Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Don’t Miss: What Is The Average Premium For Medicare Advantage Plans

You Can Receive Medicare Without Taking Your Social Security Benefits

Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA taxes during their working years.

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

Even if you are eligible to start receiving benefits, you do not have to start taking them. In some cases, it may be better to delay or to start taking benefits from one program but not the other.

Can You Delay Social Security

Many people say that they fear running out of money after they retire. Protect your future income by making a smart choice about when to begin taking Social Security. This program provides inflation-adjusted income for as long as you live. But, all future increases are based on your starting benefit. So, if you wait until your full retirement age or later, you stand to earn more.

You do not need to start getting benefits as soon as you retire. So if you choose to stop working at 62, that doesn’t mean you have to start getting Social Security at 62. You will get a larger monthly payment by waiting to collect until you are older.

You can also use strategies for married couples to get more out of your joint benefits. Working together to create a plan will help you get more money over time.

In fact, married couples who choose wisely about how and when to collect benefits may jointly receive many thousands more than those who collect early. You can use a Social Security calculator to figure out your best options.

If you have enough saved, you may want to think about using your savings to cover expenses for a while after you retire. This will allow you to delay the start date of your Social Security. Doing so can lock in a higher income amount later. That will help protect you from outliving your money.

Read Also: Does Medicare Require A Referral For A Colonoscopy

What Are The Typical Age Requirements For Medicare Coverage

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs. If you are not eligible for premium-free Part A because you have not worked and paid Medicare taxes, but are a citizen with permanent residency and are 65, you can pay premiums to have Part A coverage. If your spouse has worked long enough to qualify for premium-free Part A, your Part A premiums will be free after your spouse turns 62.

When you meet the requirements for Part A, you also qualify for Medicare Part B which helps cover medical out patient costs such as doctors visits, urgent care, durable medical equipment , some preventive care, and more. If you have Part B, there is a monthly premium you pay, which is $148.50 for 2021, and an annual deductible of $203.

Can You Draw Social Security And State Retirement At The Same Time

When you retire, you will receive your public pension, but dont count on getting the full Social Security benefit. Under federal law, any Social Security benefits you earned will be reduced if you were a federal, state, or local government employee who earned a pension with wages not covered by Social Security.

What is the maximum amount of Social Security retirement you can draw?

What is the maximum of social security? The maximum that an individual filing for Social Security retirement benefits in 2021 can receive per month is: $ 3,895 for someone filing at age 70. $ 3,148 for someone presenting at full retirement age .

Will my retirement check affect my Social Security benefits?

We will reduce your Social Security benefits by two thirds of your government pension. In other words, if you get a monthly civil service pension of $ 600, two-thirds of that, or $ 400, must be deducted from your Social Security benefits.

Recommended Reading: How Do I Change Medicare Supplement Plans

Exceptions To Medicare Age Requirements

While you are typically not eligible for Medicare unless you are 65 and a U.S. citizen, there are some other ways that you can qualify.

If you have been receiving Social Security disability insurance for two years or more, you can be eligible for Medicare early.

You can also enroll if you have ALS or end-stage renal disease. In these circumstances, you are exempt from the requirement to have been on disability insurance for two years.

If you meet none of these requirements, you will have to wait until your standard eligibility period. According to AARP, your initial enrollment period will begin three months before the month of your 65th birthday.

Original Medicare is split into two parts, Part A and Part B. Unless you meet the above requirements, neither part is available to you early.

There is a third part, Part C, which is also known as Medicare Advantage. Private insurers provide Part C plans which offer expanded benefits and coverage like vision and dental.

Prepare for Medicare Open Enrollment

Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are other ways you may be eligible for Medicare at age 62:

- Or, you have been diagnosed with End-Stage Renal Disease

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months

- Are getting dialysis treatments or have had a kidney transplant

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Don’t Miss: How To Get Medicare For Free

How Do You Get Medicare At Age 65

When youre eligible for Medicare at 65, you might be automatically enrolled in traditional Medicare, also called Original Medicare, Part A and Part B. Medicare for your spouse will happen later, when she or he turns 65.

If youre aging into Medicare at age 65, you can still help with Medicare planning for your spouse. Together, you can learn about Medicare. For example, find out when to apply for Medicare.

What Is The Average Social Security Benefit At Age 62

The Social Security Administration doesn’t publish average data for each specific age it lumps ages 1864 together. However, it does state that someone who had made the maximum contribution to Social Security throughout their career would earn $2,324 per month in benefits it they retired at age 62 in 2021. If the same person retired at 65, they would earn $2,841 per month.

You May Like: Does Medicare Cover One Touch Test Strips

How To Calculate Social Security Benefits

Lets say your FRA is 66. If you start claiming benefits at age 66 and your full monthly benefit is $2,000, then youll get $2,000 per month. If you start claiming benefits at age 62, which is 48 months early, then your benefit will be reduced to 75% of your full monthly benefitalso called your primary insurance amount. In other words, youll get 25% less per month, and your check will be $1,500.

That reduced benefit wont increase once you reach age 66. Rather, youll continue to receive it for the rest of your life. It may go up over time due to cost-of-living adjustments , but only slightly. You can do the math for your own situation using the Social Security Administration Early or Late Retirement Calculator, one of a number of benefit calculators provided by the SSA that can also help you determine your FRA, the SSAs estimate of your life expectancy for benefit calculations, rough estimates of your retirement benefits, individualized projections of your benefits based on your personal work record, and more.

