How Do You Apply By Phone

Call 772-1213 or TTY 325-0778 between 7 a.m. and 7 p.m. from Monday through Friday.5 Keep in mind that this process takes longer because forms have to be mailed to you, which you then complete and send back. At peak times, applying for Medicare by phone could take a month or more.

If you worked at a railroad, you can enroll in Medicare by calling the Railroad Retirement Board at 772-5772 or TTY 751-4701, 9AM 3:30PM, Monday Friday.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services.Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare.The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $458 | $471 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Read Also: How To Get New Medicare Card Without Social Security Number

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

What Are Important Medicare Decisions

Applying for Medicare Parts A and B is the first step. Other decisions related to Original Medicare can be made in the same timeframe:

- Should you enroll in Medicare Part D, which will cover the cost of your medications?

- Should you buy Medicare Supplement to cover expenses that arent included in Original Medicare?

- Should you replace Original Medicare with Medicare Part C ?

You May Like: Does Medicare Advantage Pay For Hearing Aids

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Medicare Renewal When Might You Have To Renew Your Medicare Coverage

There are some exceptions where youll need to take action to continue your coverage. Some situations where your Medicare Advantage or stand-alone Medicare Part D prescription drug plan coverage wont be automatically renewed include, but arent limited to:

- Your plan reduces its service area, and you now live outside of its coverage area.

- Your plan doesnt renew its Medicare contract for the upcoming year.

- Your plan leaves the Medicare program in the middle of the year.

- Medicare terminates its contract with your plan.

If your Medicare plan doesnt renew its contract with Medicare for the coming year, your Special Election Period will run from December 8 to the last day of February of the following year. If you have Medicare Advantage and dont enroll in a new plan by the date that your current plan ends its contract with Medicare, youll be automatically returned to Original Medicare.

Keep in mind that your new coverage starts on the first day of the month after you submit your enrollment application, meaning if you apply on February 8, your new Medicare plan wouldnt begin until March 1.

Recommended Reading: Which Insulin Pumps Are Covered By Medicare

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

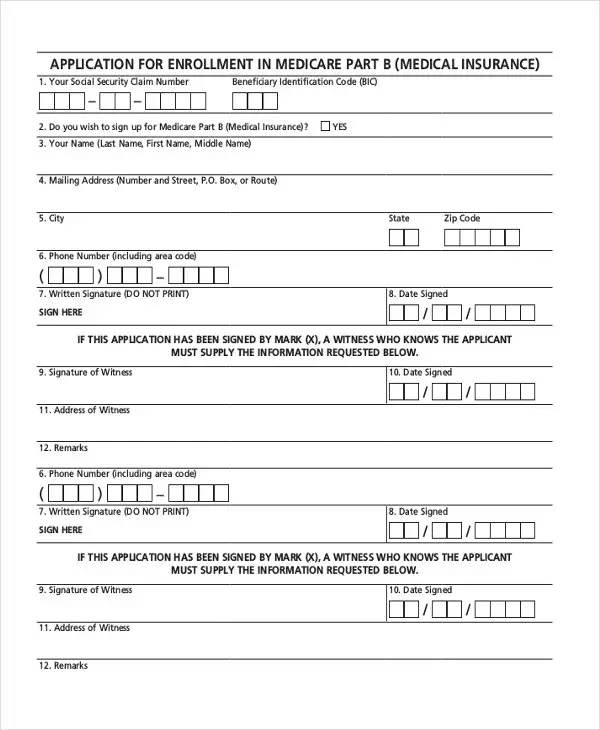

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Once you apply for Part B, give us a call so we can help you choose a supplement plan to cover what Medicare doesnt.

If youre not comfortable applying for Medicare online, you can do so over the phone.

Also Check: How To Check Medicare Status Online

Ask These Questions Before You Delay Medicare

Whether or not you can delay Medicare past 65 when youre working really depends on a few simple questions.

1. Do you have employer health coverage?

2. Does your employer have 20 or more employees?

3. Is the coverage considered creditable?

If you can answer Yes! to all the above, you likely qualify for a Medicare Special Enrollment Period and can delay enrolling without penalty. Whats the next step? and information sent directly to your inbox.

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: How To Compare Medicare Supplement Plans

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Theres A Push For Change

If the rules governing the transition to Medicare sound complicated, rest assured that experts agree. Moving into Medicare from other kinds of health insurance can be so complicated that it should be a required chapter in Retirement 101, Mr. Moeller said.

The only government warning about the risks associated with late enrollment comes in the form of a very brief notice near the end of the annual Social Security Administration statement of benefits.

The Medicare Rights Center and other advocacy groups have proposed legislation that would require the federal government to notify people approaching eligibility about enrollment rules, and how Medicare works with other types of insurance. The legislation the Beneficiary Enrollment Notification and Eligibility Simplification Act, also would eliminate coverage gaps now experienced by enrollees during the Initial Enrollment Period and General Enrollment Period. The legislation was introduced in Congress last year, and will be reintroduced this year.

