How Can I Safely Delay Medicare Part B Enrollment

You must have coverage from a GHP through your or your spouses current job to safely delay signing up for Part B.* You also have to have been covered through an employer-sponsored GHP or Medicare Part B during the month you qualified for Medicare. If you meet these criteria, youll receive an 8-month long special enrollment period during which you can enroll in Part B without penalty.

The Medicare Part B SEP begins the sooner of when:

- You are no longer currently employed OR

- Your GHP ends even if you continue to be employed.

Note that coverage through Medicaid, a retiree plan, COBRA, or individual market coverage will never allow you to safely delay enrolling in Medicare Part B.

*Disabled Medicare beneficiaries under age 65 can also qualify for a Part B SEP if theyre covered through a non-spouse family members large group health plan .

Medicare And Hsa: Confusing

We realize these rules can be confusing and sometimes downright mind-boggling! Thats why the insurance experts at Boomer Benefits are here to guide you. Are trying to determine what to do about your Medicare coverage? Give us a call so we can help you consider all the moving parts. You should also consult your tax professional about your HSA contributions to receive guidance on the financial end of things.

Enrolling Into Part B On A Delayed Basis

If you have delayed Part B while you were still working at a large employer, youll still need to enroll in Part B eventually. When you retire and lose your employer coverage, youll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30th, you should enroll in Medicare Parts A and/or B to begin on July 1st.

When you activate your Part B, you will activate your 6-month Medicare supplement open enrollment window. This is your one opportunity to enroll into any Medigap plan without health questions. Once the 6 month window expires, its gone forever. If Medigap is too expensive and you prefer a Medicare Advantage plan, you have a short window to also enroll into a Medicare Advantage plan using a Special Election Period. These are tricky, so always work with an agent who specializes in Medicare to set that up properly.

Recommended Reading: Is Obamacare Medicaid Or Medicare

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition*. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

What Does Part B Cover And What Will I Pay

Medicare Part B has an annual deductible of $203 in 2021. This deductible is projected to be $217 in 2022.

You must pay all Medicare-approved Part B costs until you meet the deductible before Medicare starts to pay its share. After you meet your deductible, you’ll generally be responsible for coinsurance of 20% of the Medicare-approved amount for the service. As described below, you can purchase a Medigap plan that will cover some or most of these charges.

