When To Apply For Medicare Late Enrollment Penalties

Fact checked Reviewed by: Leron Moore, Medicare consultant –

If you do not sign up for a Medicare health insurance and drug plan when you become eligible to do so, you may have to pay late enrollment penalties for Medicare Parts A , B , and D , unless you have other health and drug coverage that meets Medicare standards. Read on to learn more about when to enroll in Medicare to avoid penalties.

What you should know

- 1Consider signing up for Medicare during your initial enrollment period to avoid late enrollment penalties.

- 2You may be able to delay Medicare enrollment if your current health insurance and drug coverage is sufficient, according to Medicare rules.

- 3Find out if you are eligible for a special enrollment period and sign up for Medicare before that period ends.

- 4It is to your benefit to understand and avoid late enrollment penalties because they can add on to your monthly premiums for as long as you have Medicare.

The key to avoiding late enrollment penalties is to make sure that you do not have a gap in coverage for your health insurance and prescription drugs. Medicare considers group insurance that you have through your employer or union to be sufficient coverage in lieu of health insurance you can get through Medicare. Once that coverage ends, you can enroll in Medicare without late penalty fees.

Medigap Late Enrollment Penalty

Late enrollment for Medigap doesnt cause you to incur a penalty. However, in order to get the best rates for your Medigap plan, youll need to enroll during your open enrollment period.

This period starts on the first day of the month you turn 65 and lasts for 6 months from that date.

If you miss open enrollment, you may pay a much higher premium for Medigap. You may also be refused a Medigap plan after open enrollment ends if you have health problems.

If you wish to defer Medicare enrollment, you dont need to inform Medicare. Simply dont sign up when you become eligible.

To avoid penalties when you do decide to enroll, you should:

- have alternative during the time youre eligible for Medicare

- make sure to enroll during the 8-month period when your current coverage ends, known as a special enrollment period

If you decline Medicare coverage and never enroll, you wont receive Social Security benefits or Railroad Retirement Board benefits. Youll also need to return any payments youve already received through these programs.

Should I Sign Up For Medicare As Soon As I Turn 65

The right time to sign up varies for everyone. But in general, its a good idea to enroll in Medicare as soon as you are eligible. The Initial Enrollment Period starts three months before you turn 65 and ends three months after you turn 65.

Here are a few things to consider as you approach Medicare eligibility:

- Most people who worked and paid taxes will not pay a premium for Medicare Part A . The insurance will be premium-free even if you still have coverage through an employer.

- Medicare Part B has a monthly premium an average of $148.50 per month in 2021. However, this premium can increase depending on your income.

- Although you may feel you dont need Medicare Part B, you could pay a late enrollment penalty when you do enroll later. This penalty is reflected in a higher monthly premium.

- Medicare Part D also has late enrollment penalties if you dont already have coverage from an employer or another source.

Also Check: Does Medicare Pay For Mens Diapers

Late Enrollment Penalty With Part B

You are required to apply for Medicare Parts A and Part B on your own, if you are not already receiving social security benefits. You will enroll in both during your Initial Enrollment Period . The IEP begins three months prior to the month in which you turn 65 and ends three months later.

Part A is free to those that have worked in the United States for at least 10 years while Part B, however, will cost you each month. If you make $88,000 or less per year, the standard monthly premium as of 2021 is $148.50. The LEP will occur if you do not apply for Part B within your initial enrollment period. The LEP is not a one-time charge that you can pay and get rid of, its lifelong!

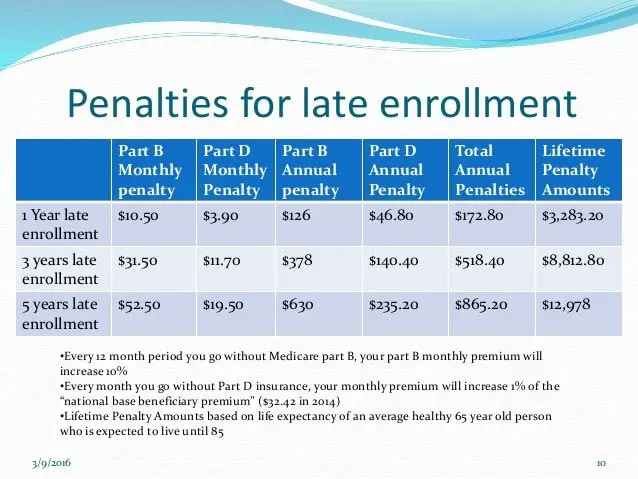

Part B monthly premiums go up by ten percent each year that you do not have creditable coverage. Heres a simple example of how to calculate your Part B late enrollment penalty.

For example: Dawn decides to not get Part B for five years after her IEP ends.

