How Are Wellness Visits Covered

Welcome to Medicare and Annual wellness visits are covered at 100% by Medicare Part B and Medicare Advantage plans.

Original Medicare does not cover routine physical exams. But Humana includes a physical exam as a covered benefit in its Medicare Advantage plans, called an Annual Preventive Physical Exam . And Humana members can receive both the annual wellness visit and the APPE in one covered visit called a Comprehensive Physical Exam .

Find out what benefits are offered by the Humana Medicare Advantage plans available in your area by comparing plans online or calling to speak with a licensed insurance agent.

Medical Benefits Under Humana Medicare Advantage Plans

All Medicare Advantage plans offer Part A and Part B coverage, according to the Centers for Medicare and Medicaid Services. This means that you’ll get the same hospital and medical care benefits as Original Medicare with Medicare Advantage. However, many Medicare Advantage plans, including Humana Medicare Advantage plans, also offer additional benefits.

Depending on the Humana plan you enroll in, you may be eligible for:

- Dental coverage

- Vision care

- Prescription drug coverage similar to or more expansive than what you would get with Medicare Part D

- Coverage for annual preventive care with no additional copay

- Coverage for certain alternative and complementary modalities, such as acupuncture

There is no single Humana Medicare Advantage plan. Instead, Humana offers a wide range of plans in different insurance markets. Therefore, the specifics of your benefits will depend on the type of plan you sign up for, as well as the particular plans available in your area.

Among Humana’s Medicare Advantage offerings are health maintenance organization plans, preferred provider organization plans, private fee-for-service plans, and special needs plans . You can use the official Humana website to compare the coverage and benefits of each type of plan and view the specific plans available in your zip code.

The Basics Of Medicare

There are 4 different parts of Medicare:

Original Medicare Part A helps cover inpatient hospital care, skilled nursing care, hospice care and home healthcare. Generally, if you have worked and paid Medicare taxes for the past 10 years, you don’t pay a monthly premium for Original Medicare Part A.

Original Medicare Part B helps cover medical visits with doctors and other healthcare providers, outpatient care, home healthcare, durable medical equipment and some preventive services. Most participants pay a monthly premium for Original Medicare Part B.

Part C helps cover services provided for under Original Medicare Part A and Part B and may include prescription drug coverage . Part C is run by Medicare-approved private insurance companies.

Part D helps cover the cost of prescription drugs and may help lower the amount you pay for prescriptions. It’s run by Medicare-approved private insurance companies.

Visit Medicare.gov, opens new window for more information.

Recommended Reading: Is Victoza Covered By Medicare

Which Drugs Are Covered By Humana Medicare Plans

Humana Medicare plans cover a wide range of prescription drugs including everything from commonly prescribed generic drugs to rare, brand-name specialty medications.

A Humana drug formulary is divided into five different tiers of drugs and each tier may be covered differently under each Humana PDP plan.

- Tier 1 – Preferred, low-cost generic drugs

- Tier 2 – Non-preferred and low-cost generic drugs

- Tier 3 – Preferred brand-name and some higher-cost generic drugs

- Tier 4 – Non-preferred brand-name and some non-preferred high-cost generic drugs

- Tier 5- Highest-cost drugs including most specialty medications

Speaking to a licensed insurance agent is one way to determine if the drug you are taking is covered by a Humana plan.

