Medicare Part C Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage. Medicare Advantage plans are required by law to cover everything found in Medicare Part A and Part B, and many Medicare Advantage plans may typically include benefits not covered by Original Medicare such as dental, vision, hearing, prescription drugs and more.

Medicare Advantage plans are sold by private insurance companies and dont have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs.

Medicare Part D Late Enrollment Penalty

Medicare prescription drug coverage is optional, but itâs best to opt into it soon after you are enrolled in Medicare. If you are eligible to enroll in Part D, you donât enroll for 63 days or more, and then you try to enroll in a Part D plan, you will have to pay the late enrollment penalty.

To avoid the penalty, you need to enroll within 62 days of the end of your initial enrollment period . Initial enrollment starts three months before your 65th birthday, includes the month of your 65th birthday, and then ends three months after the month of your 65th birthday. You will also pay the penalty if you unenroll from a Part D plan for 63 or more days and then you re-enroll.

The Medicare Part D late enrollment penalty is 1% of the national base beneficiary premium multiplied by the number of months you were eligible for but went without prescription drug coverage. That amount gets rounded to the nearest $0.10 and added to your monthly premium.

People With Esrd Can Join Medicare Advantage Plans

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Many people with ESRD will still find that Original Medicare plus a Medigap plan and Medicare Part D plan is still the most economical option overall, in terms of the coverage provided. But in some states, people under 65 cannot enroll in guaranteed-issue Medigap plans, or can do so only with exorbitantly high premiums. And some of the states that do protect access to Medigap for most beneficiaries under 65 do not extend those protections to people with ESRD. Without supplemental coverage, there is no cap on out-of-pocket costs under Original Medicare.

Medicare Advantage plans do have a cap on out-of-pocket costs, as described below. So for ESRD beneficiaries who cannot obtain an affordable Medigap plan, a Medicare Advantage plan could be a viable solution, as long as the persons doctors and hospitals are in-network with the plan.

Read Also: When Is Open Enrollment For Medicare

V Waiver Of Proposed Rulemaking

The annual updated amounts for the Part B monthly actuarial rates for aged and disabled beneficiaries, the Part B premium, and Part B deductible set forth in this notice do not establish or change a substantive legal standard regarding the matters enumerated by the statute or constitute a substantive rule that would be subject to the notice requirements in section 553 of the APA. However, to the extent that an opportunity for public notice and comment could be construed as required for this notice, we find good cause to waive this requirement.

What Counts Toward The Medicare Part B Deductible

Basically, any service or item that is covered by Part B counts toward your Part B deductible.

For example, imagine you fall and break your leg. You are taken to a hospital, treated, and released with a pair of crutches.

The care you receive as a hospital inpatient is covered under Medicare Part A . But the crutches are covered under Medicare Part B .

The amount that you are charged for the doctor, treatment, and the crutches will count toward your Part B deductible, while the bill for your hospital stay will count toward your Part A deductible.

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare.

The Part C and Part D deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible.

Some Medicare Advantage plans also feature $0 premiums, and most plans offer drug coverage and may offer routine dental and vision benefits. Call to speak with a licensed insurance agent who can help you compare plans and if you’re eligible help you enroll in a new plan, right from the comfort of your own home.

You can also compare plans online for free, with no obligation to enroll.

Find Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Don’t Miss: Is Eliquis Covered Under Medicare

Medicare Supplement Insurance Plan Deductibles

To get help paying for your Medicare deductibles, you might consider a Medicare Supplement insurance plan. If you have Original Medicare, you can get this additional insurance to help cover some of your Medicare expenses. There are 10 standardized Medigap plans that are available in most U.S. states Massachusetts, Minnesota, and Wisconsin have their own types of Medicare Supplement insurance plans. Not every Medigap plan covers the Part A and/or Part B deducible, but most of the standardized plans cover at least one of these deductibles in full or partially.

If youre concerned about Medicare deductibles and planning for future costs, you may want to consider all your options, including Medicare Supplement insurance plans. To get help finding a Medicare insurance plan, you can type your zip code into the form on this page to see a list of Medicare plans in your vicinity.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

NEW TO MEDICARE?

What Changes Are Coming To Medigap In 2021

- Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

- Companies that sell plans have varying costs.

- Medicare pays a portion of the costs under Plan G, and you pay the remainder until you reach a $2,370 deductible. Plan G will cover the remaining expenses.

Read Also: What Is Medicare Part G

Do All Drug Plans Have A Deductible

Some Medicare drug plans do not have a deductible, and the policy pays for eligible prescribed medication, up to the plan limits. Copayments or coinsurance charges may still apply.

