Enroll In Medicare Part A Consider Your Hsa First

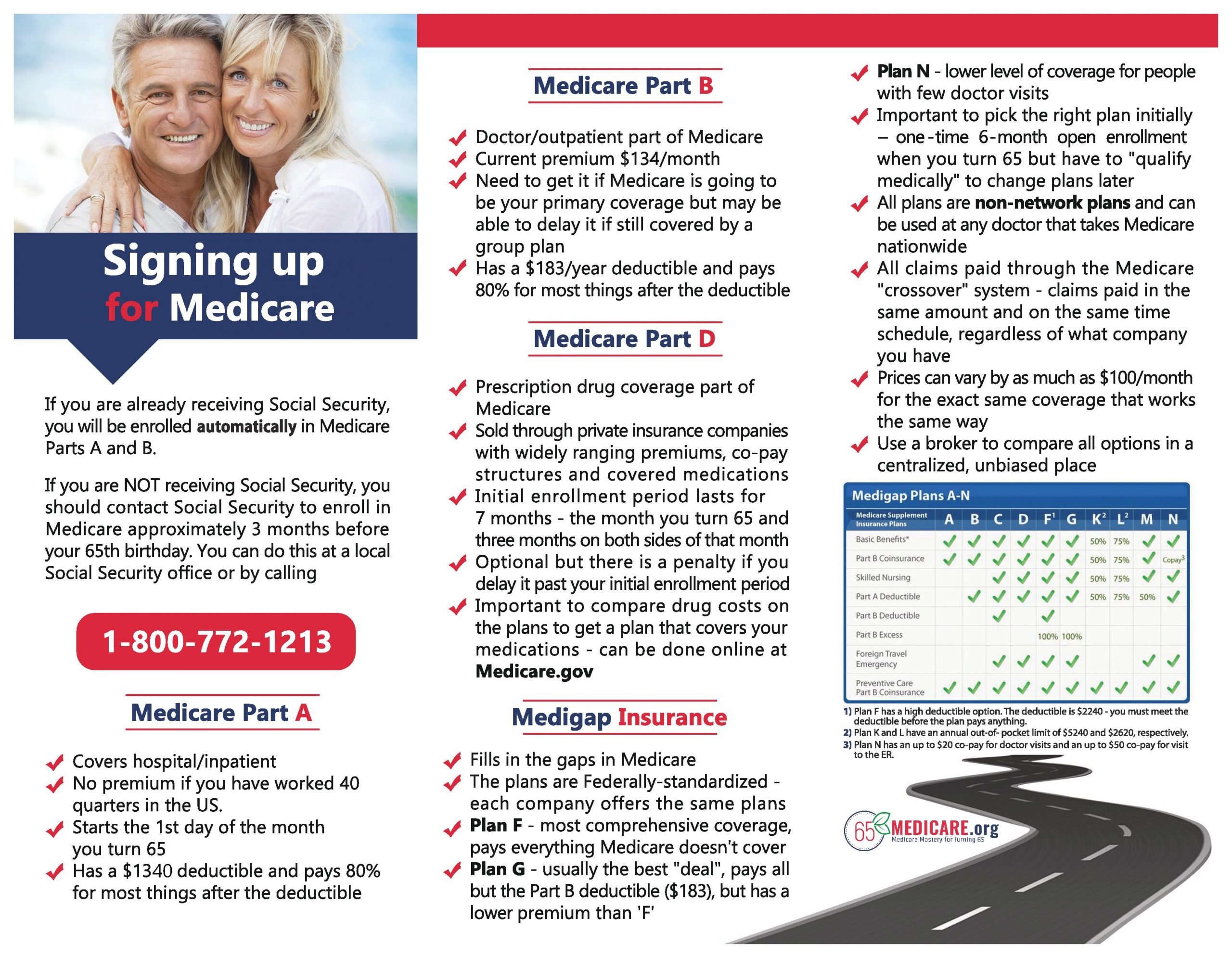

Some people enroll in Medicare Part A when they turn 65 whether theyre working or not, because Part A is usually premium-free. You earn premium-free Part A by paying into the Medicare program through payroll deductions. You qualify if you or your spouse contributed to Medicare for at least 10 years.

Careful though. Once you get Part A , you can no longer contribute to your health savings account .You may want to delay Part A if you have an HSA and want to continue contributing to it. If you decide to get Medicare and stop contributing your HSA, know that you can still continue to use the funds for qualified medical expenses including some Medicare costs.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

If the employer does require you to enroll in Medicare, then Medicare automatically becomes primary and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan only pays for services that it covers but Medicare doesnt. Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage.

Its therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability. If so, find out exactly how the employer plan will fit in with Medicare. If not, ask for that decision in writing.

Note that in this situation, signing up for Medicare Part B when you also have employer insurance will not jeopardize your chances of buying Medigap supplemental insurance after the employment ends. When Medicare is primary to the employer plan, you have the right to buy Medigap with full federal protections if you do so within 63 days of the employer coverage ending.

