Find Balance In Premium And Copays With Plan G

With Plan G, youll get the same benefits as Plan N plus coverage for any excess charges. Also, you wont have to pay those small copays that Plan N requires you to pay. In exchange for not having to pay a small copay every time you visit the doctor or hospital, you agree to pay a slightly higher monthly premium. For many years, Plan G has been the runner-up plan to Plan F.

Plan G replicates Plan F. The only difference is that it does not cover the Part B deductible.

This plan is a wise choice for those who:

- Dont want surprise out-of-pocket hospital costs

- Want rate increases that dont catch them by surprise

- Like to travel outside of the United States

- Live in a state that allows excess charges

Original Medicare Insurance Options

Medicare provides several types of coverage, 2 of which are included with your base plan, also known as Original Medicare. With Original Medicare, youll get Medicare Parts A and B. Part A provides hospitalization coverage including meals, nursing care, equipment and the room itself, while part B provides medical coverage for doctors visits, outpatient care and doctor care while hospitalized.

Costs for Medicare coverage vary depending on the coverage options you choose. Most people can expect to pay for at least part of their Medicare coverage, but premiums for base coverage can be deducted from social security payments. For example, Medicare Part A is premium-free for most people.

However, coverage may also be subject to deductibles, copayments or coinsurance, all of which can cost money out of pocket if you need hospitalization. By contrast, Medicare Part B typically requires a premium, which can be deducted from your Social Security payments or paid to Medicare directly.

While Medicare covers many health care needs, coverage often has gaps, which can become more apparent depending on the type of services you need. With Part B coverage, for example, youll often have a 20% coinsurance cost. This means your coverage pays 80% of the Medicare-approved amount for a given service, but you have to pay any remaining amount. Already you can see where there may be some gaps in your coverage that can tear a sizable hole in your budget, particularly if youre on a fixed income.

Medigap Plans Rate Comparison

When comparing Medicare Supplement insurance prices, keep in mind that they are standardized. The same plans offer the same benefits no matter where you buy them from- making it simple to find deals on rates between policies.

When youre looking for a new carrier, its important to find the company that best suits your needs. That means evaluating things like price and coverage areas as well as rating information.

We always look at all of these factors when we make recommendations because our goal is to provide clients with options that are right for them!

We can give you an accurate and customized comparison of Medigap plans in your zip code. This will help you compare current rates AND rate increases over the last few years to make sure that a carrier has stable long-term rates for your needs.

Fill out the form on the right of this page for more information about how our Medicare Supplemental insurance cost comparison software works, or if already know which plan is best suited for what type of coverage do not hesitate to contact us!

Recommended Reading: Does Medicare Cover Cosmetic Surgery

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

The Top 5 Medicare Supplement Plans In 2022 Are:

Well explain the benefits, pros, and cons of each plan below.

For now, keep in mind the most important thing to consider when it comes to Medigap plans is that each company has the exact same benefits within each plan letter, but they all charge different rates for them!

Thats where we can help. We shop all the top plans and rates for you and make sure youre paying the least amount possible each year for your coverage.

The best part?

Mon-Fri : 8am-8pm EST

You May Like: How To Get A Lift Chair From Medicare

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Best Medicare Supplement Companies

Unlike health insurance, where policies differ among providers, Medicare supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans. Itâs important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

Cigna, similar to UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

You May Like: How Can I Get My Medicare Card Number

What Is The Difference Between Plan F And Plan F High Deductible

As the name suggests, the biggest difference between a regular Plan F and a High Deductible Plan F is the amount of the deductible. The only difference in plan details is that the High Deductible Plan F requires you to meet a deductible before it begins covering you , whereas Plan F provides coverage immediately. In choosing the High Deductible Plan F, you delay your coverage until youve met that higher deductible, so determine carefully whether you think youll be needing a large amount of medical care because once your deductible is met, your monthly payments will be much lower.

