What Is Medicare Part C

Medicare Part C, also called Medicare Advantage, includes the coverage benefits of Medicare Parts A and B. Medicare Part C plans can also offer prescription drug benefits and other additional coverage . In total, Medicare Part C can cover things like:

- Medicare Part A

- Medicare Part B

- Medicare Part D

- Vision

- Health and wellness programs

How Do I Choose A Part D Plan

Perhaps the most important consideration when choosing a Part D plan is whether that plan covers the specific prescriptions you take. You can input the drugs you take and compare plan options using Medicares comparison tool. Otherwise, consider your priorities. Do you want:

- Protection from high drug costs?

- Coverage in case you need prescription drugs ?

- A low premium?

Select multiple plans to compare the star rating, premium, and deductible between plans. And click on Plan Details to see that plans costs by drug tier.

Getting The Most Coverage And Cost Savings

To keep your birth control costs as low as possible, make sure to select the right plan for your needs.

Talk with your healthcare provider, insurance company, or benefits administrator to be sure the medications you need are covered under the plans youre considering.

Its also important to check your plans requirements before you choose a birth control method.

Recommended Reading: Does Medicare Cover While Traveling Abroad

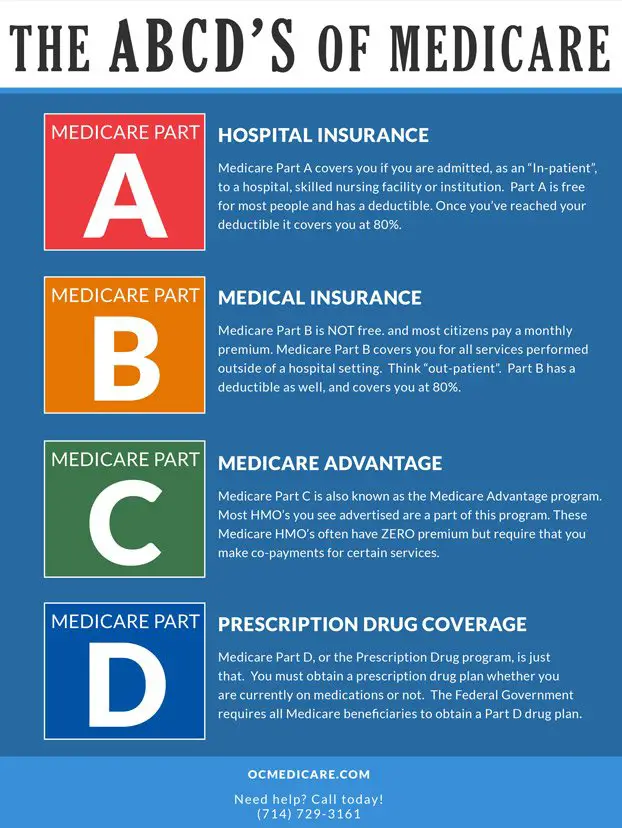

How Medicare Part D Works

Meredith Mangan is the senior insurance editor for The Balance. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequencesgood or bad.

Learn how it works, when and under what circumstances you can enroll, and what to consider when choosing a plan.

How Much Does Medicare Part A Cost

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2020 Deductible: $1,408 for each benefit period

The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

Read Also: When Must You File For Medicare

How Much Is Medicare Part D

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan.

Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers. Private insurers set their own premiums, so it pays to compare plans in your area to make sure that youre choosing the right plan for your prescription drug needs

Keep in mind, Medicare prescription drug policies and Medicare Advantage drug plans vary in terms of the particular medications they cover as well as the costs the beneficiary pays. This is despite the prescription drugs being the same.

Medicare Part D Costs depend on:

- The medications you take, and how frequently you take them

- Whether the pharmacy you go to is within the network of your plan

- Your medications are on your Part Ds formulary

- Whether you have chosen the stand-alone Part D Medicare Prescription Drug policy or the Medicare Advantage Drug Plan

- If you receive extra help paying your Part D Medicare costs

One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

You May Like: Is Silver Sneakers Part Of Medicare

Medicare Part D: Key Takeaways

- The only source of prescription drug plans is through private insurance companies.

