What Does A Medicare Supplement Cover

As we noted above, Medicare Supplements cover gaps in Medicare parts A and B. This includes, but is not limited to the following:

- Medicare Part A deductible

- Medicare Part B co-insurance

- Routine hearing, vision, and dental services

- Long-term care

The primary difference between Medicare Supplement letters is to what degree they offer coverage. I included a graphic in the previous section of this article that laid out the most common plans.

You can find what level of coverage you receive in each plan.

Two Types Of Medicare

Original Medicare allows you to see any doctor and use any facility in the U.S. that accepts Medicare. Most do. But to get blanket protection with Original Medicare, its vital to also purchase a supplemental policy referred to as Medigap that picks up the portion of certain bills that Medicare doesnt pay directly.

A Medigap policy that provides complete coverage might have a monthly premium of $100 to $300 or so, depending on where you live. Thats not nothing. But again, other than a basic deductible for Medicare Part B , youre likely to have everything covered.

Medicare Advantage is the other way you can enroll in Medicare. Most Advantage plans work like a health maintenance organization. You are limited to a network of doctors and facilities based on where you live. You also typically need preauthorization for any medical care beyond basic preventative care.

The allure of Medicare Advantage is that you dont need to purchase any supplemental coverage. In fact, youre not allowed to have a Medigap policy. Not spending $100 to $300 a month on Original Medicare + Medigap is undeniably attractive. At least when you are healthy.

But you buy insurance to protect you from the big what-if. And thats where Medicare Advantage could disappoint. Remember, you cant see every doctor who accepts Medicare. That means the specialist you really want to oversee your care may be out of reach.

Can You Have Two Medicare Supplement Plans

You may be wondering if having two Medicare Supplements are a good idea or not.

The fact is, you cannot have two active Medicare Supplement plans, and you wouldnt want them if you could.

In this article, well go over what a Medicare Supplement plan is, why you cant have two, and why you wont want more than one plan.

Also Check: Is Oral Surgery Covered By Medicare

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Compare Plans Online With Medicaregov

One way to compare plans online is using the Medicare.gov Medicare Plan Finder tool. Medicare.gov is the official U.S. Government site for the Medicare program.

The site offers two search options: a general search and a personalized search.

If you use the general search, you can find Medicare plans in your area, but the cost estimates may not be as accurate as the personalized search.

In order to view your plans on the general search, you will need to answer some questions such as your ZIP code, how you get your Medicare coverage and if you get help paying your Medicare prescription drug costs.

If you use the personalized search, you will be able to view Medicare plans in your area with more accurate cost estimates than the general search.

In order to view your plans on the personalized search, you will need to answer specific Medicare questions such as your Medicare number, Part A effective date, date of birth and other questions.

Both search options show several types of Medicare plans in your area with detailed plan information such as estimated annual costs, premiums, Star Ratings and plan benefits.

Don’t Miss: How Much Does Medicare Part B Cost At Age 65

How Much Does Medicare Part C Cost

Some Medicare Advantage plans may require you to pay a monthly premium. In 2021, the weighted average premium for a Medicare Advantage plan that includes prescription drug coverage is $33.57 per month.1

89 percent of Part C plans available throughout the country in 2021 cover prescription drugs, and 54 percent of those plans feature a $0 premium.2

6 out of 10 Medicare Advantage Prescription Drug plan beneficiaries are enrolled in a $0 premium plan in 2021.2

The average drug deductible for a Medicare Advantage plan in 2021 is $167.31 per year.

Medicare Advantage plans are required to include an annual out-of-pocket spending limit, which limits how much you will have to pay in Medicare deductibles, coinsurance and other out-of-pocket costs in a single year.

Medicare Part A and Part B don’t include an out-of-pocket spending limit. Medicare out-of-pocket costs can add up quickly if you’re faced with a long-term inpatient hospital stay or undergo extensive medical care that requires high coinsurance or copay costs.

