What Is The Medicare Maximum Out

Medicare doesnt have a limit on the amount you can spend on healthcare. But, they do cover a portion of most medical bills. Yes, there is some help, but 20% of $100,000+ surgery or accident could be bank-breaking.

But, there are options to supplement your Medicare. Some options have a maximum limit. Yet, some options dont. The best option will be the one that saves you the most money.

Basic Terms For Medicare Costs

Lets begin by defining the different forms of Medicare costs that you may experience.

Premium: The amount you pay each month to be covered by Medicare, Medicare plan, or other insurance.

Deductible: The amount you pay out of your own pocket for Medicare-covered health-care services and supplies before Original Medicare, your Medicare plan, or other insurance begins to cover expenses.

Copayment: A flat dollar amount that you must pay for a service after youve reached any deductibles that apply and after Original Medicare or your Medicare plan begins to cover your health-care expenses. This is one form of cost sharing you may be responsible for after Medicare has paid its share of costs. Some examples of situations when you may need to pay a copayment include doctor appointments or when you fill a prescription.

Coinsurance: Another form of cost sharing, this is a percentage of the total cost of the Medicare-covered equipment or service you may need to pay after you have reached any deductibles that apply for Original Medicare or your Medicare plan. For example, you might pay 20%, while Medicare pays 80% of the cost.

Annual out-of-pocket maximum: The maximum amount you must pay out of your own pocket each year before your Medicare plan pays 100% of your covered health-care expenses. Original Medicare doesnt have an out-of-pocket annual maximum limit. Medicare Advantage plans have out-of-pocket maximum limits.

New Time Limit For Filing Medicare Claims

Historically, as authorized by statute and the Centers for Medicare and Medicaid Services , physicians had a minimum time limit for filing Part B claims of 15 months and a potential maximum of 27 months after the service was furnished, depending on the month of the year when the service was furnished. Section 6404 of the Patient Protection and Affordable Care Act changed that by requiring that all claims for services furnished on or after Jan. 1, 2010, must be filed within one calendar year after the date of service, while claims for services furnished before Jan. 1, 2010, must be filed on or before Dec. 31, 2010. In its proposed rule on the 2011 Medicare physician fee schedule, which I mentioned in my previous post , CMS proposes to amend its regulations to be consistent with the statutory changes imposed by the PPACA.

In the past, CMS had one exception to the timely filing limit. That exception applied when the failure to file …was caused by error or misrepresentation of an employee, intermediary, carrier, or agent of the Department that was performing Medicare functions and acting within the scope of its authority. Consistent with the authority provided in Section 6404 of the PPACA, CMS proposes to create two new exceptions.

The first new exception would apply when CMS or one of its contractors determines that the following conditions have been met:

Also Check: What Age Can I Apply For Medicare

Medicare Prescription Drug Plans Have Maximum Out

Regardless of which way you go for your primary health insurance, your Medicare Part D plan prescription drug coverage also has shared costs. Most Medicare Advantage plans include a Part D prescription drug plan, and its costs are not included in the plans MOOP. With Original Medicare, you can buy a stand-alone Medicare Part D plan, and all of its costs are separate from the Part A and Part B shared costs.

Every Medicare prescription drug plan has four distinct cost-sharing phases:

- Phase 1 is the annual deductible. For 2021 Part D plans can have a deductible of up to $445. You pay the full retail cost of your medications at the pharmacy until the plan deductible is met.

- Phase 2 is the initial coverage limit . For 2021 the ICL is $4,130 in retail drug costs. In this phase, you pay your share at the pharmacy and the plan pays its share. When the total retail cost of your medications reaches the initial coverage limit you go to phase 3.

- Phase 3 is the coverage gap. In the coverage gap, also known as the donut hole, you pay the full cost of your medications. You remain in the donut hole until your out-of-pocket threshold reaches $6,550 in total retail drug costs.

- Phase 4 is the catastrophic coverage phase. In this phase your prescription costs are minimal.

Wasnt the coverage cap closed? Well, yes and no. The Affordable Care Act helped to fix things, but the gap still exists. What changed is the amount youll pay.

What Other Additional Services Does Medicare Advantage Cover

In addition to routine dental care, a Medicare Advantage plan may cover other services that Original Medicare generally doesnt cover such as:

- Routine vision including eyeglass lenses and frames

- Routine hearing including hearing aids

- Prescription drugs

Still have questions about comparing Medicare Advantage plans? You can call eHealth to speak with a licensed insurance agent. If youd like to explore the various Medicare coverage options in your area, use the Browse Plans button on this page.

Also Check: What Medicare Supplement Covers Hearing Aids

How Does The Out

Medicare Supplement insurance plans are private plans, which means premiums are set by the insurance companies, not the government. Generally speaking, a plan with a higher out-of-pocket limit may have a lower premium than one with a lower limit.

Plan K and Plan L generally have lower premiums compared to other Medicare Supplement insurance plans that pay 100% of your covered costs right away. However, you need to check rates with each insurance company before you decide which plan works best with your financial situation.