- Most Medicare Advantage plans include prescription drug coverage.

- You can also purchase a stand-alone prescription drug plan if youre enrolled in a PFFS or MSA plan that doesnt include prescription coverage.

- Your first opportunity to enroll in Part D is when youre initially eligible for Medicare.

- You have the option of selecting an Advantage plan and using that in place of Medicare A, B, and D.

- In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period.

- If you dont enroll in prescription drug coverage during your initial open enrollment and then enroll later during general open enrollment, a late enrollment penalty will be added to your premium.

As of mid-2021, nearly 49 million Medicare beneficiaries had prescription drug coverage through Medicare Part D. The total is split nearly equally between those who have Part D coverage in conjunction with a Medicare Advantage plan , and those who have stand-alone Part D prescription drug plans , most of which are purchased to supplement Original Medicare. But the balance has started to shift towards MAPD coverage, and it has recently surpassed albeit slightly the number of people with stand-alone PDP coverage.

How Much Does A Medicare Prescription Drug Plan Cost

These plans are private plans, which means each insurance company determines costs for its plans. Generally, you will pay a combination of the following out-of-pocket costs for your Medicare Part D coverage:

- Monthly premiums

- Annual deductible

- Copayments

- Coinsurance

Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically wont pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage. You may, however, have a separate Part D deductible.

Plans set their own copayment amounts, which range between $0 and $10 for generic medications according to the Kaiser Family Foundation. Coinsurance amounts for expensive brand-name and specialty medications range between 25% and 50% of the actual medication costs.

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in. Youll pay a percentage of your medication costs or a small copayment, whichever is higher, for covered medications for the rest of the year.

One thing to keep in mind: Medicare Supplement insurance plans sold today wont pay any Part D prescription drug costs.

