Is Medicare Mandatory When Youre First Eligible

If youre still working when you turn 65, or you become eligible through disability, you may be covered under your employers group plan. Or maybe your spouse has an employment-based or union-based group health plan that covers you. You usually dont have to enroll in Medicare right away if you have a group health plan.

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if youve worked and paid taxes long enough. If you qualify for premium-free Medicare Part A, theres little reason not to take it.

In fact, if you dont pay a premium for Part A, you cannot refuse or opt out of this coverage unless you also give up your Social Security or Railroad Retirement Board benefits. Youd also have to pay back your previous benefits to the government.

Is It Mandatory To Have Medicare Part B

While Part B is optional, penalties can be high if you wait too long. Part B covers physician visits, lab tests, outpatient surgeries, and even Durable Medical Equipment.

If you choose to delay Part B you can pay up to 10% above the standard premium for a period of every 12 months that you dont carry coverage. Also, the more time that passes the higher the penalty.

Do I Need Medicare Part B If I Have Other Insurance

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Keep in mind that both parts of Medicare can coordinate with large employer coverage to reduce your spending. Youll need to decide whether you want to enroll in Part B or delay it until later.

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $170.10/month for new enrollees in 2022. You can avoid that cost by simply delaying your Part B enrollment until you retire.

Also Check: What Age I Can Get Medicare

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Is Medicare Part B Mandatory

Medicare Part B coverage is not mandatory. An individual can go outside of the plan network for Part B services and receive a reimbursement from Medicare when Medicare is the primary payer.

Medicare Part B is essentially medical insurance. It covers services and supplies that are deemed medically necessary for the diagnosis and treatment of a health condition.These include care service received at a hospital and care received at a doctors office, a clinic or another health facility. Medicare Part B also covers a number of preventive services that help prevent illness or detect a condition at an early stage. Part A and Part B Medicare combined are known as Original Medicare.

The services and supplies covered under Medicare Part B include the following: doctors visits, X-rays and lab tests, ambulance services, mental health care, durable medical equipment, preventative services such as flu shots, pap tests and other screenings, and therapy services including occupational therapy, speech pathology services and physical therapy.

The cost of Medicare Part B varies, but individuals may pay a higher premium if they make above a pre-determined amount set by the government. Also, if an individual did not enroll in Part B when he was first eligible, he may pay a higher premium.

You May Like: Does Medicare Pay For Stem Cell Knee Replacement

When Can I Enroll In A Medicare Prescription Drug Plan

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Can I Sign Up For Medicare Part B Online

Is The Medicare Wellness Exam Mandatory

Once a beneficiary turns 65 and begins Medicare coverage, theyll be eligible for their Welcome to Medicare visit. This visit is an initial physical exam, covering some vaccines, blood pressure, height, and weight measurements, a basic vision screening, and body mass index calculation.

This appointment isnt mandatory. If you go to a wellness visit, you must do so within the first 12 months of enrolling in Medicare.

Medicare Part A B C And D: Whats The Difference

Selecting a Medicare plan can be overwhelming. Understand which plans cover which services so you can make the best choice for you.

Open enrollment happens every year from the middle of October to the middle of December. It is the period of time when you can make changes to your Medicare coverage. You can enroll in a new Medicare prescription drug plan, switch from Original Medicare to a Medicare Advantage plan or change Medicare Advantage plans.

When youâre first selecting a Medicare plan, you may be faced with an overwhelming number of choices. One of the most challenging parts of understanding Medicare is how the different parts fit together.

This article describes the differences between Original Medicare and Medicare Advantage . It also explains how Part D fits into the different plans. Youâll also learn what else to keep in mind as you are picking a plan.

Don’t Miss: How Much Income Before Medicare Goes Up

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Medicare Health Benefits Plan Menu