Medicare Advantage Plans Part 2

A Medicare Advantage Plan is a type of Medicare health plan offered by a private insurance company that contracts with Medicare to provide you with all your Part A and Part B benefits. If youre enrolled in a Medicare Advantage Plan, most Medicare services are covered through the plan and arent paid for under Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. There are six things you will want to consider if looking at a Medicare Advantage Plan. They include the premium, copays, coinsurance, deductibles, providers that take the plan and the drug formulary of the plan. This week we will look at the premium, copays and coinsurance.

The premium of MA plans can vary depending on the type of plan you have and the company offering the plan. Although the premium of the plan should be a part of your decision it shouldnt be the only consideration. For some, the MA plan with the lowest premium may fit your needs perfectly but for others it could actually cost you more in the long run if the other five considerations dont match up for you. Also, if you are currently in a MA plan and it is working for you, switching plans solely because of the premium may not be in your best interest.

If you have questions regarding any aspect of Medicare or Medicare health plans feel free call us at Alabama Health Guidance , stop by our office at 885 Florence Blvd or email me at .

Read Also: Is Unitedhealthcare Dual Complete A Medicare Plan

Medicare Supplement Insurance Plan Benefits

There are 10 Medigap insurance plans available in most states, and each plan type is designed by a different letter . Coverage is standardized across each plan letter, which means youll get the same basic benefits for Medicare Supplement coverage within the same letter category, no matter which insurance company you purchase from. However, even if basic benefits are the same across plans of the same letter category, premium costs may vary by insurance company and location. If you live in Massachusetts, Minnesota, or Wisconsin, keep in mind that these three states standardize their Medigap plans differently from the rest of the country.

Medigap plans cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some plans may help pay for other benefits Original Medicare doesnt cover, such as emergency health coverage outside of the country or the first three pints of blood. Medigap plans dont include prescription drug benefits. If you dont already have creditable prescription drug coverage , you should consider buying a separate stand-alone Medicare Part D Prescription Drug Plan to cover the costs of your prescription medications. Also, Medicare Supplement insurance plans generally dont offer extra benefits like routine dental, vision, or hearing coverage beyond whats already covered by Medicare.

What If I Submitted Enrollment To More Than One Medicare Advantage Plan

No one is allowed to be enrolled in more than one Medicare Advantage plan at a time. If you have submitted enrollment to two or more Medicare Advantage plans, it is important to determine which plan you wish to be enrolled in. This should be done immediately. It is not advisable to wait until you hear from a plan or insurance company you have submitted enrollment to before canceling an enrollment request. You should not have simultaneous Medicare Advantage enrollment requests with the same effective date because you cannot be enrolled in two Medicare Advantage plans simultaneously.

If you have submitted simultaneous enrollment requests, you are in danger of having all enrollment requests canceled if you do not cancel the enrollments you do not want. Under no circumstances can you be enrolled in more than one Medicare Advantage plan at the same time, and if all your enrollment requests are canceled due to multiple enrollment submissions, you may not be able to get the coverage you need when you need it. To avoid any possible complications, it is important to request enrollment in only one Medicare Advantage plan at a time.

Read Also: How Does Medicare Part D Deductible Work

What Is Medicare Advantage

Medicare Advantage is provided by private insurance companies contracted with Medicare and offers all of the Medicare Part A and Part B benefits besides hospice care, which Part A covers. Most Medicare Advantage plans also offer prescription drug coverage . Many Medicare Advantage plans cover other benefits, such as routine vision, hearing, and/or dental, and health/wellness programs. With Medicare Advantage, youll get your hospital insurance and medical insurance coverage through Medicare Advantage and not directly from Original Medicare.

Compare Plans Over The Phone

If youre looking for the most efficient way to compare plans, then you should consider comparing plans over the phone.

When you compare plans with a licensed insurance agent directly over the phone, you will have access to all the plan information mentioned above such as plan details, benefits, costs and other information.

What makes comparing plans over the phone different is that if you have any questions during the plan comparison process, such as how a certain benefit may help you or how much the plans deductible is, a licensed insurance agent can answer your questions right away.

