Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

What You Need To Know About Medicare Parts A B C And D

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

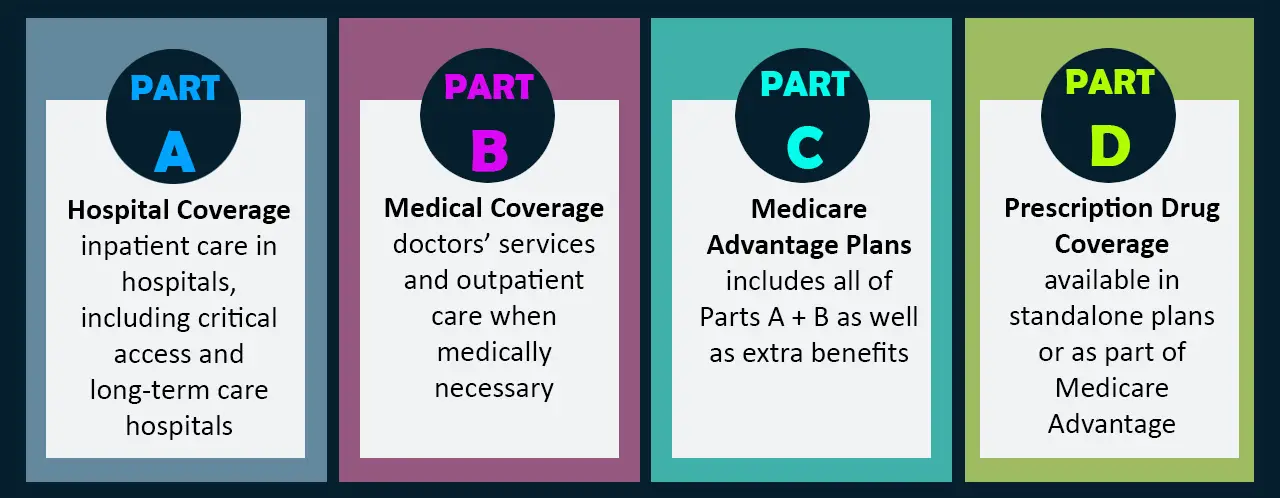

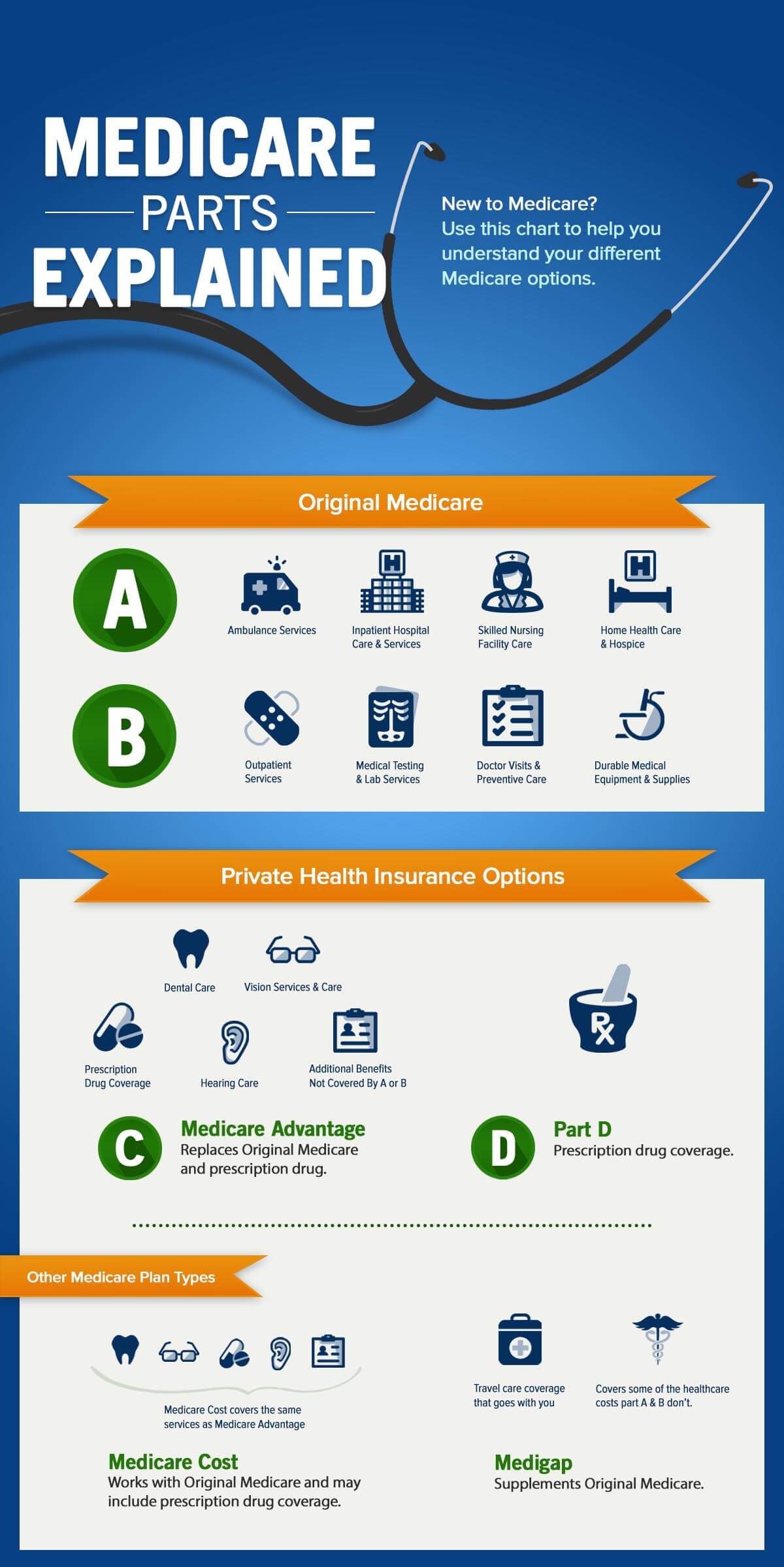

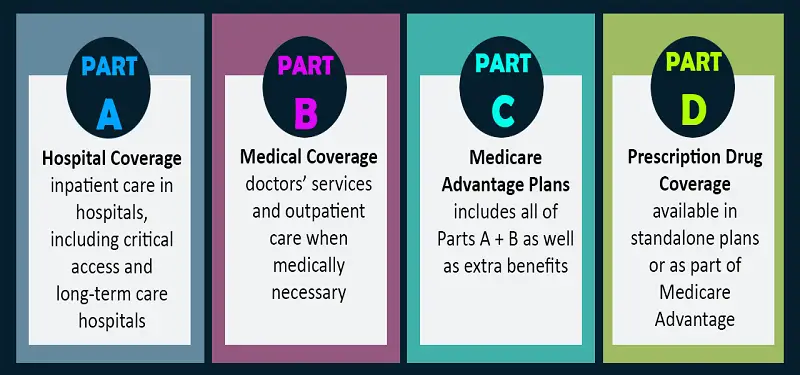

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Don’t Miss: Does Medicare Cover Bladder Control Pads

What Is The 2022 Maximum Out Of Pocket

For Medicare Advantage, maximum out-of-pocket limits can reach up to $7,550 for in-network services. Now, out of network, you could have a MOOP of $11,300.

Those with Medicare Supplement Plan L have a $3,310 out-of-pocket maximum. Those with Medigap Plan K have a $6,620 Maximum Out of Pocket for the year.

Enrollment Period For Medicare Part B

Youre eligible to enroll in Medicare Part B during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including your birthday month, and lasting up to three months after. This is called your Initial Enrollment Period . Enrollment in Part B is automatic if you are receiving Social Security or Railroad Retirement Board benefits.

You May Like: What Age Can You Start To Collect Medicare

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Don’t Miss: What Does Medicare Part B Include

Enrollment Period For Medicare Part C

You are eligible to enroll in Medicare Part C during your Initial Enrollment Period . This is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes the month of your birthday, and lasts up to three months after the end of your birthday month.

Enrollment is optional and not automatic. You must first have Medicare Parts A and B, and then you can sign up for Medicare Part C with a private insurance company. With this plan, you make payments directly to your insurance provider.

