Is The Medicare Part A Deductible Increasing For 2021

Part A has a deductible that applies to each benefit period . The deductible generally increases each year. In 2019 it was $1,364, but it increased to $1,408 in 2020. And it has increased to $1,484 for 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

- Medigap plans C and F cover the deductible .

- Enrollees who have Medicaid or retiree health benefits from an employer generally dont have to pay the Part B deductible, as the other coverage picks up the tab.

- Some Medicare Advantage plans have no deductibles and low copays benefits into one plan for the enrollee, with cost-sharing that can differ greatly from the standard Original Medicare cost-sharing).

But according to a Kaiser Family Foundation analysis, about 19% of Original Medicare beneficiaries only have Medicare Parts A and B. They dont have Medigap coverage, retiree health benefits from a former employer, or Medicaid. These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203.

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%. But again, supplemental coverage can pay some or all of this 20% cost, leaving the enrollee with far lower out-of-pocket costs than they would have under Part B by itself.

How High Is The High Deductible

The insurance company sets the deductible. One company that I know of offers two different plan deductibles. This company offers one plan with a $5000 and another with an $8000 deductible. And each plan comes with a different annual deposit into the Medical Savings Account.

The $5000 deductible plan includes a $2000 annual deposit in your savings account. That means that technically, your maximum out-of-pocket costs will be $3000. The plan with the $8000 deductible includes a $3000 deposit, leaving you with a $5000 maximum out of pocket.

As you accumulate money in your Medical Savings Account, your out-of-pocket gets lower. For example, let us assume that you purchased the plan with the $8000 deductible. Each year the company deposits $3000 in your account. If you are healthy, it is possible that at the end of year three you could have $9000 in your account.

Recommended Reading: How To Get A Lift Chair From Medicare

Are There Inflation Adjustments For Medicare Beneficiaries In High

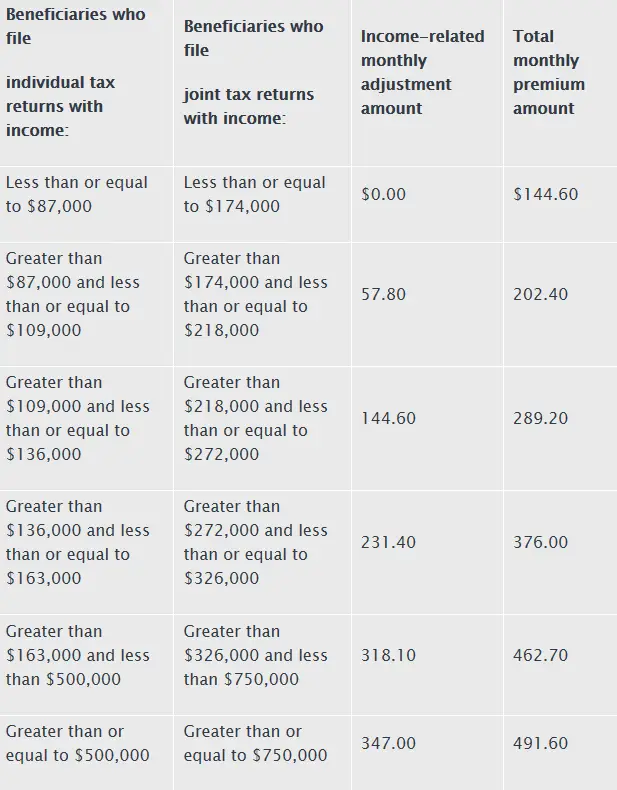

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does high income mean? The high-income brackets were introduced in 2007 for Part B and in 2011 for Part D, and for several years they started at $85,000 . But the income brackets began to be adjusted for inflation as of 2020, with the start of the high-income range increasing to $87,000/year . For 2021, these thresholds have increased to $88,000 for a single person and $176,000 for a married couple .

For 2021, the Part B premium for high-income beneficiaries ranges from $207.90/month to $540.90/month, depending on income .

As part of the Medicare payment solution that Congress enacted in 2015 to solve the doc fix problem, new income brackets were created to determine Part B premiums for high-income Medicare enrollees. These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

And starting in 2019, a new income bracket was added on the high end, further increasing Part B premiums for enrollees with very high incomes. Rather than lumping everyone with income above $160,000 into one bracket at the top of the scale, theres now a bracket for enrollees with an income of $500,000 or more .

How Do Medicare Copays And Deductibles Work

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays most often come in the form of a flat-fee and typically kick in after a deductible is met.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

You May Like: Does Medicare Cover Oral Surgery Biopsy

Do You Worry About Your Medicare Deductibles Premiums And Other Costs

Many Medicare beneficiaries are concerned about Medicare costs, like premiums, deductibles, and copayments/coinsurance, according to an eHealth study in 2020.

