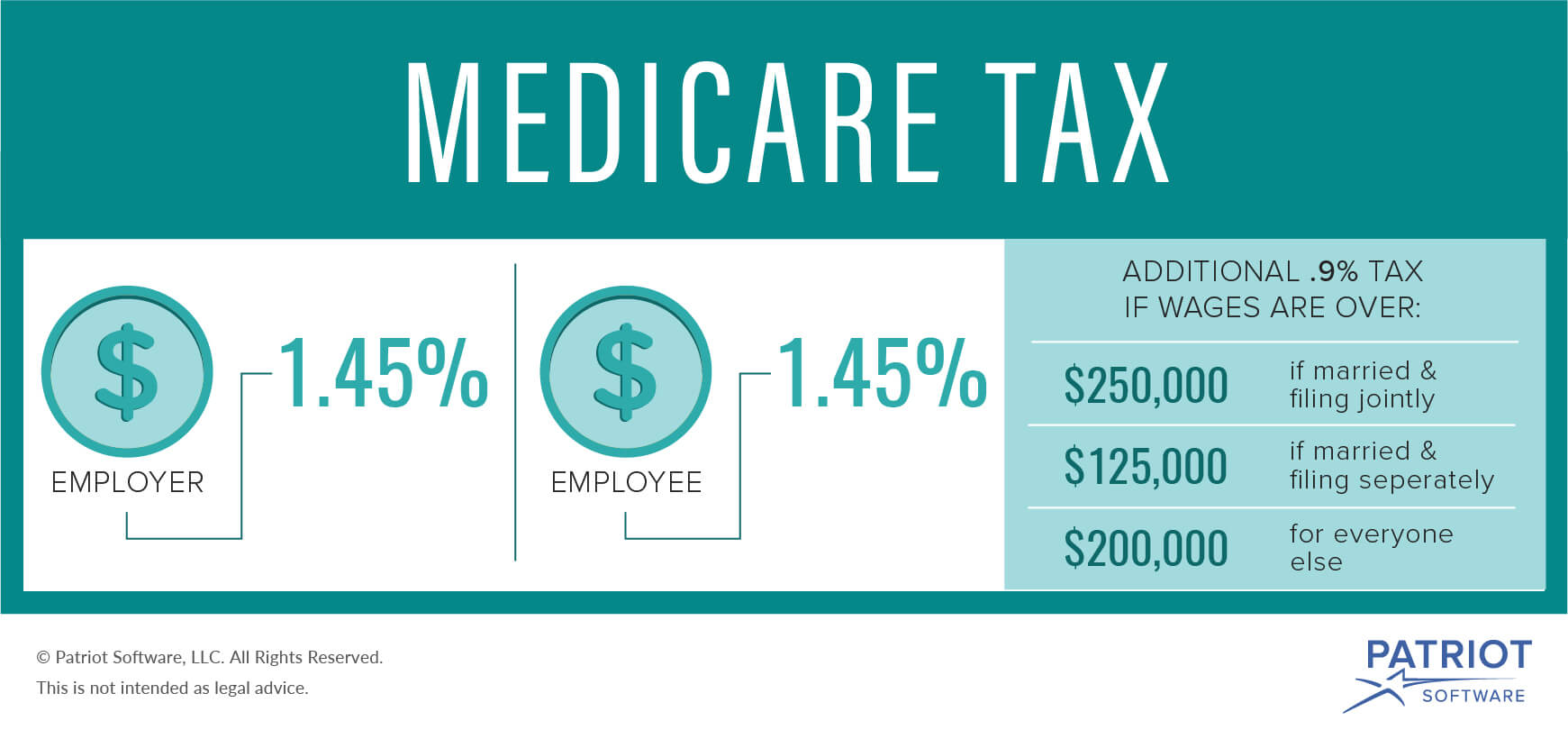

The payroll tax rate that goes toward Social Security is currently set at 6.2%, and will stay the same in 2021. All wages over $200,000 are subject to an Additional Medicare rate at 0.9% mention, bringing the total tax rate for wages above $200,000 to 2.35%. This only impacts the employee portion of the tax.

Read Also: Does Medicare Pay For Physical Therapy After Knee Surgery

When Does A Senior Citizen On Social Security Stop Filing Taxes

OVERVIEW

The IRS typically requires you to file a tax return when your gross income exceeds the standard deduction for your filing status. These filing rules still apply to senior citizens who are living on Social Security benefits. If Social Security is your sole source of income, then you don’t need to file a tax return.

Contributing To Retirement Accounts

Another key advantage of ongoing earned income even after you collect Social Security is that you can keeping contributing to your retirement savings accounts like traditional IRAs, health savings accounts , Roth IRAs, and 401s.

Note: If you are over 72, you will have to take the required minimum distribution from your traditional IRA, except for during the 2020 pause because of COVID-19.

