What Youll Need To Enroll In Medicare

To enroll in Medicare, you will need documents that prove your identity. These may include your Social Security number, drivers license, and passport. You may also need to verify your place of birth and citizenship status and provide information about your spouse, children, and place of employment if applicable.

You can sign up for Original Medicare online by creating an account with the Social Security Administration. You can also call your local Social Security office for more information.

When Working Past : 8

For people who work past 65 and qualify to delay Medicare with creditable employer coverage, there is an 8-month Special Enrollment Period that allows you to enroll in Part A , Part B , Part C and Part D without late penalties.

This Special Enrollment Period is tricky though. Why? Because while you have the whole 8 months to get Parts A & B, you only get the first 2 months to enroll in Part C or Part D without penalty. If you enroll after the two-month mark, youll face late enrollment penalties for Part D .

To qualify for the Part B Special Enrollment Period, you must have creditable employer or union health coverage based on current employment. Your Special Enrollment Period will begin eight months after your employer coverage ends or you leave your job, whichever happens first.

Will I Pay A Penalty If I Enroll During The Gep

If you went at least a year without Part B after you were initially eligible to enroll, you may owe a late enrollment penalty. The penalty does not apply if you qualify for a Part B special enrollment period. But if youre enrolling during the GEP, you may find that you owe a penalty.

The penalties are different for Part A and Part B:

- Part A: The penalty is an additional 10% added to the premium, for twice the number of years you delayed Part A coverage. This is only applicable to people who have to pay a premium for Part A most people do not.

- Part B: The penalty is an additional 10% added to the premium for each year that you delayed your coverage . This penalty continues forever.

How to avoid common Medicare open enrollment mistakes

Medicareresources.org announced today the release of its 2022 Medicare Open Enrollment Guide and provided five tips for evaluating and selecting Medicare coverage.

How and when you can change your Medicare coverage

Learn how and when you can enroll in Original Medicare, Medicare Advantage, Part D and Medigap. Learn how to choose the best plan how to change your coverage.

The Medicare Part B special enrollment period

The Medicare Part B SEP allows people to delay Part B enrollment if they have health coverage through their own employer or a spouses current employer.

Also Check: How To Report A Death To Medicare

Is There A Medicare Special Enrollment Period When Dual Eligible For Medicare And Medicaid

When eligible for Medicare and Medicaid, you can choose to change plans, whether you are switching, joining, or dropping plans. Changing plans is an option because dual-eligibility and low-income subsidy qualify you for a Medicare Special Enrollment Period.

You can do this once throughout the following dates:

Those getting Extra Help can make changes once during the above time frames.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Enrolled in an SPAP Program

You can choose to join a Medicare plan once during the calendar year.

Enrolled in an SPAP Program and you lose eligibility

You can choose to join a new Medicare plan. This is possible either the month that you lose your eligibility or when you get the notification.

Suffer from a severe condition

If theres a Medicare Advantage Special Needs Plan and you have a severely disabling condition, you can join a Medicare Chronic Care SNP at any time.

Errors by a Federal Employee

If you join a plan or decide to not participate because of a mistake by a federal employee, you have a few options.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You can choose to:

- enter a new Medicare plan

- switch from your current policy to a new one

- drop your Medicare Advantage plan and return to Original Medicare

- or drop your drug coverage.

These changes can take a full two months after the month you receive notification of the error.

What Is The Special Enrollment Period For Medicare Advantage Plans

When it comes to Medicare Advantage Plans , there are a number of reasons that you can qualify for a special enrollment period, says Armbrecht. These may include:

- If you move and your plan is not available in the new location.

- If you move to a location with other plan options.

- If you return to the United States after living abroad.

- If you are released from prison.

- If you leave an employer that had coverage.

- If you get the chance to enroll in other coverage though employment or a spouse.

- If you enter or leave a nursing home or other care facility.

- If you had Medicaid, but are no longer eligible.