In the meantime, Mr. Baker proposes a simple rule of thumb to help people approaching Medicare eligibility to avoid costly errors.

If you are eligible for Medicare, you should really consider it to be your default, primary coverage. If you are going to decline Medicare, think very carefully and take the time to really understand all the rules.

Recommended Reading: How Can I Get My Medicare Card Number

Applying For Medicare Over The Phone

Applying by phone is another good option that works for many. Just follow these simple steps.

If you apply over the phone, you will need to send in documents such as your original birth certificate to verify your identity. If this makes you nervous, applying in person is probably your best bet.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Don’t Miss: Does Medicare Pay For Mens Diapers

Applying For Medicare By Phone

Just like applying online, applying for Medicare by phone is easy. You can contact a representative at 1-800-772-1213.

Depending on the volume of calls, there might be a wait time. If the wait time is above average, you can schedule an appointment to have a representative call you.

The only downfall with applying for Medicare by phone is that it can take longer compared to online. If youre ahead of the game and start well before your birthday, then applying by phone shouldnt cause any issues. If you do not wish to apply online or by phone, you can choose to do so in person.

When Should You Apply For Medicare If You Have Employer Health Coverage

Most people should sign up for Medicare Part A when theyre first eligible because it rarely costs anything. But some people delay enrolling in Part B because they dont want to pay the monthly premium. The decision usually depends on the type of health coverage you already have.

You can put off enrolling in Part B at age 65 if you have group health coverage through your or your spouses job and the employer has at least 20 employees.6 Youll be able to enroll with no penalty during the Special Enrollment Period that follows the end of your employers insurance. You can also choose to enroll in Part B while still insured and pay the premium.

If your employer has fewer than 20 employees, you should apply for Part A and Part B as soon as youre eligible.7

Be sure to talk to your employers benefits administrator about how signing up for Medicare will affect your coverage or Health Savings Account .8 You cannot contribute to an HSA if you have Medicare Part A. Your administrator can help you time the beginning and end of your coverage through work and your new health insurance so theres no gap in your coverage.

When your group coverage is ending, youll need to complete documentation and submit it to your Social Security office. If you have questions, ask Social Security.

Also Check: Does Medicare Cover Oral Surgery Biopsy

Did You Answer Yes To Question 2

If you are still working, then we immediately move to the next question, which is how many employees does the company that you work for have? Your answer will determine whether or not you will need to sign up for Medicare at age 65.

Was your answer, less than 20 employees?

Then you will need to as soon as youre eligible. If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Was your answer, 20 or more employees? Great, then you have options.

How Do I Apply For Traditional Medicare

If youre not automatically enrolled in Medicare Part A and Part B, you need to sign up. You should enroll during your IEP, or a Special Enrollment Period if you qualify for one. As mentioned above, one example of a Special Enrollment Period might be if you delayed enrollment in Medicare Part A and/or Part B because you had employer coverage.

You typically sign up for Medicare through the Social Security Administration . You can go to the website at ssa.gov. Or, go in person to a Social Security office. You can reach the SSA at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM, in all U.S. time zones.

You May Like: Does Medicare Offer Dental Plans

What Happens If I Dont Pay My Premiums On Time

If you dont pay your Part B premiums on time, you could lose coverage. It wont happen immediately, however.

You have a 90-day grace period after the due date. Once the grace period passes, Medicare will send you a letter letting you know that you have 30 days to pay the bill or you will lose coverage. That makes a total of four months to pay your bill before Medicare will stop paying for covered services.

Private insurance plans may treat late payments differently. Check with your plan carrier if you have questions about the policies.

How Can I Make Changes To My Medicare Advantage Coverage

The fall open enrollment period, which runs from October 15 to December 7 each year, is an opportunity to switch to a different Medicare Advantage plan or to switch to Original Medicare if you think it would serve you better.

If you are already enrolled in a Medicare Advantage plan even if you just signed up during the most recent annual enrollment period and your coverage only took effect on January 1 you can switch to a different Advantage plan or to Original Medicare during the annual Medicare Advantage open enrollment period. This window runs from January 1 to March 31, and has been available since 2019. It only applies to people who are already enrolled in Medicare Advantage plans a person with Original Medicare cannot switch to a Medicare Advantage plan during this window. Instead, that enrollee would need to use the annual enrollment period in the fall to make that change.

If you already have a Medicare Advantage plan and want to switch to a different Advantage plan during general open enrollment or the Medicare Advantage open enrollment period, your existing plan will disenroll you with no lapse in coverage. Any changes you make during general open enrollment will take effect January 1. If you make a change during the Medicare Advantage open enrollment period, it will take effect the first of the following month.

Ready to enroll in new Medicare Advantage or Part D coverage? Discuss your plan options right now with a licensed Medicare advisor. Call

Also Check: Does Medicare Cover Skin Removal