Enroll Waive Change Or Cancel

Eligible participants must enroll in CMUs health plan or apply for waivers during the Open Enrollment period. Fall 2021 Open Enrollment ended September 15, 2021. Open Enrollment for new spring semester students is coming soon.

By default, the Student Health Insurance Plan premium fee is posted on student accounts the fee will be removed for students who apply for and receive an approved waiver during the open enrollment period. Full-time students who do not submit an enrollment form or receive an approved waiver before the end of Open Enrollment will be enrolled in the student medical plan.

Read Also: Part Time Starbucks Benefits

How To Disenroll From Medicare Part B

Medicare Part B helps qualified Americans pay health care costs related to doctor visits, lab testing, preventative services, and more, but this coverage isn’t free, and not everyone needs it. Those who dont need Part B can disenrollbut its not a straightforward process.

The Centers for Medicare and Medicaid Services doesnt make it easy to drop this coverage, and you’ll need to speak with a representative to disenroll. If you cancel Part B, it could also impact your ability to afford coverage in the future, so read this entire article before you begin the process.

How Do You Cancel A Medicare Supplement Plan

You may cancel a Medicare Supplement plan at any time by simply contacting your plan and notifying them that you wish to cancel. You should note, however, that if you cancel your Medigap plan and dont qualify for a guaranteed issue right, you will likely face medical underwriting if you decide to apply for another Medigap plan in the future. This means that an insurance company can use your medical history to determine your plan premium costs and whether to issue you a plan in the first place.

If you decide to cancel your current Medicare Supplement plan, you may be able to compare plans and find a better Medigap option for your coverage needs.

Don’t Miss: Can You Have Two Medicare Advantage Plans

How To Switch From Obamacare To Medicare

- Happy 65th Birthday: If you have a Marketplace plan, you can keep it until you decide to get Medicare. Most people enroll as soon as they are eligible through the Initial Enrollment Period, which begins three months before their 65th birthday and ends three months after their 65th birthday.

- If you like, you can keep your Marketplace plan, too. But once your Medicare Part A coverage starts, youll no longer be eligible for premium tax credits or other cost savings you may be getting. So youd have to pay full price for the Marketplace plan.

- There is another option after turning 65. You could continue getting your health insurance at work until you retire or lose your job.

How To Cancel Health Insurance Purchased From A Private Insurer

Contact Your Provider: If you want to cancel health insurance you bought from a private insurer, youll need to contact that insurer for directions. Different carriers have different cancellation protocols. Some insurers may send you a form to fill out others may want a more formal written confirmation to end coverage. Call the customer service number listed on the back of your health insurance card to get the details you need to follow.

Recommended Reading: How Do I Find Out What My Medicare Number Is

How Do I Cancel Medicare Advantage After Death

You guessed it â Social Security informs the Centers of Medicare & Medicaid Services of your death, and your Medicare Advantage plan is also informed in that process.

CMS actually disenrolls that member from an MA organization upon their death and then informs the MA organization of the death.

The disenrollment is effective the first day of the calendar month following the death.

So, as long as the funeral home informs Social Security of a personâs death, their Medicare Advantage plan will be cancelled as well.

Why Youre Getting Bombarded With Mail And Phone Calls

Its plain and simple: YOURE TURNING 65. Thats it. Really, thats the only reason. Medicare, insurance companies, insurance agents, etc. are all contacting you because youre turning 65.

Now, nobody knows your specific situation:

- You could have very good health insurance coverage as a retiree

- You might already be on Medicare because of a disability

- You may qualify for Medicaid

- You might have full benefits as a veteran, through VA benefits or Tricare

Whichever of these situations you may be in, you have different needs for both Medicare and for supplemental insurance. But, the people calling you and sending you mail dont know your situation. All they know is youre turning 65 and you need to do something about Medicare.

So every phone call and piece of mail pretty much falls into one of three different categories. Lets take a look at what they are, starting with the less important stuff first

Recommended Reading: What Benefits Do You Get With Medicare

You May Like: Is Keystone First Medicaid Or Medicare

Get Help Switching Or Enrolling In A Medicare Advantage Plan

If you would like further help learning how to cancel your current Medicare coverage for a new Medicare Advantage plan, a licensed insurance agent can help guide you through the process.

Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

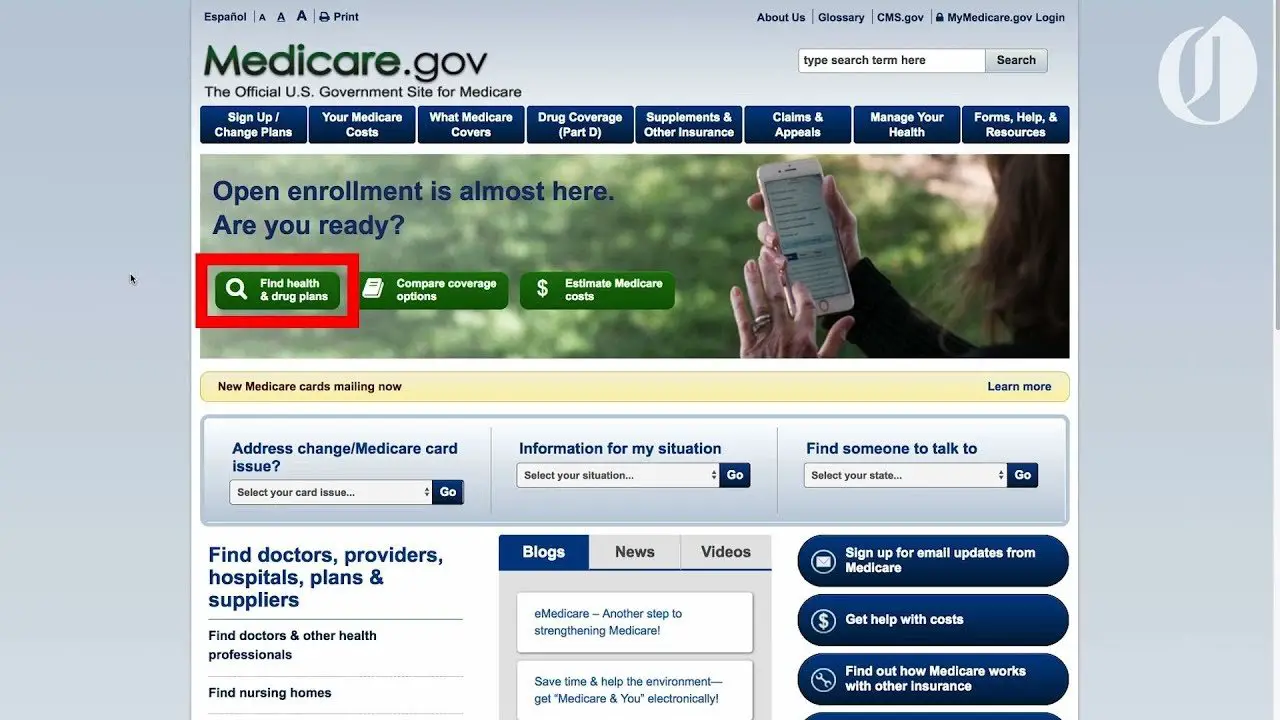

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Deferring Enrollment Before It Starts

If you want to defer your enrollment, you will have to contact the Social Security Administration to make sure that you arent enrolled in Medicare. This should be a straightforward process, but make sure that you do it as soon as you can, so you dont pay any premiums and then have to cancel later.

Recommended Reading: Does Medicare Cover Blood Pressure Machines

Looking For In A New Plan

Before you start searching for a new plan, you want to consider what exactly youre looking for. Think about what your current plan lacks some areas you might want to look at include:

- Deductibles and copay percentages

- Pregnancy coverage and maternity care options

- Drug coverage options

Create a wish list of everything you need in a plan and use your needs to guide you when you compare plans and speak with representatives from health insurance companies.