Another big one is if you develop a chronic condition, says Armbrecht. There are Medicare Advantage plans that specialize in certain chronic conditions like diabetes. So there is a special enrollment period to find the right plan for your needs, he says.

Read Also: How To Apply For Medicare In Kentucky

How Do I Know If I Qualified For A Sep

Those unsure about eligibility should talk to a licensed insurance agent. Working with an agent helps you to understand the options available in your area that youre eligible for enrolling.

If youre recently moved and havent notified Medicare or your Medicare plan about the move, you need to immediately. This is also so you can ask about specific dates of enrollment eligibility.

If youre losing coverage or your coverage is changing, you may be eligible for a SEP. Those with Medicaid, extra help, or other assistance may have additional SEPs that allow more frequent plan changes.

Those with chronic health issues can enroll in a Medicare Advantage Special Needs Plan anytime during the year. Qualifying for this type of plan is a SEP on its own.

Contact a Medicare expert to guide you if you want to change your coverage. You may be eligible for a Medicare special circumstance.

Other Medicare Special Enrollment Periods

There are some additional circumstances that could trigger a special enrollment period for you. One relates to Medicare Star Ratings, which are released by CMS.

Star ratings are a way to compare how good different Medicare Advantage plans are. The lowest rating a plan can earn is one star, with the highest rating being five stars. The rating is based on how effective the plan is in serving its beneficiaries.

You may be eligible for a special enrollment period to switch to a five-star plan if one is available in your area. This period lasts from Dec. 8 to Nov. 30 each year and can only be used once.

You also can be eligible for a special enrollment period if you qualify for Extra Help to pay for drug coverage or if youre eligible for both Medicare and Medicaid.

If you have Extra Help or Medicaid, you can make changes to your coverage one time from January to March, April to June or July to September.

In 2023, CMS also added an additional qualifier for those who miss their enrollment window. If you miss an enrollment period due to circumstances such as an emergency, natural disaster or incarceration, then you would become eligible for a special enrollment period.

You May Like: How Much Money Can I Make On Medicare

How To Avoid Part D Late Enrollment Penalties When You Retire After 65

During this Special Enrollment Period, you can enroll in a Medicare Advantage or stand-alone Medicare Part D Prescription Drug Plan. However, the timing is slightly different.

You have 8-months to enroll in Medicare Parts A and B during this Special Enrollment Period. But you only have 60 days to enroll in a Medicare Advantage or Medicare Part D Prescription Drug Plan. If you dont enroll in those first two months, you may face late enrollment penalties for Part D coverage.

How To Avoid Penalties

Keep in mind: If you delayed signing up for Medicare because you or your spouse were working, you need to enroll within eight months of losing your health insurance. Otherwise, you may have to pay a late-enrollment penalty.

This amounts to 10 percent of your Part B premium for each 12-month period you could have had Part B but didnt enroll. If you had job-based coverage during that time, those months wont count when the penalty is calculated.

To prove that you had health insurance, the employer who provided the insurance should fill out Form CMS-L564 and send it to the Social Security office along with your application.

Images: Social Security Administration Centers for Medicare & Medicaid Services

This story, published Jan. 28, was updated to reflect the opening of Social Security local offices.

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

More on Medicare

Don’t Miss: Does Medicare Cover Rides To Medical Appointments

Is There An Open Enrollment Period For Medicare Supplement Plans

Your Medicare Supplement Open Enrollment Period begins the first day of the month your Medicare Part B becomes effective. This six-month enrollment period grants you guaranteed issue rights for any Medigap plan available to you. However, many carriers allow you to enroll in a Medicare Supplement plan up to six months before your Medicare Part B start date.

A Medicare Supplement plan is essential for Medicare enrollees who wish to pay as little out-of-pocket for healthcare coverage as possible. Medicare Supplement plans cover the costs that Medicare Part A and Part B leave behind, eliminating the high expenses associated with Medicare coverage.

