Prescription Drug Coverage Can Vary

VA coverage includes prescription drug benefits, and for this reason, many VA members may choose not to enroll in Medicare Part D .

And because VA drug benefits are considered creditable coverage by Medicare, VA members are not required to pay a late enrollment penalty if they choose to sign up for Medicare Part D at a later date.

You can use this helpful Medicare plan finder to look for Medicare prescription drug coverage that may be available in your area.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

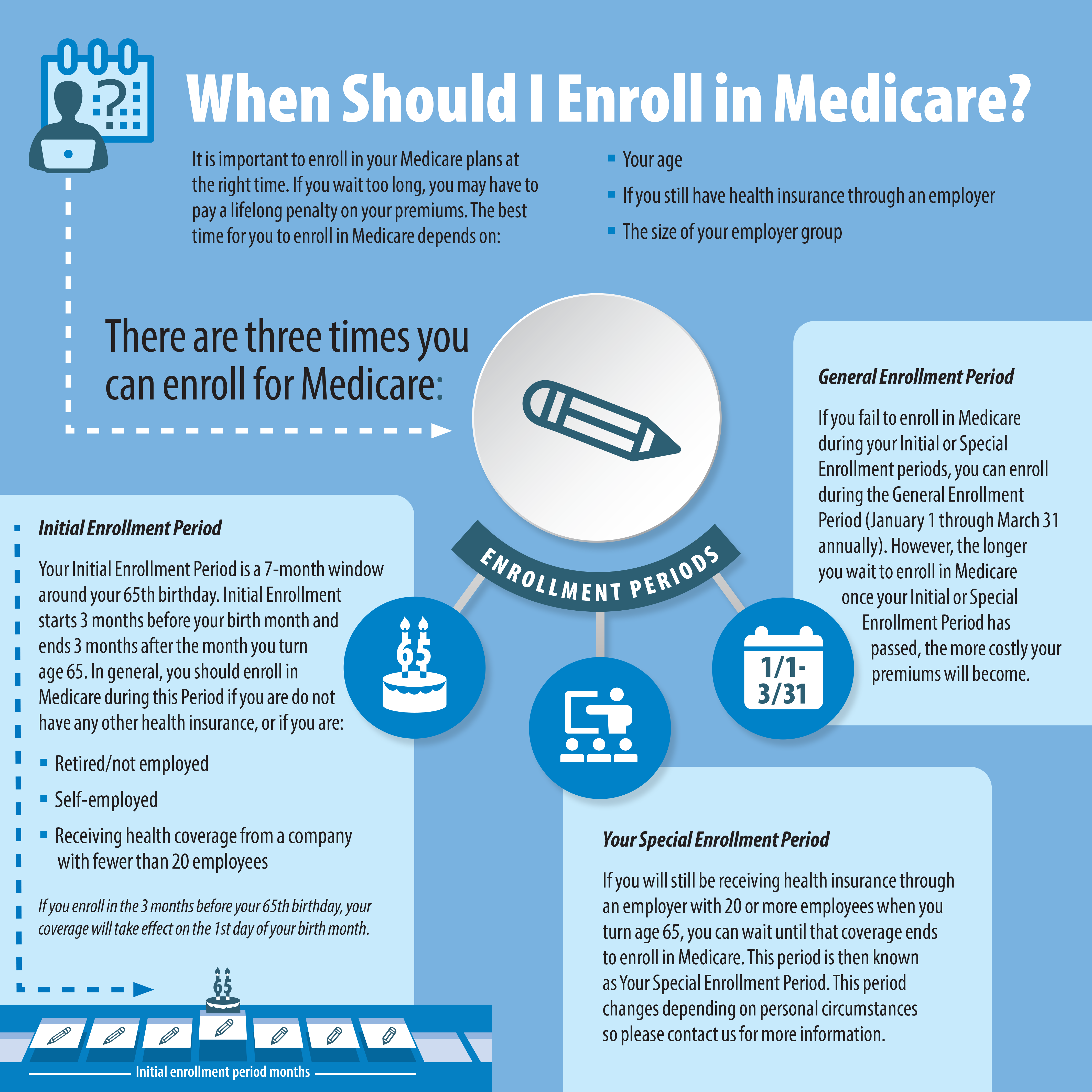

You Might Be Subject To Late Enrollment Fees If You Forego Medicare Enrollment

If you do not sign up for Medicare Part B during your Initial Enrollment Period, you may be subject to late enrollment penalties if you decide to sign up later on.

