What Does Medicare Advantage Cover

All Medicare Advantage plans cover any service that original Medicare covers, with the exception of hospice care.

Medicare Advantage will always cover urgent or emergency care, even if youâre in an HMO plan that requires in-network providers . It will also cover emergency care outside the service area .

Medicare Part D is baked into most Medicare Advantage plans. Most Medicare Advantage plans also offer benefits such as hearing, vision and dental care.

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

In addition to the fact that Medicare Advantage plan insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan . These are valuable benefits that Original Medicare does not cover. For healthy people, these extras make a Medicare Advantage plan a very good deal.

Many of the extra benefits that some insurance plans offer look very enticing, but they often come with limits or high out-of-pocket costs. For example, a plan may have excellent healthcare benefits and a poor Part D plan .

Also, it is important to understand that the extra benefits, including Part D prescriptions, are not included in the plans maximum out-of-pocket limit. So, lets say you use the plans dental coverage and pay $1,500 in copays for restoration work, that $1,500 is not included in your MOOP, nor are your Part D medications. This is why so many people feel that traditional Medicare, plus a supplement plan, dental plan, and a stand-alone Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan are the best way to go.

Medicare Advantage Vs Original Medicare

Medicare Advantage plans may have provider networks that limit your choices. If you go outside the network, your care may not be covered or may cost significantly more than if you stay in-network. With Original Medicare, you generally can use any doctor or medical facility that accepts Medicare assignment.

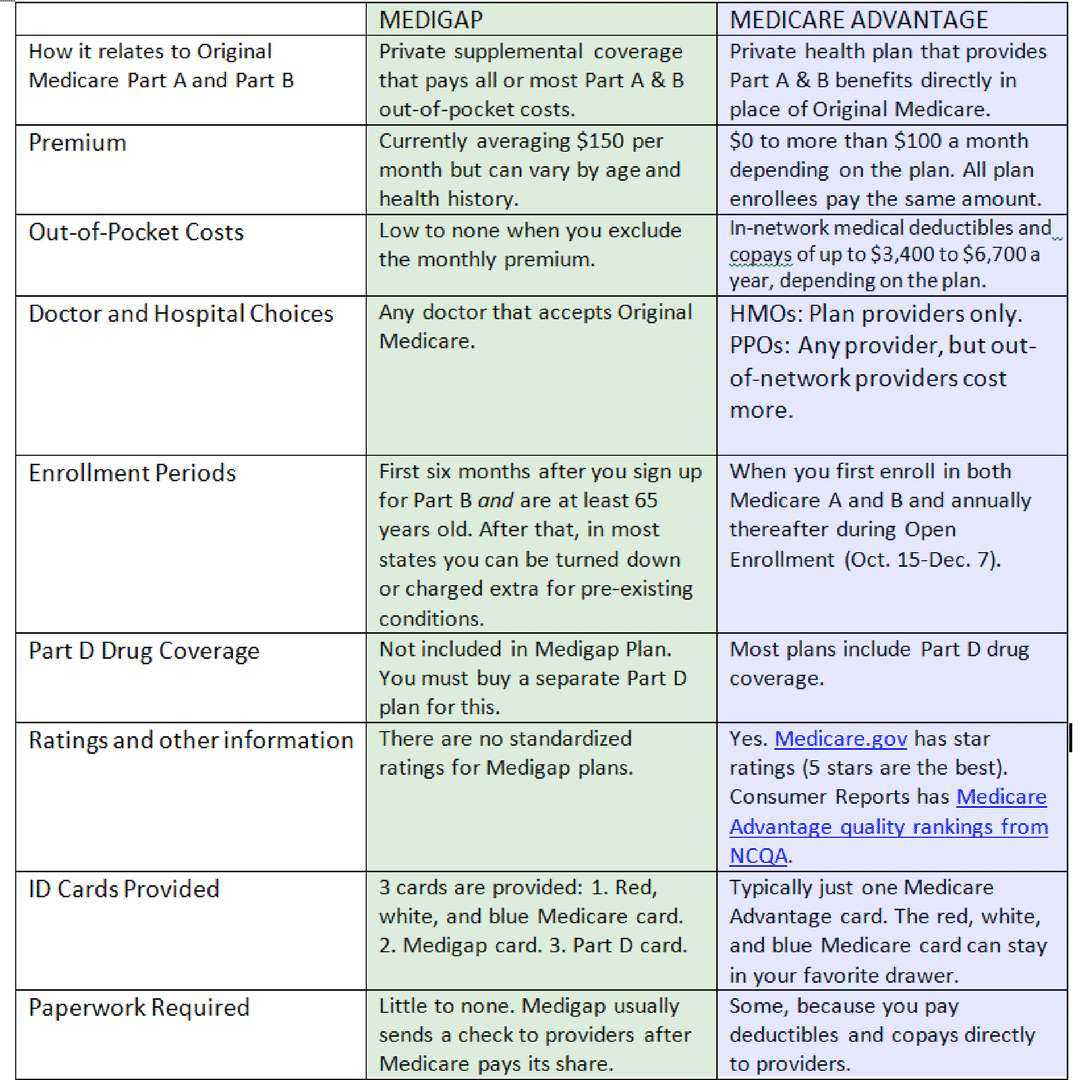

In exchange for less freedom, though, you often pay less. You would still be required to pay a monthly premium for Part B, but the additional cost for a Medicare Advantage plan may be less than for a Medigap plan. Sometimes the Medicare Advantage plan may have a $0 premium.