Who Should Sign Up At 65 Even If They Have Other Insurance

This leaves a fairly long list of other types of insurance that become secondary payers to Medicare. Therefore, if you’re turning 65 and any of these situations apply to you, you should sign up for Medicare during your initial enrollment period.

- You have group coverage through your or your spouse’s employer, but the employer has fewer than 20 workers.

- You have retiree coverage, either through your former employer or your spouse’s former employer.

- You have group coverage through COBRA.

- You have TRICARE, the healthcare program for military service members, retirees, and their families. Retired service members must get Medicare Part B when eligible in order to keep their TRICARE coverage.

- You have veterans’ benefits.

- You have coverage through the healthcare marketplace or have other private insurance. Once your Medicare coverage begins, you’ll no longer get any reduced premium or tax credit for marketplace coverage, and you should drop this coverage as you’ll no longer need it .

If one of these situations applies to you and you don’t sign up for Medicare Part B during your initial enrollment period, you could face permanently higher premiums when you do.

Also Check: What Does Medicare Part D Do

Am I Automatically Signed Up For Medicare When I Turn 65

The short answer is no, unless you are already receiving Social Security or Railroad Retirement Board benefits. If youre already receiving those benefits, youll receive your Medicare card in the mail before your 65th birthday.

Otherwise, youll have to sign up for Medicare on your own and you may or may not be notified about your eligibility. Thats why it is even more important to know your Initial Enrollment Period dates so you are ready to enroll when its your time.

If Your Employer Is Small

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

However, it may be more cost-effective in this situation to drop the employer coverage and pick up Medigap and a Part D plan or, alternatively, an Advantage Plan instead of keeping the work plan as secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,470, according to the Kaiser Family Foundation. However, employees contribute an average of $1,243 or about 17% with their company covering the remainder.

At small firms, the employee’s share might be far higher. For example, 28% are in a plan that requires them to contribute more than half of the premium for family coverage, compared with 4% of covered workers at large firms.

Also Check: Does Medicare Cover Ear Cleaning

How To Opt Out Of Medicare Part B

So, if you dont want to be enrolled, you may be able to opt out. Follow the instructions in your Welcome to Medicare packet, which Medicare sends you during the three months before youre eligible, in most cases.

Were always happy to answer your questions. Call one of our eHealth licensed insurance agents at 1-888-296-0117 . Representatives are available from 8 AM to 8 PM Monday through Friday, and from 10 AM to 7 PM Saturdays, Eastern time.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Recommended Reading: Is It Better To Have Medicare Or Medicaid

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Things You Should Know

How to find out whether or not you are eligible for Medicare Part A and Part B benefits if you are retired and under age 65 and your spouse or you are disabled

If you or your spouse is disabled and receiving Social Security disability benefits, contact Social Security about Medicare-eligibility. If eligible, contact the GIC at 617.727.2310 to request a Medicare Plan enrollment form.

If you have been a state employee and have never contributed to Social Security

You may still be eligible for Medicare benefits through your spouse. When you turn age 65, visit Social Securitys website or call Social Security to apply to see if you are eligible.

What happens to your spouse’s coverage if you enroll in a GIC Medicare Supplemental Plan

Your spouse will continue to be covered under in a GIC non-Medicare plan if he/she is under age 65 until he or she becomes eligible for Medicare. See the Benefit Decision Guide for under and over age 65 health insurance products. If your spouse is over age 65, he/she must enroll in the same Medicare supplemental plan that you have joined.

What you need to do at age 65 if your spouse or yourself was not eligible for Medicare Part A for free, but now, you and your spouse have subsequently become eligible for Medicare Part A for free

You or your spouse must notify the GIC in writing when you become eligible for Medicare Part A. The GIC will notify you of your coverage options. Failure to do this may result in loss of GIC coverage.

Also Check: How Do I Apply For Medicare In Missouri

Do I Need To Sign Up For Medicare When I Turn 65

It depends on how you get your health insurance now and the number of employees that are in the company where you work.

Generally, if you have job-based health insurance through your current job, you dont have to sign up for Medicare while you are still working. You can wait to sign up until you stop working or you lose your health insurance .

- If youre self-employed or have health insurance thats not available to everyone at the company: Ask your insurance provider if your coverage is employer group health plan coverage If its not, sign up for Medicare when you turn 65 to avoid a monthly Part B late enrollment penalty.

- If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you dont have gaps in your job-based health insurance. Check with the employer.

-

If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up.

What If Youre Still Working At 65

If youre still working at 65 and receiving health insurance through your employer, you may still need to sign up for Medicare. If your company offers health insurance and has fewer than 20 employees, your health insurer will refuse to pay for costs that Medicare would have covered. Signing up for Medicare will ensure that those costs are covered.

