What Does Medicare Part C Cover

The law requires that Medicare Part C cover emergency care and other urgent care. Medicare Advantage plans also cover almost all of the services Original Medicare covers. That includes hospital care and other inpatient care that you can get through Medicare Part A. It also includes the outpatient care, like preventive care and lab services, that you receive from Medicare Part B.

Most Medicare Advantage plans also come with vision, dental, hearing, and prescription drug coverage. Medicare prescription drug plans that are part of Part C are known as Medicare Advantage Prescription Drug plans.

Some Medicare Advantage plans cover additional other services like transportation to doctor visits or adult day care services. Certain plans also tailor their benefits to chronically ill enrollees.

However, all of the benefits and services that go beyond what Original Medicare covers are optional. Insurers do not have to offer them and not all plans include them. Read the benefits information for a specific plan to see exactly what it covers.

No Medicare Advantage plan covers hospice care. However, Original Medicare still covers hospice care even if you primarily use Medicare Advantage.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first and a secondary payer will only kick in for costs not covered by the primary payer. The secondary payer may not pay all of the remaining uncovered costs, and you may be responsible for any additional balance.

In many instances, if you are age 65 and covered by either a retiree plan or a plan with fewer than 20 employees, then Medicare is your primary payer and private insurance is your secondary. If this is your situation, you should enroll in Part A and B, along with D if your private insurance plan doesnt have creditable prescription drug coverage.

If youre covered by a plan with 20 or more employees, Medicare is often the secondary payer. Medicare may pay costs that your employers plan doesnt.

You May Like: What Are The Four Different Parts Of Medicare

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

One important thing to know about Medigap: It only supplements Medicare and is not a stand-alone policy. If your doctor doesn’t take Medicare, Medigap insurance will not pay for the procedure.

Insurance agents are not allowed to sell Medigap to participants of Part C, Medicare Advantage.

Medigap coverage is standardized by Medicare but offered by private insurance companies. According to, Patrick Traverse, founder of MoneyCoach, Mt. Pleasant, S.C.,

“I recommend that my clients purchase Medigap policies to cover their needs. Even though the premiums are higher, it is much easier to plan for them than what could be a large out-of-pocket outlay they might have to face if they had lesser coverage.”

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period in the fall. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

You May Like: Is Dexcom G6 Cgm Covered By Medicare

Changes To Medicare Advantage Under Obamacare

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

There was also an initial drop in the number of Medicare Advantage plans being offered. An Avalere Health analysis found a 5 percent drop in the availability of Medicare Advantage plans. In addition, the variety of plan types also dropped, with more Medicare Advantage providers offering only HMO policies instead of PPO, PFFS and Special Needs Plans.

For the 2020 enrollment season, Medicare Advantage customers saw an increase in plan options nationwide, with a total of over 5,000 Advantage plans on the market according to state data that we analyzed from the Centers for Medicare and Medicaid Services.

The donut hole, which is a coverage gap in Medicare, has also been eliminated thanks to measures put into place under the Affordable Care Act. Now, once you reach your drug plans initial coverage limit , youll pay 25 percent of the cost of your medications until you reach the catastrophic limit on the other side.