Medicare Advantage plans may also have a maximum out-of-pocket limit for covered care. That caps the amount youll be expected to pay in addition to your premiums. In 2021, that cap is $7,550.

Also Check: How Old To Get Medicare And Medicaid

How Do Medicare Advantage Plans Work For Medical Insurance

Medicare Advantage plans generally cover all the services that Medicare Part B covers including:

- Doctor visits

- Limited outpatient prescription drugs, including chemotherapy

- Durable medical equipment such as walkers and wheelchairs

- Getting a second opinion before surgery

The copayments/coinsurance you pay may differ from Medicare Advantage plan to Medicare Advantage plan. For example, one plan may charge a $10 copayment for a primary care doctor visit and a $20 copayment for a specialist visit. Another Medicare Advantage plan may charge you a $0 copayment for a primary care doctor visit and a $35 copayment for a specialist visit depending on the service, for example.

Cms Releases 2022 Premiums And Cost

The Centers for Medicare & Medicaid Services released the 2022 premiums, deductibles and other key information for Medicare Advantage and Part D prescription drug plans in advance of the annual Medicare Open Enrollment to help Medicare enrollees decide on coverage that fits their needs. The average premium for Medicare Advantage plans will be lower in 2022 at $19 per month, compared to $21.22 in 2021, while projected enrollment continues to increase. As previously announced, the average 2022 premium for Part D coverage will be $33 per month, compared to $31.47 in 2021.

We are committed to ensuring that the health system and Medicare work for people, their families and their providers, said CMS Administrator Chiquita Brooks-LaSure. Open Enrollment is the one time each year when more than 63 million people with Medicare can review their health care coverage to find new plans or change existing plans, discover extra benefits and help them save money.

An increasing number of Medicare Advantage dual eligible special needs plans cover both Medicare and Medicaid services for people who are dually eligible. In 2022, 295 plans , will cover all Medicare services, plus Medicaid-covered behavioral health treatment or long term services and supports, through a single organization.

Get CMS news at cms.gov/newsroom, sign up for CMS news via email and follow CMS on Twitter

Also Check: Is Trump Trying To Get Rid Of Medicare

Are Zero Premium Medicare Advantage Plans Really Free

Although Medicare Advantage plans can have a $0 premium, there are other things you may have to pay for out of pocket. These costs can include:

- Copays. A copayment is an amount that you pay for a service after you have met your deductible. These may be higher with plans that have a lower monthly premium, while plans with a higher monthly premium may have lower copays.

- Coinsurance. Coinsurance is the amount that you are responsible for paying for a covered service, even after youve paid your deductible. For example, if your coinsurance is 20 percent, you will pay the first 20 percent of the amount due, and your health plan will cover the rest.

- Deductible. A deductible is the amount that you are responsible for paying before your insurance plan begins to pay its share. Deductibles are often higher with plans that have lower premiums, meaning youll pay less each month in premiums but more out of pocket for individual healthcare services. After you pay your full deductible, your health plan will pay most of the cost for medical services, but you may still have to pay a copay or coinsurance.

- Other Medicare premiums. Even with a Medicare Advantage plan, you are responsible for paying the premiums for all other parts of Medicare that you may have. Most people do not pay a premium for Part A, but Part B does have a monthly premium.

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

Recommended Reading: Will Medicare Cover Walk In Tubs

Medicare Part D Prescription Drugs

The Part D monthly premiums vary by the plan you choose and the area of the country you live in. They can range from $10 to $100 per month. Premiums may be higher based on your reported income for two years before enrollment.

The amount you pay for your Part D annual deductible cant be more than $480.

After you reach a predetermined amount in copayments, youve reached the coverage gap, also called the donut hole. According to the Medicare website for 2022, once you and your plan have spent $4,430 on covered drugs, youre in the coverage gap. This amount may change from year to year. In addition, people who qualify for extra help paying Part D costs, dont fall into the gap.

During the coverage gap, youll pay 25 percent for most brand-name drugs, and 25 percent for generic drugs. If you have a Medicare plan that includes coverage in the gap, you may get an additional discount after your coverage is applied to the price of the drug. .

Once you have spent $7,050 out-of-pocket in 2022, youre out of the coverage gap and automatically into what is called catastrophic coverage. When youre in catastrophic coverage, you only play a small coinsurance amount for covered drugs for the rest of the year.

