You Cant Get Medicare Coverage Yet

Were glad youre thinking about it already. You can sign up three months before your 65th birthday.

*Since your birthday is July 1st, Medicare considers June your birthday month.

Your Initial Enrollment Period is just around the corner. Be sure to sign up when it begins.

Keep reading to learn how to sign up.

*Since your birthday is July 1st, Medicare considers June your birthday month.

Sorting Out Insurance Plans And Covered Treatment Options

It is incomprehensible to me why insurance companies make the process so cumbersome and difficult and unpleasant. Add to that the fact that we often shift insurance carriers over the years for various reasons. That adds a whole new level of complication as we try to sort out which plan to get or what medications and treatments are covered. Additionally, we have to START ALL OVER with the approval process for medications!

Find Affordable Medicare Supplement Plans

How to Track the Part BDeductible The Medicare Part B deductible is an annual medical deductible. Everyone with Original Medicare is responsible for the Part B deductible.

However, Medigap Plan G and Plan N require you to pay the deductible out of your pocket. And, most Medicare beneficiaries meet the Part B deductible over one or two doctor visits. But do you know how to track the Part B deductible, so you dont accidentally overpay?

In this article well discuss:

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage or get Extra Help, youll likely pay a late enrollment penalty if you join a plan later. Generally, youll pay this penalty for as long as you have Medicare prescription drug coverage. To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

There are two ways to get Medicare prescription drug coverage:

- Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service plans, and Medicare Medical Savings Account plans. You must have Part A and/or Part B to join a Medicare Prescription Drug Plan.

- Medicare Advantage Plans or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called MA-PDs. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

How Do I Know If I Have Medicare

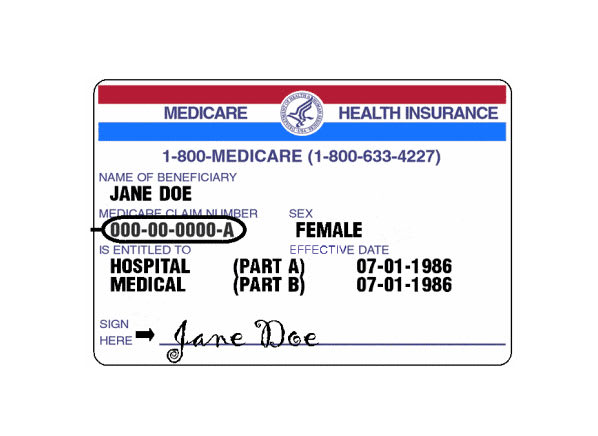

Since Medicare is a national program, all Medicare insurance cards look the same. Heres an example:

People with Medicare Advantage will have two insurance cards: One for traditional Medicare, and one for their Medicare Advantage plan. Medicare Advantage cards will look different from each other, depending on the plan.

Also Check: Who Do You Call To Sign Up For Medicare

Dont Rely On Your Medicare Summary Notice

Most insurance companies will mail an Explanation of Benefits after each claim is submitted, But, this isnt the case with Medicare.

CMS mails your Medicare Summary Notice once a quarter. And, it doesnt provide important details about the Part B deductible. It will simply indicate if youve met the deductible. Which means you still need to make sure that you actually paid Medicares Part B deductible.

Now, its entirely possible to use the Medicare Summary Notice to help track the Part B deductible. You just have to cross reference it with payment information you have on file. The point is to make sure you dont pay more than the Part B deductible for that specific calendar year.

Documentation and cross referencing are the key to knowing how to track the Part B deductible. So, as soon as you start your Medigap plan, and at the beginning of each year, get your techniques in place so you dont accidentally overpay.

About REMEDIGAP

Give us a call at 888-411-1329 or simply click on our quote form for free Medigap quotes.

Thank you for reading our article How to Track the Part B Deductible. Please leave any comments below or email us your questions.

Find affordable Medicare Supplement Insurance plans in your area

Getting Prescriptions With Part D Id

Throughout the nation, each enrolled beneficiary has a Medicare ID card, provided by Social Security.

Upon enrolling in a Part D plan, each beneficiary gets a prescription drug plan ID card from the plans insurance company. On this card, members get a member number that identifies them to the pharmacists and doctors that provide medications.

Primarily, the prescription plan uses the Medicare ID number in record keeping by checking the Medicare ID number the Part D plan will show on system records. Often, beneficiaries can use the Part D benefits before they receive a member card by simply using their Medicare ID.

