Top Rated Assisted Living Communities By City

In 2019, seniors paid an average of $29 a month for their Medicare Advantage plans. Available plans vary by state, and monthly premiums vary too: Some plans pay for a persons Medicare Part B premiums, while other plans include extra benefits, like dental and vision coverage. Usually, seniors can choose at least one plan with no monthly premium costs at all, although zero-premium plans often carry a higher deductible.

Does Medicare Cover Home Sleep Study

If you are experiencing difficulty sleeping, you are all too aware at how much it affects your life. And you may be wondering why youre not sleeping well and what you can do to get a good nights sleep.

So how can you figure out why youre having problems when sleeping? One common way is by doing a sleep study. With a sleep study your healthcare provider can learn if you are suffering from a sleep condition such as obstructive sleep apnea, or OSA.

If this is something you may need, a common question that comes up is, does Medicare cover home sleep study? In this article, we answer that question in clear, plain English. Youll also get information about sleep study costs and more.

Is Medigap Plan G Better Than Plan F

While there can be a sizable difference in average premiums between Plan F vs. Plan G, there’s only a small difference in benefits these two plans offer.

-

Plan F provides coverage each of the 9 possible benefits that the 10 standardized Medigap plans can offer, including the Medicare Part B deductible.

-

Plan G does not cover the Medicare Part B deductible, but it offers coverage for all of the same out-of-pocket Medicare costs that Medigap Plan F covers.

Medigap Plan F and Plan G are the two most popular Medigap plans.2

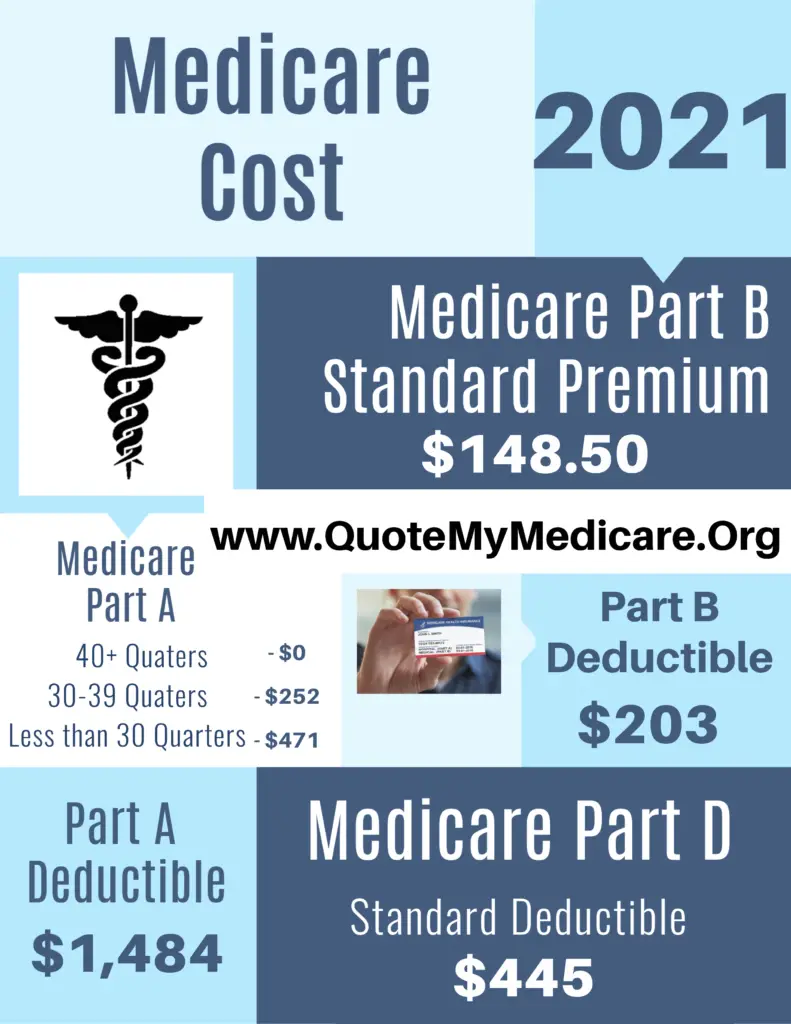

In 2021, the Part B deductible is $203 per year.

The $203 annual deductible equates to around $17.00 per month.

This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

Below, Medicare expert John Barkett talks more about this and other changes coming to Medicare in 2020.

Recommended Reading: How Much Does Medicare Part B Cost At Age 65

What Are Medicare Costs

It’s not just about premiums. Many Americans find that qualifying for Medicare eases some financial stress, as its possible to pay less and get more. However, there are still expenses you should be aware of.

Take a moment to familiarize yourself with the out-of-pocket costs associated with Medicare Parts A, B, C, and D, so that you can select a plan that is best suited for the type of retirement youre planning on. All costs listed here apply for 2021.

