Bankers Fidelity: Highest Rated Senior Experience With A Medicare Insurance Company

Bankers Fidelity has been serving Seniors on Medicare for over 65 years. With an A- rating from both AM Best and S& P, Bankers Fidelity remains a successful Medicare insurance company.

| Bankers Fidelity Pros: | Bankers Fidelity Cons: |

| Bankers Fidelity offers a large plan selection nationwide. | Medicare Supplement plans are only available in 37 states. This carrier is unavailable in many highly-populated states, such as California, Florida, and New York. |

| The company has been around for several years and has always had a very high rating compared to other insurance companies. | Medicare Supplement plan premiums tend to vary significantly by location. In some areas, plans are priced extremely high, and in others, the monthly premium is very low. |

Do These Plans Differ Across Insurance Providers

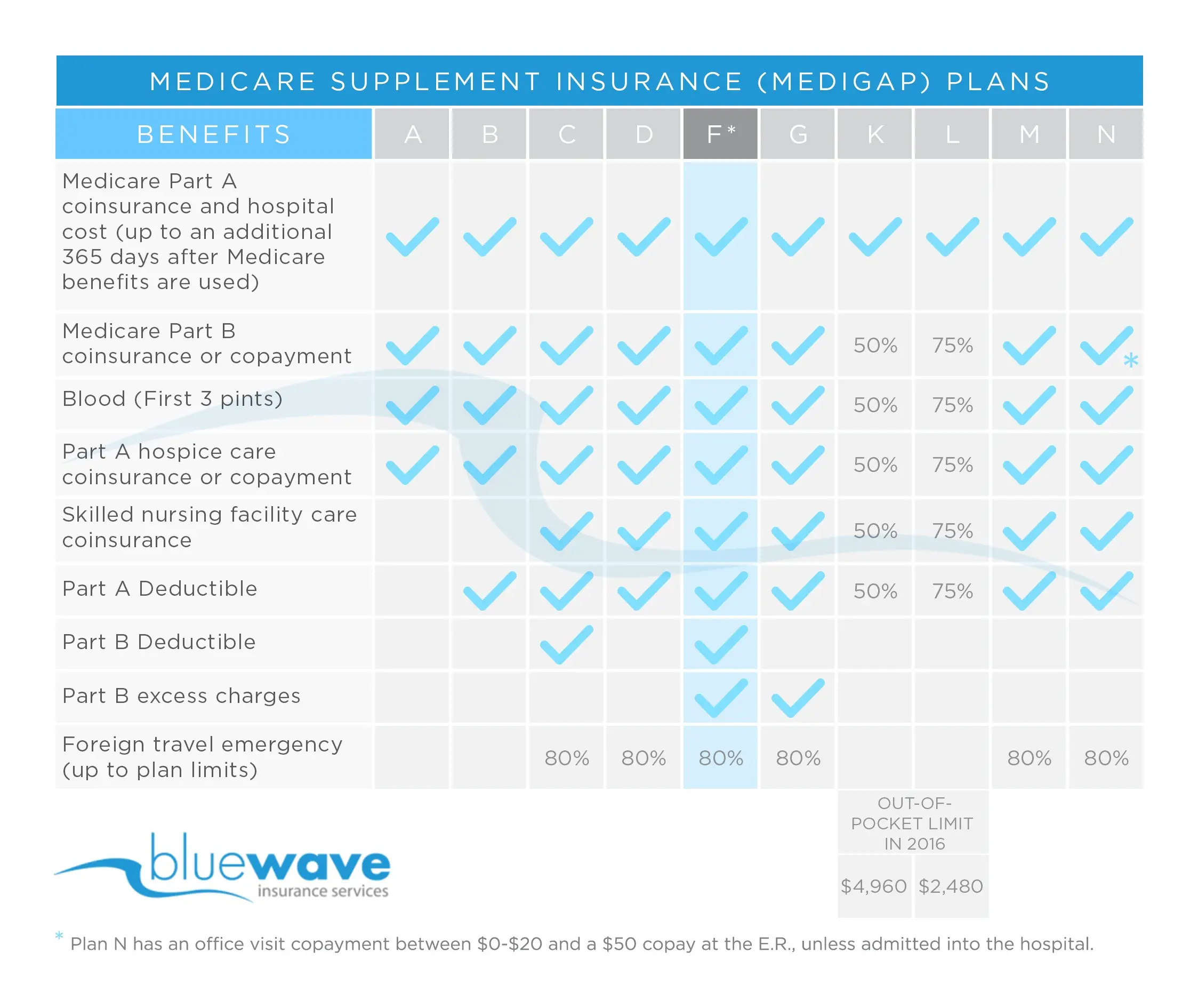

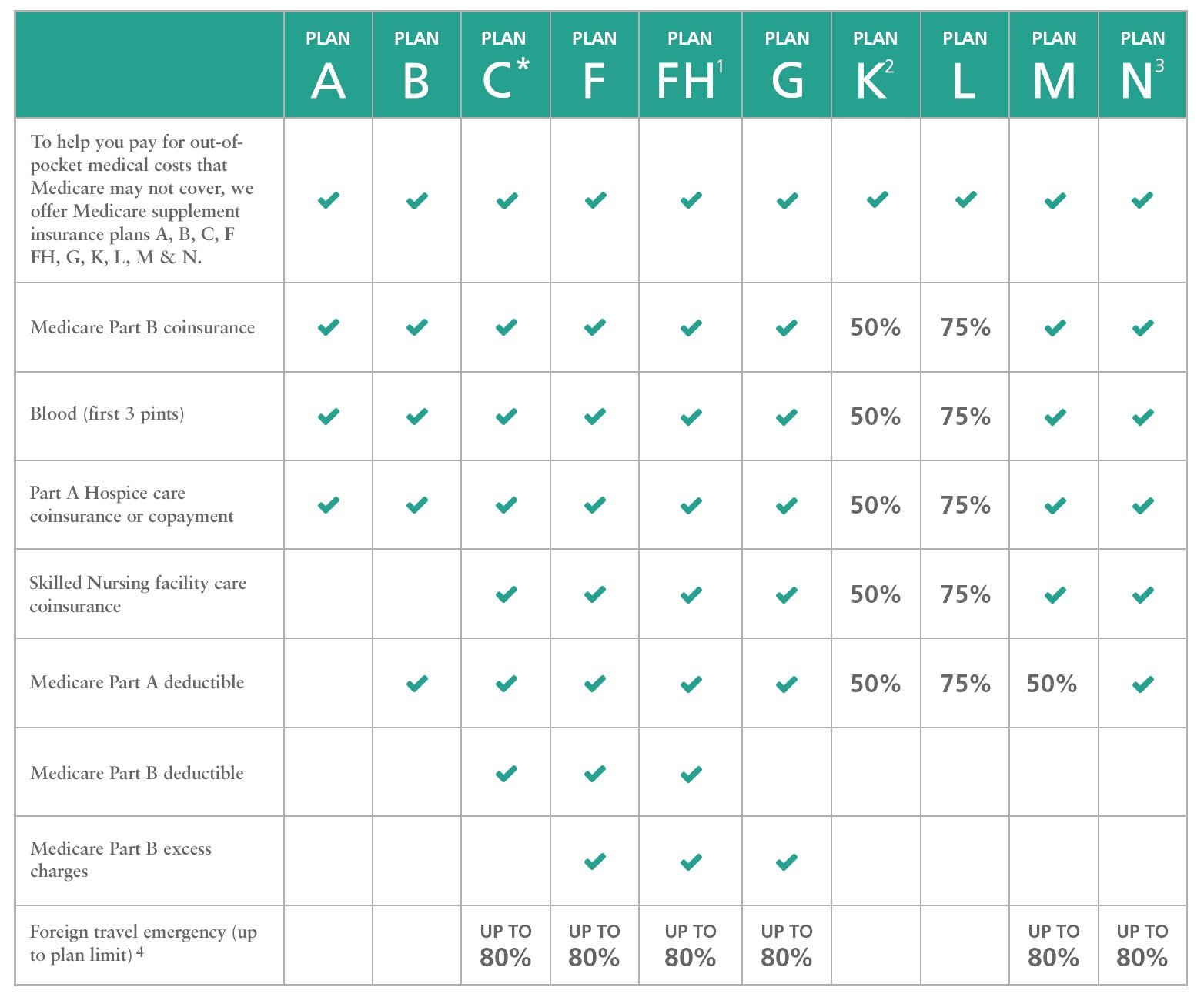

One of the best things about Medicare supplemental insurance is that it is standardized by the federal government. The same 10 plans are available to choose from regardless of which insurance carrier you go through. However, not every plan is available in every state.

