How Much Do Medicare Advantage Plans Cost

Most of the 24.1 million Americans enrolled in a Medicare Advantage plan in 2020 paid no premiums for their plan itself. But to enroll in an Advantage plan, they still had to pay the monthly premium for Medicare Part B .

There were more than 3,100 different Medicare Advantage plans sold by private insurance companies that contract with Medicare in 2020. The plans are required to provide all the same coverage offered by Original Medicare Part A and Part B.

Medicare Advantage plans can offer additional benefits and that can increase their costs. So, monthly premiums for Medicare Advantage plans vary based on the terms of the plan, the benefits offered and other circumstances.

Overall, the average monthly premiums for Medicare Advantage plans have decreased 34 percent between 2015 and 2020, according to the Kaiser Family Foundation. This has been driven largely by steep declines in premiums for local PPO plans.

But regional PPO plans have bucked the trend, increasing by more than 30 percent over the same period.

Read Also: Does Medicare Cover Laser Therapy

Is A Plan With A Low Medicare Advantage Premium My Best Option

The Medicare Advantage premium is just one cost of the plan. Keep in mind that plans with lower premiums may also have more basic coverage and plans with higher premiums may have more extensive coverage.

When eHealth asked Medicare beneficiaries about their top health-care concerns, 42% said it was Medicare premiums. Copayments and deductibles were the top concern for 51% of those surveyed. eHealths survey respondents included over 1000 Medicare beneficiaries.

The premium isnt always the only factor affecting your Medicare costs. For example, suppose Medicare Advantage plan 1 has a $0 monthly premium and $0 coverage for routine dental services. If you get $2,000 of dental work, you could pay $2,000.

Suppose Medicare Advantage plan 2 has a $50 monthly premium and $1,000 coverage for routine dental services. You pay $600 in premiums for the year, but with the $1,000 dental coverage, your total spending is only $1,600 compared to $2,000.

*This report reviews costs and trends among people who purchased Medicare insurance products through eHealth from January 1 through March 31, 2018 and the same period in 2019.

Do you have more questions about Medicare Advantage plan premiums? Just enter your zip code on this page to begin searching for plans in your area.

Find Plans in your area instantly!

How Much Do Medicare Part A And Part B Cost In 2022

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $499 per month in 2022.If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

- The standard Part B premium is $170.10 per month in 2022.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2022.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Recommended Reading: Are Doctors Required To Accept Medicare

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, using online banking services, or signing up for Medicares bill pay, which will automatically draft the premium from your bank account each month.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.

You May Like: Is Dexcom G6 Cgm Covered By Medicare

What Does Medicare Advantage Cover

Medicare Advantage plans must cover everything that Original Medicare covers, including inpatient hospital and skilled nursing facility care, emergency and urgent care, doctor visits, surgery, preventive care, certain vaccines and medical equipment such as wheelchairs and walkers. 2

Medicare Advantage plans may also cover additional services not included in Part A and Part B. Most plans include Part D prescription drug coverage. Many offer some coverage for dental and vision care, hearing aids, and fitness centers. Plans recently have been permitted to provide other benefits, including adult daycare, in-home support services, and home safety modifications, such as grab bars and wheelchair ramps. Traditional Medicare does generally not cover those services.3

How Can My Medicare Part C Plan Have A $0 Premium

Medicare Advantage plans with $0 premiums are not uncommon. In fact, it was predicted that 96% of Medicare enrollees would have at least one choice for a zero-premium plan in 2021, according to the Kaiser Family Foundation.4 You may be wondering, how can an insurance company have $0 premiums? Thats a great question. And its easy to explain. This is how the process works:

Its important to remember that, although you may pay $0 in premiums for Medicare Advantage, this does not mean that the plan is free. You still have to pay your Part B premium, annual deductible, copayments, and coinsurance for your Part C plan.

Don’t Miss: How To Apply For Medicare In Kentucky

Medicare Advantage Plans Defined

Also known as Medicare Part C, government-authorized Medicare Advantage Plans provide all the coverage of Original Medicare, as well as additional benefits. Many plans eliminate the need for Medicare Part D because they include prescription drug coverage. Seniors pay a premium for their Medicare Advantage Plans every month. They also pay a deductible on covered services, and coinsurance after theyve met the deductible.