Also Check: Which Insulin Pumps Are Covered By Medicare

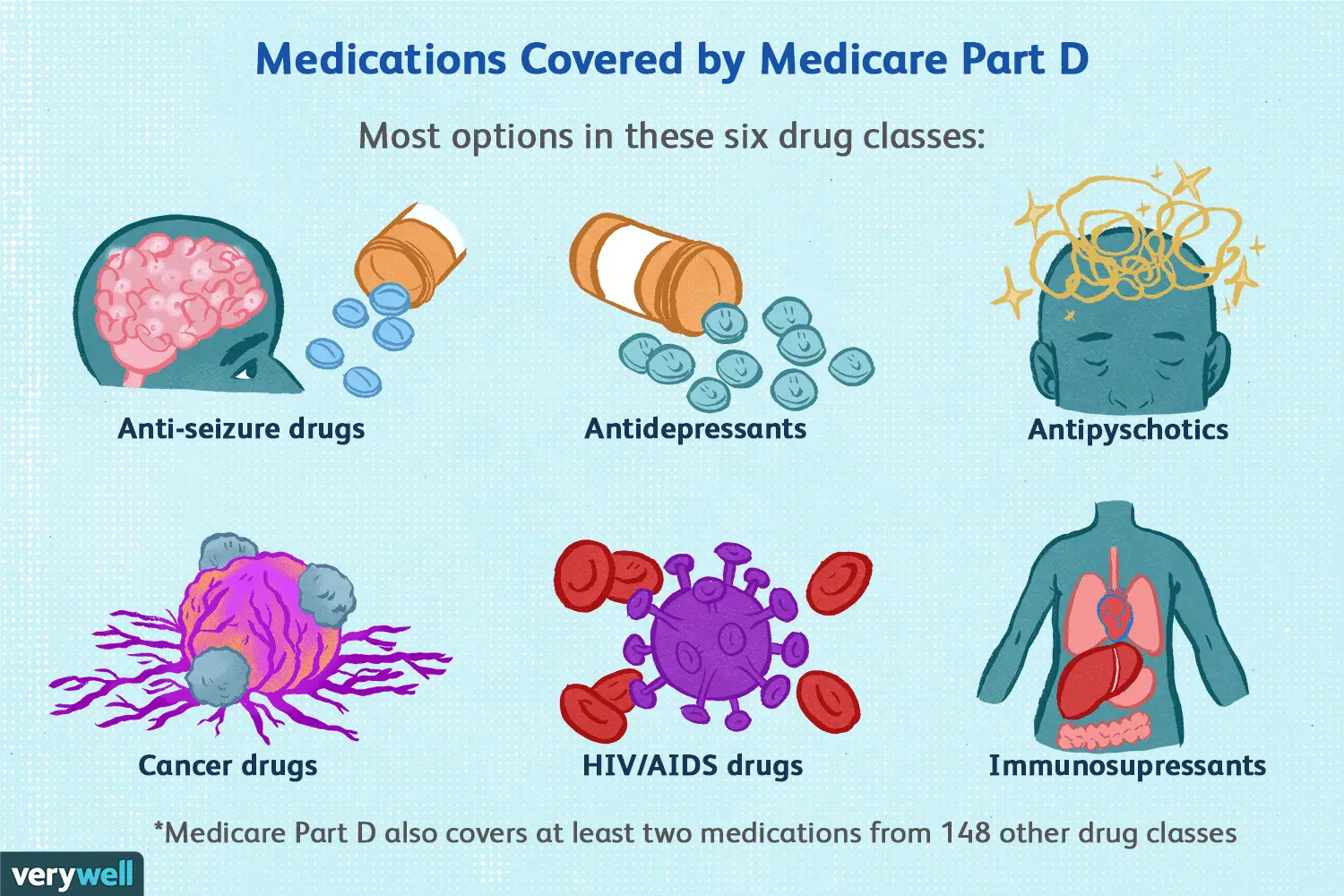

Drugs Not Covered Under Medicare Part D

Since each Medicare Part D Prescription D plan decides which drugs not to cover on its formulary, the list here is not complete. However, plans usually do not cover:

- Weight loss or weight gain drugs

- Drugs for cosmetic purposes or hair growth

- Fertility drugs

- Drugs for sexual or erectile dysfunction

- Over-the-counter drugs

Medicare Part D also does not cover any drugs that are covered under Medicare Part A or Part B.

Medigap Changes : How Will Plan D Be Affected

Medicare Supplement Plans C and F will not be sold to anyone eligible for Medicare on or after January 1, 2020.5 But the good news is Plan D is a suitable Plan C replacement. Why? Medigap Plans C and D offer the same benefits, except that Plan C covers the Part B deductible and Plan D does not.1

Why should this matter to you? If youre eligible for Medicare before 2020, you may want to consider getting Plan C. If you do, you will be grandfathered in, which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

If coverage for the Part B deductible isnt a priority, you can buy Medigap Supplement Plan D now or whenever you become eligible for Medicare. Your monthly premium for Plan D may be less since it does not cover your Part B deductible. The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida.6

Also Check: How To Apply For Medicare In Alaska

Medicare Part D Premiums By Filing Status And Income

| Single | |

|---|---|

| $412,000 or more | $77.10 + your plan’s premium |

Remember that these premiums are just for Part D and they apply in addition to your Part A and Part B premiums. The premium for 2021 Part B plans is $148.50 , or more for those with higher incomes. And check out our guide to choosing your tax filing status.

When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Also Check: Does Medicare Cover Laser Therapy

What Is Part D And How Does It Work

Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carriers network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drugs cost. The insurance company will pay the rest.

Your Part D insurance card will be separate from your Medigap plan.

Medicare Part D plans all follow federal guidelines. Each insurance carrier must submit its plan outline to the Centers for Medicare and Medicaid Services annually for approval.

To improve your understanding of Medicare Part D, lets look at the basic way that each Part D plan works:

Medicare Part C In 2022

There are no one-size-fits-all changes for Part C plans in 2022. Since these plans are offered by private insurance companies, their rates and deductibles will vary. The Annual Election Period that occurs every year from October 15 December 7 is the time that current Part C plan holders can find out what their benefits will look like in the upcoming year.