Well explore these premiums and look at some statistics to give you a better picture of these Medicare costs.

NEW TO MEDICARE?

Is Original Medicare Enough

The short answer is that Original Medicare alone can leave you open to large medical bills. Unlike traditional health insurance, Medicare does not limit your maximum out-of-pocket medical costs.

Original Medicare consists of Part A Hospital Insurance andPart B Medical Insurance. Under Original Medicare you will pay a $1484 per benefit period deductible if you are hospitalized. Medicare pays 100% of the associated hospital costs above the deductible. So far so good, right?

Not so fast. With Medicare Part B you pay a $203 deductible and then 20% of all Medicare approved charges. And this is where you can get into financial trouble. Treatments such as chemotherapy fall under Part B, and that can leave you thousands of dollars on medical bills.

Finally, Original Medicare does not cover prescription drugs. That is why Part D was created under President George W. Bush. But Part D is another cost that you have to incur in the form of a premium.

Here is a great analysis of using Original Medicare alone https://www.cnbc.com/2019/06/07/considering-basic-medicare-with-no-backup-insurance-is-a-big-mistake.html

Also Check: Is Medicare Advantage A Good Choice

Isnt Medigap Insurance Better Than Medicare Advantage Plans

There are a lot of opinions about whether a Medigap Insurance policy is better than a Medicare Advantage Plan. However, for retirees on a shoestring budget I believe that the argument is irrelevant!

Medigap have a monthly premium, and the premium increases annually. The annual rate increases are a result of factors. First, the rates will increase as a result of the total medical claims that the plan has paid out versus the total of all premiums collected. Even if the plan was profitable the rates would still increase each year as you get older.

The most popular Medicare Supplement is the Plan G. Under the Medicare Supplement Plan G, the only medical cost that you pay is the Medicare Part B $203 deductible. All other Medicare approved charges that are not paid by Medicare, are paid by the supplement.

But this great coverage comes at a cost. According to the North Carolina Department of Insurance website Premium Comparison Database, the least costly Plan G would cost $107 a month. At age 75, assuming that you could change to the least expensive plan, the new premium would be $138 a month. The company that had the least expensive plan at age 65 would now be $232. And if you health chages you may not be able to change to the lower priced plan.

In addition to your Plan G premium, you would also have to purchase a Part D Prescription Drug Plan.

For retirees on a shoestring budget, these premiums can be a financial problem.

When Do You Qualify

If you are at least 65 years old, you are eligible for Part A and Part B if you meet the following criteria:

- You are a U.S. citizen or permanent legal resident who has lived in the United States for five continuous years.

- You or your spouse have worked long enough to be eligible for Social Security or Railroad Retirement benefits.

- You or your spouse are government employees or retirees who have not paid into Social Security but have paid Medicare payroll taxes.

If you under the age of 65, you are eligible if:

- You have been receiving Social Security disability benefits or certain Railroad Retirement Board disability benefits for at least 24 months.

- You have ALS .

- You have End-Stage Renal Disease and you or your spouse have paid Social Security taxes for a certain length of time.

Don’t Miss: Should I Enroll In Medicare If I Have Employer Insurance

What Is The Medicare Part B Annual Deductible

4.1/5Medicare Part BDeductiblesMedicare Part Bannual deductibleMedicare Part Bannual deductiblein-depth answer

The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. In other words, a deductible is the amount that you must first pay out of your own pocket for health care before your Medicare insurance coverage kicks in.

Subsequently, question is, does Medicare have a deductible? Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductiblean amount you pay for healthcare or for prescriptionsbefore your healthcare plan begins to pay.

Secondly, what is the Medicare Part B deductible for 2019?

$185 in

How is Medicare Part B calculated?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS. The standard Part B premium amount in 2020 is $144.60. Most people pay the standard Part B premium amount.

Medicare Part C Managed Medicare Or Medicare Advantage:

Medicare Advantage Plans, or sometimes called Part C or MA Plans are offered by Medicare-approved companies that must follow set rules. They are considered an all-in-one alternative to the traditional Medicare program. The Part C plans include Parts A, B and usually D. Most plans offer extra benefits that original Medicare doesnt cover including vision, hearing and dental.

Don’t Miss: What Is Medicare Part G

How Do Lifetime Reserve Days Work With Medicare

Part A covers inpatient hospital care, skilled long-term facility, and more, for up to 90 days. But if you ever need to extend your hospital stay, Medicare will cover 60 additional days, called lifetime reserve days.

For instance, if your hospital stay lasts over 120 days, you will have used 30 lifetime reserve days. Please note that youll pay a coinsurance of $742 for each lifetime reserve day you use. You can only use your lifetime reserve days once.