What Is Your True Out

Your true out-of-pocket range is the point where prescription drug coverage will begin to pay 100% of prescription costs. This is also known as your donut hole.

The true out-of-pocket range occurs when you or anyone else enrolled in your prescription drug plan has spent the total annual out-of-pocket costs of $4 310. Generally, prescription medication costs are reduced by 50% while you are within the donut hole.

Once you have reached the coverage gap , Medicare prescription plans pay 100% of prescription drugs for the rest of that year.

Read Also: What Insurance Companies Offer Medicare Supplement Plans

What Is Medicare Part C

Medicare Part C, also called Medicare Advantage, includes the coverage benefits of Medicare Parts A and B. Medicare Part C plans can also offer prescription drug benefits and other additional coverage . In total, Medicare Part C can cover things like:

- Medicare Part A

- Medicare Part B

- Medicare Part D

- Vision

- Health and wellness programs

Why Do I Need Medicare Part C

It is not necessary to enroll in Part C. Although it is one of the four parts of Medicare, it exists as one of many options for additional coverage.

Many beneficiaries find the relatively low premiums and all-inclusive nature of these plans attractive. After thoroughly researching their options, some benefit from choosing to go with a Medicare Advantage plan. Especially those under 65 who are eligible for Medicare due to a disability.

Researching Medicare Supplement plans as an alternative option for additional coverage will help you decide whether Part C or Medigap is your best choice.