As well as the deductible, other charges apply to PDPs, including:

- monthlypremiums: the amount the insurance company charges every month for the policy

- copayments and coinsurance: the fixed price or percentage amount applied after meeting the deductible

- late enrollment penalty: the amount added to the monthly premium when a person delays enrolling in Medicare Part D, payable for the entire time the policy is active

- coverage gap: a temporary limit on drug coverage that starts after a specific amount has been paid to cover drugs

The monthly premium for Medicare Part D depends on the drug plan chosen.

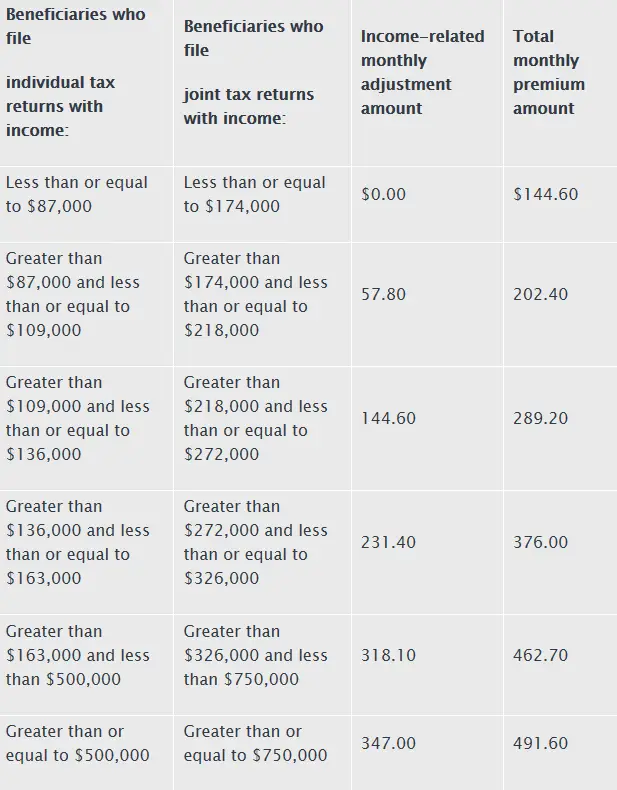

Medicare may use an Income-Related Monthly Adjustment Amount to decide the premium cost relative to a personâs income. An individual must earn above $88,000 filing individually, or above $176,000 filing jointly before paying an IRMAA charge.

A person pays the monthly premium directly to the private insurance company administering their chosen plan.

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

You May Like: What Age Qualifies You For Medicare

Does Medicare Have A Deductible

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities. Many Medicare beneficiaries live on fixed incomes from pensions or social security. Any cost above what appears in their normal budget poses a risk to their financial security. Given those circumstances, it is reasonable for Medicare recipients to want to know about what, if any, kind of deductibles apply to their Medicare coverage.

Medicare Part A Deductibles

Medicare Part A helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, including medically necessary services and supplies, general nursing care, semi-private rooms, and meals.

Medicare Part A does have a deductible for each benefit period. Well talk more about benefit periods in the next section. Your deductible for each period in 2019 is $1364. That means youll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if youre admitted as an inpatient at a skilled nursing facility for a period of time.

Benefit Period

Medicare Part B Deductibles

Related articles:

How Do Lifetime Reserve Days Work With Medicare

Part A covers inpatient hospital care, skilled long-term facility, and more, for up to 90 days. But if you ever need to extend your hospital stay, Medicare will cover 60 additional days, called lifetime reserve days.

For instance, if your hospital stay lasts over 120 days, you will have used 30 lifetime reserve days. Please note that youll pay a coinsurance of $742 for each lifetime reserve day you use. You can only use your lifetime reserve days once.

Also Check: What Does Medicare Cost Me

What Happens Once You Reach The Deductible

Once you meet the required Medicare Part B deductible, you will typically be charged a 20 percent coinsurance for all Part B-covered services and items for the remainder of the year.

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent.

Its worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

The Medicare-approved amount is the maximum amount that a health care provider is allowed to charge for a service or item as determined by Medicare.

Lets use the broken leg scenario from above and say that the cost of the pair of crutches was $80.

- If the injury happened before reaching your Medicare Part B deductible, you would be responsible for the full $80 .

- If you had already met the Part B deductible prior to the injury happening in this hypothetical situation, you would only be responsible for $16 . Medicare would then pay the remaining $64.