Enrolling in Medigap during a guaranteed-issue period is essential. Especially if you have pre-existing conditions that could result in denial of your policy in the future.

If you miss your Medicare Supplement Open Enrollment Period, you can still apply for Medigap coverage throughout the year. However, there is still a chance of denial due to underwriting.

Other Ways To Sign Up

If you dont want to enroll online, print the form and mail it, fax it or bring it to your local Social Security office. Alternatively, you can fill out Form CMS-40B and have the employer who provides your health insurance complete Form CMS-L564. If the employer is unable to complete the form, you can submit the documents that show you had health insurance.

Social Security offices opened April 7 after being closed during the COVID-19 pandemic. To avoid long lines, contact your local office to find out whether you can go in person or must mail your application.

To find your local office, use the Social Security field office locator. If you want to mail your application, use certified mail, which provides confirmation that your document was delivered. Another option is to fax the application to 833-914-2016.

You May Like: What Is The Donut Hole In Medicare Coverage

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

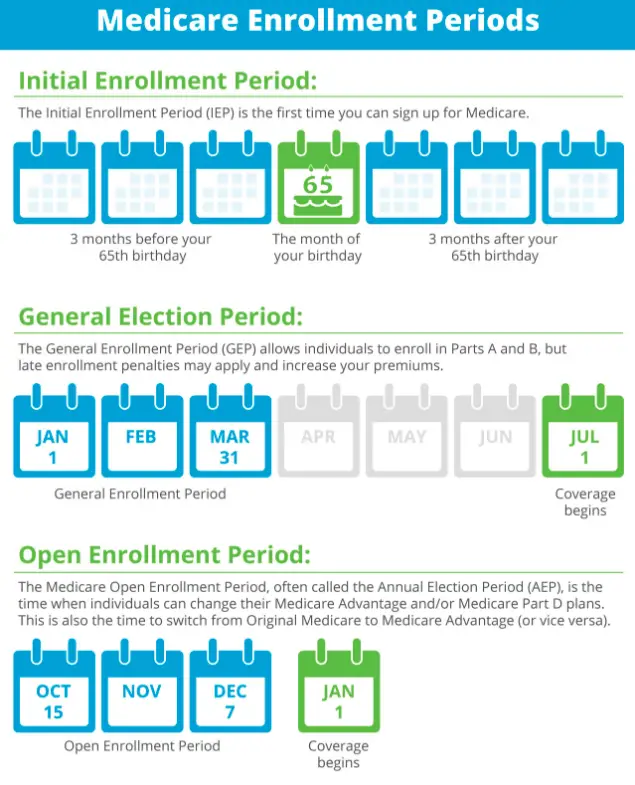

What Is The Medicare Enrollment Period

Medicare enrollment periods can be confusing because different enrollment periods have different dates for various purposes. There are many enrollment periods for people signing up for Medicare benefits for the first time. When you are new to Medicare, you may not need to apply for benefits. You could be automatically enrolled in Medicare coverage if you meet a few requirements.

If you do not qualify for automatic enrollment, you will need to utilize the Initial Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Don’t Miss: Does Medicare Cover Roho Cushions

Enroll In Medicare Part B

You can also enroll in Medicare Part B during your IEP. The basic premium is $170.10 per month in 2022, but may be higher depending on your income and may change each year.

Who it is best for

Part B is a good choice for eligible adults who no longer have employer-sponsored health coverage. If you have health insurance from your employer, you can delay Part B enrollment until that coverage ends because employer-sponsored healthcare may be more cost-effective and comprehensive.

Late enrollment penalty

You can enroll in Part B after your IEP, but will incur a late enrollment penalty unless you qualify for a Special Enrollment Period. This penalty is a 10% increase to your monthly premium for each year you could have enrolled but did not. Unlike the Part A penalty, this premium increase is permanent.

For example, if you delayed enrollment by 4 years, you may incur a 40% premium increase as a late enrollment penalty.