What Isnt Covered By Medicare Part B

You can get many medical services under your Medicare Part B coverage, but it doesnt cover everything you might need. For example, Medicare doesnt cover custodial care in the patients home or an institution, or personal care that can be provided by someone who isnt a skilled medical professional. This means Medicare wont cover nursing home care. Part B also doesnt cover dentures, most dental services, acupuncture, routine foot care, hearing aids or eye exams that you need to get eyeglasses.

You May Like: Is Balloon Sinuplasty Covered By Medicare

Read Also: Which Is Primary Medicare Or Private Insurance

Stop Unwanted Robocalls And Texts

FCC Announces Anti-Robocall Actions

Acting Chairwoman Jessica Rosenworcel has announced anti-robocall actions, including: issuing the largest robocall fine in FCC history, sending cease-and-desist letters to six voice providers that have consistently violated FCC guidelines on the use of autodialed and prerecorded voice message calls, launching a Robocall Response Team, and formally reaching out to renew state-federal partnerships to combat the proliferation of illegal robocalls.

FCC Consumer Video: Dont Hang On, Hang Up! To watch this video with captions, click play, then the CC icon.

Unwanted calls including illegal and spoofed robocalls are the FCCs top consumer complaint and our top consumer protection priority. These include complaints from consumers whose numbers are being spoofed or whose calls are being mistakenly blocked or labeled as a possible scam call by a robocall blocking app or service. The FCC is committed to doing what we can to protect you from these unwelcome situations and is cracking down on illegal calls in a variety of ways:

Check out the consumer guide on , which includes information on many of the call blocking and labeling tools currently available to consumers.

File a complaint with the FCC if you believe you have received an illegal call or text, or if you think youre the victim of a spoofing scam. Click the tabs below for tips, FAQs and resources.

How To Generate An Electronic Signature For The Form Cms 2690 On Android Devices

In order to add an electronic signature to a request cancellation medicare, follow the step-by-step instructions below:

If you need to share the sample letter to cancel medicare part b with other people, you can easily send the file by electronic mail. With signNow, you can eSign as many documents per day as you require at a reasonable price. Start automating your eSignature workflows right now.

Recommended Reading: What Is Part B Excess Charges In Medicare

Ask About A Premium Refund And Check Your Bank Statements

If you paid in full for a one-year policy and you want to cancel it before the policy ends, ask your insurance company if you can be reimbursed for the premium amounts for the remaining months. Many companies will refund you for the time left on your policy.

You should also check your bank statements after you cancel your policy and your new coverage starts to make sure youre not being billed for the canceled plan and that your new coverage is active under the new payments.

How Do I Report A Death To Life Insurance Or Annuity Companies After Death

Reporting a death to a life insurance or annuity company does require a death certificate. A signature is also needed from each beneficiary.

If you have your life insurance or annuity policy with us at Sams/Hockaday, we will guide you and your family through this process.

Your loved ones will not go through any of this alone, so while you should definitely ensure they know who your agent is, you can rest assured our office will handle it.

Read Also: How Much Does Medicare Part B Cost At Age 65

Trying Out A Different Medicare Supplement Insurance Plan

Outside of your Medicare Supplement Open Enrollment Period , you may be able to take advantage of the free look period to try out a different Medicare Supplement insurance plan. This 30-day period starts when you get a new Medicare Supplement policy but dont cancel the old one. To get the new policy, you have to promise that youll cancel your old policy within 30 days. You will pay the premiums for both plans for one month, so the look isnt technically free. You may be subjected to medical underwriting when applying for the new plan outside of your Medicare Supplement OEP. If at the end of the 30 days you decide you prefer your old plan, you can keep your old plan and cancel the new plan.

The product and service descriptions, if any, provided on these eHealth Insurance Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

This website and its contents are for informational purposes only. Nothing on the website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

New To Medicare?

Why Is My Out Of State Hmo And/or Medicaid Plan Not Considered Comparable Coverage

Unfortunately, most out of state HMO/Medicaid plans do not meet Northwesterns comparable coverage requirements. This is because these plans provide no non-emergency coverage in the Chicago and Evanston area, meaning that the student and the University assume the liability and financial burden of uncovered care should the student have non-emergency medical needs while on campus.