Recommended Reading: Does Medicare Cover Outside Usa

Example Of Medicare Part D

Daniel is a veteran considering whether to opt into Medicare Part D. As an older American, Daniel is already covered by Medicare for various medical expenses. However, some of his prescription medications are not covered by Medicare, causing him to look for additional coverage.

In researching his options, Daniel examines several plans offered by private insurers under the Medicare Part D program. In doing so, he realizes that because of his prior military service, he is already entitled to prescription drug coverage through the Veterans Affairs program. When comparing this VA plan against the terms and conditions offered by private insurers under Medicare Part D, he concludes that his best option is to rely on his VA benefits.

For this reason, Daniel decides not to opt into Medicare Part D. Because his VA plan is recognized by the government as a form of creditable prescription drug coverage, he will not be charged a penalty for failing to opt into Part D.

Cvs Health Unitedhealth And Humana Have The Most Stand

Figure 4: Distribution of Medicare Part D Stand-alone Drug Plan Enrollment by Firm, 2018-2019

In 2019, 9 out of 10 stand-alone drug plan enrollees are in plans sponsored by five firmsCVS Health, UnitedHealth, Humana, WellCare, and Cigna. Enrollment in PDPs sponsored by CVS Health, which has the most stand-alone drug plan enrollees in 2019, increased over time through acquisition of other plan sponsors, while UnitedHealth and Humana have had large market shares since the Part D program began . However, enrollment in PDPs sponsored by the three largest firms declined between 2018 and 2019, while WellCare and Cigna gained PDP enrollees in part due to merger activity: specifically, Cignas acquisition of Express Scripts and the divestiture of Aetnas PDP enrollment to WellCare pursuant to the acquisition of Aetna by CVS.

The decline in Humanas PDP enrollment between 2018 and 2019 was driven by a large drop in enrollment in the Humana Walmart Rx PDP, which may be attributable to a 37% increase in the average monthly premium for this PDP . This plan was among the lowest-premium PDPs in all regions in 2018, but that is no longer the case in 2019.