How Do I Get Medicare Part C

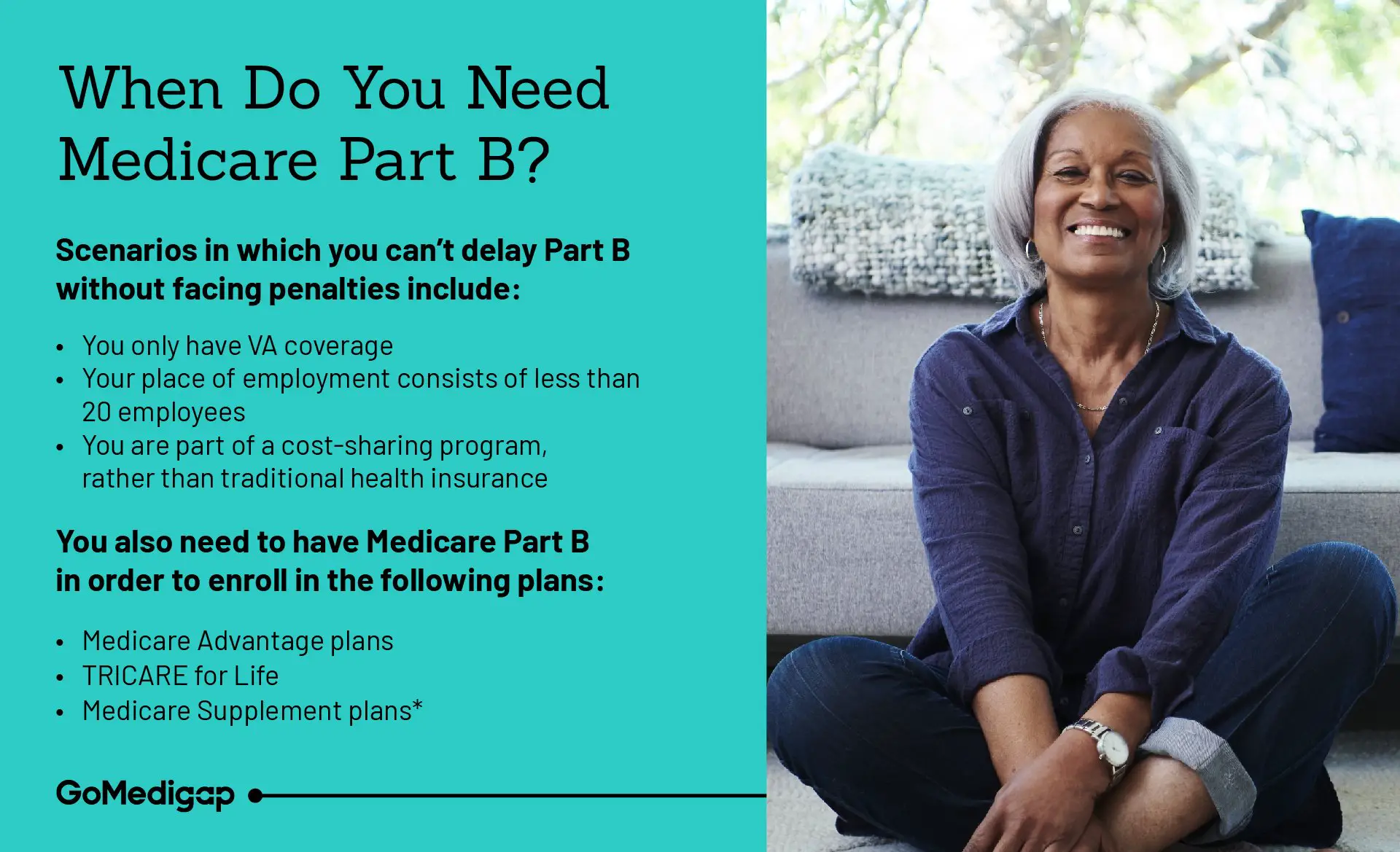

Enrolling in a Medicare Advantage plan is different from enrolling in Original Medicare . First, before you can enroll in a Part C plan, you must already be enrolled in Part A and Part B. Second, youll need to find a Medicare plan provider and enroll directly with them. Medicare Advantage plans are only provided by private insurance companies and are not sold by the government.

Recommended Reading: Do I Need Health Insurance With Medicare

Medicare Part C Plans

What is a Part C Medicare plan? Medicare Part C plans are private Medicare plans which pay instead of Medicare.

Think of Medicare Advantage plans as a package where you will have Part A, Part B and usually Part D together in one plan. You will have one ID card that you use at hospital, doctors office and pharmacy. Most Advantage plans include a built-in Part D drug plan, although in some areas you can find them without Part D.