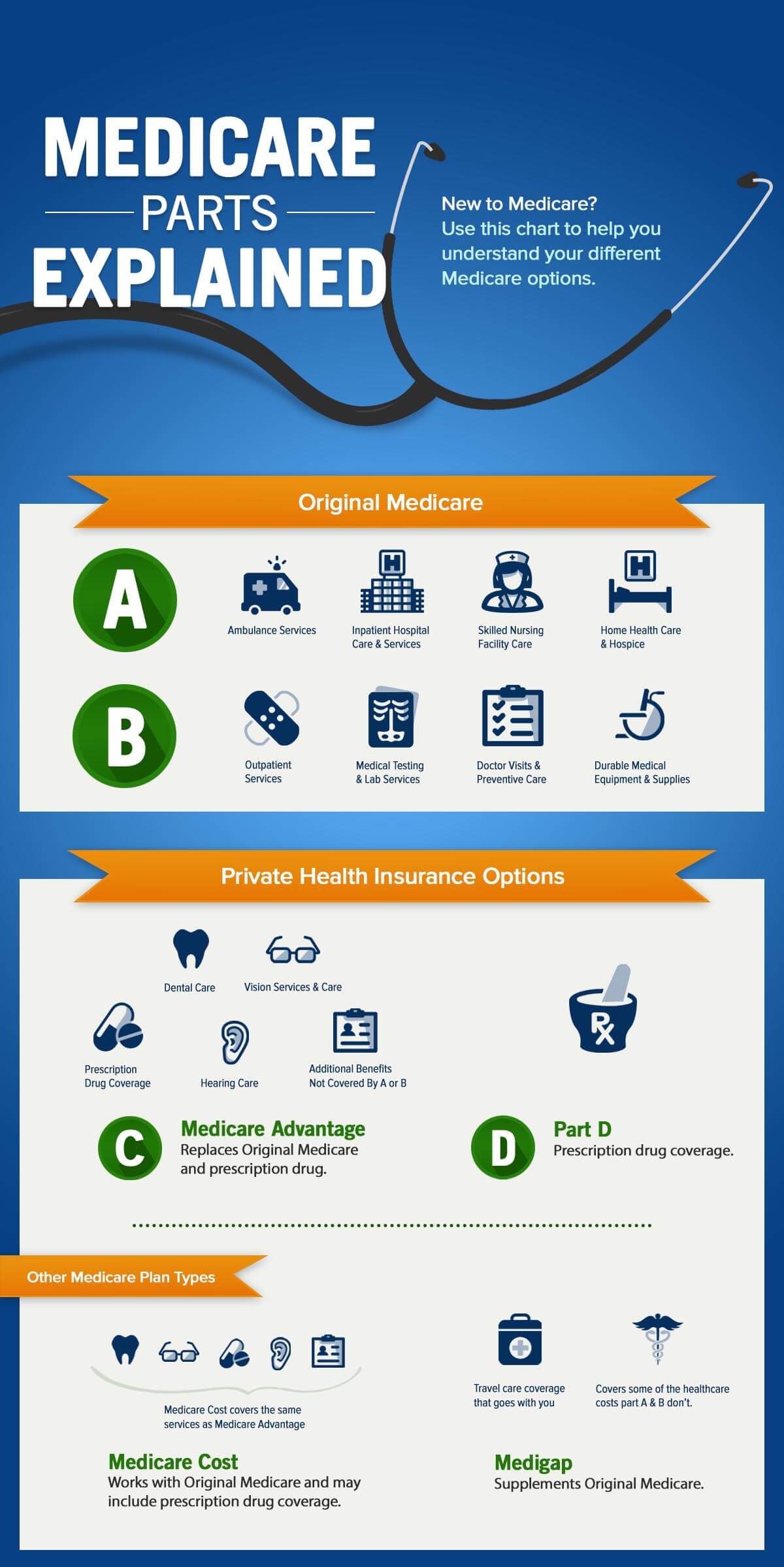

In general, Medicare Part B covers two types of services:

- Medical services: Healthcare services that you may need to diagnose and treat a medical condition. These services are often provided on an outpatient basis, but can also be provided during an inpatient stay. Medicare will only pay for services that they define as being medically necessary.

- Preventive services: Healthcare services to prevent illness or help detect an illness in an early stage so it can be managed before getting worse .

You May Like: Is Unitedhealthcare Dual Complete A Medicare Plan

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

One important thing to know about Medigap: It only supplements Medicare and is not a stand-alone policy. If your doctor doesn’t take Medicare, Medigap insurance will not pay for the procedure.

Insurance agents are not allowed to sell Medigap to participants of Part C, Medicare Advantage.

Medigap coverage is standardized by Medicare but offered by private insurance companies. According to, Patrick Traverse, founder of MoneyCoach, Mt. Pleasant, S.C.,

“I recommend that my clients purchase Medigap policies to cover their needs. Even though the premiums are higher, it is much easier to plan for them than what could be a large out-of-pocket outlay they might have to face if they had lesser coverage.”

Also Check: Can You Get Medicare If You Retire At 62

What Is The Penalty For Delaying Enrollment In Medicare Part B

An increasing number of Americans are putting off enrolling in Medicare Part B when they first qualify for it. Medicare-eligible individuals can delay enrolling in Part B only if theyre covered by an employer-sponsored group health plan through a current job . Those who postpone enrollment and arent covered by a GHP will owe a 10 percent Part B late-enrollment penalty for every year they delay signing up.

The Part B premium in 2020 is $144.60 per month for most people. Consider an individual who qualified for Part B five years ago but didnt enroll until this year and didnt have qualifying GHP coverage. They will owe a 50 percent LEP that increases their monthly cost for Part B this year to about $217.

While the percentage of the premium increase is fixed for as long as an individual has Medicare, the penalty amount would actually get higher over time. This is because the penalty is set as a percentage of the monthly Part B premium which usually increases each year.

Its Worth Asking Human Resources These Questions

If youre covered by a GHP and will be qualifying for Medicare soon, its worth your time to talk to Human Resources about transitioning to Medicare coverage. Heres what you should ask:

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He managed a Medicare technical assistance contract at the Medicare Rights Center in New York City and represented clients in Medicare claims and appeals. Josh also helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including an associate at Sachs Policy Group, where he worked with insurers, hospital, and technology clients.

Also Check: Does Medicare Offer Dental Plans

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

What Are The Risks Of Enrolling Late In Medicare Part B

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period, youll have to wait until the next General Enrollment Period, which happens from January 1 to March 31 each year. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll. If you owe a late-enrollment penalty, youll pay a additional 10% on your premium for every 12-month period that you were eligible for Medicare Part B but didnt sign up for it. You may have to pay this higher premium for as long as youre enrolled in Medicare.

Read Also: How Much Do Medicare Plans Cost

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

What If Im Covered Under A Cobra Plan

If you are covered under a COBRA plan, then you should usually choose to enroll in both parts of Medicare rather than delay. COBRA plans function differently than ordinary group plans. As we mentioned, you do not incur penalties if you delay enrollment because you have health insurance from an employer. However, this doesnt hold for COBRA plans: if you delay enrollment and are under a COBRA plan, you may have to pay penalty fees.

Read Also: Can You Sign Up For Medicare Part B Anytime

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.

You May Like: How To Get Help Paying Your Medicare Premium

The Cost Of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2020 is $144.60 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month.

Youll also have an annual deductible of $203 in 2021 .

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

While most people pay the standard amounts for premiums and deductibles, some people will pay more, depending on their income. The more you make, the higher your likelihood will be for paying more than the standard amount. The extra fee per month is called the Income Related Monthly Adjustment Amount . How much more can you expect to pay if you fall outside of the standard range? The Medicare website offers a handy chart on the rates for those with higher incomes, which is updated each year. These are the rates for 2020, based on the income reported on your 2018 tax return:

These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds. For example, a couple that earns over $174,000 per year and files a joint tax return will pay $202.40 per month for Medicare Part B premiums.

Understanding What Medicare Part B Offers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

- Surgeries

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

Read Also: How To Enroll In Original Medicare

Where To Go Next

We are here to help! If you have questions feel free to call us at . We will answer your questions and can go over options for Medicare Supplement Plans or Medicare Advantage plans.

This information is especially useful to know about as you enroll in Medicare for the first time. We are entirely independent of any insurance company, so we can always put your needs first

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Will Medicare Pay For Handicap Bathroom