Eligibility For Medicare Part B

In general, Medicare is available to U.S. citizens and permanent legal residents who:

- Are age 65 or older

- Are under age 65 and have a disability

- Have end-stage renal disease

- Have amyotrophic lateral sclerosis, also called Lou Gehrig’s disease.

When you are first eligible for Medicare, you have a seven-month Initial Enrollment Period to sign up for Part A and/or Part B. If you’re eligible when you turn 65, you can sign up during the seven-month period that:

- Starts three months before the month you turn 65

- Includes the month you turn 65

- Ends three months after the month you turn 65

If you don’t sign up for Part B when you are first eligible for it, you could be stuck paying a late enrollment penalty of 10% for each 12-month period when you could have had Part B but didn’t enroll in it. However, you may choose to delay enrolling in Part B if you already have health coverage. Check Medicare’s website to find out more.

Delaying Part B Coverage

Some people choose to delay enrolling in Part B. This is often the case if they are are still working and receive health insurance coverage through their workplace, or if theyâre on their spouseâs health insurance plan.

If your workplace has 20 more employees, you may choose to keep employer-sponsored coverage and save from paying the Part B monthly premium. Once you leave work and retire, you will be given an eight-month special enrollment period to apply for Medicare Part B.

If you donât sign up during special enrollment, youâll have to wait until general Medicare open enrollment starts on January 1 to sign up for coverage that wonât be effective until July 1. Youâll also have to pay a lifetime late-enrollment penalty â a monthly penalty that lasts as long as you have Part B.

What Does Medicare Part B Cost

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 and increases with income.3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier.

The annual deductible for Part B is $198 in 2020 .4 Once this is paid, youll only pay your coinsurance payments, which are 20% of covered expenses.

Some low-income and disabled people may be eligible for help paying Part B premiums through their state’s Medicare Savings Program . Those eligible for free Medicare Part B may qualify for free or lowered deductibles and coinsurance as well.

If you con’t qualify for an MSP, consider purchasing a Medicare Supplement plan to help cover the costs of both Parts A and B.

Learn more about Medicare costs.

Recommended Reading: Why Is My First Medicare Bill So High

How To Enroll In Part B

A person becomes eligible for Medicare Part B when they reach 65 years of age.

However, people with specific disabilities qualify for Medicare Part B earlier, including those with end stage renal disease and individuals with amyotrophic lateral sclerosis , also known as Lou Gehrigs disease.

If a person receives benefits from Social Security or the Railroad Retirement Board, these organizations will automatically enroll them in Parts A and B.

Some people may choose to delay enrollment in Part B because other sources provide coverage, such as insurance for which their employer or their spouses employer pays.

If a person cannot pay the Medicare Part B premium, they can apply for Extra Help or Medicaid, which helps individuals with a low-income access and pay for insurance.

How To Apply For Medicare Part B

If youâre already receiving Social Security benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65.

Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65. You can also sign up for Medicare during Medicare Open Enrollment, which lasts from October 15th until December 7th.

You can apply by visiting your local Social Security office, calling Medicare at 1-800-772-1213, or simply filling out an application online at the Social Security Administration website. Here is a step-by-step guide to applying for Medicare.

Recommended Reading: What Is The Annual Deductible For Medicare

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription-drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

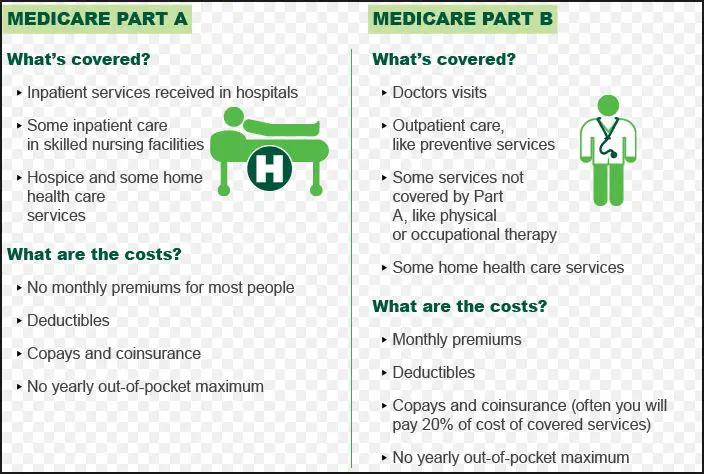

What Does Medicare Part A Cover

Medicare Part A covers the hospital charges and most of the services you receive when you’re in the hospital.

What is covered by Medicare Part A

Hospital stays and inpatient care, including:

Medications for pain and symptom management:

Up to $5 per prescription

Durable medical equipment used at home and respite care:

Home hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

*Lifetime reserve days are a set number of covered hospital days you can draw on if youre in the hospital longer than 90 days. You have 60. Each lifetime reserve day may be used only once, but you may apply the days to different benefit periods. Lifetime reserve days may not be used to extend coverage in a skilled nursing facility.