Medicare C plans resemble group insurance benefits you may have had through former employers. Generally, there is a local network of providers that you will use. You will pay copays for many routine services like doctors visits, lab-work, ambulance, surgeries, hospital stays, urgent care and more.

Related Article: What is Medicare Advantage?

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Don’t Miss: When Can Medicare Plans Be Changed

Whats Medicare Part C

Medicare Part C is the Medicare Advantage program. Part C gives you an alternative way to get your Original Medicare benefits.

So, you could say that Part C = Part A + Part B.

Medicare Advantage plans are available through private, Medicare-approved health insurance companies. Its common for Medicare Advantage plans to include prescription drug coverage through Medicare Part D. These are sometimes called Medicare Advantage Prescription Drug plans.

When it comes to Medicare Advantage Prescription Drug plans, you could say that Part C = Part A + Part B + Part D.

Under Medicare Part C, Medicare Advantage plans can also offer extra benefits, like routine dental services or membership in fitness programs.

How Much Does Medicare Advantage Cost

Medicare still costs money even though its funded through the government via taxes. The government sponsors Medicare Part C, and extra services may be included in the plan, which can drive up costs. In general, costs break down as follows:

- Under Medicare Part C, you must qualify for Part A and Part B, which means that you must at least pay a Part B premium. In 2020, the standard Part B premium is $144.60 per month for new beneficiaries. This will increase to $148.50 in 2021.

- The cutoff amount for the standard premium is an income of $87,000 or less per year . If you have a higher income, you will generally pay a higher premium.

- The deductible is $198 per year in 2020, which increases to $203 in 2021.

- You also pay a 20 percent coinsurance or 20 percent of all medical costs after meeting the deductible for Part B.

- Medicare Part C has additional costs, which mean that you pay a monthly premium for it as well. These premiums vary but can be as low as $0 per month. Per our analysis of 2021 state data from the Centers for Medicare and Medicaid Services, premiums average to around $26 a month next year.

Also Check: Does Medicare Cover You When Out Of The Country

Medical Savings Account Plans

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan paired with a health savings account . With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

Deductibles vary by plan, but can be thousands of dollars. If you spend all of the money in your MSA before reaching your deductible, you will need to pay expenses out of pocket until you hit your deductible. Make sure to take the high deductible into account before getting an MSA.

When Can You Enroll

To enroll in a Medicare Advantage plan, you can take advantage of certain election and enrollment periods.

The Initial Coverage Election Period is when youre first eligible for a Medicare Advantage plan.

When you become eligible for Medicare and youre enrolled in Medicare Part A and Part B, you can enroll in a Medicare Advantage plan. In this case, your ICEP is the seven-month period that starts three months before the month where you turn 65, runs through your birth month, and continues for the three months after that. This is the same as your Medicare Initial Enrollment Period.

If you dont sign up for Medicare Part B when youre first eligible , your ICEP is the 3-month period before your Part B start date. For example, if you enrolled in Part B during the General Enrollment Period , your Part B start date would be July 1, so your ICEP would be April 1 to June 30.

Your next chance to enroll in a Medicare Advantage plan is during the Annual Election Period , also called the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage. It runs from October 15 to December 7 each year. You can add, change, or drop Medicare Advantage plans during the AEP, and your new coverage starts on January 1 of the following year.

Read Also: Is Obamacare Medicaid Or Medicare

How Do Medicare Part C Plans Work

Medicare Advantage plans all offer you care through a network of health care providers. Plans are divided into multiple types based on whether you can use providers outside of your network and how much you would have to pay for doing so. This is the same system that other private insurance plans use. Plans may not advertise very clearly what type they are, so make sure to check the plan details for more information.

The table below lays out the major features for each type of Medicare Advantage, and then we go into more detail on each one.

| HMO |

|---|

| Yes |

How Medicare Snps Work

Medicare SNPs are a type of Medicare Advantage Plan . Medicare SNPs limit membership to people with specific diseases or characteristics. Medicare SNPs tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve.