Your traditional 401, or similar employer-based retirement plan, is a different story. In general, you can continue stashing away money in your current employer-provided plan as long as you’re still working, even part-time, and you can delay taking your RMD until after you retire.

This additional savings can help, especially if your savings are running a bit behind your goals. The combination of the added savings, tax-deferred growth potential, and the ability to defer tapping into your savings can be powerful, even at the end of your working career.

Also Check: Does Medicare Cover Dupuytren’s Contracture

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

What Is Withholding Tax How Does A Withholding Tax Work

A withholding tax is an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

Here’s a breakdown of the taxes that might come out of your paycheck.

-

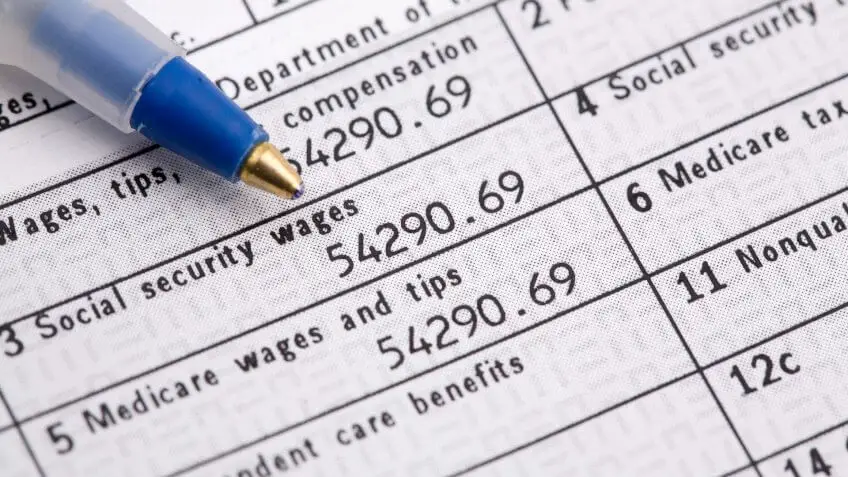

Social Security tax: 6.2%. Frequently labeled as OASDI , this tax typically is withheld on the first $137,700 of your wages in 2020 . Paying this tax is how you earn credits for Social Security benefits later.

»MORE:See what the maximum monthly Social Security benefit is this year

-

Medicare tax: 1.45%. Sometimes referred to as the hospital insurance tax, this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

-

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4.

-

State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf. The amount depends on where you work, where you live and other factors, such as your W-4 .

-

Local income or wage tax: Your city or county may also have an income tax. This money might go toward such expenses as the bus system or emergency services.

See what else you can do for your business

-

Learn about coronavirus relief options for small businesses and the self-employed.

|

Employer pays |

You May Like: When Must The Medicare Supplement Buyer’s Guide Be Presented

When You Claim Matters

If you claim your Social Security benefits before your FRA, or full retirement age , you will end up with a permanently reduced monthly benefit because of the early age. If you claim at the earliest possible age of 62, your monthly checks could be up to 30% less than at your FRA.1

There will also be an earnings test until you reach that FRA: If you have earned income in excess of $19,560 in 2022, your benefits will be reduced by $1 for every $2 of earned income over the limit.

In the year of reaching your FRA, the earnings test limit is $51,960 in 2022, and your benefits will be reduced by $1 for every $3 of earned income over the limit.

These benefits are not truly “lost,” however. If your benefits have been reduced due to earning, your monthly Social Security check will be increased after your FRA to account for benefits withheld earlier due to excess earnings. Note that “earned” income includes wages, net earnings from self-employment, bonuses, vacation pay, and commissions earnedbecause they’re all based upon employment. Earned income does not include investment income, pension payments, government retirement income, military pension payments, or similar types of “unearned” income.

Once you reach your FRA, there is no earnings test and no benefit reductions based on earned income.

Scenarios: Claiming Social Security at 62 while working

How Much Fica Tax Does Your Employer Pay On The Taxable Portion Of Your Income

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

Also Check: Does Medicare Cover Chiropractic X Rays

Who Is Exempt From Paying Into Social Security

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Almost all U.S. workers are required to contribute part of their paychecks to the Old-Age, Survivors, and Disability Insurance programbetter known as Social Security. This pension program is an important source of income for many retirees. Among elderly beneficiaries, 50% of married couples and 70% of unmarried recipients receive 50% or more of their retirement income from Social Security.

Dating back to the days of the Great Depression, Social Security benefits were created as part of a social safety net designed to reduce poverty and provide care for the elderly and disabled. Most American taxpayers do not qualify for an exemption from Social Security taxes. However, they do exist for a small number of people.

Who Pays Social Security Taxes

Employees pay Social Security taxes of 6.2% of their eligible earnings up to a wage limit.

