Medicare Costs Vs Private Insurance Costs

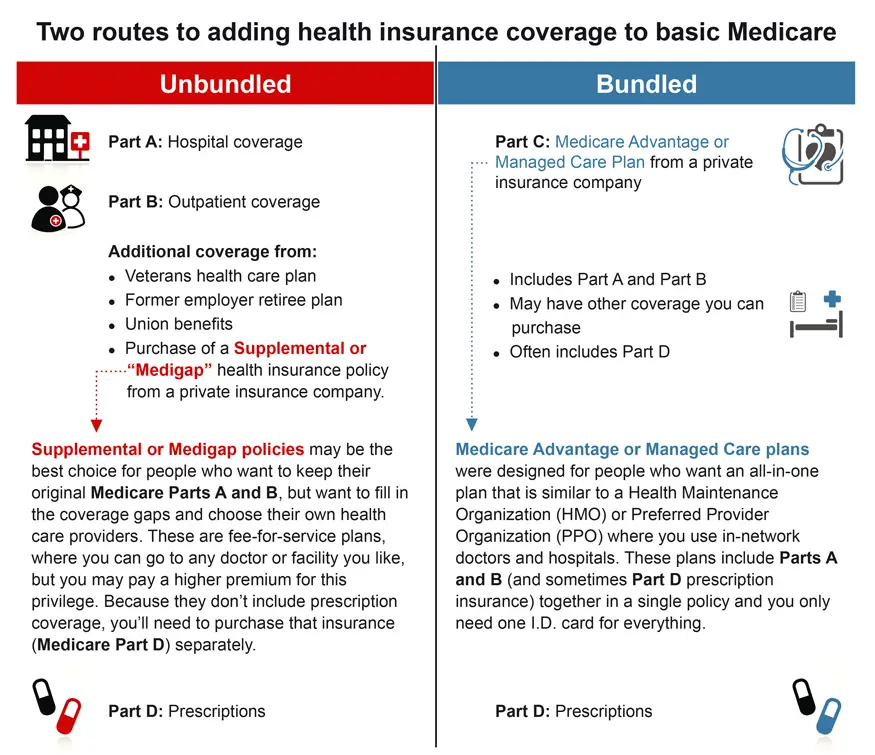

How do Medicare costs compare to private insurance? Medicare Part A is usually free. Part B costs $148.50 per month for most enrollees in 2021. You can delay purchasing Part B if your private insurance is less expensive. You can even bundle this with a Part D prescription drug plan and a Medicare Supplement policy.

What you need to consider is not only the comparison of monthly premiums, but potential out-of-pocket costs. This is where supplemental policies shine. They dramatically limit out-of-pocket expenses depending on what plan you choose

How does Medicare Compare with My Employer-Sponsored Plan?

If you only have Original Medicare, you will find many gaps between the plan and the employer plan you had. But if you bundle that with a Part D prescription drug plan and a Medicare Supplement policy , your coverage will be similar. Often there will be fewer out-of-pocket expenses depending on the type of supplement policy you purchase.

How Does Private Insurance and Medicare Work together?

Are you wondering how private insurance and Medicare work together? If you have private insurance along with Medicare, the two insurance carriers follow a coordination of benefits. This process helps them decide which insurer will pay first.

If the employer plan has 20 or more employees, the group plan will usually pay first. If the employer plan has fewer than 20 employees, Medicare will usually pay first.

Choosing Private Insurance

Medicare Supplement Plans

Plan A

Plan B

Plan C

Plan D

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first , and a secondary payer will only kick in for costs not covered by the primary payer. The secondary payer may not pay all of the remaining uncovered costs, and you may be responsible for any additional balance.

In many instances, if you are age 65 and covered by either a retiree plan or a plan with fewer than 20 employees, then Medicare is your primary payer, and private insurance is your secondary. If this is your situation, you should enroll in Part A and B, along with D if your private insurance plan doesnt have creditable prescription drug coverage.

If youre covered by a plan with 20 or more employees, Medicare is often the secondary payer. Medicare may pay costs that your employers plan doesnt.

How Do Medicare And Private Insurance Costs Differ

Its difficult if not impossible to compare Medicare costs directly to private insurance costs. There are a wide range of variables that can affect the comparison. But typically, private insurance is more expensive than Medicare.

Part of that is because private insurance rates can be as much as 2.5 times than Medicare rates, according to a 2020 study by the Kaiser Family Foundation.Insurance costs whether private or Medicare costs are reset each year. Original Medicare has a fixed set of costs. But private insurance costs can vary widely from plan to plan.

Original Medicare costs the same regardless of your age or where you live. Private insurance costs can be affected by several factors.