Two common SNPs are:

You May Like: Is Bevespi Covered By Medicare

I Have Medicare Part A And Part B Ive Heard About Part C And Part D But I Dont Know What Those Are Do I Need To Sign Up For Those During The Medicare Open Enrollment Period

Medicare Part C plans, also known as Medicare Advantage plans, are private health insurance plans, mainly HMOs and PPOs, for people enrolled in Medicare. If you enroll in a Medicare Advantage plan, you still have Medicare, but you get all of your Medicare-covered benefits through a private plan. Most Medicare Advantage plans also cover prescription drugs and may cover other services, such as vision, dental, and hearing benefits. If you have Part A and Part B already, and are covered under the traditional Medicare program, you do not need to sign up for a Medicare Advantage plan during Open Enrollment unless you want to get your Medicare benefits through a private plan.

Medicare Part D is the Medicare prescription drug benefit which is offered by private stand-alone prescription drug plans, sometimes called PDPs, and Medicare Advantage plans that cover drugs. If you are covered under traditional Medicare and you want drug coverage, you can enroll in a stand-alone drug plan during the Medicare Open Enrollment period. If you did not sign up for a Part D plan when you got your Part A and Part B coverage and you do not have another source of drug coverage that is at least as good as Part D coverage, be aware that you may be charged a late enrollment penalty. Once you are enrolled in a Part D plan, you can switch drug plans during the Medicare Open Enrollment period.

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Recommended Reading: When Can You Get Medicare Health Insurance

Some Retiree Health Plans Terminate At Age 65

If youre not yet 65 but are retired and receiving retiree health benefits from your former employer, make sure youre aware of the employers rules regarding Medicare. Some employers dont continue to offer retiree health coverage for former employees once they turn 65, opting instead for retirees to transition to being covered solely by Medicare. Without coverage from your company, youll need Medicare to ensure that you are covered for potential health issues that arise as you age.

What Do Medicare Advantage Plans Cover

Medicare Advantage plans provide all of your Part A and Part B coverage and must cover all medically necessary services. Many plans also offer prescription drug coverage and additional programs not covered by Original Medicare. To enroll in a Medicare Advantage Plan, you must already have Original Medicare Part A and B coverage.

Part C

- Combines Original Medicare, Part A and Part B, in 1 plan

- Often also includes Medicare Part D prescription drug coverage

- May come with additional programs and services not offered by Original Medicare

These plans are part of the government’s Medicare program, but are offered and managed through private insurers, like Cigna. Medicare Advantage Plans may include plan extras not found in Original Medicare. You must be enrolled in Medicare Part A and Part B to join.

Recommended Reading: Is Dental Care Included In Medicare

How Flexible Are Medicare Advantage Plans

Most private health insurance companies that offer Medicare Part C do their best to give members multiple choices when it comes to plans, but certain plans are only available in specific service areas. This means that not all plan types may be available throughout the country, especially in rural areas. In these cases, you may want to go with Original Medicare if you cant find the plan that you want. Most companies will offer different types of plans, including:

- Medicare HMO Health Maintenance Organization

- Medicare PPO Preferred Provider Organization

- Medicare PFFS Pay-Fee-For-Service

- Medicare SNP Special Needs Plans

The most flexible of these plans is likely the PPO, which does not require you to pick a primary care provider or stay within network. In general, PPOs charge a higher fee when you go out of network and may have a higher monthly cost than an HMO. These plans do allow you to go out of network, which is beneficial if you have a chronic health condition or need to see a special doctor. If you already have a primary care doctor you like, a PPO may also be the best option.

An HMO is not a flexible option. For one, you have to pick a primary care provider, and you cant see doctors or facilities outside of the network. You also need a referral to see a specialist. If you have to get urgent care, you need to make sure that your facility is in your network or else you will pay out of pocket.