Read Also: What Age Do You Register For Medicare

Three Firmsunitedhealth Humana And Cvs Healthcover Nearly 60 Percent Of All Medicare Part D Enrollees In 2019

Figure 3: Distribution of Medicare Part D Enrollment by Firm in 2019

The top three firmsUnitedHealth, Humana, and CVS Healthcover nearly 60 percent of all beneficiaries enrolled in Part D in 2019 , while the top five firmsincluding WellCare and Cignaaccount for three-quarters of Part D enrollment . The recent acquisitions of Aetna by CVS Health and Express Scripts by Cigna have resulted in further consolidation of the Part D marketplace. In particular, between 2018 and 2019, Cigna increased its market share from 3 percent to 8 percent, while CVS Health increased its market share from 14 percent to 17 percent. Under the CVS Health-Aetna merger, Aetna divested its stand-alone PDP business to WellCare, resulting in a more than doubling of WellCares Part D market share, from 4 percent in 2018 to 10 percent in 2019.

From The Centers For Medicare And Medicaid Services: Benefit Design For Simplified Determination Of Creditable Coverage Status

If an entity is not an employer or union that is applying for the retiree drug subsidy, it can determine that its prescription drug plans coverage is creditable if the plan design meets all four of the following standards. However, the standards listed under 4 and 4 may not be used if the entitys plan has prescription drug benefits that are integrated with benefits other than prescription drug coverage . Integrated plans must satisfy the standard in 4.The 2022 Medicare Part D Model Plan Parameters

Also Check: What Medications Are Covered By Medicare

What Should I Know About A Plan’s Drug List

Medicare Part D and Medicare Advantage plans have a drug list that tells you what drugs are covered by a plan. Medicare sets standards for the types of drugs Part D plans must cover, but each plan chooses the specific brand name and generic drugs to include on its formulary. Here are some important things to know:

- A plan’s drug list can change from year to year.

- Plans can choose to add or remove drugs from their drug list each year. The list can also change for other reasons. For example, if a drug is taken off the market. Your plan will let you know if there’s a coverage change to a drug you’re taking.

- Many Part D plans have a tiered formulary.

The Part D Standard Benefit

At a minimum, plan sponsors must offer a standard benefit package mandated by law. The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the Donut Hole. Sponsors may also offer plans that differ from but are actuarially equivalent to the standard benefit. Finally, they may also offer enhanced plans that provide benefits in addition to the standard benefit. Typically, the enhanced plans offer some coverage during the Donut Hole.

The Standard Benefit is defined in terms of the financial structure of the cost-sharing, not the drugs that must be covered under the plan.

Medicare does not establish premium amounts for plans. Instead, premiums are established through an annual competitive bidding process and evaluated by CMS. Premiums vary from plan to plan and from region to region. Medicare does establish the maximum deductible amount, the Initial Coverage Limit, the TrOOP threshold, and Catastrophic Coverage levels every year. The table below shows the standard benefit for this year .

Standard Part D Benefit 2020-2021

Alternatives to the Standard Benefit

Income-Related Monthly Adjustment Amount Part D

Income-Related Adjustments 2021

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $77.10 |

Drug Tiers

| Tier 1 | |

| $65 | 33% |

The Donut Hole

TrOOP

Once beneficiaries reach their out-of-pocket threshold costs), they move out of the Donut Hole and into Catastrophic Coverage.

EOBs

The Donut Hole Discount

| 63% | 75% |

Recommended Reading: Where To Send Medicare Payments

What Is The Medicare Part D Late

If youve gone 63 consecutive days without creditable prescription drug coverage, either because you didnt enroll when you were first eligible or because you lost your creditable coverage and didnt get new coverage in time, then you may have to pay a late-enrollment penalty when you do enroll into Medicare Part D.

The Medicare Part D late-enrollment penalty is added to the premium of the Part D Prescription Drug Plan you enroll into. Your Medicare Prescription Drug Plan determines this penalty by first calculating the number of uncovered months you were eligible for Medicare Part D, but didnt enroll under Part D or have creditable coverage. Your Medicare Prescription Drug Plan will then ask you if you had creditable prescription drug coverage during this time. If you didnt have creditable prescription drug coverage for 63 or more days in a row after you were first eligible, the Medicare Prescription Drug Plan must report the number of uncovered months to Medicare.

For example, lets say you disenrolled from your Medicare Prescription Drug Plan effective February 28, 2021, and then decided to enroll into another Medicare Prescription Drug Plan during the Annual Election Period, with an effective date of January 1, 2022. This means you didnt have creditable prescription drug coverage from March 2021 through December 2021, which adds up to 10 uncovered months.

How To Track The Part B Deductible For Plan G And Plan N

Please dont rely on your Medicare provider to tell you when youve met the Part B deductible. Otherwise, you may get overcharged and find yourself trying to get your money back.

This is especially important if you have Medicare Supplement Plan G or Medicare Supplement Plan Nbecause youll receive bills from medical providers. And, you want to make sure you only pay the amount youre responsible for.