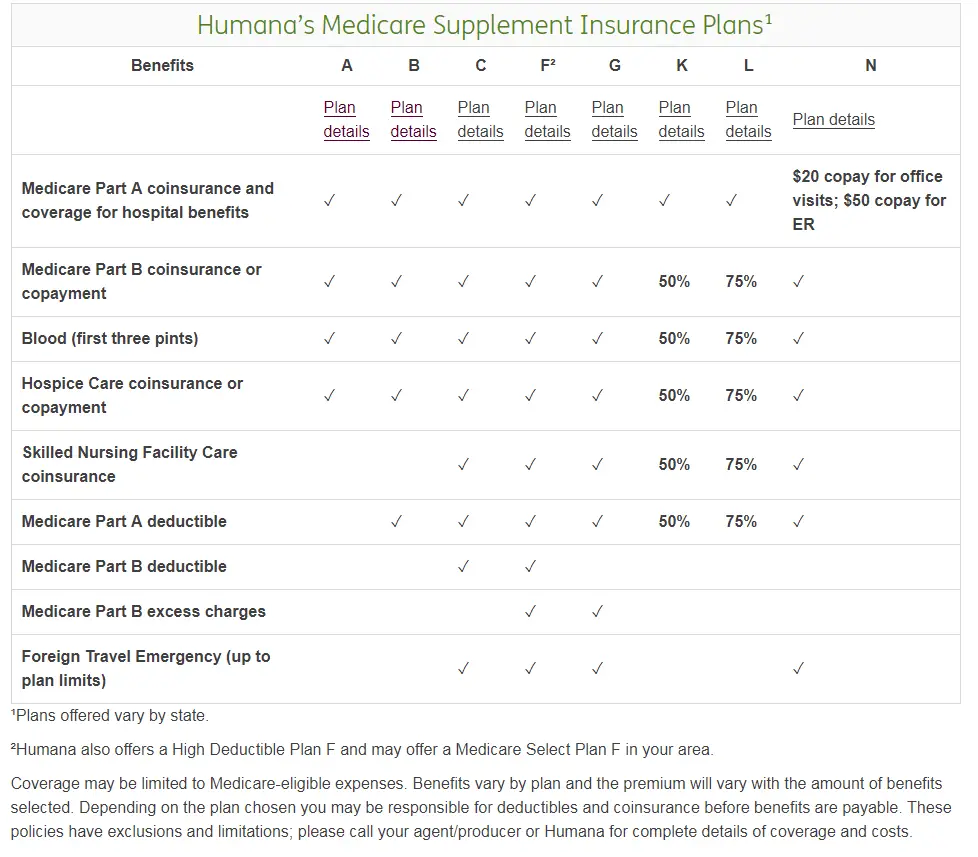

Humanas Medicare Supplement Insurance Plans

Even if you have Medicare parts A and B, there are still some healthcare-related costs that arent covered including copayments, coinsurance, and deductibles. To help offset some of these expenses, you may choose to purchase a Medicare Supplement Insurance Plan, also known as Medigap.You must:

- Be 65 years of age or if youre under 65, have a qualifying disability or end-stage renal disease

- Be enrolled in Medicare parts A and B

- Live in the state covered by the supplemental policy

There are a number of Medicare Supplement Insurance Plans offered by Humana and they range from Plan A to Plan N, each providing benefits for various copayments and coinsurances.

For instance, Medicare Supplement Insurance Plan A provides benefits related to Medicare Part A coinsurance and coverage, Medicare Part B coinsurance and copayments, blood, and hospice care coinsurance and copayment.

Medicare Supplement Insurance Plan G provides these same benefits plus benefits related to skilled nursing facility coinsurance, Medicare Part A deductibles, Medicare Part B excess charges, and foreign travel emergencies.

Generally speaking, Medicare Supplement Insurance Plans do not cover costs related to vision, dental, or hearing aids. They also dont typically provide benefits related to long-term care, private-duty nursing, or prescription drug coverage.

Recommended Reading: A Medicare Supplement Policy Must Not Contain Benefits Which

Plan Benefits For 2022 Humana Gold Plus H2486

Jump to:

Humana Gold Plus H2486-007 H2486-007 is a 2022 Medicare Advantage Plan or Medicare Part-C plan by Humana available to residents in Washington. This plan includes additional Medicare prescription drug coverage. The Humana Gold Plus H2486-007 has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit of $6,200 . This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $6,200 out of pocket. This can be a extremely nice safety net.

Humana Gold Plus H2486-007 is a Local HMO. With a health maintenance organization you will be required to receive most of your health care from an in-network provider. Health maintenance organizations require that you select a primary care physician . Your PCP will serve as your personal doctor to provide all of your basic healthcare services. If you require specialized care or a physician specialist, your primary care physician will make the arrangements and inform you where you can go in the network. You will need your PCPs okay, called a referral. Services received from an out-of-network provider are not typically covered by the plan.

Humana Prescription Drug Coverage Options

Many Medicare Advantage Plans typically provide some level of prescription drug coverage, and Humana offers three stand-alone Medicare prescription drug plans if that is the only type of coverage you need. They are:

Humana Walmart Rx Plan

This prescription drug plan offers lower costs if you fill your scripts at one of the 5,200+ Walmart or Sams Club pharmacies nationwide. They can be filled at other pharmacies, but at a higher cost. The premiums can be as low as $22.20 per month. Many also have $0 deductibles for Tier 1 or 2 medicines and copays as low as $1 for certain generic drugs.

Humana Preferred Rx Plan

Under this plan, you can use most any pharmacy youd like to fill your prescriptions, even via mail delivery if thats what you prefer. Copays are as low as $0 for generic drugs if you use a Humana Pharmacy, and premiums range from $22.50 to $41.70 per month with a $415 annual deductible.