Recommended Reading: Do I Qualify For Medicare If I Am Disabled

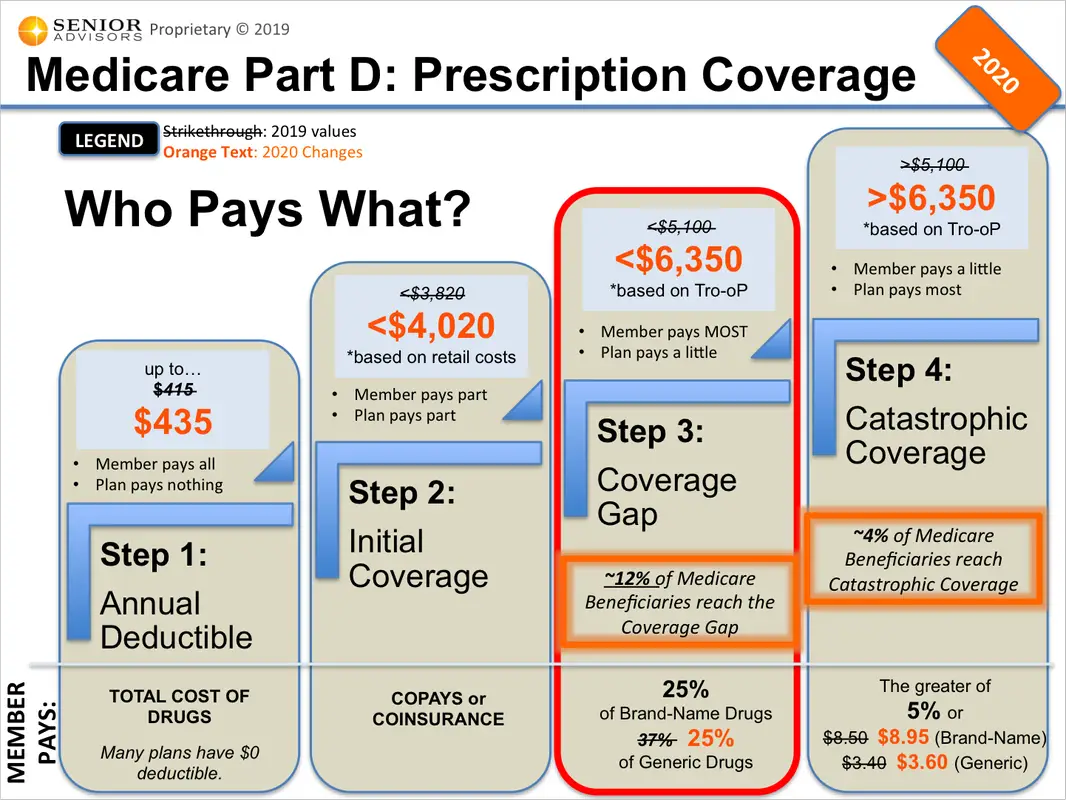

How Much Does Medicare Part D Cost

What you pay for a Medicare Part D plan will vary based on your specific plan, what state you live in, and your income. There are a few costs you should understand because most plans have them:

-

a premium that you pay each month to keep your plan active

-

a deductible, which is the amount you need to spend before insurance starts covering your costs

-

copays and coinsurance that you pay each time you fill a prescription

Most Medicare drug plans also have a coverage gap , which is a temporary limit on what the drug plan will pay for drugs. Low-income individuals can avoid the coverage gap if they receive Medicare Extra Help. Extra Help covers most or all of your premiums, copays, coinsurance, and deductible.

Read more about the cost of Medicare.

Understanding Medicare Part D Prescription Drug Coverage

An animated white speech bubble appears over an animated character’s green and white head.

ON SCREEN TEXT: What is a Medicare Part D Plan?

The character and speech bubble separate and exit the screen on opposite sides. Blue text appears above a sheet of paper.

ON SCREEN TEXT: Medicare Part D plans are…

The paper and text slide up. Blue text appears, along with blue and white pill bottles.

ON SCREEN TEXT: Stand-alone plans that provide prescription drug coverage.

A bottle covers the text and turns over as pills pour out of it.

ON SCREEN TEXT: Part D plans cover certain common types of drugs as regulated by the federal government, but each plan may choose which specific drugs it covers.

The text disappears as the camera moves down to show another sheet of paper.

ON SCREEN TEXT: The list of drugs a plan covers is called a formulary.

Text appears on the paper.

ON SCREEN TEXT: Part D plans do not cover:

ON SCREEN TEXT: Drugs that aren’t on the plan’s formulary

ON SCREEN TEXT: Drugs that are covered under Medicare Part A or Part B

The text is crossed out with a blue line as the page scrolls down.

ON SCREEN TEXT: Drugs that are excluded by Medicare

More text is crossed out with a blue line. After the page scrolls down, the last chunk of text is crossed out with a blue line. The screen swipes down and white text appears on a blue background.

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare

Don’t Miss: What Is The Average Premium For Medicare Advantage Plans

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

Medicare Part A In 2022

Most individuals wont notice a premium in change for Part A since the majority of Medicare beneficiaries receive premium-free Part A. As long as youve paid Medicare taxes for ten years, youll have this benefit.

However, there are still some individuals who have to pay a Part A premium. The amount you pay is based on the number of quarters you paid Medicare taxes. If you paid Medicare taxes for more than 30 quarters, but less than 40 quarters, your premium will be $274 in 2022. If you did not reach the 30 quarter mark, youd pay the full Part A premium of $499.

The Part A deductible is also increasing in 2022. In 2021, the deductible was $1484. That will increase to $1556 in 2022. Its important to remember that this deductible applies per benefit period, not calendar year. Its possible for individuals who get hospitalized more than once to have to pay this deductible multiple times in one year.

Recommended Reading: What Age Can A Woman Get Medicare