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Don’t Miss: How Do You Contact Medicare

What Types Of Medicare Advantage Plans Are Available

You can choose among several types of Medicare Advantage plans in Pennsylvania, including:

- Health maintenance organizations : With this plan type, youre required to seek treatment from healthcare providers who belong to the plans network. A network is a group of doctors and healthcare facilities that have contracted with an insurance company. If you go to an out-of-network provider, you may be responsible for the costs. You also may need a referral from your primary care doctor to see a specialist. HMOs are the most common type of Medicare Advantage plan.2

- Preferred provider organizations : Like an HMO, a PPO has a network of providers. Although you can go to out-of-network providers, you may pay more if you do. You typically dont need a referral to visit a specialist.

- Special needs plans : These plans are for Medicare members who have specific healthcare needs. There are three types of SNPs:

- Chronic special needs plans : This plan type is for those with chronic health conditions like diabetes, autoimmune disorders, cancer and end-stage renal disease .

- Dual eligible special needs plans : These plans serve those who qualify for both Medicare and Medicaid.

- Institutional special needs plans : These plans are for those who live in an institution, such as a nursing home, or who need nursing care at home.

Get Help

In Pennsylvania trained counselors offer free Medicare counseling through APPRISE. Reach them by calling 1-800-783-7067 from 9 a.m. to 4 p.m. Monday Friday.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2021 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Most enrollees in individual Medicare Advantage plans are in plans that provide access to eye exams and/or glasses , hearing exams/and or aids , telehealth services , dental care , and a fitness benefit . Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer plans do not submit bids, and data on supplemental benefits may not be reflective of what employer plans actually offer.

You May Like: Does Medicare Cover Knee Injections

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays.

Is Medicare Advantage Or Medigap Coverage Your Best Choice

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your particular health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you have to choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your particular wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

Also Check: How Many Medicare Plans Are There

What Is The Average Cost Of Medicare Part D In 2022 By State

The chart below lists the average monthly premiums for Medicare Part D prescription drug plans by state.1

- The lowest average Part D premiums were for plans in Mississippi, Kentucky, Indiana and Oklahoma, with average premiums around $41 or less per month.

- California, Florida, Pennsylvania and West Virginia had Part D plans with the highest average premiums, around $52 or more per month.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