5 years x 10%/year = 50%

$148.50 + 50% = $222.75/month

Instead of Dawn only having to pay $148.50 per month for her Part B premium, she is stuck paying an additional $74.25 every month. Applying for Part B sooner rather than later means you will have coverage and you will avoid the penalties for not signing up for Medicare. A win-win situation if you ask me!

Related Article: 4 Simple Steps to Understanding Medicare

What Is The Lep For Medicare Part B

If you did not enroll in Medicare Part B when you were first eligible your monthly premium may go up 10% for each 12-month period you could have had Medicare Part B, but did were not enrolled. The penalty is based on the standard Medicare Part B premium, regardless of the premium amount you actually pay

In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Medicare Part B. So similar to the LEP for Medicare Part D, this is permanent for as long as you are enrolled in Medicare. And, the penalty increases the longer you go without Medicare Part B coverage.

Also Check: Does Cigna Have A Medicare Supplement Plan

Need Help Paying For Coverage

If youre delaying enrollment in Part B and/or Part D because you cant afford it, check to see if you qualify for help.

The Medicare Savings Programs and Extra Help program can provide financial help for various health care or prescription drug costs. Your income and assets determine if youre eligible. Assets include cash, savings and investment and vacation property.

Medicaid can help pay for Medicare premiums, deductibles, copays and/or coinsurance. Medicaid may cover services Original Medicare doesnt. For example, Medicaid can cover care in a designated nursing facility if you dont have money, assets or long-term care insurance to pay for it.

You may be dual eligible for Medicare and Medicaid and get a plan at reduced costs. In Minnesota, this type of plan is called Minnesota Senior Health Options . For no monthly premium, it covers medical, prescription drugs, dental, long-term care and other benefits and services.

You Need Prescription Drugs

If you use prescription drugs, you will either need to get a stand-alone Part D prescription drug plan or a Medicare Advantage plan that includes drug coverage. Medicare Part A will only cover drugs you use in the hospital as an in-patient. Part D also covers some vaccines, such as for shingles and the flu.

Don’t Miss: Can You Change Medicare Plans After Open Enrollment

Income Tax Law Changes

How did Sue come away with this understanding? She read statements on the Medicare.gov website, which are, at best, hard to decipher, and, at worst, misleading. For example, she read, “Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.” and “You have 8 months to sign up for Part B without a penalty … .”

Unfortunately, Sue got it wrong. In determining if you need to permanently pay a Medicare Part B penalty, Medicare counts all the months between age 65 and the month you first enroll in Part B even if you, like Sue, had a series of jobs with a largish employer with no gap between jobs extending beyond 8 months. Instead of being exempt from the penalty because she was always in a special enrollment periods between jobs, Sue was hit with a 20 percent lifetime Medicare Part B premium penalty! This is calculated based off of Medicare’s base premium, which is $144.60 for 2020. Hence, Sue’s penalty, this year, is $28.90 per month or $347.04 over the year. Moreover, since the base premium can rise, through time, faster than the rate of inflation, Sue’s real penalty may be higher, indeed a lot higher, down the road.

To make matters worse, Sue was also hit with a Medicare Part D premium based on the cumulative 25 months she went without credible prescription drug coverage. The Part D penalty is calculated according to the following.

What Is A Medicare Medical Savings Account

Medicare Medical Savings Accounts, or MSA, is a consumer-directed Medicare Advantage plan that is similar to an HSA.

The MSA plan combines a high-deductible insurance plan with a medical savings account that can be used to pay your healthcare costs.

This special type of high-deductible Medicare Advantage plan covers your costs once you meet a higher yearly deducible, which can vary by plan. The MSA plan also deposits money into a special type of savings account that can be used to pay for healthcare costs prior to meeting the deductible.

These plans offer everything Medicare Advantage plans must cover, which includes all Part A and Part B services. Additionally, they may offer extra benefits like:

- Vision

Read Also: What Does Medicare Cost Me

When Does The Part B Penalty Not Apply

If you miss the enrollment deadline during your Initial Enrollment Period and sign up during the next General Enrollment Period, and that time period is within fewer than 12 full months, you will not pay a penalty. So, for example, if your IEP ends on June 30, and you enroll in Medicare Part B during the General Enrollment Period , only 9 months will have passed before the end of the GEP on March 31.

For folks under age 65 who are enrolled in Medicare disability and paying a Medicare Part B late enrollment penalty, you will not pay the penalty after turning 65. Those with Medicaid will not need to worry about Medicare Part B premiums and penalties, as the state pays those.

If living outside of the United States, you do not get premium-free Medicare Part A, and you cant enroll in Medicare Part A or Medicare Part B abroad. You will get a Special Enrollment Period for three months after returning to the United States.

What If I Still Have Coverage Through An Employer

If youre still working when you turn 65 and have group health coverage through your employer, you may be able to delay Medicare enrollment without penalties. You may also be able to delay enrollment if youre covered under a spouses work plan.