Once you overpay, then you have to try and get your money back from the provider. Which can lead to stress and time wasted.

You May Like: Where Do I File For Medicare

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

- Visit the Check Your Enrollment page on Medicare.gov, the official website for Medicare.

- Fill out the requested information, including your zip code, Medicare number, name, date of birth and your effective date for Medicare Part A coverage or Part B coverage.

If you just recently enrolled, it may not be immediately reflected online. You may contact the plan provider directly to confirm your enrollment or check online again at a later date to see if your enrollment status has been updated.

If you are enrolled in Medicare Part A and/or Part B, your Medicare card should detail what Medicare coverage you have, as seen below.

When Can I Join Switch Or Drop A Medicare Drug Plan

- When you first become eligible for Medicare, you can join during your Initial Enrollment Period.

- If you get Part B for the first time during the General Enrollment Period, you can also join a Medicare drug plan from April 1 through June 30 and your coverage will start on July 1.

- You can join, switch, or drop a Medicare drug plan between October 15 through December 7 each year and your changes will take effect on January 1 of the following year, as long as the plan gets your request before December 7.

- If you’re enrolled in a Medicare Advantage Plan, you can join, switch, or drop a plan during the Medicare Advantage Open Enrollment Period between January 1 through March 31 each year.

- If you qualify for a Special Enrollment Period.

Recommended Reading: What States Have Medicare Advantage Plans

What Are The Benefits Of Buying Prescription Coverage Through A Medicare Advantage Plan

The biggest two benefits are in coverage and cost. A Medicare Advantage Plan is often less expensive in terms of prescription drugs since the plans are structured differently than a Part D plan. Theres also a longer list of medications that are covered with Medicare Advantage than you may find with Medicare Part D.

How To Check Your Medicare Application Online

If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your:

- ZIP code

- Medicare Part A effective date

You can also check the status of your application by visiting or calling a Social Security office.

You can ask your pharmacy to check the status of your Medicare Part D enrollment by sending a test claim.

You can also call the Member Services department of your Medicare Part D plan.

Also Check: How Much Can I Make On Medicare

Meeting The Individual Mandate

The Affordable Care Act changed the health insurance industry. No longer can companies deny coverage to those that wish to buy it. The trade-off was that everyone must buy insurance and stay covered.

Those with certain forms of Medicare do not need to do anything else. They have qualified health insurance and do not need to pay the penalty. Part B Medical Insurance is the outpatient services part of Medicare. Standing alone, it does not satisfy the requirement for minimum essential coverage.

Need more coverage than Original Medicare provides? Call our hotline at for assistance in finding a more comprehensive plan near you, or compare plans yourself online.

Best In Education: Aarp

-

Information is easy to follow

-

Ability to review all different Parts of Medicare available in your area

-

Lots of educational materials on the website, including general Medicare information, AARPs Medicare Plans, as well as enrollment questions

-

Must enter at least some of your medications to get an accurate personalized estimate of your costs

-

Higher deductibles

-

Cannot split payments over multiple methods

AARP was founded in 1958, and was a trailblazer for the insurance of older people, especially since Medicare itself didnt even exist until 1965. As such, AARPs focus is 100% on patient understanding and comfort, and all of the information is written with you in mind. There are free Medicare guides available for download on its website, and its easy to compare plans or connect with an associate for more detailed information and assistance. AARP provides all the tools you need for a well-rounded understanding of Medicare.

Some medication may not be covered by all plans, which can make a huge difference. Make sure you check and see which, if any, of AARPs plans cover your medication, and how much you may have to pay for it.

Don’t Miss: Does Medicare Pay For Private Duty Nursing

Check Status Of Medicare Application

There are various ways to receive Medicare coverage.

If you already collect Social Security benefits before age 65, youll be automatically enrolled in Medicare Part A hospital insurance and Medicare Part B medical insurance when you turn 65.

Otherwise, you need to sign up for this coverage on your own.

Once your application is submitted, you can check on its status by:

- Logging in to your My Social Security account

- Visiting your local Social Security office

- Visiting the Check Enrollment page on your MyMedicare.gov account

To check the status of your Medicare application on the Social Security website, you will need to enter your Social Security number and the confirmation number you received when you filed your application.

Your application status will show:

- The date your application was received

- Any requests for additional documents

- The address of the Social Security office processing your application

- Whether a decision has been made about your application

Once your application is processed, you will receive a notification letter in the mail to inform you of whether your application was approved.

If you need help, or are unable to check your application status online, call the Social Security Administration at 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday.

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

Recommended Reading: How To Qualify For Extra Help With Medicare Part D