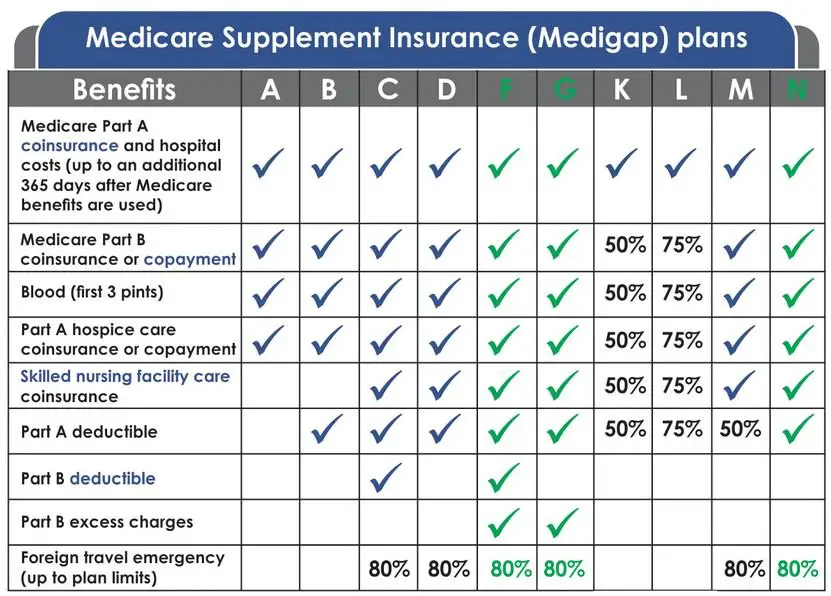

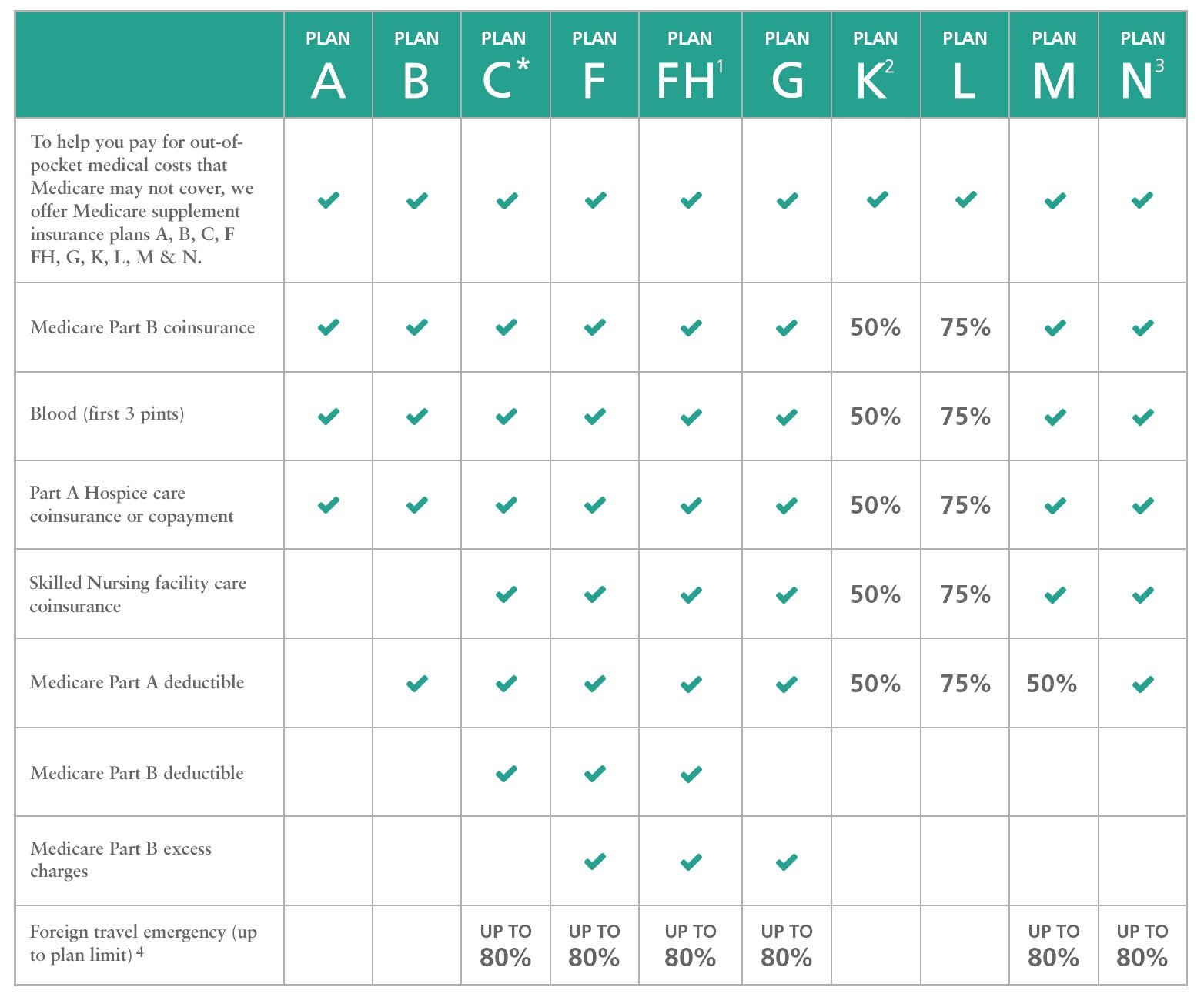

The Medicare Supplement Plans Comparison Chart: Compare Medigap Benefits Side By Side

by Christian Worstell | Published April 29, 2021 | Reviewed by John Krahnert

There are 10 standardized Medicare Supplement Insurance plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N. When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes.

Recommended Reading: Does Medicare Cover Bed Rails

Compare These Plans Side

If a “yes” appears, the plan covers the described benefit 100%. If a row lists a percentage, the policy covers that percentage of the described benefit. If a “no” appears, the policy doesn’t cover that benefit.

| Medigap Benefits | ||

|---|---|---|

| Part A: inpatient hospital deductible | No | |

| Part A: skilled nursing facility coinsurance | Yes | Yes |

| Part B: deductible** | ||

| Coverage while in a foreign country | No | |

| State-mandated benefits | Yes |

* The plan pays 100% after you spend $1,000 in out-of-pocket costs for a calendar year.

**Coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to get this benefit

Plans A And B: Lower Benefits Higher Out

Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital. Plans A and B generally have higher out-of-pocket costs for things like Skilled Nursing Facility Coinsurance, Medicare Part B Excess Charges, and Foreign Travel Emergency Care.

Also Check: Is Medicare Advantage A Good Choice

What Are The Best Rated Medicare Supplement Companies In 2022

Now that youre familiar with the top 10 well-known Medicare Supplement companies, well let you know which five are the highest rated. There are several official types of ratings for insurance companies but in this article, well focus on the AM Best and S& P ratings. A high rating with both of these agencies indicates a companys financial stability and offering of high-quality insurance products.

Mutual Of Omaha: Best Rated Medicare Supplement Company

Its clear why Mutual of Omaha is at the top of our list. This company has an A+ rating with AM Best and an AA- rating with S& P. Established in 1909, Mutual of Omaha has been a household name for over a century. They pay 98% of Medicare claims within 12 hours, saving clients the hassle of worrying about claim status.