Would you like to compare Medicare Supplement insurance plans in your state with no obligation? Its easy just type your zip code in the box on this page to begin.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

As you can see, your Medicare costs may vary quite a bit depending on the type of coverage you have, as well as the services or supplies you need, and how often you need them. Taking the time to compare costs across Medicare plan options in your area may help you save money. If youd like help finding coverage that may suit your needs and budget, feel free to contact a licensed eHealth insurance agent by dialing the phone number on this page!

NEW TO MEDICARE?

Can You Explain The Out

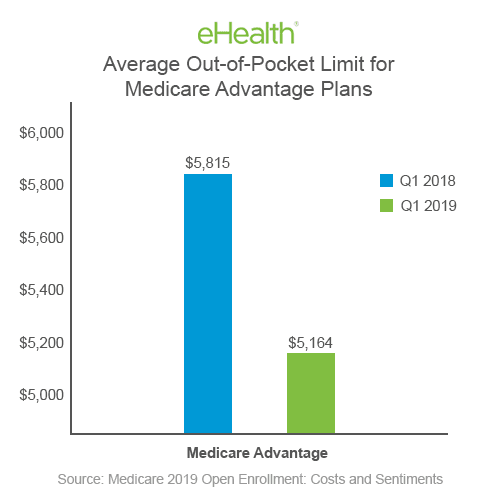

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.

Beginning in 2011, Medicare set the maximum out-of-pocket limit for in-network services at $6,700 and $10,000 for in- and out-of-network combined. That will change as of January 1, 2021. The maximum limits will increase to $7,550 for in-network and $11,300 for in- and out-of-network combined.

There is an explanation for this change. For the first time, those diagnosed with end-stage renal disease or kidney failure will be able to enroll in a Medicare Advantage plan. Previously, if someone who had elected Medicare Advantage was diagnosed with ESRD, he could continue with the coverage. However, those with the condition could not enroll in a plan. The Centers for Medicare and Medicaid Services now considers those costs when calculating the limits.

Here are some facts to know.

Check the Medicare Advantage plans evidence of coverage for details on the out-of-pocket limit.

Read Also: How To Get Help Paying Your Medicare Premium

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. Here’s a closer look at what isn’t covered by Medicare, plus information about supplemental insurance policies and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

Lifetime Limits For Medicaid

Medicaid is jointly funded by the federal and state governments but is run by the states. While the federal government sets the minimum standards for Medicaid coverage, each state can propose changes to those standards through 1115 Medicaid waivers. While lifetime coverage limits have been denied at this time, there are other limits set by the program.

As of November 2020, Indiana and Utah implemented work requirements for Medicaid eligibility. Arizona, Georgia, Nebraska, Ohio, South Carolina, and Wisconsin have had their waivers for work requirements approved but they have not yet been implemented, Other states, including Arizona, Idaho, Mississippi, Montana, Oklahoma, South Dakota, and Tennessee, have work requirement waivers pending. The idea is that “able-bodied” people should be encouraged to work. Doing so would increase the odds that they would gain access to employer-sponsored plans, instead of relying on Medicaid. It also limits how many people can access the program, indirectly setting limits on coverage.

Also Check: How To Apply For Medicare By Phone

Do Medicare Part D Prescription Drug Plans Have An Out

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have whats called a catastrophic coverage phase, which works similar to an out-of-pocket maximum.

As you make deductible and cost-sharing payments for covered drugs, you will accumulate a balance that counts toward your catastrophic coverage amount for the year. Once your out-of-pocket spending reaches this number, you will then pay either 5% coinsurance or a $3.70 copayment for generic drugs and $9.20 for brand-name drugs for the remainder of the year.

The catastrophic coverage limit for 2021 is $6,550. Once you spend that amount on drugs that are covered by your plan, youll only pay the low copayment or coinsurance amounts listed above for generic and brand-name drugs through the rest of 2021.

Benefits With Medicare Coverage Limits

Some Medicare benefits that have annual coverage limits include:

- Extended hospitalization

- Skilled nursing facility care

- Therapy services

If you require any of these services beyond the annual limits, and don’t qualify for an exception, you may be responsible for the full cost of those services for the rest of the year.

Read Also: Can Permanent Residents Get Medicare

Medicare Advantage Plans Have An Out

If you have a Medicare Advantage plan, you may have different out-of-pocket costs, depending on the plan you select.

As mentioned above, Medicare Advantage plans provide all of the same benefits that are offered by Original Medicare. This means that Medicare Advantage plans cover cancer treatments, too.