Humana Enhanced

If youd like a prescription drug plan with no deductibles , Humana Enhanced is an option to consider. Copays are as low as $0 for mail delivery and $5 for in-network pharmacies, but they can go as high as $116 for Tier 3 brand-name drugs. If you have a Tier 4 or 5 drug, coinsurance costs range from 33 percent to 50 percent depending on the tier and whether you receive your prescription via mail or in person at a pharmacy .

Read Also: Does Medicare Pay For Medical Alert Bracelets

When And Howto Enroll

A person may enroll in one of the Medicare Humana Advantage plans during the Initial Enrollment Period. This 7-month window includes the 3 months either side of the month in which an individual turns 65.

If someone misses enrolling during this time, they may sign up during the annual open enrollment period from .

A person can find the Humana Advantage plans available in their area and compare costs using this tool. Once they have selected the plan that suits their needs, they may enroll by calling Humana on 1-888-204-4062.

As companies other than Humana offer Advantage plans, and prices vary among companies, it is a good idea to compare prices before buying. This tool shows the options from all of the companies serving a persons area.

More Articles About Humana Plans

1 $0 premium plans may not be available in all areas.

2 Humana Inc. Humana Reports Second Quarter 2021 Financial Results Maintains Full Year 2021 Adjusted EPS Financial Guidance. . Retrieved from https://humana.gcs-web.com/static-files/e12df80f-be23-47ec-b388-5e917524690e.

3 Humana. Learn more about Humana Medicare Advantage plans. Retrieved from www.humana.com/medicare/products/medicare-advantage.

4 Humana. Humana prescription drug plans . Retrieved from www.humana.com/medicare/products/drug-plan.

5 Humana. Medicare Supplement Insurance plans. Retrieved from www.humana.com/medicare/products/supplement.

6 TZ Insurance Solutions LLC/TruBridge licensed agents who may call you are not direct employees of Humana and are not connected with or endorsed by the U.S. Government or the federal Medicare program.

7 According to internal data from TZ Insurance Solutions in 2020.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC is a licensed and certified representative of Medicare Advantage HMO, PPO and PFFS organizations and stand-alone prescription drug plans with a Medicare contract. Enrollment in any plan depends on contract renewal.

For a complete list of available plans please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

To learn more about a plans nondiscrimination policy, please click here.

Y0040_GHHKP6XEN_2022

Read Also: Does Medicare Cover Home Health Care For Seniors

Mail Order Pharmacy For Prescription Drugs

| Preferred Generic | You pay the following until total yearly drug costs reach $2,930: $0 copay for a one-month supply of drugs in this tier from a preferred mail order pharmacy $0 copay for a three-month supply of drugs in this tier from a preferred mail order pharmacy. |

|---|---|

| Non-Preferred Generic | You pay the following until total yearly drug costs reach $2,930: $0 copay for a one-month supply of drugs in this tier from a preferred mail order pharmacy $0 copay for a three-month supply of drugs in this tier from a preferred mail order pharmacy. |

| Preferred Brand | You pay the following until total yearly drug costs reach $2,930: $45 copay for a one-month supply of drugs in this tier from a preferred mail order pharmacy $125 copay for a three-month supply of drugs in this tier from a preferred mail order pharmacy. |

| Non-Preferred Brand | You pay the following until total yearly drug costs reach $2,930: $95 copay for a one-month supply of drugs in this tier from a preferred mail order pharmacy $275 copay for a three-month supply of drugs in this tier from a preferred mail order pharmacy. |

| Specialty | 33% coinsurance for a one-month supply of drugs in this tier from a preferred mail order pharmacy. |

Humana Medicare Advantage Plans Reviews And Ratings

Humana rates consistently well across several review sites, with customers noting its professionalism, reliable coverage, and large provider networks. Humana received lower marks for coverage limits, especially related to prescription drugs.

Trusted ratings and reviews can help you understand how an insurers plans stack up against the competition. See how Medicare, A.M. Best, the Better Business Bureau and more rate Humana Medicare Advantage Plans.

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Recommended Reading: How Do I Join Medicare

Humana Medicare Supplement Review: Why It’s A Good Deal

Good for

- Those who want good rates during initial enrollment.

- Those who want perks like SilverSneakers.

- People who own multiple homes and need a nationwide company.

Bad for

- Those who prefer the convenience of Medicare Advantage.

- Those who value frustration-free customer service.