When you decide to choose a Medicare supplemental insurance plan, it’s important to make sure it is available in your area via your chosen carrier. And part of why it is so important is that most with this supplemental insurance keep it in the long-term.

Remember when we said that your carrier can’t deny you coverage later on so long you make your payments? If you switch to a new carrier after developing a health condition, you may be denied coverage. So you have a powerful incentive to find the right insurance carrier and effectively lock down the plan that you need.

Let’s review which of the 10 supplemental insurance plans are best for certain applicants.

Plan F: Best Medicare Supplement Plan For Coverage

As you can see by the chart above, there is one Medicare Supplement plan that stands above the rest when it comes to the benefits offered.

Plan F is the only Medigap plan to offer coverage in each of the nine benefit areas offered by this type of insurance. Members of Plan F enjoy little to no out-of-pocket expenses because their Medigap plan picks up nearly all health care costs not paid for by Original Medicare . Roughly half of all Medigap beneficiaries are enrolled in Plan F.

However, Plan F does come with one downside. Federal legislation has made Plan F off-limits to anyone who first became eligible for Medicare on or after January 1, 2020. Only those who became eligible for Medicare before that date may enroll in Plan F. Because of that rule, we can expect to see Plan F enrollment decrease every year until it eventually no longer exists.

Medigap Plan C is the only other type of Medigap plan that is subject to the same enrollment rule as Plan F. If you were eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C if either plan is available where you live.

Also Check: Is Medicare Getting A Raise

How Much Does Medicare Supplement Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

Compare Medigap Plan Costs

Deductible, coinsurance and copayment coverages are standardized between companies. However, the monthly price may vary greatly between companies depending on your age, where you live and discounts. To make sure a plan is financially beneficial, multiply the monthly premium by 12 and add any out-of-pocket cost you may need to spend. Weigh that cost against the chance youâll spend more than that amount on health care if you do not have supplement insurance.

- Monthly premium: Monthly premiums for the same types of policies vary from insurer to insurer, so you should get multiple quotes before choosing a policy.

- Discounts: Some companies offer discounts for paying your premium in full annually, paying electronically, being married or being a nonsmoker. Consider getting quotes from companies you already have policies with, and ask the agent if discounts exist for current customers.

Don’t Miss: Is Medicare A Federal Program

What Is The Best Medicare Supplement Plan For 2022

Original Medicare is a federal healthcare program that leaves out-of-pocket costs for enrollees. When you have Original Medicare, you do not have 100% coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

To fill this coverage gap, many seniors enroll in a Medicare Supplement plan to help cover the costs that Original Medicare leaves for you. Knowing the best Medicare Supplement plans for 2022 can ensure you receive the most complete coverage possible.

Plan G: Best Medicare Supplement Plan For New Enrollees

Because of the enrollment rules tied to Plan F, new enrollees are barred from enrolling in that popular plan. So whats the best Medigap plan for someone who became eligible for Medicare after Jan. 1, 2020?

Plan G offers all of the same benefits as Plan F except that it doesnt pay for the Medicare Part B deductible. The Part B deductible is $233 per year in 2022, so its a relatively small cost requirement when compared to some other types of Medicare out-of-pocket copays and deductibles. And the monthly premiums for Plan G are typically lower than those of Plan F, which can more or less cancel out the Part B deductible cost.

Plan D is another candidate for the best Medigap plan for new enrollees. Plan D offers the same coverage as Plan G with the exception of Medicare Part B excess charges. However, excess charges can usually be avoided simply by making sure to only visit health care providers who accept Medicare assignment.