How Much Do Medicare Beneficiaries Pay Out Of Pocket

While Medicare is designed to cover the bulk of your medical expenses, the system was designed with high cost sharing and no out-of-pocket limits in original Medicare. The more medical services you need, the more youll pay in Medicare costs.

The idea is that this will help drive responsible use of medical services. It also means that you could pay a lot out of pocket after Medicare has paid its share.

Read Also: Do I Need To Sign Up For Medicare Part B

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARA’s archives.gov.

Legal Status

Do You Want Coverage For Annual Deductible Cost

Well, of course, you do. You can keep the annual deductible low by signing up with Medigap Plan. Medigap plans are like an add-on or supplement plans, which you can add to your Original Plan.Its to provide you with better coverage and keeping the overall costs low.

You can find Medigap plans with some private insurers that abide by the rules of Medicare. Made available to you by private insurers, you may have to pay different prices for the same plans. Its because insurers get to decide the prices.

If you want to compare the prices, you can make use of our search tool. You can compare the plans and choose the one that suits you.

The coverage that Medigap brings is quite impressive, though. Regardless of where you live and which company you buy an insurance plan from, youll get same benefits for the plan you choose.

Lets take an example of Medigap Plan F. Youll get cover for Deductibles for both Part A & B, including all the supplementary expenses. No matter where you buy it from. The prices might change, but not the benefits.

So, whether it is Medicare deductible 2021 or some other deductible, youre not bound to pay the full amount. A Medigap plan is capable of covering you for both the plans If want.

Keep in mind to put some research. You must know what coverage you get for paying a definite sum of money. You can use our website to see if taking up a Medigap Plan and paying monthly premiums is worth it.

Recommended Reading: Is Pennsaid Covered By Medicare

Medicare Parts A B & C

As a reminder, there are four parts of Medicare: A, B, C and D. Medicare Part A covers inpatient services, which includes hospital services that you receive as part of an overnight stay. Part B covers outpatient services, such as preventive care, doctor visits, and other medically necessary services.

Part A and Part B make up Original Medicare. Everyone is required to enroll in both parts, and even if you get a more comprehensive private plan, you will still need to pay for Parts A and B.

Medicare Part C, also called Medicare Advantage, is optional and itâs a private health insurance offered through Medicare. It works much like regular health insurance, but itâs generally less expensive because itâs part of Medicare.

Medicare Part C includes Original Medicare benefits plus some extras, usually including prescription drug coverage, known as a Medicare Advantage Prescription Drug plan. You usually donât need Medicare Part D if you have a Medicare Advantage plan.

Heres What Medicare Plan G Covers

Medicare pays first, then Medicare Plan G steps in and pays the rest after the annual deductible has been satisfied.

Plan G offersthe same comprehensive coverage as Medicare Plan F, except for Plan B deductible. Thats it! It is Plan F with one item removed. Here is a comprehensive list of what Plan G covers.

- Medicare Part A deductible, coinsurance, & hospital costs

- Medicare Part B Coinsurance, co-payment, & excess charges

- Foreign Travel Emergency

- Preventative Care Part B Coinsurance

- Skilled nursing facility coinsurance

- This is inclusive of most doctor services when you are a hospital inpatient and also outpatient therapy

- Durable medical equipment , blood transfusions, lab work, X-rays, surgeries, ambulance rides, and much more

In short, apart from one feature Plan G is the second most comprehensive plan behind Plan F. The only difference is the Medicare Part B deductible is not covered by the plan, meaning it will be covered by you.

It is worth noting some states have slightly different Medicare supplement insurance benefits. If you or your loved one lives in Minnesota, Wisconsin, or Massachusetts, click here to learn more about the specifics of benefits in these states.

Recommended Reading: Why Is My First Medicare Bill So High

Medicare Advantage Deductible In 2021

If you are enrolled in a Medicare Advantage plan, your deductible and cost-share amounts are set by the plan. Some Medicare Advantage plans may have deductibles as low as $0.

Lets take a look at average deductibles for Medicare Part C over the three-year period spanning 2018-2020.

According to eHealth research, the average Medicare Advantage plan annual deductible went down from $145 in 2018, to $133 in 2019, to $129 in 2020. All of the plans in this study included prescription drug coverage.

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary, all plans must set a limit on your maximum out-of-pocket expenses. This is a total spread across your deductibles, coinsurance and copayments.

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs.

Some Medicare Part D prescription drug plans dont have a deductible. Those that do may not have a deductible of more than $445 in 2021.

Prepare for Medicare Open Enrollment

Also Check: When Can Medicare Plans Be Changed