- Original Medicare, Parts A and B

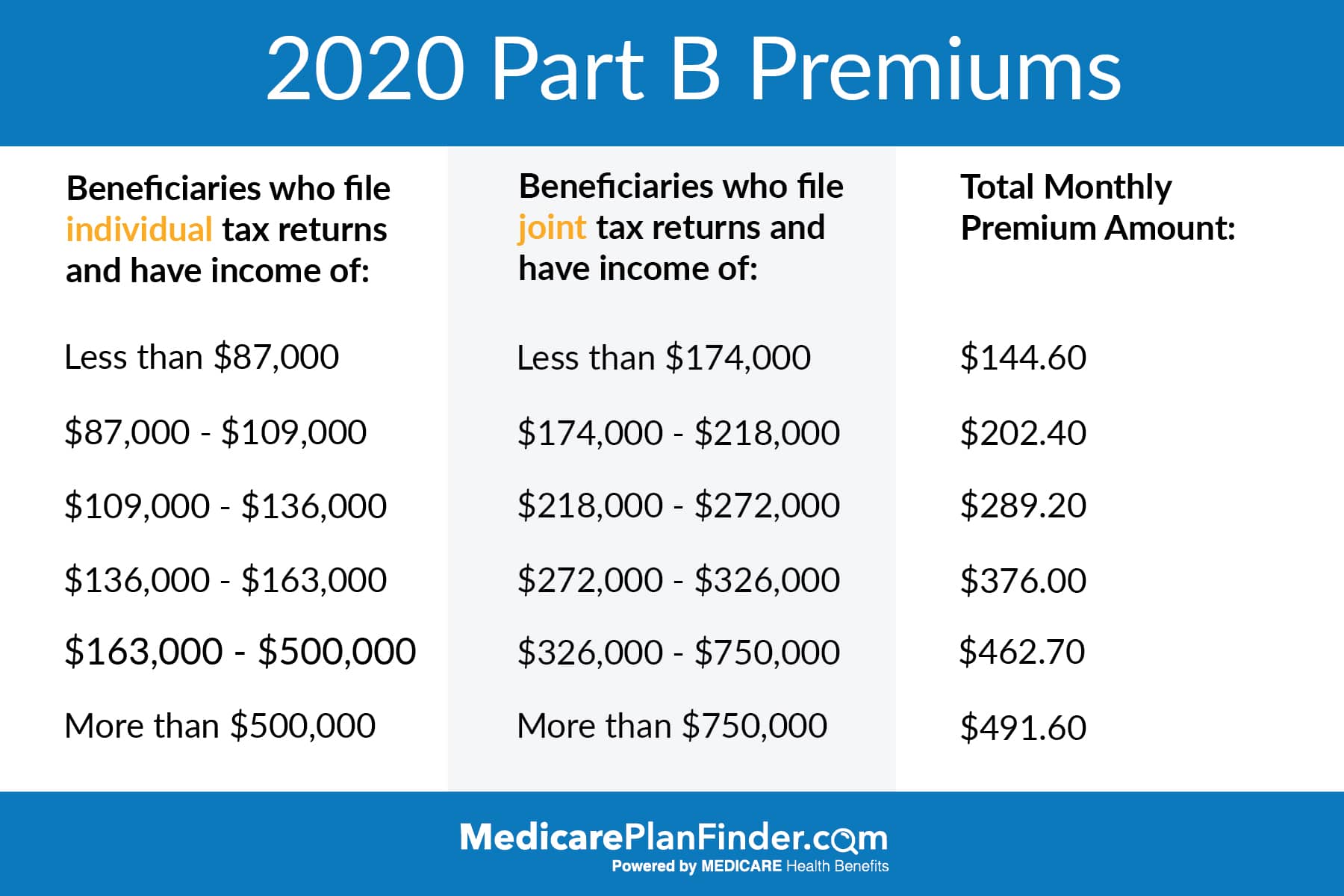

- Modified Adjusted Gross Income determines Part B Premiums

If you fall under one of the following criteria you are eligible to sign up for Medicare:

- People 65 years of age and older.

- Some people with disabilities under 65 years of age.

- People with End-Stage Renal Disease .