Find Cheap Medicare Plans in Your Area

Good for

- Those who want good rates during initial enrollment.

- Those who want perks like SilverSneakers.

- People who own multiple homes and need a nationwide company.

Bad for

- Those who prefer the convenience of Medicare Advantage.

- Those who value frustration-free customer service.

Humana offers a range of Medicare Supplement Insurance plans at affordable rates. Costs are about average compared to competitors, ranging from $120 to $314 per month for Medigap Plan G. Humana offers useful add-ons such as vision and hearing discounts, but the rate of customer complaints is higher than typical.

Insurance For Your Health And Financial Wellness

Medicare has transformed the nations healthcare system over the past 5 decades. To learn more, explore these .

Explore Medicare

Recommended Reading: Is Medicare Advantage And Medicare Supplement The Same Thing

What Are Medicare Supplement Plans

If you decide to stay with Original Medicare, you may want to consider a Medicare Supplement plan to help with your Part A and Part B out-of-pocket costs. Unlike other types of Medicare plans, benefits for Medicare Supplement plans are standardized at the federal level in most states . Premiums, however, may vary among plans.

Each standardized plan covers different combinations of out-of-pocket Medicare expenses, such as the Part A deductible and Part B coinsurance amounts. Some Medigap plans cover limited expenses for medical care during foreign travel.

Keep in mind that standard Medicare Supplement plans donât cover costs associated with routine vision, dental, and hearing care, prescription drugs, and long-term custodial care in a nursing facility. Some companies do offer innovative benefits above the standardized benefits such as vision and dental.

To start comparing Medicare plan options in your vicinity, just fill in your zip code in the zip code field at the top of this page.

*Out-of-network/non-contracted providers are under no obligation to treat Humana members, except in emergency situations. For a decision about whether Humana will cover an out-of-network service, we encourage you or your provider to ask Humana for a pre-service organization determination before you receive the service. Please call Humanaâs customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.

Humana Special Needs Plans

Humana also offers special needs plans for people who have specific conditions. An SNP plan can also be an HMO or a PPO. However, SNPs must always include Original Medicare benefits plus prescription drug coverage. Other benefits may include routine dental, vision, and hearing care, an OTC allowance, SilverSneakers membership, and a Healthy Foods Card.

Humana’s Chronic Condition SNPs cater to older adults with diabetes mellitus, cardiovascular disorders, chronic heart failure, and/or chronic lung disorders. The company’s Dual-Eligible SNP is for individuals who are eligible for Medicare and Medicaid. The plan combines your Medicare and Medicaid benefits in one plan that’s easy to manage.

Humana’s SNP plans are best for older adults who:

- Have a qualifying chronic health condition

- Are eligible for Medicare and Medicaid

- Live in one of the 28 states that Humana SNPs are offered in2

FYI: Humana also offers 9 out of the 10 standard Medigap plans to supplement your Original Medicare. Options vary based on your location. For more details, check out our Humana Medigap plans review.

You May Like: How Soon Before Turning 65 Do You Apply For Medicare

Summary Of Benefits For 2021 Humana Gold Plus H6622

Jump to:

Humana Gold Plus H6622-034 H6622-034 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Humana available to residents in Wisconsin. This plan includes additional Medicare prescription drug coverage. The Humana Gold Plus H6622-034 has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit of $4,500 . This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $4,500 out of pocket. This can be a extremely nice safety net.

Humana Gold Plus H6622-034 is a Local HMO. With a health maintenance organization you will be required to receive most of your health care from an in-network provider. Health maintenance organizations require that you select a primary care physician . Your PCP will serve as your personal doctor to provide all of your basic healthcare services. If you require specialized care or a physician specialist, your primary care physician will make the arrangements and inform you where you can go in the network. You will need your PCPs okay, called a referral. Services received from an out-of-network provider are not typically covered by the plan.

What Are Humana Medicare Advantage Plan Options

Humana offers nearly a dozen plans, including HMOs, PPOs, PFFS plans, and SNPs. Some plans dont have monthly premiums and have relatively affordable out-of-pocket costs, with visits to primary care doctors ranging from $0 to $15 and visits to specialists from $20 to $45. In addition to covering medical and hospital care, all plans include memberships for SilverSneakers, and many have an allowance for over-the-counter medications. Plans vary depending on your location. Check available options in your area.

These are among the most popular Humana Medicare Advantage Plans:

Humana Medicare Advantage Plans

*Based on pricing in Chicago, IL in 2022

Don’t Miss: How Old Before Eligible For Medicare