Read Also: How To Get Replacement Medicare Id Card

Can You Expand Your Medicare Coverage With A Medicare Supplement Insurance Plan

Your Medicare coverage generally comes with cost-sharing, as you read above. A Medicare Supplement insurance plan may pay some or all of the out-of-pocket costs of Medicare Part A and Part B.

These out-of-pocket costs may include deductibles, copayments, and coinsurance. Some Medicare Supplement insurance plans even cover emergency medical care during overseas travel .

Private insurance companies sell Medicare Supplement insurance plans. All Medicare Supplement insurance plans must provide basic benefits, such as Medicare Part A and Part B coinsurance amounts, blood, and additional hospital benefits not covered by Medicare Part A. Read more about Medicare Supplement insurance.

As youve seen, you may have several Medicare coverage options. To compare plans, type your zip code in the box on this page and press the button.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connected with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Medicare Advantage Part C

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits, to compete for your business.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or $0 dollar premiums plus a variety of coverages and benefits not offered by Original Medicare .

Don’t Miss: What Is Medicare Plan F

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

Read Also: Does Medicare Offer Dental Plans

What Do The Letters On Your Medicare Card Mean

The Medicare number displayed on your red, white and blue Medicare card is 11 characters long:

- The 2nd, 5th, 8th and 9th characters are always a letter, and the 3rd and 6th characters are sometimes a letter.

- All other characters will be numbers, and the letters S, L, O, I, B and Z will never be used.

The MBI is randomly generated and is non-intelligent, which means it contains no hidden or special meaning and is therefore more difficult for someone to use to steal your identity or commit fraud.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

You May Like: When Can You Enroll In Medicare Part D

What Happens If I Delay Signing Up For Part D

Like with Part B, if you are late signing up for Part D, you can be subject to a late enrollment penalty. The penalty gets added to your monthly premium. Even if you do not currently take any medications, you should not wait to sign up for Part D because the penalty remains for as long as you are on the plan.

What Are The Four Parts Of Medicare

by Christian Worstell | Published December 22, 2020 | Reviewed by John Krahnert

Medicare is divided into four parts: A, B, C, and D.

The first two parts, A and B, are sometimes called Original Medicare.

Part C, also known as Medicare Advantage is a private insurance plan that provides similar benefits as Original Medicare.

The final piece of Medicare, Part D, are prescription drug plans.

Another aspect of Medicare coverage you can consider is Medicare Supplement Insurance . These are insurance plans that help pay for out-of-pocket costs that Medicare doesn’t cover, such as deductibles, copays, coinsurance and more.

Read Also: Does Cigna Have A Medicare Supplement Plan

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

Who Qualifies For Medicare Part D

To qualify for Medicare Part D, you must have Part A or enrolled in Part B and be entitled to Medicare because of age or disability. You also need to live in the plans service area, pay premiums, have no other drug coverage that meets Medicares standards, meet specific income requirements if your income is above a certain level, and already be enrolled in either Medicaid or the Childrens Health Insurance Program .

The Social Security Administration says that about 99% of people with Medicare coverage can receive prescription drug coverage. To find out if you already have this coverage, contact your current insurer.

Also Check: When Can I Apply For Medicare In California

Which Parts Of Medicare Do I Need

If you choose Medicare Advantage, that usually is all you need. Medicare Advantage typically includes:

- Hospital coverage

- Prescription drug coverage

- An out-of-pocket maximum

You cannot be enrolled in a Medicare Advantage plan and Medicare Supplement plan at the same time.

If you chose Original Medicare, you have hospital and medical coverage. You can add:

- A stand-alone prescription drug plan

- A Medicare Supplement plan to cover out-of-pocket costs

To start looking for Medicare Advantage, Medicare prescription drug, or Medicare Supplement Insurance plans in your area, enter your zip code on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Why Do I Need Medicare Part B

Part B is crucial for attending to your health needs. The benefits of Part B include specialist services and preventive services. As we age, we are at a higher risk of acquiring chronic health conditions.

Part B covers your annual physical exams, laboratory tests at doctors appointments, mental healthcare, and more. Some of the costs you incur at the hospital might also fall under Part B.

You May Like: How To Get Medicare Insurance License

Issues To Watch Out For

The prescription drug program is complex, and there are many issues that arise from receiving prescription medications through Medicare Part D.

For one, prescription medication plans can be very expensive even with the prescription coverage provided by a prescription drug plan. Furthermore, some people find it difficult to choose a prescription drug plan because of the sheer number of options available in todays prescription drug market.

For example, prescription drug plans have different tiers that offer prescription coverage for a certain cost. The more expensive the prescription tier, the lower your prescription medication costs will be.

However, with all of these options comes a series of decisions to make about which prescription drug plan is best for you and how it aligns with your prescription medications.

In addition, most people notice that their prescription medications cost them more over time because they are dropped from the formulary list of drugs covered by their prescription drug plan. This can happen when a generic alternative becomes available or when another company offers a similar therapy at a cheaper price pointeven though the therapy may deliver results differently than what has been prescribed in the past.