In 2020, the wage limit was $137,700.

If your wages exceed that limit, you stop paying Social Security taxes at that point.

What you might not know is that you are not the only one paying Social Security taxes. Your employer must match the amount you pay.

That adds 6.2% for a total Social Security tax of 12.4%.

Read Also: Are Medicare Advantage Plans Hmos

Social Security And Medicare

In addition to federal and possibly state income taxes, you will pay Social Security and Medicare taxes on any wages earned in retirement. There is no age limit on these withholdings, nor any exemption for any sort of Social Security benefits status.

The good news is that these earnings can also count toward the calculation of your benefits. The Social Security Administration checks your earnings record each year and will increase your benefit, if appropriate, based on these additional earnings.

If you are making much less in retirement than before, could it hurt your benefits? No, because the benefit payment is still based on your 35 highest years of earnings. At worst, there would be no impact at best, it could help if this replaces any of the lower 35 years.

Read Viewpoints on Fidelity.com: 6 key Medicare questions

The bad news is that your earnings may not only push you into a higher tax bracket, but also into a higher threshold for your Medicare premiums once you are over 65. Medicare sets the cost for Part B each year at a fixed rate for most participants , but it increases for individuals with an annual income over $91,000 and married couples with an annual income above $182,000. The cost for these higher-earning participants can range from $238.10 to $578.30 per month in 2022.

Exemption For Qualifying Religious Groups

Members of certain religious groups may be able to claim a religious exemption.

In order for this exemption to work, your religious group must have been in existence at the end of the year in 1950.

The group must have provided its members with a reasonable standard of living ever since that date. If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption.

To do that, youll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Don’t Miss: Can I Switch Medicare Supplement Plans

Social Security/medicare And Self

In general, aliens performing services in the United States as employees are liable for U.S. Social Security and Medicare taxes. However, certain classes of alien employees are exempt from U.S. Social Security and Medicare taxes.

Resident aliens, in general, have the same liability for Social Security/Medicare Taxes that U.S. Citizens have.

Nonresident aliens, in general, are also liable for Social Security/Medicare Taxes on wages paid to them for services performed by them in the United States, with certain exceptions based on their nonimmigrant status. The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes:

- A-visas. Employees of foreign governments are exempt on salaries paid to them in their official capacities as foreign government employees.

- The exemption does not apply to spouses and children of A nonimmigrants who are employed in the United States by anyone other than a foreign government.

Medicare Taxes And Benefits

Medicare is a United States federal health insurance program that reduces the cost of healthcare services. Medicare plans cover people age 65 or older, younger people who meet eligibility requirements, and individuals with certain diseases. You are eligible for premium-free Medicare Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years.

Don’t Miss: Is Keystone 65 A Medicare Advantage Plan

Tax Credit For Seniors

Even if you must file a tax return, there are ways you can reduce the amount of tax you have to pay on your taxable income. As long as you are at least 65 years old and your income from sources other than Social Security is not high, then the tax credit for the elderly or disabled can reduce your tax bill on a dollar-for-dollar basis.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

If you ended up with a huge tax bill this year and dont want another, you can use Form W-4 to increase your tax withholding. Thatll help you owe less next year.

If you got a huge tax refund, consider using Form W-4 to reduce your tax withholding. Youre giving the government a free loan and even worse you might be needlessly living on less of your paycheck all year. It may feel great to get a tax refund from the IRS, but think of how life mightve been last year if youd had that extra money when you needed it for groceries, overdue bills, getting the car fixed, paying off a credit card or investing.

Don’t Miss: How Much Does Ss Deduct For Medicare

Who Is Exempt From Social Security Tax

Foreign students and educational professionals in the U.S. on a temporary basis dont have to pay Social Security taxes. Nonresidents working in the U.S. for a foreign government are exempt from paying Social Security taxes on their salaries. Their families and domestic workers can also qualify for the exemption.

What Happens When Your Earnings Exceed The Taxable Maximum

After your earnings exceed the taxable maximum for that year at a given job, Social Security taxes will stop being withheld and you will notice a bump in your paychecks. “Once you bump up against the $142,800, then the net amount of your paycheck just increases,” Clark says. “There’s no more Social Security tax that is deducted.”

If you earn more than the taxable maximum through multiple jobs, each of your employers must withhold Social Security taxes from your wages until you exceed the tax limit at that individual job. However, when you file your tax return, you can claim a refund for Social Security taxes withheld in excess of the maximum amount for that year.

“If you have multiple employers or change jobs during the year, there is a potential for over-withholding of Social Security,” says Ken Cornutt, a certified financial planner and founder of Westside Financial in Los Angeles. “You can claim a refund from the IRS if too much has been withheld throughout the year.”

You May Like: Do Medicare Supplements Cover Pre Existing Conditions