Don’t Miss: What Age Does Medicare Eligibility Start

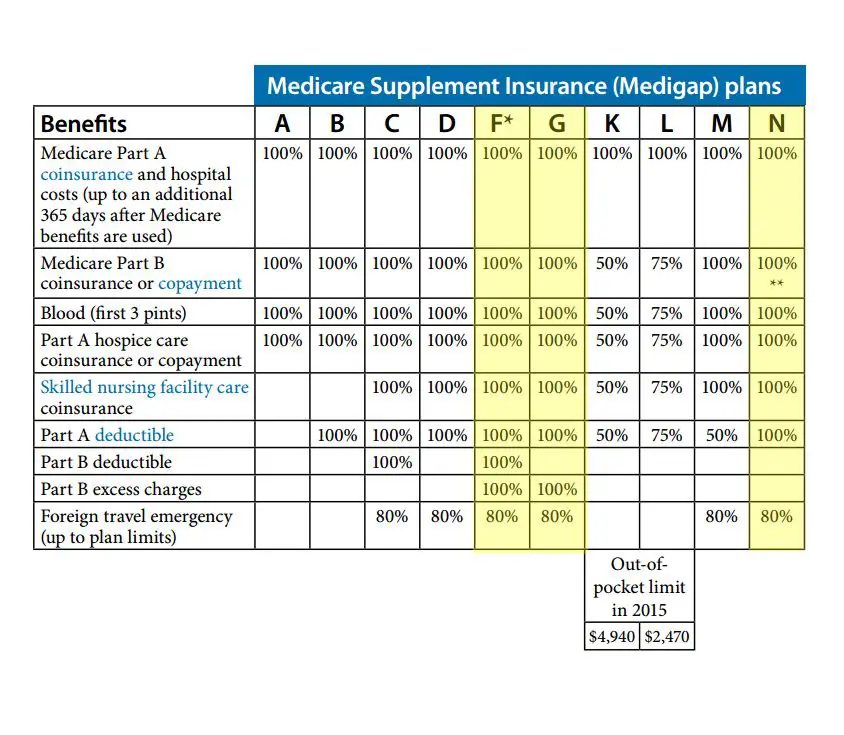

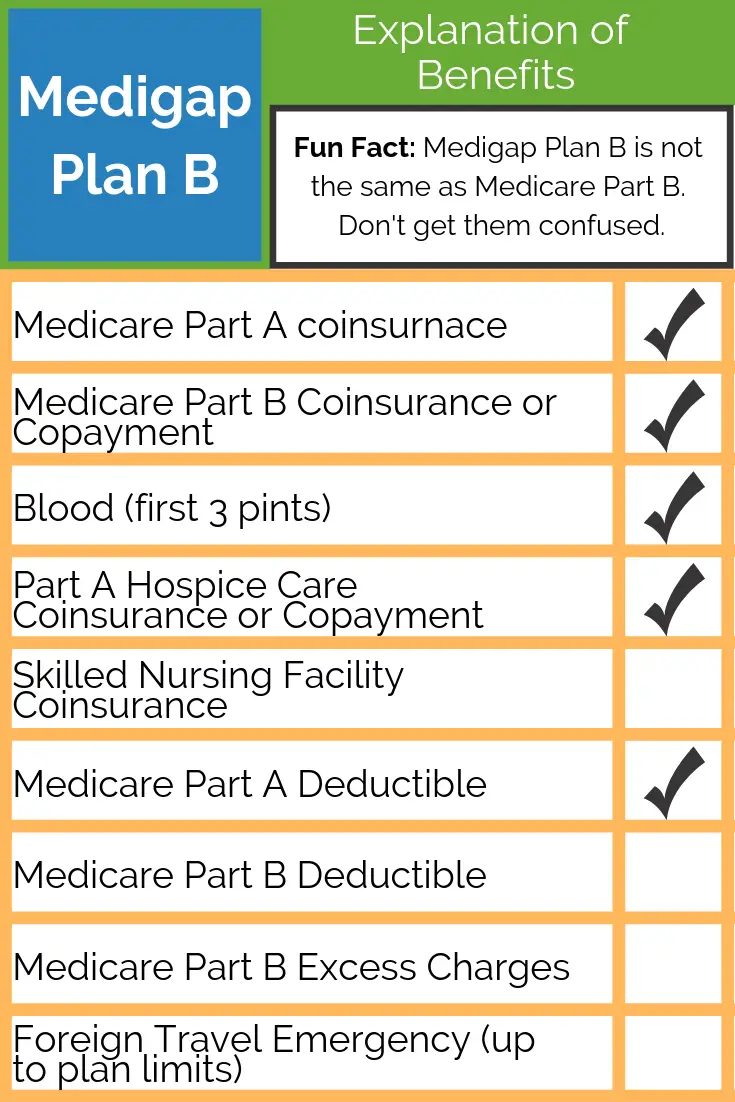

Is Medigap Plan B And Medicare Part B The Same

You may have heard of Part B, its common to get these two confused however, simplifying the information can help. Medicare has a way of making things as clear as mud. Part B and Plan B are two separate things.

Plan B is a Medicare Supplement policy that helps beneficiaries with healthcare costs. Youll use the word plan when referring to a Medigap plan.

- Was this article helpful ?

Is Medicare Mandatory For Veterans

If youre a veteran receiving Veterans benefits, Part B isnt necessary. But, the Veterans Affairs suggests both Part A and Part B.

Veterans have a more extensive network of doctors and services when they have Medicare and Veterans Association. By choosing to opt-out or delay benefits, veterans may potentially have penalties when they need Medicare.

Veterans qualifying for TRICARE must have Part B to keep their benefits. To enroll in Part B, you need Part A or at least a Part A effective date. Also, its essential to keep your information in DEERS current.

Active duty members and family members can have Part A and TRICARE, and delay Part B. Then, once active duty status ends, you need Part B to keep TRICARE.