What Is A Medicare Advantage Plan

Otherwise known as Medicare Part C, Medicare Advantage is a health insurance plan offered by private insurance companies that have been pre-approved by the federal government to deliver Medicare coverage and services to Medicare beneficiaries.

A Medicare Advantage plan includes the primary benefits of Original Medicare . However, with Medicare Advantage, you get additional benefits like dental, vision, hearing, and wellness programs.

Unlike Medicare Supplement plans, Medicare Advantage plans have no medical underwriting. As long as you are eligible for Medicare, you will always be accepted into a Medicare Advantage plan and can not be denied coverage.

It is advisable to compare the Medicare Advantage plan cost of MA plans before settling on one.

Recommended Reading: What Is Medicare Ffs Program

What Is A Deductible

A Medicare deductible is the out-of-pocket dollar amount you must pay for your own healthcare or prescription drug costs before your Medicare coverage kicks in. Under Medicare Part A, each benefit period carries its own flat-rate deductible. Medicare Part B also carries a flat-rate deductible.

Medicare Part C , Medicare Part D , and Medigap supplemental plans will have various deductibles that are set by private insurance providers and depend on the plan you choose.

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

Don’t Miss: When Can You Get Medicare Health Insurance

Who Needs The Shingles Vaccine

According to the Centers for Disease Control and Prevention , the Advisory Committee on Immunization Practices recommends the shingles vaccine for people 50 and older. It is a manufactured inactivated vaccine intended to prevent shingles. The vaccine is administered in two separate doses given by intramuscular injection, separated by two to six months.

The shingles vaccine is considered an important vaccine for seniors because our immune system weakens as we age. The recommendation for vaccination is based on the potential severity of symptoms and long-term complications.

A shingles vaccine called Zostavax is no longer used in the United States as of November 2020. If you received that vaccine, the CDC recommends talking with your doctor about getting the Shingrix vaccine.

| The CDCs fact sheet on shingles lists these risks and potential complications: |

|

|

|

|

|

Shingrix is more than 90% effective at preventing shingles, but it does not prevent chickenpox.

What Is The Late Enrollment Penalty

Another factor influencing the cost of your premium is when you enroll. For each full month after eligibility that you dont have prescription drug coverage, youll typically have to pay 1% of the base premium , and youll have to pay that for as long as you have Medicare prescription drug coverage.8 The penalty amount may change from year to year.

Don’t Miss: Does Medicare Cover Skin Removal

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

TTY 711, 24/7

A closer look at 2021 data also reveals:

- Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

- All states except for Alaska offer at least one $0 monthly premium Medicare Advantage plan. $0 premium plans may not be available in all locations within each state.

In addition to premiums, many Medicare Advantage plans typically include some out-of-pocket expenses. These can include plan deductibles, copayments or coinsurance and an out-of-pocket spending maximum.

Don’t Miss: Is Stem Cell Treatment Covered By Medicare

Medicare Advantage Plans Defined

Also known as Medicare Part C, government-authorized Medicare Advantage Plans provide all the coverage of Original Medicare, as well as additional benefits. Many plans eliminate the need for Medicare Part D because they include prescription drug coverage. Seniors pay a premium for their Medicare Advantage Plans every month. They also pay a deductible on covered services, and coinsurance after theyve met the deductible.

Can You Get Help Paying For Prescription Drug Coverage

If you have limited resources, you can apply for Extra Help, worth about $5,000 from the Social Security Administration.12 To qualify, youll need to have a net worth of less than $14,790 and an income of less than $19,320. Married couples who live together can get help if they have a net worth of less than $29,520 if married and living with your spouse and an income of less than $26,130.13

If you meet the requirements for extra help, the cost of prescription drugs is capped at $3.95 each for generics and $9.85 each for brand name medication.14

You May Like: Does Medicare Advantage Pay For Hearing Aids

How Much Does A Medicare Supplement Insurance Plan Cost

- Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare.

- The costs youll pay for Medigap depend on the plan you choose, your location, and a few other factors.

- Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

Medicare supplement insurance policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that arent covered by original Medicare. Some examples of the costs that may be covered by Medigap include:

- deductibles for parts A and B

- coinsurance or copays for parts A and B

- excess costs for Part B

- healthcare costs during foreign travel

- blood

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. Below, well explore more about the costs of Medigap plans in 2021.

So what are the actual costs associated with Medigap plans? Lets examine the potential costs in more detail.

South Carolina Department On Aging Getcaresc

One of the most important resources offered by the South Carolina Department on Aging is GetCareSC. Its an online hub that provides information on assisted living , insurance counseling, transportation if needed, and volunteer opportunities for those who want to assist seniors to live healthy and independent lifestyles. Seniors, their families, or their caregivers will find answers to many of their questions at GetCareSC.