Factors That Affect Private Insurance Costs

- Benefits included in the plan

- Maximum out-of-pocket expenses

The example below compares employer-provided insurance premiums to Original Medicare premiums. It also breaks down the cost of total monthly premiums and an employees average share of the cost among employer plans.

| Private Health Insurance |

| $506 for those who’ve paid Medicare tax for fewer than 30 quarters |

Source: Kaiser Family Foundation and U.S. Centers for Medicare & Medicaid Services

Medicare Advantage, Medigap and Medicare Part D drug plan premiums vary from plan to plan. But Medicare and private insurance costs go well beyond just the premiums.

Medicare and Private Insurance Out-of-Pocket Costs

Also Check: Are Grab Bars Covered By Medicare

Advantages Of Private Insurance Coverage

One of the main advantages of private insurance coverage for home health care is that it often provides more comprehensive coverage than Medicare/Medicaid. Private insurance plans typically cover a wider range of services, including specialized services such as speech therapy or occupational therapy. Additionally, private insurance plans typically have lower co-payments and deductibles than Medicare/Medicaid plans. Finally, private insurance plans often provide additional benefits, such as coverage for durable medical equipment or transportation to medical appointments.

Tricare Champva & Va Benefits With Medicare

If you have TRICARE or CHAMPVA coverage, you will need to see if you qualify for premium-free Part A. If you are eligible, you will be required to enroll in both Part A and Part B to keep TRICARE or CHAMPVA coverage. If you are not eligible, enrollment is optional, but you could face late enrollment penalties. Its best to talk with your TRICARE and CHAMPVA benefits administrator to learn more.

VA benefits alone will not qualify you to delay Medicare without penalty, so if you have VA health coverage and are still working past 65, you will need to enroll in Medicare during your Initial Enrollment Period.

You May Like: How Much Will Medicare Pay For Nursing Home Care

What You Need To Know About Medicaid Combined With Other Insurances

Image taken by Mayte Torres / Getty Images

Medicaid and private health insurance provide coverage for millions of people, and its common for the average person to have one insurance or the other. However, its possible to have both Medicaid and private insurance. Learn how having Medicaid and private health insurance works, and how it can benefit you.

How Will Medicare Affect My Hsa

You cant contribute to a health savings account while on Medicare. A health savings account lets you set aside pre-tax income in an account to pay for certain medical expenses. This saves you money on overall healthcare costs.

If you are 65 years old or over, your Part A coverage will start up to six months before the date you sign up. You will face a tax penalty if your Part A coverage overlaps with when you put money into your HSA.

To avoid penalties, you and your employer should stop putting money into an HSA six months before you plan to retire or apply for Social Security or RRB benefits.

If you have a high deductible health plan with an HSA based on you or your spouses employment, you may be eligible for a special enrollment period. This will allow you to sign up for Part B without a penalty.

You will still be able to withdraw money from your HSA after your coverage starts. Money from HSA accounts can be used to pay for qualified medical expenses like

Recommended Reading: Does Medicare Cover Fall Alert Systems

Understanding Original Medicare Eligibility And Enrollment

Original Medicare is available to a wide variety of people. Most often, Medicare enrollees are people who have reached their 65th birthday and already receive Social Security benefits. However, it is also available to certain patients with end-stage renal disease.

Medicare enrollment happens during special periods, known as enrollment periods. The first enrollment period, when someone turns 65, is known as the Initial Enrollment Period. There is also an Open Enrollment Period at the end of each year, and certain life events can trigger a Special Enrollment Period, which lets people change their insurance.

Enrolling late in Medicare can result in late enrollment penalties. These can be severe, especially for Part B. However, there are various reasons that allow you to rightfully delay your coverage, such as having coverage from your employer.

Can I Keep My Employer Health Insurance With Medicare

If youre receiving health insurance coverage from your current place of work but also qualify for Medicare, you may find yourself choosing between Medicare and your group health plan. In most cases, the size of the company where you work determines whether youll face penalties for not enrolling in Medicare when youre eligible.

Here are the rules for choosing employer health benefits instead of Medicare:

- If your employer has fewer than 20 employees: you must sign up for Medicare when youre eligible or you may face a late enrollment penalty for Part B when you sign up later.

- If your employer has 20 or more employees: you can delay signing up without any late enrollment penalties in the future.

If youre under 65 years old and eligible for Medicare because of a disability, youre not required to sign up until you turn 65 years old. But if youre still receiving group health insurance coverage at that time, the same rules listed above apply.

Once you retire and give up your employer health benefits, you will have a special enrollment period of eight months to enroll in Part A and Part B, if you havent enrolled already. This special enrollment period begins the month after your employment or group health plan ends.

