What Are The Differences Between Medicare And Medicaid

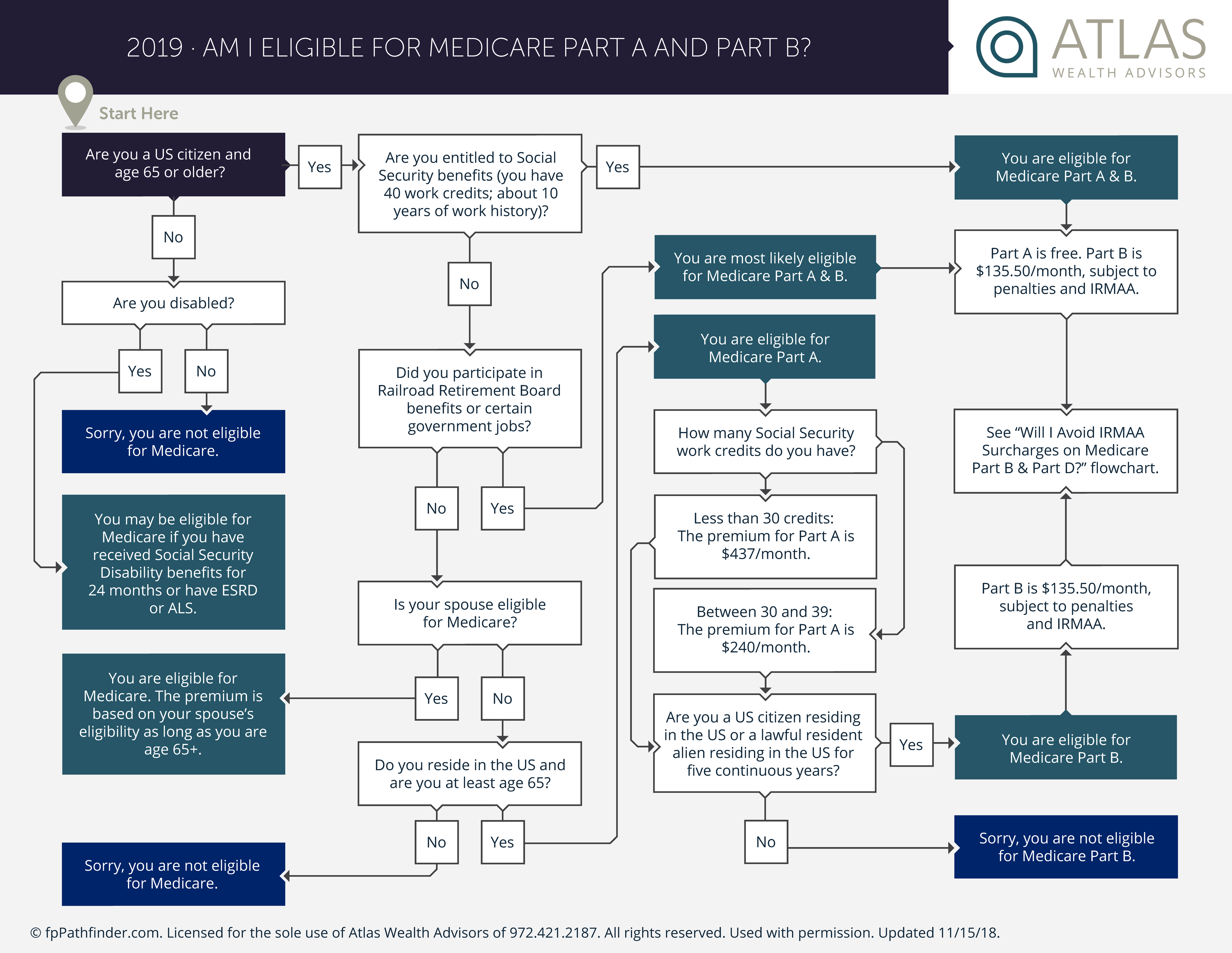

Medicare is a federal health insurance program open to Americans aged 65 and older, and those with specific disabilities who are under the age of 65. Medicaid, a combined state and federal program, is a state-specific health insurance program for low-income individuals with limited financial means, regardless of their age.

Medicare, generally speaking, offers the same benefits to all eligible participants. However, coverage is divided into Medicare Part A, Part B, and Part D. Medicare Part A is for hospice care, skilled nursing facility care, and inpatient hospital care. Medicare Part B is for outpatient care, durable medical equipment, and home health care. Part D is for prescription coverage. Not all persons will elect to have coverage in all three areas. In addition, some persons choose to get their Medicare benefits via Medicare Advantage plans, also called Medicare Part C. These plans are available via private insurance companies and include the same benefits as Medicare Part A and Part B, as well as some additional ones, such as dental, vision, and hearing. Many Medicare Advantage plans also include Medicare Part D.