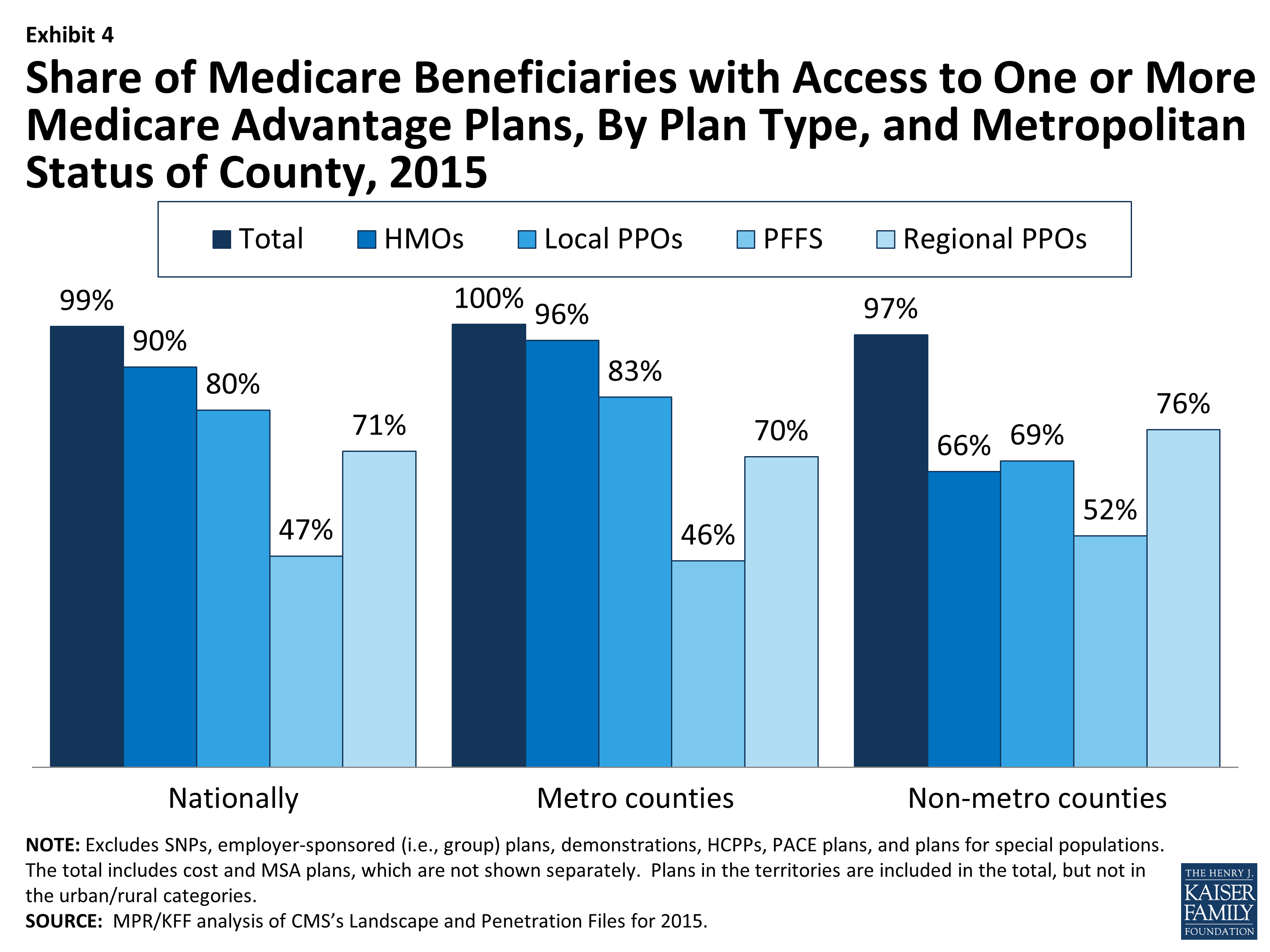

Are Advantage Plans Region

Some Medicare Advantage companies operate in select states and may have different plan options and names depending on where a person lives.

Medicare Advantage plans are usually region-specific because the plan negotiates with providers in that region to be in their network. KFF notes that there may be more plan availability in larger areas than in rural locations.

To get more information about Medicare Advantage plans, a person can call 1-800-MEDICARE to find out which plans are available in their area or use Medicares Plan Finder.

You May Like: Does Medicare Pay For Hearing Aids

Premiums For Medicare Advantage Plans With Prescription Drug Coverage

In 2021, the average monthly premium for plans that include Medicare Part D prescription drug benefits is $21 according to the Kaiser Family Foundation.3 The average monthly premium is weighted by enrollment. That means most people are selecting the lower-priced plans on an overall basis.

Below are the average 2021 monthly premiums for some of the different types of plans .3

| Plan Type |

|---|

| $25 |

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

Also Check: Is Pennsaid Covered By Medicare

Medicare Part B Costs By Income Level

Medicare Part B premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount .

The 2022 Medicare Part B premium costs by income level are as follows:

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2022 Part B deductible is $233 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

You May Like: How Much Is Medicare Part B Now

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage. Even though costs vary, below is an overview of what many people typically pay for each part of Medicare.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

What Are Prescription Drug Options With Medicare Advantage

Most Pennsylvania Medicare Advantage plans include Medicare Part D, which is prescription drug coverage. If you join an MSA or PFFS plan without drug coverage, you can purchase a separate, standalone Part D plan. If you join an HMO or PPO without drug coverage, you cannot buy a separate plan to cover prescriptions.

If you dont join a plan with Part D coverage, you may have to pay an ongoing late penalty once you do enroll.45

Also Check: Does Medicare Pay For A Portable Oxygen Concentrator