How to enroll late if you delayed

If you delayed enrolling, you can sign up for Part B during the General Enrollment Period or during a Special Enrollment Period if you are eligible. Your coverage starts the month after you sign up.

Medicare Special Enrollment Period For International Volunteers

Individuals volunteering in a foreign country may be able to enroll in Part A and/or Part B with a Medicare Special Enrollment Period when they return to the United States. To qualify for a Medicare Special Enrollment Period, you must:

- Have volunteered for at least 12 months outside of the United States

- Have volunteered for a tax-exempt program

- Have had other health coverage for the duration that you served overseas

Also Check: Dental Coverage With No Waiting Period

Also Check: How To Apply For Medicare In San Diego

Enroll In Medicare Part D

Your IEP allows you to enroll in Medicare Part D as long as you also enroll in either Part A or Part B at the same time.

Who it is best for

Part D provides prescription drug coverage. If you do not have drug coverage through an employer or Medicare Advantage plan, Part D can help you pay for your medications. Even if you do not currently take medications, having active Plan D coverage can help protect you against drug price increases so long as your coverage remains active.

Late enrollment penalty

If you choose not to enroll in Part D during your IEP and forgo any type of drug coverage for more than 63 days, you may be subject to a late penalty. This penalty adds 1% to your premium for each month you could have enrolled but did not, and this remains for as long as you have Part D coverage.

For example, if you delayed enrolling in Part D for 12 months, you may incur a 12% premium increase as a late enrollment penalty for as long as you have Part D coverage.

How to enroll late if you delayed

If you delay enrollment, you can sign up for a Medicare drug plan during the Annual Enrollment Period .

How Can I Get Help With Enrollment

If youre having trouble navigating the Medicare enrollment process, dont hesitate to reach out for help. There are a number of organizations that can help you sign up for Medicare and navigate the enrollment process.

If youre having trouble navigating the Medicare enrollment process or youre not sure if you qualify for help, there are a number of organizations that can help you sign up for Medicare and navigate the enrollment process.

If youre confused about your options or want to make sure youre getting the best coverage possible, you can also speak with a Medicare representative. You can do this by calling the Medicare helpline or by meeting with a representative in person at an enrollment event.

You May Like: Is Oral Surgery Covered By Medicare

Exceptional Conditions For Medicare Seps

CMS has the legal authority to establish SEPs when a person or group of people meet certain exceptional conditions. Some of these conditions include:

- Individuals making MA enrollment requests into or out of employer-sponsored MA plans

- Individuals disenrolling from an MA plan to enroll in the Program of All-inclusive Care for the Elderly

- Individuals who dropped a Medicare Supplement insurance plan when they enrolled for the first time in an MA plan and are still in a trial period

- Individuals enrolled in a Special Needs Plan who are no longer eligible for the SNP because they no longer meet the specific special needs status

- Non-U.S. citizens who become lawfully present in the U.S.

What Is The 5

Medicare gives overall performance star ratings to Medicare plans on a five-point scale, with five stars being the best. These ratings are based on information from the plans themselves, health care providers and member surveys. They are updated each year.

If youre not currently in a five-star Medicare Advantage plan, Medicare drug plan or Medicare cost plan, and theres one available in your area, you can switch to a five-star plan during a special enrollment period. Each year the SEP goes from Dec. 8 to Nov. 30 the following year, and you may change only once during that time.

There are some caveats:

-

If you switch from a Medicare Advantage plan with prescription drug coverage to a stand-alone Medicare prescription drug plan, youll be disenrolled from the Medicare Advantage plan and enrolled in Original Medicare for health coverage.

-

Suppose you switch from a Medicare Advantage plan with prescription drug coverage to a Medicare Advantage plan that doesnt include prescription drug coverage. In that case, you might lose your drug coverage, and you may have to wait until the next official enrollment window to sign up again.

» MORE:Best Medicare Advantage plans in 2022

Read Also: Can I Choose Marketplace Coverage Instead Of Medicare