Recommended Reading: Does Medicare Cover Oral Surgery Biopsy

Prescription Drugs You Take At Home

PartB medical insurance covers only drugs that cannot be self-administered and thatyou receive as an outpatient at a hospital, a clinic, or at the doctor’soffice.

MedicarePart A covers drugs administered while you are in the hospital or in a skillednursing facility, and coverage for all other prescription drugs falls underMedicare Part D, which you must enroll in and pay for separately from Parts Aand B.

What Original Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. With a few exceptions, Original Medicare doesn’t include coverage for prescription drugs. It also does not cover health care benefits you may have been used to getting with an employer plan such as dental, vision, hearing health care or wellness items like fitness memberships.

Also Check: How To Get A Lift Chair From Medicare

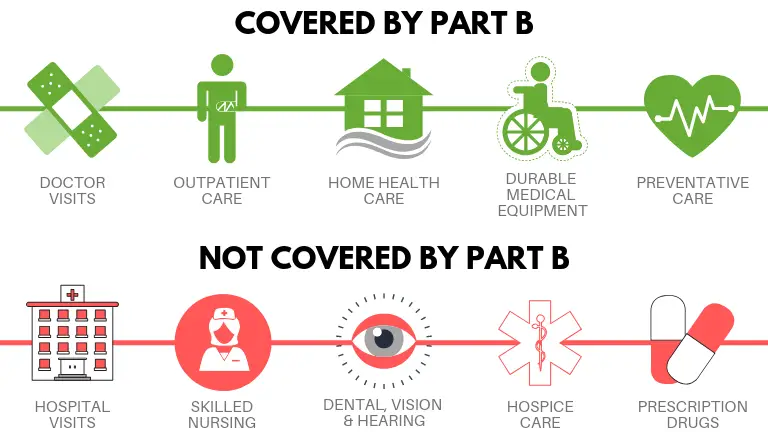

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Medical Equipment Used To Administer Medications

- Infusion pumps

- Nebulizer machines

* Oral chemotherapy and anti-nausea agents have to meet certain criteria to be covered by Part B. While the majority of injectable medications will be covered by Part B, keep in mind that some drugs may be excluded. The coverage requirements change on an annual basis.

** Hepatitis B risk factors for the purpose of Part B coverage include diabetes mellitus, ESRD, hemophilia, living with someone who has Hepatitis B, or being a healthcare worker who could be exposed to blood or other bodily fluid.

Also Check: Does Medicare Cover Skin Removal

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. Here’s a closer look at what isn’t covered by Medicare, plus information about supplemental insurance policies and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

Cutting Part B Reimbursement

Medicare pays for medications administered in the healthcare provider’s office a bit differently than the ones you get from the pharmacy. Your practitioner purchases these medications in advance. Because their office is responsible for storing these medications and preparing them for use, medical professionals are paid 6% above the wholesale acquisition cost of the drug. They are paid separately to actually administer the medication.

Concerns have been raised that some healthcare providers may have been abusing the system, ordering the most expensive drugs in order to make a profit. Because patients are still required to pay 20% of the treatment cost, this also increases out-of-pocket expenses for patients.

Medications covered by the Centers for Medicare and Medicaid Services are paid at a 6% rate, while there’s a 3% add-on cost for new prescription drugs.

Also Check: Does Cigna Have A Medicare Supplement Plan

What Are Cataracts And How Do They Affect Vision

According to the National Eye Institute, a cataract occurs when the lens of your eye becomes cloudy. The lens is the clear part at the front of the eye that helps you to focus on an image. When functioning normally, light enters your eye through the lens and passes to the retina, which then sends signals to your brain that help you process what you see as a clear image. When the lens is clouded by a cataract, light doesnt pass through your eye to your retina as well, and your brain cant process images clearly, resulting in blurry vision.

Cataracts can occur in one or both eyes, but they cannot spread from one eye to the other. Your chances of developing cataracts increase significantly with age.

Some people develop cataracts at a much younger age, such as in their 40s or 50s. However, these cataracts tend to be smaller in size and do not usually affect vision. In general, people dont experience vision problems from cataracts until they reach their 60s.

What Is Unique About Medicare Advantage When It Comes To Hospital Coverage

Medicare Advantage plans protect you with an annual out-of-pocket maximum a dollar amount specific to your plan that defines the most money you will have to pay out of your pocket for the plan year for healthcare. Original Medicare doesnt have an out-of-pocket maximum, although if you have Parts A and B, you can add one of the two standard Medigap plans that include an out-of-pocket max.

While Medicare Part A coverage is standard across the board, Medicare Advantage plans that replace Original Medicare come in all shapes and sizes. Some Medicare Advantage plans, for example, provide coverage for all hospital visits, regardless of their length or whether theyre considered to be inpatient or outpatient.