All of our licensed insurance agents are based in the USA and can help you understand your plan options. Our help is provided at no cost to you. This means you are under no obligation to purchase a policy from us.

But, if you do find a plan that works for your coverage needs, you can start your enrollment process in just a few minutes.

Get started immediately by calling 1-800-557-6059TTY Users: 711.

Read Also: Does Medicare Pay For Private Duty Nursing

Once I Disenroll From Medicare Advantage Am I Automatically Enrolled In Original Medicare

You shouldnt have to take any extra steps once you disenroll in Medicare Advantage. If you were enrolled in Medicare Advantage, you would have already continued paying your Original Medicare premiums anyway.

You may encounter issues, though, when leaving Medicare Advantage. If you voluntarily drop your Medicare Advantage coverage, you may run into difficulty when signing up for Medicare Part D prescription drug coverage or a Medigap supplemental insurance plan.

The High Cost To Actually Use Medicare Advantage

And once you start to use your Advantage insurance, you will likely run into coinsurance that will typically require you to pay 20% of your bills. With a serious illness, that can easily be a six-figure treatment that charges coinsurance.

Some good news is that the government limits your Medicare Advantage annual out-of pocket-healthcare costs. This year, the maximum out-of-pocket is $7,550. Many Medicare Advantage plans set their out-of-pocket even lower. According to the Kaiser Family Foundation, a nonprofit healthcare research organization, the average out-of-pocket this year was around $5,000.