Contact Information:Website | 803-734-9900

Also Check: Does Medicare Cover Cosmetic Surgery

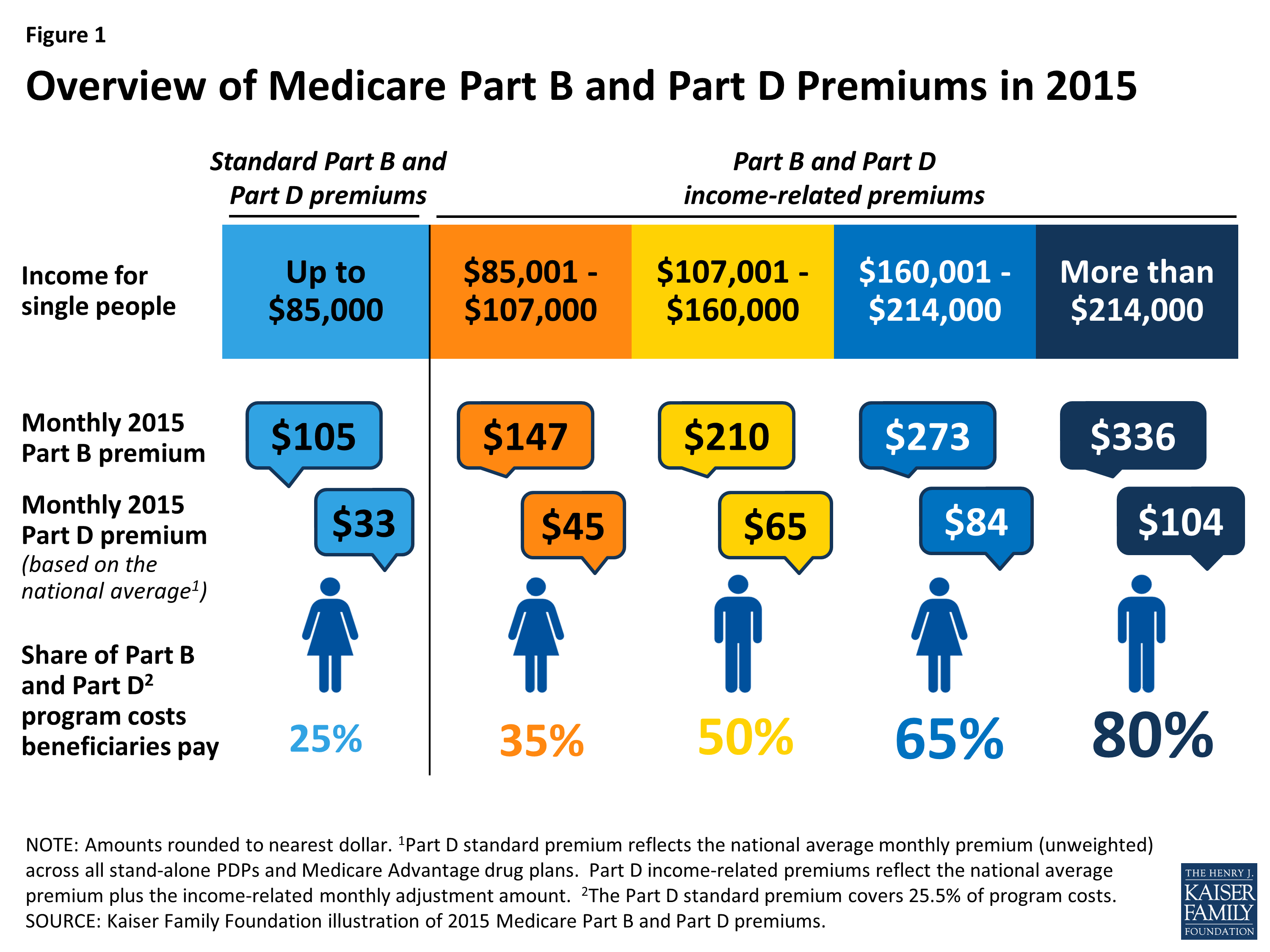

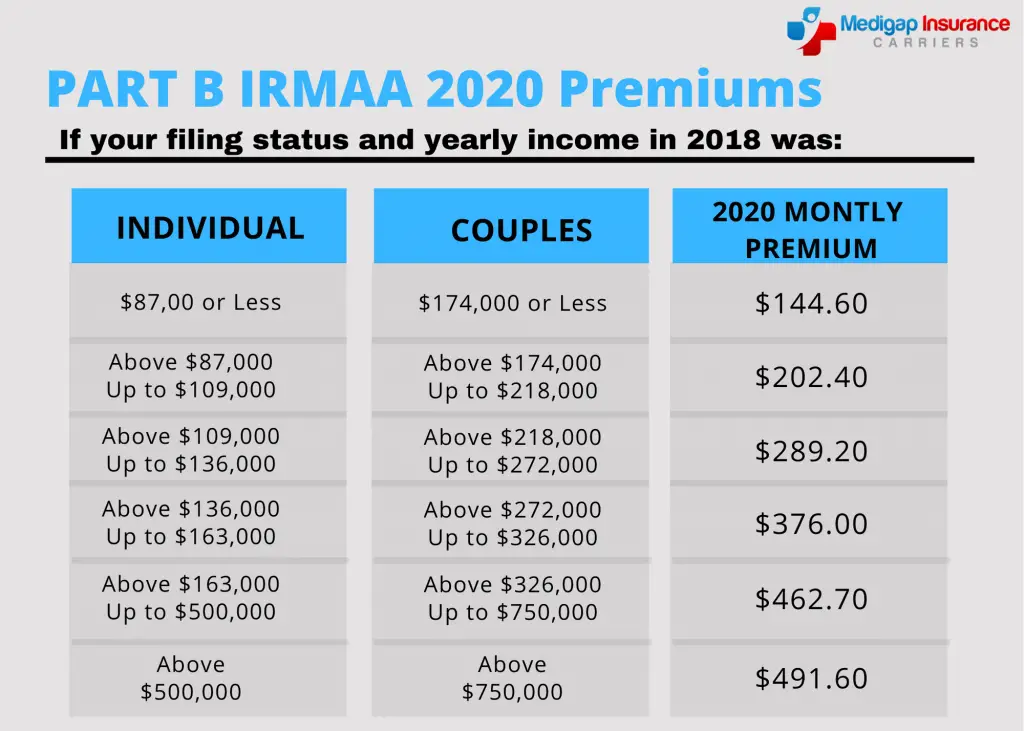

Premium Surcharge Is Based On 2019 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2019 tax returns were filed in 2020, so those were the most current returns available when income-related premium adjustments were determined for 2021.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

What Is A Medicare Supplement Deductible

You may know the word deductible from other types of insurance you already have, such as auto insurance. A deductible is an amount you pay before your insurance plan begins to pay. Some Medicare Supplement plans pay the Medicare Part A hospital deductible, but make you pay the Medicare Part B medical deductible. Some plans cover neither the Part A nor the Part B deductible and you will be responsible for those costs out of pocket.

Medicare Supplement high deductible plan F* may charge a lower monthly premium than other plans. However, this low premium may be attached to a high deductible, meaning you must pay a significant amount out of pocket before your Medicare Supplement plan pays anything.

You May Like: What Age Is For Medicare

What Are Other Medicare Supplement Plan Costs

Having a Medicare Supplement plan unfortunately doesnt mean that all your Medicare costs will be covered. You still must pay your Medicare Part B premium and may owe a Medicare Part A premium as well. There is also a limit on what coinsurance costs your Medicare Supplement plan may cover. For example, if you stay in the hospital over 365 days, you may be responsible for all costs. Similarly, if you stay in a skilled nursing facility over 100 days, you may be responsible for all costs. The only way to have a known limit on your costs is to get a plan with an out of pocket maximum.

Do you want to look for a Medicare Supplement plan in your area? Just enter your zip code on this page.