How Reaching Age 62 Can Affect Your Spouses Medicare

While you may not be eligible to enroll in Medicare when you turn 62, your age can have an impact on your spouses benefits.

If you are in the workforce and your spouse is not, then you turning 62 can give them access to the premium-free Part A of Original Medicare.

You may also be eligible to receive Social Security benefits but dont have to start taking them. This is a requirement because if your spouse didnt work, they are essentially reliant upon your work history for their eligibility.

Part A premiums can also be significant in 2021, they can be as much as $471 a month.

To be eligible for the premium-free Part A when you turn 65 and can enroll in Medicare, you must have paid Medicare taxes for at least 10 years and be eligible for or receive benefits from Social Security or the Railroad Retirement Board.

You also could qualify for the premium-free Part A if you had Medicare-covered government employment.

Recommended Reading: Is Root Canal Covered By Medicare

Will Working After Age 66 Increase Social Security Benefits

You can get Social Security retirement or survivor benefits and work at the same time. The amount of your benefit reduction, however, is not really lost. Your benefit will increase at full retirement age to account for benefits withheld due to previous earnings.

How can I increase my Social Security benefits after retirement?

Try these 10 ways to increase your Social Security benefit:

- I have been working for at least 35 years.

- Earn more.

- Work until full board age.

- Claim delay up to the age of 70.

- Request spouse payments.

- Dont earn too much in retirement.

- Minimize social security taxes.

How often does Social Security recalculate benefits based on your earnings?

How often does Social Security recalculate benefits based on earnings? The Social Security Administration recalculates the retirement benefit annually after obtaining income information from tax documents.

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

1

Also Check: Does Medicare Cover Rides To Medical Appointments

Does A Pension Count As Earned Income

For the year in which the return is filed, earned income includes all employee income, but only if it is computable in gross income. The earned income does not include amounts such as pensions and annuities, social benefits, unemployment benefits, work benefits or social security benefits.

Are pensions taxed as earned income?

Most pensions are financed with pre-tax income, which means that the full amount of retirement income will be taxable upon receipt of the funds. Private and government pension payments are generally taxable at the regular rate of income, assuming you have not paid after-tax contributions to the plan.

Does pension count as gross income?

Common sources of gross income include wages, salaries, tips, interest, dividends, IRA / 401 distributions, pensions, and annuities.

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Heres an example of when a younger spouse whos not yet on Medicare might help you save money.

- Suppose you reach age 65 and qualify for Medicare, but you havent worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youll qualify for premium-free Part A. Your spouse wont qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

NEW TO MEDICARE?

Recommended Reading: Do Medicare Advantage Plans Cover Chemotherapy

When Older People Are Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

If you were born on January 1 of any year, refer to the previous year when calculating your full retirement age.

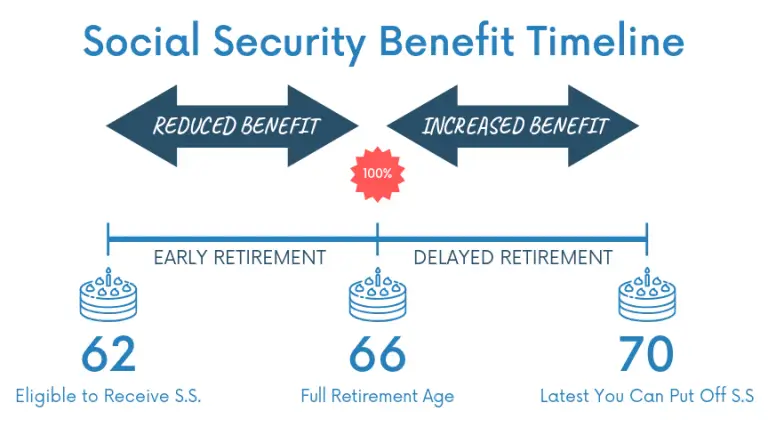

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

If you are a widow or widower, you can start claiming your spouse’s reduced Social Security benefits when you are age 60, or 50 if you are disabled. You can then switch to taking your own full benefit at your full retirement age.

You can also choose to delay your Social Security benefit past full retirement age until age 70. This will often make you eligible for delayed retirement credits, which increase your monthly benefit for the remainder of your life.

What Is The Medicare Eligible Age

You may decide to retire at 62 because you can start collecting Social Security at that age and you feel ready to move on to a new stage in life. According to the Social Security Administration, you may start receiving retirement benefits as early as age 62. Your employer health benefits will likely end when you retire and you may wonder about your Medicare eligibility age.

Medicare is the government health care program for people age 65 and older and people younger than 65 with certain disabilities. Your Medicare eligible age is not correlated to when you retire and retiring early will not make you eligible for Medicare. Generally the only ways to be eligible for Medicare before age 65 is to:

- Have end-stage renal disease

- Have ALS

- Have a disability and have been receiving Social Security disability benefits for at least 24 months

If you retire at 62 and do not have a disability, you will generally have to wait three years for Medicare coverage. You can look on eHealth for an affordable individual or family health insurance plan as you wait to reach your Medicare eligible age.

There are certain advantages to waiting to retire beyond age 62 besides reaching the Medicare eligible age. If you retire early, your benefits are reduced a fraction of a percent for each month before your full retirement age, according to the Social Security Administration. The amount your benefit will be reduced depends on your year of birth.

Read Also: Does Medicare Cover Family Counseling