Medicare Advantage plans also have an annual out-of-pocket limit that will cap your out-of-pocket spending. Original Medicare doesnt have an out-of-pocket limit.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

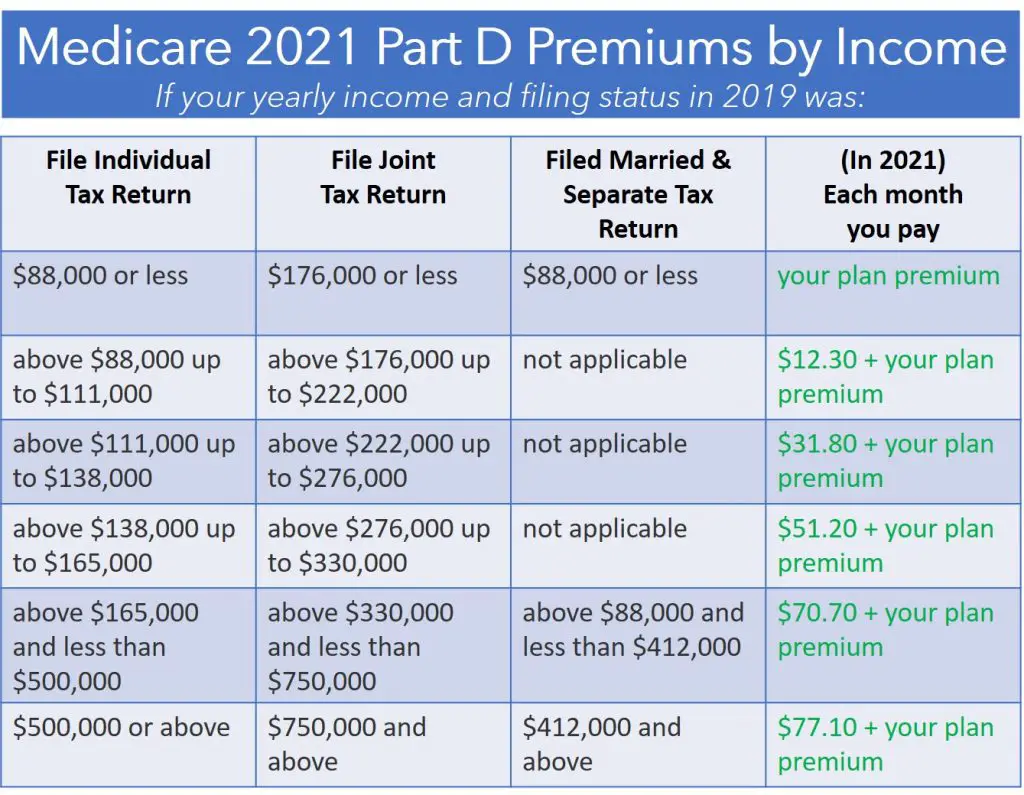

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Read Also: What Does Bcbs Medicare Supplement Cover

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

In 2021, higher premium amounts start when individuals make more than $88,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Contact Your Local State Health Insurance Assistance Program

Based on the information you provided, you do not appear to be eligible for Medicare cost-saving programs.

Each state offers a State Health Insurance Assistance Program , partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

Visit www.shiptacenter.org to find your local SHIP office.

You May Like: What Is Medicare Ffs Program

Some Types Of Medicare Coverage Include Annual Out

- Medicare Supplement Plans K and L

- Medicare Advantage plans

There are a lot of new terms to learn when you enroll in health insurance, like Medicare. You may see words such as assignment, coinsurance, and out-of-pocket limit. Its important to understand what these words mean so you know what you have to pay when you get medical care. Knowing these terms also helps you compare plans and premiums to find the coverage thats best for you financially.

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2021 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Most enrollees in individual Medicare Advantage plans are in plans that provide access to eye exams and/or glasses , hearing exams/and or aids , telehealth services , dental care , and a fitness benefit . Similarly, most enrollees in SNPs are in plans that provide access to these benefits. This analysis excludes employer-group health plans because employer plans do not submit bids, and data on supplemental benefits may not be reflective of what employer plans actually offer.

You May Like: Is It Mandatory To Take Medicare At 65

Other Things To Know About The Qmb Program:

Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments, except outpatient drugs. Pharmacists may charge you up to a limited amount for prescription drugs covered by Medicare Part D.

- If you get a bill for Medicare charges: Tell your provider or the debt collector that youre in the QMB Program and cant be charged for Medicare deductibles, coinsurance, and copayments.

- If you already made payments on a bill for services and items Medicare covers: You have the right to a refund.

- If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

In some cases, you may be billed a small copayment through Medicaid, if one applies.

Make sure your provider knows you’re in the QMB program

The SLMB Program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources.

Are There Inflation Adjustments For Medicare Beneficiaries In High

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does high income mean? The high-income brackets were introduced in 2007 for Part B and in 2011 for Part D, and for several years they started at $85,000 . But the income brackets began to be adjusted for inflation as of 2020, with the start of the high-income range increasing to $87,000/year . For 2021, these thresholds have increased to $88,000 for a single person and $176,000 for a married couple .

For 2021, the Part B premium for high-income beneficiaries ranges from $207.90/month to $540.90/month, depending on income .

As part of the Medicare payment solution that Congress enacted in 2015 to solve the doc fix problem, new income brackets were created to determine Part B premiums for high-income Medicare enrollees. These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

And starting in 2019, a new income bracket was added on the high end, further increasing Part B premiums for enrollees with very high incomes. Rather than lumping everyone with income above $160,000 into one bracket at the top of the scale, theres now a bracket for enrollees with an income of $500,000 or more .

Recommended Reading: Does Medicare Cover Dexa Scan