Recommended Reading: How Do I Get Part A Medicare

United American: Best User Experience For A Medicare Insurance Company

United American Insurance Company began in 1947, offering Medicare insurance options since 1966. Currently, the company maintains an A+ rating from AM Best and has done so for over 40 years. However, S& Ps rating for United American is AA-.

United American offers many top Medicare Supplement plans but is most well-known for its Medicare Supplement High Deductible Plan F and High Deductible Plan G policies. A key reason why many people on Medicare choose United American is their two-year policy anniversary rule.

United Americans two-year policy anniversary rule allows those who enroll in a high-deductible plan to switch to the standard version of their plan on the two-year anniversary of the policy with no underwriting health questions. This means you cannot face denial due to pre-existing health conditions. Thus, if you have Medicare Supplement High Deductible Plan G with United American and would like to switch to Medigap Plan G through the same carrier, you can do so after two years.

| United American Pros: | United American Cons: |

| Carrier specializes in high-deductible Medicare Supplement plans. They consistently have the lowest premium costs in most areas. | Very few Medicare Supplement plans are available through this carrier in most areas. |

| United American receives some of the highest customer ratings and few customer complaints. | Standard Medicare Supplement plan premiums are typically higher than other carriers. |

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

| Plan A | |

|---|---|

| Part A hospice care coinsurance | 50% |

| Medicare Part B excess charges | |

| Foreign travel emergency | |

| $114-$239 | $102-$302 |

Prices for policies are based on a sampling of quotes for a 65-year-old female nonsmoker. Rates vary by location, age, gender and other factors.

= 100%

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

Read Also: Where To Apply For Medicare Part D

Choose A Regular Or High

If you would like a Medicare Supplement Plan and choose Plan G, decide if you would like a Regular or a High-Deductible Plan G. High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible, which was set at $2,490 for 2021. These plans will have lower monthly premiums than a regular plan. You will need to decide if paying more in monthly payments makes more sense financially than paying higher costs when you need care.

The Cost Of Medicare Supplement Plans In New York

The cost of your Medicare Supplement insurance in New York can differ greatly based on your preferred plan type and company. Empire Blue Cross Blue Shield offers the most affordable rates for Plan A, B and N, EmblemHealth provides the lowest monthly premium for Plan C, G and F, and UnitedHealthcare is the cheapest provider for Plan K and L.

To determine your rates, companies use one of the three pricing styles:

- Community-Rated: This is the most common pricing style in New York. Providers using this method charge the same monthly premium to everyone, regardless of age.

- Attained-Age: This pricing style bases premiums on your current age, which means your rates increase as you get older. None of the providers in New York use this method.

- Issue-Age: With this, your premium depends on how old you are when you buy your plan. This pricing style isnt used by companies in New York.

Average Cost of Medicare Supplement in XXXX

Sort by Plan Letter:

Also Check: How Do I Choose The Best Medicare Advantage Plan

The Best Medicare Supplement Companies Of 2022

PayingForSeniorCare is committed to providing information, resources, and services free ofcharge to consumers that help seniors and their families make better decisions about senior living and care.

We may receive business-to-business compensation from senior care partnerships and/or website advertising. This compensation doesnt dictate our research and editorial content, nor how we manage our consumerreviews program. PayingForSeniorCare independently researches the products and services that oureditorial team suggests for readers. Advertising and partnerships can impact how and where products,services, and providers are shown on our website, including the order in which they appear, but theydont determine which services or products get assessed by our team, nor which consumer reviews getpublished or declined.

PayingForSeniorCare.com awards some companies with badges and awards based on our editorial judgment. We dont receive compensationfor these badges/awards: a service provider or product owner may not purchase the award designation orbadge.

Learn moreabout our mission and how we are able to provide content and services to consumers free of charge.

- Monthly Plan Premiums Start at $0

- Zero Cost, No Obligation Review

- Find Plans That Cover Your Doctors and Prescription Drugs

| 9 | 18 |

What Is Medicare Supplemental Insurance

Medicare supplemental insurance is special coverage designed to help you pay for what your Original Medicare didn’t cover. Such insurance is one of the best ways you can save money on out-of-pocket expenses.

The exact Medicare supplemental insurance options available are determined by the government. There are 10 different supplement plan options, and it is up to each person to determine which plan is right for themselves and their needs.