If your company has more than 20 employees, its still a good idea to enroll in free Part A coverage right away. Your coverage will be free since you already paid Medicare taxes. However, if you have a Health Savings Account, you wont be able to contribute to it once you enroll in Medicare, even if you only enroll in Part A.

Don’t Miss: Are Synvisc Injections Covered By Medicare

When To Apply For Medicare

Once Medicare eligibility begins, youll have a 7 month Initial Enrollment Period to sign up. For most people, this is 3 months before, the month of, and 3 months after their 65th birthday.

Its important to sign up for Medicare when youre first eligible because once your Medicare Part A coverage starts, youll have to pay full price for a Marketplace plan. This means youll no longer be eligible to use any premium tax credit or help with costs you might have been getting with your Marketplace plan. Also, if you enroll in Medicare after your Initial Enrollment Period, you may have to pay a late enrollment penalty. Its important to coordinate the date your Marketplace coverage ends with the effective date of your Medicare enrollment, to make sure you dont have a break in coverage. If you have limited income or resources, you may qualify for help paying costs.

Act Quickly If You Want A Medicare Advantage Or Part D Plan When You Retire

When you work past 65 and qualify for a Special Enrollment Period, there is one tricky thing to note about this time period. The Special Enrollment Period lasts 8 months, but you only get the first two months to enroll in a Medicare Advantage or Part D plan.

Many people get tripped up by this because they do get the full 8 months to get Part A and Part B. And this is even trickier when you consider that you need both Parts A and B to get a Medicare Advantage plan, and either Part A or Part B to get a Part D stand-alone plan.

TIP: Enroll in everything you want and need within the first two months of your Special Enrollment Period to ensure you dont accidently get hit with financial penalties for Part D.

Another good reason to enroll in the first two months is that it can take some time for plans to process your application. Make your decisions and enroll early to avoid a lapse in coverage.

Recommended Reading: What Age Can I Apply For Medicare

If You Delay Enrolling In Part B

If you do not want Part B coverage because you are actively employed and covered by the employer plan and you automatically received Medicares initial enrollment package, sign the included form and check the box next to I do not want medical insurance. Return the form to the Social Security Administration in the provided envelope before the date listed so you wont owe a monthly premium.

If you turn down Part B and dont have other coverage due to active employment, but later decide you want Part B coverage, you can only enroll during the annual General Enrollment Period , which is January 1 through March 31. Your Part B benefits will not be effective until July 1 of that year. You may also be required to pay a late enrollment penalty of 10% of the current Part B premium for each 12-month period you could have had Part B coverage, but did not take it.

For beneficiaries age 65 and older, this penalty is for life, and you will always pay more for your Part B coverage than other people.

If you are younger than age 65, have Medicare because of a disability and are charged the Part B penalty, it will be waived when you turn 65 and qualify for Medicare based on age.

- Part B within 8 months

- Part D within 2 months

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Also Check: Will Medicare Pay For A Power Lift Chair

Im Turning 65 Soon But I Like My Current Insurance Do I Have To Enroll In Medicare Will There Be Penalties If I Dont

It depends on how you are receiving your current insurance. If you are receiving employer-sponsored health insurance through either your or your spouses job when you turn 65, you may be able to keep your insurance until you retire. You will need to contact your employers benefits representative to find out whether they will continue your coverage when you turn 65. Since Medicare Part A is premium-free for most beneficiaries, you may want to enroll in Part A as soon as you are eligible , even if you will continue to receive employer-sponsored insurance at that time. If you are covered under an employer plan, you may want to delay signing up for Part B until you retire. However, it is a good idea to check with Social Security or Medicare to confirm you will not face a penalty for late enrollment. Similarly, unless you have drug coverage that is as good as what Medicare drug plans offer, you will need to sign up for a Medicare prescription drug plan when you enroll in Medicare or you may face a late enrollment penalty.

If you decide to drop your Marketplace coverage when you become eligible for Medicare, make sure your Medicare coverage has started before you cancel your Marketplace plan so that you avoid any gaps in coverage. You can start signing up for Medicare three months before your 65th birthday.

Can You Get Private Insurance Instead Of Medicare

If you have Medicare Part A or Part B, insurers generally arent allowed to sell you a traditional individual health insurance plan .

You can purchase individual health insurance if youve never enrolled in Medicare because you think the overall costs are too high. If youre in the unusual situation of paying for Part A premiums, you can also switch to individual health insurance.

If you develop a medical condition before turning 65 that would qualify you for Medicare, such as ESRD, you can decline to purchase Medicare.

If you decide to purchase private insurance once youre eligible for Medicare unless youre continuing the employer-sponsored insurance that qualifies you for a Special Enrollment Period then youll have to pay the costly late enrollment penalty once you do apply.

If youre nearing the age of 65, then its important you start considering your Medicare coverage.

Read Also: What Are Medicare Requirements For Bariatric Surgery