With group health coverage, you may qualify for a Special Enrollment Period if your coverage ends. The SEP allows you to sign up for Medicare Part and B when certain events happen in your life, such as losing coverage or moving. Generally, the SEP lasts for eight months after your coverage ends.

Before making a final decision on your coverage, take time to explore and understand your options. Talk to your plan administrator to learn more about how it works with Medicare, the best time to enroll, and how you can avoid a penalty.

Recommended Reading: Is Pennsaid Covered By Medicare

Medicare Late Enrollment Penalty For Part D

Although enrollment in Medicare Part D coverage for prescription drugs is considered voluntary, you will still incur a Medicare Part D late enrollment penalty if you dont enroll in a Medicare prescription drug plan during your IEP.

As with Part B, the Part D late enrollment penalty is based on the amount of time you were without coverage. The penalty applies for as long as you are enrolled in a Part D plan.

The Medicare Part D penalty is 1% for each month you went without prescription drug coverage, rounded to the nearest $0.10. The national base Part D premium is around $33. If you were without creditable prescription drug coverage for 26 months, for example, your premium would be nearly $10 higher than the national base. This late enrollment penalty is added to the currently monthly premium that you pay for your chosen drug plan.

Since the premium penalty is pegged to the national base Part D premium set each year by the CMS, it will go up every time the Part D premium increases. For more details on how Medicare calculates your Part D late enrollment penalty, visit Medicare.gov.

This is why its a mistake to pass on prescription drug coverage as soon as youre eligible. Even if you dont take many prescription medications right now, enrolling in a drug plan eliminates a future penalty that would stick with you forever.

Medicare Part D Late Enrollment Penalty Exceptions

If you qualify for the Extra Help program, you will not have to pay a late penalty. The Extra Help subsidizes the cost of Part D prescription drug coverage for low-income individuals. It also eliminates any penalty, even if youve gone without creditable coverage for more than 2 months.

However, keep this in mind: YOU are responsible for later proving that you had creditable coverage from a former employer. That means saving the letter of creditable coverage that your employer group health insurance company sends you after you quit your job. This letter should arrive within two weeks of the last day of your coverage.

BE SURE THAT YOU SAVE THEM. This is not something that your Medicare insurance agent can help you produce later on, so you must be diligent about saving evidence of your coverage. When you finally retire and enroll in Part D, you will have to prove to your new Part D carrier and Medicare that you had creditable coverage for all of the months since you turned 65. That proof of coverage is the only way to get out of paying a Part D late penalty.

You can also avoid the late enrollment penalty for Part D with creditable prescription drug coverage through an employer, union, or other source, such as VA drug coverage.

Read Also: Does Medicare Pay For Teeth Implants

B Late Enrollment Penalty

If you didn’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage.

Medicare Part B Late Enrollment Penalties

The late enrollment penalty for Medicare Part B will result in a 10% increase in your monthly premiums for each 12-month period you went without coverage starting from your initial eligibility. Unlike for Part A, the late enrollment penalty for Part B is lifelong .

To help understand this calculation, lets say you were eligible for Part B at age 65, but did not enroll, until age 70. You would have a 5-year period without Part B coverage, which would be a 50% penalty , multiplied by the base Part B premium of the calendar year you are enrolled. So for 2021, the base cost would be $148.50, multiplied by 50%, and would equal $74.25, which would be added to your Part B monthly premium costs. Please note this penalty is in addition to any applicable Part B Income-Related Monthly Adjustment Amount payments.

Also Check: What Does Part B Cover Under Medicare

How Much Is The Late Enrollment Penalty For Medicare Part B

En español | You will face permanent late penalties if you miss your deadline for enrolling in Part B, unless youre in a situation where the penalty might be waived. How much youd pay each month depends on how long you delayed enrollment and on the amount of the standard Part B premium in any given year.

Part B is a voluntary benefit. You dont have to sign up if you dont want to. However, to avoid late penalties, you need to meet your personal enrollment deadline. Depending on your situation, this could be one of the following:

- The end of your seven-month initial enrollment period , which begins three months before the month of your 65th birthday and ends at the end of the third month after your birthday month.

- The end of a special enrollment period to which youre entitled if, after the end of your IEP, youre covered by health insurance provided by an employer for which you or your spouse actively works. This SEP lasts for up to eight months after the employment ends.

If you miss either of these deadlines , you can still enroll in Part B, but youd face two consequences: You could sign up only during a general enrollment period , which runs from Jan. 1 to March 31 each year, with coverage not beginning until July 1 of the same year. And you might be liable for late penalties.

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didnt.

Information About Drug Coverage

If you have , you can choose to wait to enroll in Part D or a Medicare Advantage Plan that includes drug coverage, without incurring a late penalty. You can enroll in Part D or Part C for up to two full months after you lose your creditable drug coverage. You cannot go for more than 63 days in a row without drug coverage, or you will be subject to a late enrollment penalty.

Don’t Miss: When Can You Apply For Part B Medicare