There is no late enrollment penalty for enrolling in original Medicare during this special enrollment period if the rules above were followed.

Don’t Miss: Does Medicare Offer Dental Plans

Medicare As An Automatic

In some cases, Medicare is an automatic. For instance, Medicare.gov says that if you receive benefits via either Social Security or the Railroad Retirement Board for more than four months before turning 65, you automatically receive Medicare Part A and Part B .

One exception to this is if you live in Puerto Rico. While Part A is automatic for Puerto Rican residents, you have to sign up for Part B.

When automatic coverages take place, they are typically effective the first day of your birth month. However, if your birthday is on the first, they kick in the month before.

Medicare is also automatically provided if youre under 65 years of age and have received disability benefits from Social Security for a period of 24 months or if youve been receiving certain disability benefits under the RRB for the same timeframe.

If youve been diagnosed with ALS , which is more commonly known as Lou Gehrigs disease, Medicare is provided without any action on your part and becomes effective the month disability benefits begin.

Signing Up For Medicare Might Make Sense Even If You Have Private Insurance

shapecharge / Getty Images

If youre about to turn 65 and you have private health insurance coverage, you may be wondering if you need to sign up for Medicare. The short answer is, it depends. You might be able to delay enrolling in some parts of Medicare, but not signing up for other parts can cost you.

Navigating Medicares options, enrollment deadlines, and requirements can be confusing. However, its important to know when you need to apply for coverageespecially if you have other health insurance coverageso you dont get hit with costly penalties. Heres how Medicare works, what to consider when you already have health insurance, and how to avoid penalties for late enrollment.

Don’t Miss: When And How Do I Apply For Medicare

Is Medicare Primary Or Secondary To Medicaid

Medicaid is a state-run federal assistance program helping low-income Americans. When you become eligible for Medicare and are also eligible for Medicaid, youre dual-eligible. For those who are dual-eligible, Medicare is the primary payer. Medicaid will not pay until Medicare pays first.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If youre dual-eligible and need assistance covering the costs of Medicare Part B and Part D, you could qualify for a Medicare Savings Program to assist you with these costs. Always make sure your provider accepts both Medicare and Medicare before seeking care.

Why Do Doctors Not Like Medicare

Doctors dont always accept Medicare since it usually doesnt pay physicians as much as many private insurance companies, leaving more of the expense to patients. Often, the primary care clinic cant staff adequately to keep up with all of the paperwork required when accepting a variety of insurance providers.

Recommended Reading: How To Become A Medicare Certified Provider

Medicare Part B: What Does It Cover

Part B of Medicare pays for medically necessary outpatient services. This can vary from diagnostic tests to doctor visits and outpatient surgeries. Medicare Part B will also usually cover durable medical equipment .

The Part B premium is $164.90 in 2023, although this can be higher depending on your income. The Part B deductible is $226 in 2023, and you will pay a 20 percent co-insurance after your deductible has been met.

Do I Need Part D If I Have Drug Coverage Through My Spouse

Not necessarily. The rules are different for Medicare Part D prescription drug coverage. As long as you continue to receive creditable prescription drug coverage under the employer plan whether your spouse is still working or retired you do not need to sign up for a Part D plan.

If you lose this coverage at some point, you will then be eligible for a special enrollment period of two months to purchase a Part D plan without incurring a late-enrollment penalty.

Keep in mind

Youll have different decisions to make if the spouse with employer health coverage turns 65 first. If the older spouse enrolls in Medicare instead of keeping the employers insurance, the younger spouse may lose private health insurance coverage. If that happens, a younger spouse may need to find other sources of coverage before turning 65 and becoming eligible for Medicare.

One option is to continue the employers coverage through COBRA, which can last up to 36 months if you lose employer coverage because your spouse becomes entitled to Medicare. Or you can buy a private plan through the Affordable Care Act federal insurance marketplace or through a state that has its own exchange.

You May Like: How Much Of Cataract Surgery Does Medicare Cover

Differences In Eligibility For Private Insurance Vs Medicare/medicaid

Private insurance plans have eligibility requirements that must be met in order to qualify for coverage. These requirements can vary by plan, but generally include age, residency, income, and health status. Medicare/Medicaid, on the other hand, are government programs that are available to anyone who meets the eligibility requirements. These programs have no pre-existing condition exclusions, so coverage is available regardless of health status.

Medicare Part D Prescription Drug Plans

Original Medicare does not cover prescription drugs, with very few exceptions. If you need prescription drugs of any kind, you should make sure you have a Part D prescription drug plan.

Part D plans are offered by private insurance companies. This means that they vary in price and coverage, unlike Original Medicare. When you look for a Part D plan, make sure that you look at the plans formulary. This refers to a tiered list of drugs that the plan covers.