If you are enrolled in an out of state HMO plan we encourage you to reach out to your insurance carrier to see if a rider is available which provides a guest network for the Chicago/Evanston area. If this is not offered by your insurance carrier then you will need to either enroll in the NU-SHIP or seek alternative comparable coverage.

Read Also: How Much Is Premium For Medicare

How To File Aetna Complaints And Get Your Voice Heard

Aetna is an American managed health care company, providing health insurance and related services to over 22.5 million people. It was founded in 1853 and is based in Hartford, Connecticut.

The company began participating in Medicare with the passage of the Patient Protection and Affordable Care Act in 2010, as well as the Health Insurance Portability and Accountability Act of 1996 .

In 2018 the United States Department of Justice filed a lawsuit against Aetna for unlawfully denying users insurance claims. The jury has awarded $25.5 million to the family of the cancer patient who was denied coverage by the company.

Aetna has also been accused of retroactively denying peoples insurance policiesa process known as health rescission.

Following the acquisition of Humana Inc. in July 2018, Aetna was ordered to pay $17 million to a cancer patient who was denied coverage for a heart condition.

In April 2018, the state of New Mexico sued Aetna for unlawful practice of denying Medicaid recipients access to expensive prescribed medications. Aetna has also been criticized by Medicare for overcharging the government approximately $12 million in Medicare overpayments in 2007 and 2009.

All things considered, Aetna isnt the most reliable health care insurance provider. Insurers have reported countless problems with the company, from denying benefits to delaying payments.

How To Delete Wellcare Account

You might have created an account on Wellcare during the course of using the app. Many apps make it so easy to signup but a nightmare to delete your account. We try to make it easier but since we don’t have information for every app, we can only do our best.

Generally, here are some steps you can take if you need your account deleted:

Bonus: How to Delete Wellcare+ from your iPhone or Android.

Delete Wellcare+ from iPhone.

Don’t Miss: What Is Medicare Ffs Program

Lost Stolen Or Damaged Cards

If your Medicare card is lost, stolen or damaged, it can be replaced.

Any New Brunswick resident who has a valid Medicare card may have it replaced if it is lost, stolen or damaged for the minimal fee of $10.00.

If you report your card stolen, in order to protect your privacy, the stolen card will be terminated. A new Medicare number and card will be issued upon receipt of the $10.00 fee. It is your responsibility to notify your service providers of your new number.

To arrange for a replacement card, visit your local Service New Brunswick office or send a completed Medicare Change Request, Replacement and/or Renewal, signed and dated, to New Brunswick Medicare, along with a cheque or money order, made payable to the Minister of Finance, in the amount of $10.00 for each replacement card required .

Exempt from the $10.00 replacement card fee are:

- Seniors who receive the Guaranteed Income Supplement,

- Income assistance recipients, and

- Residentâs whoâve received a damaged or misprinted card.

NOTE: The Department of Health is committed to safeguarding your privacy. Visit our privacy webpage for more information on our privacy practices and about your rights regarding this issue.

How To File A Complaint

Medicare provides an appeals service so that if a doctor or other health service provider refuses to file a claim, a person can file a complaint.

To get help with filing a complaint, a person can contact their State Health Insurance Assistance Program . They can also call Medicare and explain why they would like to file a complaint.

A complaint and an appeal are two separate processes. A complaint requests that Medicare investigates a service provider. An appeal asks Medicare to reconsider payment for drugs or services.

Depending on the Medicare part used, the claim process may vary. For example, a claim for services or equipment from original Medicare is processed differently from claims for other Medicare parts.

The claims process has several steps a person should follow:

- Contact Medicare to get the deadline for filing the claim.

- Get an itemized bill for the medical service as it validates the claim.

- Add documents such as medical history or referrals to specialists.

- Highlight the relevant portions of bills or other documents, and cross out items already paid by Medicare or that do not apply.

In addition, a person should include any additional health insurance coverage and a cover letter that explains why they are making a claim.

The completed form and all documents can be mailed to the Medicare office listed on the persons payment request form.

Recommended Reading: What’s Better Medicare Or Medicare Advantage