*As of January 1, 2020 people new to Medicare cant buy plans that cover the Medicare Part B deductible. This means that Medicare Supplement Plans C and F will no longer be available to new Medicare enrollees. However, if you already have a Plan C, Plan F, or high-deductible Plan F, you can keep it. If you were eligible for Medicare before January 1, 2020, you also may be able to buy Medicare Supplement Plan C, F, or high-deductible Plan F.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Also Check: How To Get A Lift Chair From Medicare

Deductibles And Cost Sharing

You will pay full price for care until you reach the $1,484 deductible for each benefit period.

A benefit periodis the time that you are in a hospital or nursing facility, plus the 60 days that immediately follow your stay.

It is possible to have multiple benefit periods within a year, and you would be responsible for meeting the deductible in each of those periods.

Once you have reached that deductible, your costs are determined by the number of days that you remain in the hospital or facility. You will pay $0 per day for each hospital stay under 60 days, $371 per day for each hospital stay that lasts 61 to 90 days, and $742 per day for stays that exceed 90 days.

After 90 days, you will be using what are known as “lifetime reserve days. All Medicare recipients are granted 60 of these days in their lifetime. Once you have used all of them, you are responsible for all costs incurred during any subsequent hospital stays.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2021 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Most enrollees in individual Medicare Advantage plans are in plans that provide access to eye exams and/or glasses , hearing exams/and or aids , telehealth services , dental care , and a fitness benefit . Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer plans do not submit bids, and data on supplemental benefits may not be reflective of what employer plans actually offer.

Read Also: Does Medicare Pay For Mens Diapers