Plus, Mutual of Omaha offers more than just Medigap plans. You can also enroll in a Part D prescription drug plan or purchase long-term care insurance through MOO. Household discounts make it beneficial to choose MOO if your spouse already has an active Medigap policy with this company.

Aetna: Highly Rated Company for Medigap Plans

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around an A from AM Best and an A+ from S& P underscore the reasons for this companys longevity.

Cigna: A Top-Rated Carrier for Medicare Supplement Plans

Best For Customer Service: Aetna

Aetna has scored well in our other healthcare services roundups, so its no surprise to see this time-tested insurer appear again. With over 50 years of working with Medicare and over a decade of experience in providing supplements, Aetnas experience shines.

In most states, you can choose from 6 supplement plans and easily compare plan features online. If you need assistance, Aetnas well-known customer service can help answer questions or highlight plans that meet your needs.

Aetna offers a rate lock that ensures you rates wont change within the first year and a household discount offers a way to save more if someone else in your household has a supplement plan through Aetna.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Can I Keep My Plan G If I Move To Another State Or Country

If you move to another state and your plans Supplement Plan G is available in your new location, you can keep your plan. If it’s not available in your new location, you may need to switch plans or providers if other companies offer Plan G coverage in your new area. You can keep your Medicare Plan G coverage if you move to another country, although it wouldnt cover care other than emergency care visitsand thats after a $250 deductible. If you plan to move back to the United States, it may be worth keeping Medicare Plans A and B, though Plan B may incur higher premiums. It depends on how long you plan to be gone and other insurance options for you in your new home country.