Medicaid is more comprehensive in its coverage, but the benefits are specific to the age group. Children have different eligibility requirements and receive different benefits from low-income adults and from elderly or disabled persons.

Helpful Resources

Making Changes To Medicare: Open Enrollment Period

If you already have Medicare Parts A and B, you have an Open Enrollment Period every year between October 15 and December 7. During open enrollment, you can switch from one Medicare Advantage plan to another. You can also switch from traditional Medicare to a Medicare Advantage plan during this time. If you want to switch from a Medicare Advantage Plan back to traditional Medicare, you can do so during open enrollment or during the special Medicare Advantage Disenrollment Period that runs from January 1 through February 14 each year. Once you select a new plan to enroll in, you’ll be disenrolled automatically from your old plan when your new plan’s coverage begins.

When coverage begins. When you switch coverage during the Open Enrollment Period, your new coverage starts January 1. When you switch back to traditional Medicare during the Medicare Advantage Disenrollment Period, your coverage will start on the first day of the month after the month in which you disenroll.

Special trial period for first year you join a Medicare Advantage plan. If you first join a Medicare Advantage plan during your Initial Enrollment Period, you can drop the plan anytime during the first 12 months. But you can only switch to a new Medicare Advantage plan during an Open Enrollment Period .

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare, can select an advantage plan 3-month before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Medicare is one thing you dont want to procrastinate on. Many people change plans during the Annual Enrollment Period if you make a change during this period, your policy will begin on January 1st of the following year.

Recommended Reading: Does Medicare Cover Bladder Control Pads

How Much Does Medicare Cost

One of the biggest misunderstandings about the Medicare program is its costs. It is not free and it does not cover everything.

All Medicare beneficiaries pay a monthly premium for their medical coverage . The premium is based on your annual income. High-income earners pay a little more than those with a lower income. For 2021, the basic Part B monthly premium is $148.50. For high-income earners, the rate is between $245 and $368 per month.

Some Medicare Advantage plans do not have an additional monthly premium but, you must continue paying your Medicare Part B premium. When a Medicare Advantage plan has a $0 premium it simply means that what you pay for your Medicare Part B each month covers the full cost of the private insurance plan.

Medicare Part A is hospital insurance and is available at no cost to people who worked and paid Medicare taxes for ten or more years. If you did not pay Medicare taxes for a full ten years , you must pay a monthly premium for your Medicare Part A benefits. The amount you pay is based on the number of quarters you paid Medicare taxes. The more you paid in the past, the less youll pay for your premiums.

Signing Up For Medicare

If you’re collecting Social Security benefits. If you claim Social Security benefits at age 65 or earlier, you will automatically be enrolled in Medicare when you turn 65, in both Part A and Part B. You can disenroll from Part B but not from Part A.

To enroll in Part B after age 65 later , you can fill out an Application for Enrollment in Medicare Part B and bring it or mail it to a Social Security office.

If you’re not collecting Social Security benefits. If you are 64 years and nine months or older and you have not started collecting Social Security benefits, you can sign up for both Part A and Part B online at .

How Medicare enrollment affects HSAs. Note that, when you’re enrolled in Part A, you are no longer allowed to make pre-tax contributions to your health savings account , though you cancontinue to use the funds already in your HSA account. Since anyone collecting Social Security retirement benefits has to be enrolled in Part A, this means that no one collecting Social Security can contribute to an HSA.

For 2018 premiums and deductibles, see Nolo’s 2018 Medicare cost update.

Also Check: Do You Have Dental With Medicare

When Does Medicare Coverage Start If Youre Not Automatically Signed Up

Typically, youre automatically enrolled in Original Medicare if youre already receiving Social Security retirement benefits when you turn 65 or qualify by disability.

If youre not automatically enrolled in Medicare, the date Medicare coverage begins depends on when you enroll in Medicare Part A and/or Part B .

- If you enroll in Medicare the month before your 65th birthday, your Medicare coverage will usually start the first day of your birthday month.

- If you enroll in the month of your 65th birthday, your coverage will generally start the first day of the month after your birthday month.

- If you enroll a month after you turn age 65, coverage usually begins two months after you signed up.

- If you enroll two months after you turn age 65, coverage typically begins three months after you signed up.

- If you enrolled three months after you turn 65, coverage usually begins three months after you signed up.

When To Apply For Medicare

While there are exceptions, in general, adults become eligible for Medicare on their 65th birthday. In fact, more than 11,000 people turn age 65 daily and get their eligibility for coverage. This is often a source of confusion because originally you got your Medicare and Social Security retirement benefits at the same time .

Social Security retirement and Medicare benefits are no longer linked. If you retire at the earliest age possible, which is age 62, you wont receive your Medicare benefits until age 65. However, if you delay taking Social Security until age 70, your Medicare benefits will start at age 65 anyway. In all cases, you can apply for Medicare up to three months prior to your 65th birthday to make sure your benefits start on time.