You May Like: Is Blood Pressure Monitor Covered By Medicare

Below Coverages Are Included In Medicare Part B

- Health Provider Services Doctors, nurse practitioners, occupational and physical therapists as well as mental health programs are all examples of licensed healthcare providers covered by Medicare Part B.

- Durable Medical Equipment Walkers, wheelchairs oxygen tanks and other durable devices bought or leased from a Medicare approved supplier and authorized by your healthcare provider.

- Home Healthcare Services Part-time and intermittent services if you are homebound and unable to receive them at an outpatient facility.

- Ambulance Services Emergency to and from the hospital, also when no alternative medically safe option is available.

- Preventive Services Screenings and counseling designed for prevention and maintaining good health.

- Therapy Outpatient physical, speech, and occupational therapies as ordered by a physician.

- Chiropractic Care For manipulation of the spine only.

What Do Medicare Parts A And B Cover

Part A, which in most cases is free, covers:

- Inpatient care in a hospital

- Skilled nursing facility care

- Nursing home care

- Hospice care

- Home health care

In 2022, the deductible for Part A is $1,566.

Part B, which has a standard premium of $170.10 in 2022, covers medically necessary services and preventive services such as:

- Durable medical equipment

- Inpatient and outpatient mental health services

- Lab tests

You May Like: Does Medicare Cover In Home Caregivers

What If I Want To Re

If you change your mind, you may re-enroll at a later time. Keep in mind you may have to pay late enrollment penalties if you didnt have appropriate coverage in place. In some cases you may be able to re-enroll online, though if you have Part A and not part B, you must print, sign and submit new forms.

In some cases you may need to prove you had adequate employer-sponsored or other coverage to avoid penalties. Once this happens, youll be granted a special enrollment period so you can re-enroll. During this time, you may also be able to add Part D drug coverage, Medicare Advantage or Medigap coverage as well.

Automatic Enrollment In Medicare Part B

While the eligibility requirements and coverage of Medicare Part B are rather simple, enrollment can be a little more complex. This complication is due to Part Bs accommodation of different life circumstances.

If you are an American citizen and a permanent resident of at least five years in the United States, then you will be automatically enrolled in Medicare Plan B when eligible. This means that on your 65th birthday, you will be enrolled without you having to do anything.

Or, if you are eligible on the basis of your disabilities, you will be automatically enrolled in Medicare Plan B shortly after you qualify for disability, or when you receive either Social Security Administration or Railroad Retirement Board benefits.

There are exceptions to automatic enrollment eligibility and they are as follows:

In these circumstances, you will need to enroll manually.

Read Also: Does Medicare Cover Handicap Ramps

Do I Need Medicare Part D

Medicare Part D is technically voluntary coverage you arent required to enroll in a plan. However, if you go without prescription drug coverage before you enroll in a plan, you may pay a late penalty with your monthly premium. If you have prescription drug coverage through an employer group or retiree plan, you dont have to enroll in a Medicare Part D plan until your coverage ends.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

You May Like: When Can You Start Medicare

How Much Does Medicare Part B Cost

The out-of-pocket costs for Part B include a premium, deductible, and coinsurance. Part B will cover 80% of your medical expenses once youve met the annual deductible. You must pay the monthly premium for Part B. Most beneficiaries will pay the standard monthly premium. Those in a higher income bracket will pay more.

In 2022, the Part B premium is $170.10 a month. If you receive Social Security, Railroad Retirement Board, or Office of Personnel Management benefit payments, your Part B premium will be deducted from your monthly check. Part B has an annual deductible of $233. This deductible can slightly increase each year.

If you dont receive Social Security, you could get a monthly bill from Medicare. They have an online payment option called Easy Pay for those with a MyMedicare account.

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

Recommended Reading: How To Opt Back Into Medicare

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

How Do Special Enrollment Periods Work

Special Enrollment Periods are a bit more complicated than the other periods weve discussed, but are very useful to know about. These periods are specific to you and are triggered by certain life events. This includes things like moving out of state, moving out of long-term care facility, or losing your current creditable coverage. The purpose of Special Enrollment Periods is to make sure that you can add on Medicare coverage if you suddenly find yourself in a new scenario, so you dont have to wait until the General Enrollment Period.

Special Enrollment Periods are 60 days long. However, they will vary with regards to whether the 60 days is before or after the event in question. If you know that one of these life changes is on the horizon for you, make sure to contact Medicare in advance to get the details. And, if a change comes unexpectedly, contact them right away, so you can take advantage of Special Enrollment as soon as you can.

Recommended Reading: Will Medicare Pay For A Patient Lift