When Should You Buy A Medigap Policy

All states allow for guaranteed issue, which means that you have the right to buy a Medigap policy for six months starting the first day of the month you are at least 65 and enrolled in Medicare Part B.

During this enrollment period, an insurance company cannot turn you down for a Medigap policy or charge you more for a preexisting health condition.14

If you dont buy a Medigap policy during that period, youre only entitled to a guaranteed issue Medigap policy in certain situations:

- Your Medicare Advantage plan closes.

- You move out of the area.

- Your retiree plan shuts down.

- You joined a Medicare Advantage plan at age 65 but decided to switch back to Original Medicare within a year.

- Your Medigap policy closes.15

Theres some homework to do to figure out the right choice, but it will be well worth it. The best Medigap policy can ensure you have the coverage you want at a price you can afford and, most important, help you manage healthcare costs that Medicare wont cover.

Recommended Reading: Will Medicare Pay For Handicap Bathroom

How Can You Compare & Choose A Medigap Policy

Start by looking at the chart below of lettered Medigap policies to see which benefits come with each plan.

Consider how much coverage you want for each of the benefits listed to find the lettered plan thats right for you. When you have decided on a Medicare Supplement Insurance plan, select three to five Medigap policy insurance companies and reach out to them to ask what they charge for that plan.

Check, too, with your states department of insurance for a list of companies that sell Medigap policies some include the list on their website. You may also want to ask your doctors office which insurance companies the doctor works with or your family and friends who have a Medigap policy if theyre happy with their coverage.

To get a complete sense of your total costs, be sure you understand not only what your monthly premium would be, but also the deductible, copays and coinsurance.10 To estimate your Medicare and Medigap costs for the year, include your premiums for Part B, the Medigap policy and the Part B annual deductible .

Some expenses are unpredictable. For instance, the Part A deductible kicks in if you need to be admitted to the hospital. How much you need to pay in copays and coinsurance depends on how many services and which ones you need and which Medicare Supplement Insurance plan you have. Since it is an estimate, you might want to err on the side of overestimating.

Best Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Offers dental, hearing, vision, and Part D plans for extended coverage

-

Few states offer High-Deductible plan

-

Rates increase based on age

Blue Cross Blue Shield companies offer a number of discount programs for Medicare Supplement Plan G. Blue of California, for example, offers a New to Medicare discount for your first year , discounts for using automatic bank payments , discounts for enrolling in a dental plan at the same time , and a 7% discount if you and someone else in your household sign up for BCBS Medigap plans.

If you are looking for a company with Medicare experience, know that BCBS, founded in 1929, was the first company to manage Medicare claims in 1966. It has grown to include more than 36 companies, notably Anthem, CareFirst, Highmark, and the Regence Group. Altogether, BCBS offers Medicare Supplement Plan G in 44 states, excluding Alabama, Hawaii, Massachusetts, Minnesota, Utah, and Wisconsin. High-Deductible Plan G is available in 16 states, including Alaska, Arkansas, Illinois, Iowa, Maryland, Michigan, Montana, New Mexico, North Carolina, Oklahoma, South Carolina, South Dakota, Texas, Virginia, Washington, and Wyoming.

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your states plan for details about BCBS discount programs.

Also Check: Does Cigna Have A Medicare Supplement Plan

Medicare Advantage Plan Options

Medicare Advantage Plans bundle Medicare Parts A and B services with other coverages, such as vision care or dental coverage, or Medicare Part D coverage, which covers prescription drug costs. Youll also see Medicare Advantage plans referred to as Medicare Part C, although most plans include Part D as well.

Commonly, Medicare Advantage plans use a provider network, which might be a Health Maintenance Organization , a Preferred Provider Organization or another cost-saving structure. Out-of-network services may cost more.

Most Medicare Advantage plans also cover Medicare Part D for prescription drug coverage.

Online Quote Option