Medicare is also available to adults with Social Security disability benefits. If you qualify for Social Security Disability Insurance , your Medicare benefits start on the 25th month of your Social Security benefits.

Don’t Miss: When Do Medicare Benefits Kick In

Retirees And Those Still Working

If you paid into a retirement system that didnt withhold Social Security or Medicare premiums, youre probably still eligible for Medicareeither through your retirement system or through your spouse. To receive full Medicare coverage at 65, you must have earned enough credits to be eligible for Social Security.

Each $1,470 you earn annually equals one credit, but you can only earn a maximum of four credits each year. You will receive full benefits at retirement if you have earned 40 credits10 years of work if you earned at least $5,880 in each of those years.

If you continue to work beyond age 65, things get a bit more complicated. You will have to file for Medicare, but you may be able to keep your companys health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Theres a lot to consider that makes it prudent to talk to a person knowledgeable in Medicare about your specific choices. This could be your Human Resources department or a Medicare representative.

If you continue to work beyond 65, theres a lot to consider that makes it prudent to talk to a Medicare expert about your choices.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Also Check: Does Medicare Cover Bed Rails

Healthier Care Made Possible

It’s time to make a choice about the type of health plan and coverage you’ll need for this coming year. It’s important to think about every year because your needs may have changed. This is why so many people are looking at Medicare Advantage plans. They want great care at a cost they can afford. In fact, Medicare Advantage plan members save $1,598 more than people with original Medicare. Keep watching this video to help you find a Medicare Advantage plan that’s right for you.

My name is Sofia, and I’m 70 years old. I love gardening and being outdoors. I’ve been pretty healthy, and I want to stay that way. To me, preventing illness is the most important thing. Through my Medicare Advantage plan, I have a doctor and care team who take the time to create a wellness plan just for me. I also have a membership to a fitness center offered at no extra cost. And I feel like I’ve found the right fit for me.

It is important to know what your needs will be this coming year. How many times will you visit the doctor? Do you visit specialists regularly? Do you have any medical problems that might need hospital care? Do you expect any surgeries or hospital stays? What about prescription medicines? Are there other needs to think about? All of these questions may give you a reason to look at a Medicare Advantage plan instead of original Medicare. What’s right for You

The Cost Of Medicare At 60

If Medicare at 60 becomes reality, there are financial concerns that the country must address. Those who age in are eligible for Part A premium-free if theyve paid in while working for at least 40 quarters . The tax money goes to the Hospital Insurance Trust Fund. This fund pays for Part A, which is why it is premium-free for most.

A major concern is that the HI Trust Fund is at risk of insolvency. Meaning, there might not be sufficient revenue to cover Part A premiums in just a few years. The original prediction for when this would happen was 2026, but the pandemic is an additional strain on the fund and is speeding up the timeline.

The HI Trust Fund would need to be well-funded if Medicare at 60 becomes law. Millions of more people would need to start receiving the coverage that theyve already paid into.

Also Check: When Is Open Enrollment For Medicare

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Get Answers To Your Medicare Questions And Enroll In A Plan

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans that are available where you live.

Compare Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: How Much Does Medicare Part A And B Cover

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

| The Year You Were Born | Age You Reach Full Retirement |

|---|---|

| Full Retirement Age 1954 |

If youre looking for the governments Medicare site, please navigate to www.medicare.gov.

Also Check: What Does Medicare Part B Include

How Do I Get Full Medicare Benefits

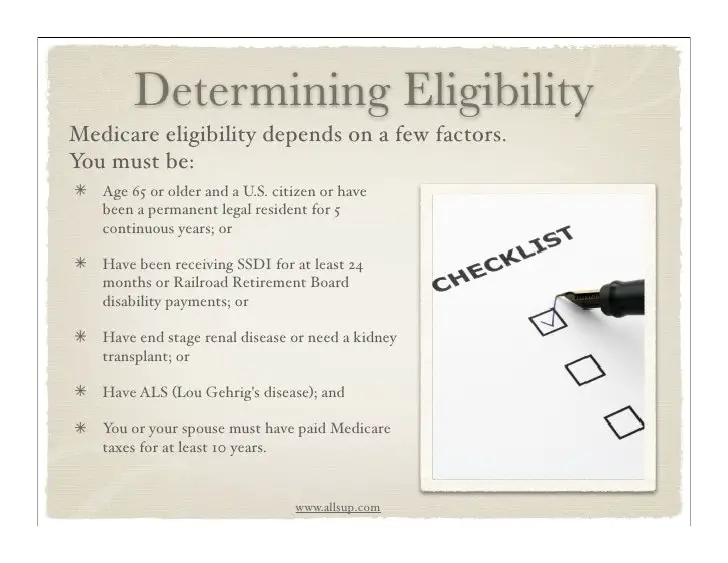

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.