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

Recommended Reading: Does Cigna Have A Medicare Supplement Plan

How Are Medicare Advantage Premiums Changing For 2021

According to CMS, the average Medicare Advantage premiums for 2021 is about $21/month for 2021, down from $23/month in 2020. Average Advantage premiums have been , and the average premium for 2021 is the lowest its been since 2007.

But when we only consider Medicare Advantage plans that include Part D prescription drug coverage , a Kaiser Family Foundation analysis found that the average premium in 2020 was about $36/month MA-PDs continue to be more expensive than the average of all Medicare Advantage plans.

About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021. Enrollment in these plans has been steadily growing for the last 15 years. The total number of Medicare beneficiaries has been steadily growing as well, but the growth in Medicare Advantage enrollment has far outpaced overall Medicare enrollment growth. In 2004, just 13 percent of Medicare beneficiaries had Medicare Advantage plans. That had grown to 36 percent by 2020, and the new Medicare Plan Finder tool that debuted in the fall of 2019 was designed in a way that could accelerate the growth in Advantage enrollment.

What Will Medicare Part B Cost 2020

4.2/5how muchllMedicare Part B2020premium will2020deductiblePart B will

People also ask, what will Part B cost in 2020?

Standard Part B premiums are $144.60/month in 2020. The Social Security COLA was large enough to cover the full cost of the Part B increase for almost all enrollees. The high-income threshold increased to $87,000 for a single person.

Beside above, what is the income limit for extra help in 2020? To qualify for extra help with Medicare prescription drug plan costs in 2020, your annual income must be limited to $19,140 for an individual .

Accordingly, what will Medicare cost in 2020?

The Centers for Medicare and Medicaid Services announced the new 2020 rates Friday. For about 70% of Medicare beneficiaries, the premiums will rise nearly 7% to $144.60 a month, up from $135.50 in 2019.

What happens when the donut hole ends in 2020?

In 2020, you’ll pay no more than 25 percent of the price for brand name drugs and generic drugs while you’re in the donut hole. You remain in this Part D donut hole coverage gap until you have paid $6,350 in out-of-pocket costs for covered drugs in 2020. You then enter the catastrophic coverage phase.

Don’t Miss: How Much Medicare Is Taken Out Of Social Security Check

How Do I Choose A Medicare Advantage Plan

Choosing an Advantage Plan isnt really that difficult. First, retirees on a shoestring budget, you will want a plan with a zero, or a very low premium. And if available in your area, a plan with a Part B give-back is even better.

Second, make sure that your prescription drugs are adequately covered. This is a critical step in choosing a plan.

If you feel strongly that you want a certain doctor or hospital in your network, make sure that they are on the network.

Finally, stick to the large national health insurance companies. Companies like United Healthcare and Aetna provide a national network. These companies have plans that will allow you to seek care nationwide and if the provider is in their network elsewhere, you can get care and still be considered in-network.

What Is The Difference Between A Deductible And A Copay

Depending on your health plan, you may have a deductible and copays.

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service . Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

Also Check: How Much Is Medicare B Deductible

How Does The Medicare Advantage Msa Work

The plan is composed of two distinct components. There is a high deductible health insurance policy plus a Medical Savings Account. You can choose to use the money in your account to pay for medical expenses subject to your deductible. Or you can leave the money in your account to grow and pay for medical expenses out of current funds.

Once you have reached your deductible, the insurance company will pay one hundred percent of all Medicare covered medical expenses.

One of the best things about the Medicare Advantage MSA is that there are no networks. That means that you can use any doctor or hospital that is willing to accept your plan. One of the things that makes the Medicare Advantage MSA different is that you must check with your healthcare provider each visit to ensure that he/she will still accept the plan.

People With Esrd Can Join Medicare Advantage Plans

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Many people with ESRD will still find that Original Medicare plus a Medigap plan and Medicare Part D plan is still the most economical option overall, in terms of the coverage provided. But in some states, people under 65 cannot enroll in guaranteed-issue Medigap plans, or can do so only with exorbitantly high premiums. And some of the states that do protect access to Medigap for most beneficiaries under 65 do not extend those protections to people with ESRD. Without supplemental coverage, there is no cap on out-of-pocket costs under Original Medicare.

Medicare Advantage plans do have a cap on out-of-pocket costs, as described below. So for ESRD beneficiaries who cannot obtain an affordable Medigap plan, a Medicare Advantage plan could be a viable solution, as long as the persons doctors and hospitals are in-network with the plan.

Recommended Reading: Does Medicare Pay For Eyeglasses For Diabetics

Medicare Part D Premiums And Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a uniqueformulary, which is the list of drugs it covers.

It is important to ensure that the drugs you are currently taking or expect to take in the future are included in your plans formulary. Otherwise, you could end up paying for those drugs entirely out of pocket.