Like other forms of insurance, Medicare supplemental insurance requires that you pay a monthly premium. If you are on a budget, it’s important to find a plan that will actually save you money over time.

Recommended Reading: Are Medicare Advantage Premiums Deducted From Social Security

What You Need To Know To Choose

- Consider the monthly premium price. Medicare supplement insurance is highly regulated insurers must offer essentially the same coverage for each of the 10 types of Medicare supplement policies. Make sure you can handle the monthly expenses and you are comfortable with the value.

- Calculate the total out-of-pocket costs. Include your monthly premium and an estimate of Part D drug coverage, which Medicare supplement plans dont include.

- Check out incentive benefits. Some insurers offer Medicare supplement customers incentives such as a discount on dental, hearing or vision insurance purchases. They may also have free or discounted gym plans.

- Consider these issues. The most popular is Plan F, but it is no longer available to new enrollees. Plan G and Plan G high deductibles are similar, but they dont cover the Medicare Part B deductible, which Plan F does. They do cover Part B excess charges, which can be an advantage if the healthcare provider you pick charges more than Medicare allows. Another popular feature available in Plan G and some of the other plans is coverage of foreign travel emergencies.

- Evaluate customer service. Good customer service is what sets Medicare supplement plans apart. Asking friends and neighbors who subscribe is a way to rate customer service in your area.

Numerous supplemental plans from which to choose

Ten basic Medigap policies exist, each with different benefits.

How We Chose The Best Medicare Supplement Insurance Companies

The world of insurance is large and there are hundreds of companies across the country offering Medicare Supplement plans. So, to narrow it down and choose the best companies in the industry, we took the following factors into consideration:

Variety of Plans OfferedWhile there are countless companies offering Medicare Supplement Insurance, many only offer a couple of policies out of the 10 available. We focused our search on companies that are able to provide a majority of the available plans. These companies give potential customers the greatest amount of options to select a plan that fits their needs.

Number of States ServedThere are many insurance companies around the country that only offer Medicare Supplement Insurance in a handful of states. While its difficult to find true nationwide coverage, the companies featured on our list are able to serve a majority of the country. However, not all plans will be offered in all places.

Company IntegrityWhen purchasing something as important as health insurance, its vital to select a provider you can trust. Because of this, we focused our search on companies that are widely regarded as trustworthy and have a long history of providing customers with insurance services. To determine this, we looked at factors like awards won, Better Business Bureau ratings, and customer reviews.

Don’t Miss: Does Medicare Pay For Inogen Oxygen Concentrator

How To Shop For Medicare Advantage Plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

-

Check star ratings. The CMS collects data on Medicare Advantage plans from member surveys, the plans themselves and medical providers, and then assigns a star rating based on the results. The star rating is on a scale of 1 to 5, with 5 being best.

-

Compare out-of-pocket costs. Each plan will have a monthly premium and a maximum out-of-pocket cost, which is the most youll pay in a year for covered health care.

-

Keep your meds in mind. Your medications may seem like an afterthought, but make sure you investigate how each plan will cover your medications or whether theyre covered at all.

-

Look for your doctors. If youve got a list of caregivers and medical facilities you use and prefer, look for plans that include them.

-

Consider the plan type. If you see specialists frequently and you dont want to seek a referral for every office visit, a PPO plan is probably the better fit. If youre a light health care user and see mostly your primary care physician, an HMO might be more affordable.

Top 10 Medicare Supplement Insurance Companies In 2022

Home / FAQs / Medigap Plans / Top Medicare Supplement Companies

When shopping around for a Medicare Supplement policy, it is helpful to be familiar with the top 10 Medicare Supplement insurance companies. Whether youre new to Medicare or are considering supplemental coverage a few years after enrolling in Medicare, we provide the information you need to make the best decision possible.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

We assess several elements for a Medicare Supplement insurance company to be one of the best. Factoring into our choices for the top companies are consumer reports, AM Best rating, Standard and Poor rating, and the companys number of years in the market. Knowing about a carrier is essential when comparing Medigap rates to find the best policy for you.

Don’t Miss: Can I Change From Medicare Supplement To Medicare Advantage