Read Also: What Does Part B Cover Under Medicare

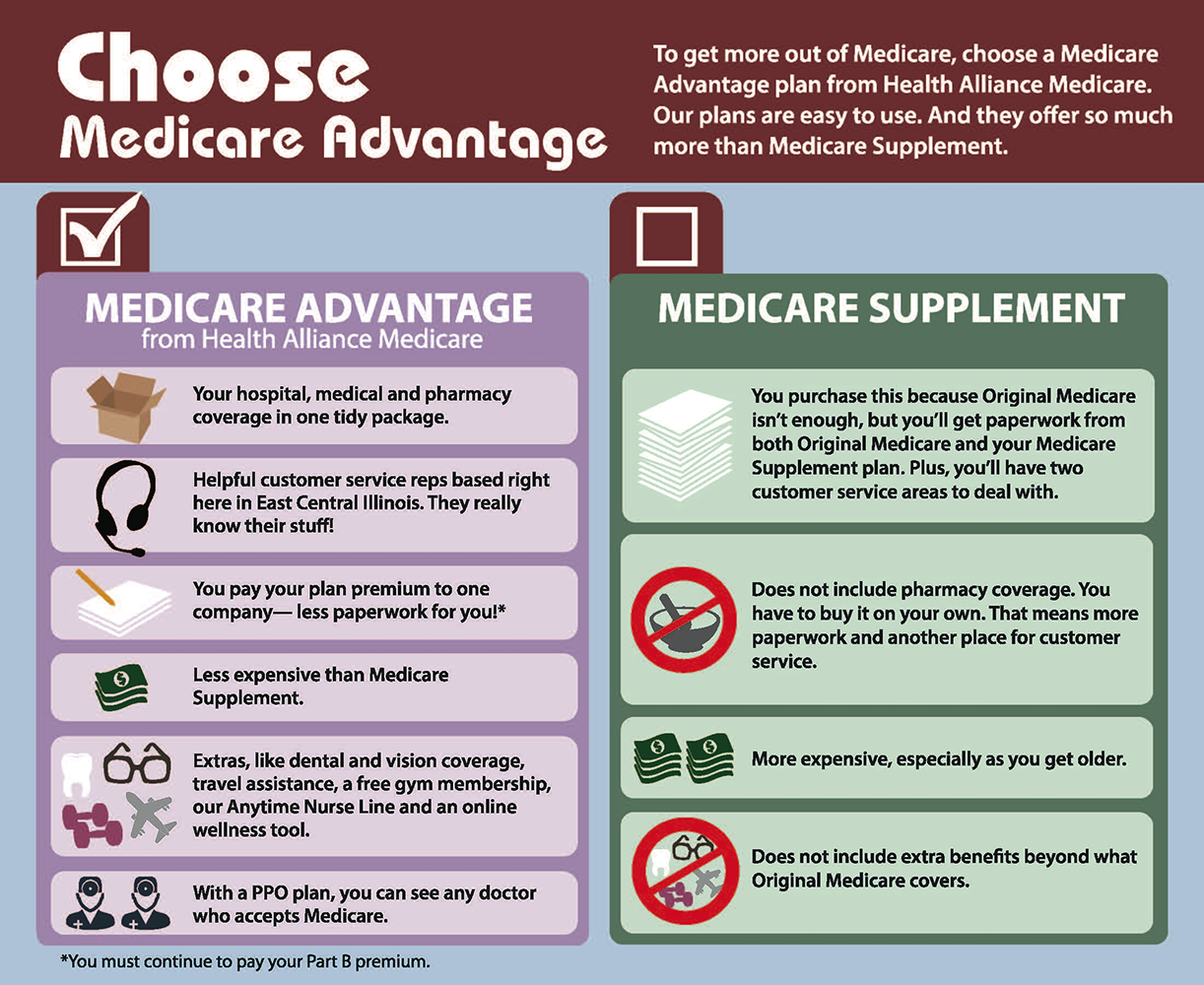

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Original Medicare: Cost And Coverage

Now lets return to Original Medicare. It definitely costs more upfront, as its imperative to add a Medigap policy to cover the coinsurance costs that are embedded in all Medicare. Again, a premium for a Medigap Plan G might run $100 to $300 a month, depending on where you live. But for that premium you have no other out-of-pocket costs other than the standard deductible for Medicare Part B .

If you live in a high-cost area, that works out to $3,600 a year per person. Clearly that is a significant cost that you want to plan for. But then you dont have to worry.

Don’t Miss: How Do I Get Dental And Vision Coverage With Medicare

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

Consider Premiumsand Your Other Costs

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

- Hospital stay$100 per day for the first 4 days

- Emergency Room – $120 copay

- Diagnostic radiologyup to $100 copay

- Lab Servicesup to $50 copay

- Outpatient x-raysup to $50 copay

- Outpatient surgery – up to $100 copay

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Also Check: What Is The Difference Between Medicare Advantage And Regular Medicare

What Is A Medicare Supplement Insurance Plan

Medicare Supplement insurance plans can work alongside Medicare and may help cover costs that Medicare doesnt pay, such as coinsurance, copayments, and deductibles. You need to pay the premium for your Medicare Supplement insurance plan, as Medicare will not cover the cost of a Medicare Supplement insurance plan. Medicare Supplement insurance plans are standardized and in most states there can be up to 10 plans, labeled A-N. Each policy covers the same benefits as other policies of the same name, no matter which insurance company is offering it.

Medicare Supplement insurance plans dont cover costs associated with any kind of health-care plan other than Medicare Part A and Part B, including Medicare Advantage plans, employer/group health coverage, Medicaid, or TRICARE .

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage Plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started.

Keep in mind that you can only enroll in a Medicare Advantage Plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage Plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

Recommended Reading: How To Renew Medicare Benefits

What If I Have Additional Questions About Coverage

Working with both private insurance and Medicare can be a complicated process. If you have questions or concerns about whats covered and which provider pays first, there are several sources you can reach out to, including:

- Medicare. You can get in touch with Medicare using its general contact information or by reaching out to its Benefits Coordination and Recovery Center directly at 800-MEDICARE .

- Social Security Administration . Contacting the SSA at 800-772-1213 can help you get more information on Medicare eligibility and enrollment.

- State Health Insurance Assistance Program . Each state has its own SHIP that can aid you with any specific questions you may have about Medicare.

- United States Department of Labor. If your employment has ended, you can contact the Department of Labor to learn more about COBRA coverage at 866-487-2365.

- TRICARE. Contacting TRICARE directly at 866-773-0404 may be beneficial when navigating coverage alongside Medicare.