Usually, brand-name drugs will be higher on the list and will cost you more out-of-pocket when compared to generic drugs. Plans are defined by their formularies, so never decide on a plan without confirming that the drugs you need are available on their formulary at a cost you can deal with.

You May Like: What Do Medicare Advantage Plans Cover

Should You Have Medicare And Private Insurance Or Should You Delay Medicare Enrollment

If youâre eligible for Medicare and have private health insurance, there may be some situations when it may make sense to delay Medicare enrollment, especially in Medicare Part B. Part B is medical insurance So, you might find yourself paying two monthly premiums â one for your plan and one for Part B â for very similar Medicare coverage.

So, some people choose to keep the group health plan and delay enrollment in Part B. But it really depends on your situation. Before you decide to delay Part B enrollment, call your private insurance plan and ask them how your plan works with Medicare. You can also contact eHealth and ask one of our licensed insurance agents for more details about delaying Part B enrollment.

If you decide to delay Part B enrollment, make sure you sign up as soon as your private insurance coverage ends, so you can avoid a penalty for late enrollment in Part B.

Original Medicare Covers Most Of Your Healthcare Needs But You May Want Additional Coverage For Services Not Included With Medicare Such As Prescription Drugs And Dental Care

The answer to this question can be a bit complex, depending on what you mean. In general, you do not need additional health insurance if you have Medicare. There is no compulsion to have other health insurance legally speaking.

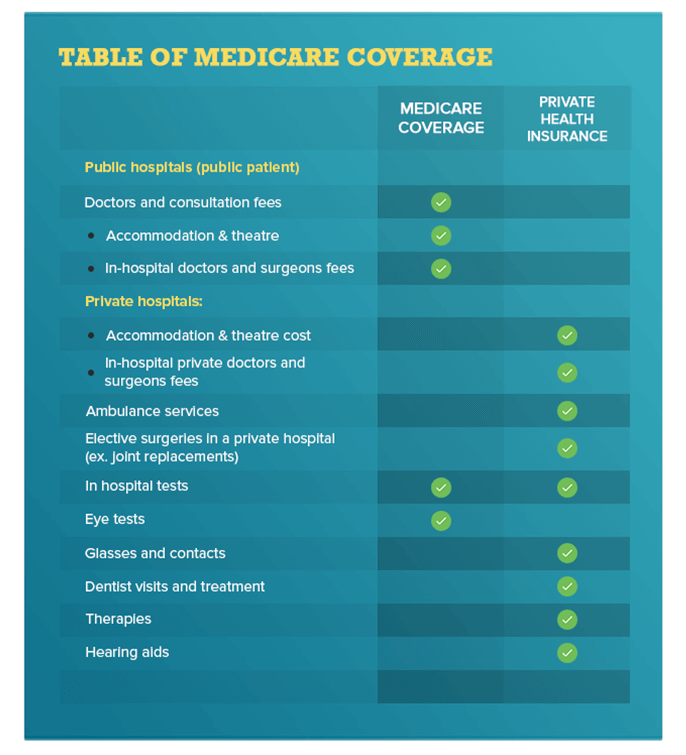

However, most people will want to have additional health insurance even when they have Medicare. This is because Medicare doesnt cover everything that most retirees would like covered. Although Medicare coverage is fairly comprehensive, there is no coverage for dental, vision, or prescription drug costs. The options for each of these categories will vary.

The main options that you have for additional health insurance are:

Well go through what exactly Original Medicare covers, as well as all of your options for additional insurance coverage.

You May Like: What Is The Best Supplemental Insurance To Medicare

Ffs And Cost Reimbursement

The paradigm shift is from cost reimbursement to the use of premiums. Medicare’s original usual, customary, and reasonable rules for paying physicians marked an advance over the relatively arbitrary fee schedules used by private insurers at the time. It was also a politic route through the sticky wicket of how much to pay various physicians by letting doctors establish their own fees based on what they had charged in the past and what their peers were charging in their area.

Cost reimbursement of hospitals and other institutional providers built on state-of-the-art practices by some private insurers, notably Blue Cross plans, and greatly refined this technology. It also seemed politic, in that Medicare would only pay costs, not full charges. Medicare and its administrative agents became the experts on hospital financing. There was a time when Medicare intermediaries knew every hospital financial officer by name and their budget by heart. This helped put Blue Cross plans in a position to negotiate payment arrangements with hospitals for new insurance offerings .

Similarly, Medicare developed its system for paying physicians according to a resource-based relative value scale to correct skewed financial incentives among various procedures and medical specialties. The RBRVS is the most sophisticated physician payment technology in the industry .