If you are looking for a specific level of coverage from a Medicare Advantage plan, a GoHealth licensed insurance agent can locate the right plan for your situation.

Don’t Miss: Will Medicare Pay For Handicap Bathroom

What Does Part B Of Medicare Cover

Medicare Part B helps cover medically-necessary services like doctors services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

The basic medically-necessary services covered include:

- Abdominal Aortic Aneurysm Screening

- Bone Mass Measurement

- Cardiac Rehabilitation

- Durable Medical Equipment

- EKG Screening

- Foot Exams and Treatment

- Glaucoma Tests

- Kidney Dialysis Services and Supplies

- Kidney Disease Education Services

- Outpatient Medical and Surgical Services and Supplies

- Pap Tests and Pelvic Exams

- Physical Exams

- Smoking Cessation

- Speech-Language Pathology Services

- Tests

- Transplants and Immunosuppressive Drugs

To find out if Medicare covers a service not on this list, visit www.medicare.gov/coverage, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048.

When Can You Enroll In Medicare Part B

You can sign up for Medicare Part B during the 7-month period that begins 3 months before your 65th birthday and 3 three months after that birthday.

If you have ALS, you may enroll in Medicare as soon as your Social Security disability insurance goes into effect.

If you have ESRD, you can enroll for Medicare starting on the first day of your fourth month of dialysis. If you do home dialysis, you dont have to wait 4 months and can apply immediately.

You may also apply immediately for Medicare if youre hospitalized for a kidney transplant.

Don’t Miss: Does Medicare Cover Bed Rails

Medicare Doesn’t Cover Most Dental Care

Medicare doesnt provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500. You could also get coverage from a separate dental insurance policy or a dental discount plan. An alternative is to build up money in a health savings account before you enroll in Medicare you can use the money tax-free for medical, dental and other out-of-pocket costs at any age .

Medicare Dental Coverage Under Medicare Advantage

If youd like to get more comprehensive dental coverage under Medicare, you might want to consider a Medicare Advantage plan, available under the Medicare Part C program. Offered through Medicare-contracted private insurance companies, these plans are required to offer at least the same coverage as Original Medicare in other words, a Medicare Advantage plan would cover dental care under the same situations as Original Medicare. In addition, many Medicare Advantage plans offer additional benefits such as routine dental or vision care, wellness programs, and prescription drug coverage.

While Medicare dental benefits may vary by plan, some of the services you may be covered under a Medicare Advantage plan may include routine dental exams, cleanings, X-rays, fillings, crowns, root canals, and more. Some Medicare Advantage plans may require you to use dentists in provider networks when receiving care, or you may have the option to use non-network dentists but at a higher cost-sharing level you can check with the specific plan youre considering for more details.

Keep in mind that there may be certain costs related to your dental coverage, including deductibles, copayments, and or/coinsurance. In addition, youll need to keep paying your Part B premium if you enroll in a Medicare Advantage plan, along with any monthly premium required for your plan.

You May Like: Should I Enroll In Medicare If I Have Employer Insurance

What Is Not Covered In Medicare Part B

Its important to understand that your Medicare Part B plan will not cover:

- Dental

- Hospice care

- Prescription drugs

When you want more information about what Medicare Part B covers and how to get the care you need for treatment and services it does not cover, then you should speak with a licensed insurance agent. They can advise you about affordable plans that allow you to keep the doctors and specialists you are already seeing.

Do You Have To Pay A Part A Premium

You may be wondering does Medicare Part A cover 100 percent? And while this is not the case, there are provisions in place to make Medicare affordable to beneficiaries.

Many people dont pay a monthly premium for Medicare Part A. For example, if you worked at least ten years while paying taxes, you dont pay a premium for Part A. If you worked for fewer than 30 quarters, you generally pay $471 per month in 2021. If you worked more than 30 but fewer than 40 quarters, your premium is $259 per month in 2021

Read Also: What Is Medicare Part G

Does Medicare Part A Cover Doctor Visits

Part A covers qualifying hospital visits Part B, rather than Part A, covers doctors services at the hospital, much like Part B covers non-emergency visits to your doctors office.

If you go to the hospital and your stay doesnt meet the requirements of an inpatient stay, you usually need Part B for Medicare to provide coverage. Commonly known as medical insurance, Part B covers many outpatient expenses.

What Is Not Covered Under Medicare Part A

Even in the case of an inpatient stay that Medicare Part A covers, Part A wont cover:

- A private room .

- Private-duty nursing.

- Television and phone in your room .

- Personal care items .

Being surprised that a couple of items on your bill arent covered by Part A is one thing discovering that the stay isnt covered by Part A at all is quite another thing.

Medicare literature on what qualifies as a covered stay states, An inpatient admission is generally appropriate for payment under Medicare Part A when youre expected to need 2 or more midnights of medically necessary hospital care, but your doctor must order this admission and the hospital must formally admit you for you to become an inpatient.

Recommended Reading: How Can I Get My Medicare Card Number