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Overview Of Medicare Advantage Coverage And Benefits

Medicare Advantage is a type of Medicare offered by private insurance companies. MA plans cover the primary benefits provided by Original Medicare, which includes Medicare Part A hospital insurance and Medicare Part B medical insurance.

Medicare Advantage plans typically offer policies that go beyond traditional Original Medicare. MA packages often include coverage for dental exams, vision services, hearing services, and wellness programs. Some plans also offer Medicare Part D prescription drug coverage.

Medicare Advantage pros and cons

Medicare Advantage is becoming increasingly popular, as more Medicare beneficiaries are opting for comprehensive MA plans over traditional Original Medicare. According to the Centers for Medicare and Medicaid Services , almost 40% of Medicare beneficiaries 26 million people are expected to have Medicare Advantage or other alternative Medicare plans in 2021, up from 31% in 2015.

Here are some benefits and pitfalls of MA plans that can affect your health coverage and your wallet:

Recommended Reading: Are Legal Residents Eligible For Medicare

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plan’s monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Medicare Payments To Medicare Advantage Plans

Medicare pays Medicare Advantage plans a capitated amount to provide all Part A and B benefits. In addition, Medicare makes a separate payment to plans for providing prescription drug benefits under Medicare Part D, just as it does for stand-alone prescription drug plans . Payments to plans are adjusted for enrollees health status and other factors.

Over the years, the payment methodology has been modified to achieve different policy goals, for example, to attract plans in rural areas, achieve Medicare savings, or deliver extra benefits to plan enrollees. The Balanced Budget Act of 1997 established a payment floor, applicable almost exclusively to rural counties. The Benefits Improvement and Protection Act of 2000 created payment floors for urban areas and increased the floor for rural areas. The Medicare Prescription Drug Improvement and Modernization Act of 2003 increased payments across all areas, and the Affordable Care Act of 2010 reduced payments to plans.

If a plans bid is higher than the benchmark, enrollees pay the difference between the benchmark and the bid in the form of a monthly premium, in addition to the Medicare Part B premium. If the bid is lower than the benchmark, the plan and Medicare split the difference between the bid and the benchmark the plans share is known as a rebate, which is designed to be used to provide supplemental benefits to enrollees. Payments to plans are then adjusted based on enrollees risk profiles.

You May Like: Should I Enroll In Medicare If I Have Employer Insurance

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the pros and cons of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for your personal situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

MA Plan ProsLearn more in this article.

You May Like: What Medicare Plans Do I Need

Added Benefits And Services

Do you need extra coverage like dental, hearing, or vision care? Some plans include extra benefits for no extra cost. Some offer them as plan “riders” for an additional monthly fee. Look for a plan that meets your budget and helps you save money on the benefits and services you need.

Why Are Some Medicare Advantage Plans $0

Many Medicare Advantage plans are offered to you with $0 monthly premium for a few reasons:

- Costs are lower because Medicare agrees upon rates with a network of healthcare providers.

- Medicare Advantage plans cover a range of preventive care and wellness programs, which keep participants healthier. The healthier the participant, the lower the cost of their healthcare.

- If you dont use all of the flat fee that Medicare pays the private insurance company, that money can be passed on as savings to you, making your premium $0 per month.

You May Like: Do I Need Medicare If I Have Other Insurance

Medical Savings Accounts Another Type Of Medicare Advantage

When we talk about Medicare Advantage, we often refer to these plans as a single entity, but in reality, there are actually 6 different types of MA plans.

The last one â Medical Savings Accounts â are another type of Medicare Advantage plan with no monthly premium.

Some Insurers See ‘eye

The payment issue has been getting a closer look as some Democrats in Congress search for ways to finance the Biden administration’s social spending agenda. Medicare Advantage plans also are scrambling to attract new members by advertising widely during the fall open-enrollment period, which ends next month.

“It’s hard to miss the big red flag that Medicare is grossly overpaying these plans when you see that beneficiaries have more than 30 plans available in their area and are being bombarded daily by TV, magazine and billboard ads,” says Cristina Boccuti, director of health policy at West Health, a group that seeks to cut health care costs and has supported Kronick’s research.

Kronick called the growth in Medicare Advantage costs a “systemic problem across the industry,” which CMS has failed to rein in. He says some plans saw “eye-popping” revenue gains, while others had more modest increases. Giant insurer UnitedHealthcare, which in 2019 had about 6 million Medicare Advantage members, received excess payments of some $6 billion, according to Kronick. The company had no comment.

“This is not small change,” says Joshua Gordon, director of health policy for the Committee for a Responsible Federal Budget, a nonpartisan group. “The problem is just getting worse and worse.”

Making any cuts to Medicare Advantage payments faces stiff opposition, however.

Recommended Reading: Will Medicare Pay For A Medical Alert Necklace