The Part B late enrollment penalty is 10 percent of the Part B premium for each 12-month period in which you were eligible to enroll but did not. You will have to continue to pay the penalty for as long as you remain enrolled in Part B.

You may be able to avoid the Part B late enrollment penalty if you qualify for a Medicare Special Enrollment Period. Choosing not to enroll in Medicare Part B because you have VA coverage does not qualify you for a Special Enrollment Period.

If Your Income Is High Or Very Low Or You’re Feeling Lucky You Might Be Able To Rely On Traditional Medicare Here’s Why Most People Don’t

Only 19% of Original Medicare beneficiaries have no supplemental coverage .

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.

Don’t Miss: Which Medicare Plans Cover Silver Sneakers

Am I Eligible For A Medicare Supplement Plan If Im Under Age 65

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement. If youre not sure whether Medicare Supplement insurance is available in your state, give Medicare.com a call at the phone number on this page, and licensed insurance agent can help you double-check the rules for your state. You can also contact your states insurance department for more information.

If youre under 65 and have Original Medicare due to a disability, amyotrophic lateral sclerosis , or end-stage renal disease , your state may let you apply for a Medicare Supplement policy when youre under 65. However, depending on where you live, you might not be able to purchase the policy option you wantor any Medicare Supplement policyuntil you turn 65. As mentioned above, the best time to enroll in a plan is during your Medicare Supplement Open Enrollment Period, when you have guaranteed-issue rights. If youre applying for a Medicare Supplement plan and youre under 65, you may not be able to get any plan you want with guaranteed issue.

Final Thoughts On Whether You Need A Medicare Supplement

So, you may have been asking yourself: Do I need Medigap coverage? Is Medigap necessary?

The answer is: Not for everyone, because some will choose Medicare Advantage.

But are Medicare Supplement plans worth it? YES.

Because we have many options for covering the gaps, there is no need to run around without supplemental coverage. If you find yourself asking whether you really need a Medicare supplement, ask yourself if you can afford to pay 20% of a $50,000 knee replacement or 20% of eight weeks of cancer chemotherapy.

If you are like most of us, you cant pay that much out of pocket. So yes, then you need a Medicare supplement or Medicare Advantage plan.

A Medigap plan or Medicare Advantage plan is a wise investment to protect you from catastrophic medical spending.

Regardless of your current financial situation, there is sure to be a plan that will fit your budget and medical needs. We have certified agents to guide you through the process of choosing the best plan to fit your needs.

Read Also: How Many Parts Medicare Has

How Do I Enroll

You can buy a Medigap policy from any insurer that is licensed to sell them in your state. But, an insurer cannot sell you a Medigap policy if you have Medicare Advantage unless you are in the process of switching back to Original Medicare.

Also, not all insurers offer all plans in all states. You can find what ones are available in your state on the Medicare website.

How Many Employees Does Your Employer Have

If you work for an company with 20 or more employers, youre not required to sign up for Original Medicare or Medicare supplemental insurance. You can continue to use your employer group coverage until you retire.

Delaying your Medicare enrollment wont result in any penalties. Youll still have access to an initial enrollment period for both Original Medicare and Medigap insurance.

If you work for a company with fewer than 20 employees, however, youll need to sign up for Original Medicare. Even if you have group insurance, it becomes the secondary payer under current Medicare rules, which means that Medicare will pick up the tab first.

You also become eligible for Medicare supplemental insurance. Your initial enrollment period works just the same as it does for retirees at age 65, so youll have a six-month window in which to apply for the Medigap plan you want in addition to Original Medicare.

Nobody is required to have Medigap, but it can help you save money on out-of-pocket costs when you rely on Medicare as your primary payer. For instance, many Medicare supplemental insurance plans cover deductibles and copayments you would otherwise have to pay out-of-pocket when using healthcare services.

Read Also: Does Medicare Pay For Eyeglasses For Diabetics

Medicare Supplement Insurance Plan Overview

Before deciding whether you need a Medicare Supplement insurance plan when you retire, you may want to read this brief overview of this type of plan.

The difference between what Medicare pays and the amount you owe for medical care is sometimes called the Medicare coverage gap. If you have Medicare Part A and Part B, you might have the option of purchasing a Medicare Supplement insurance plan to help pay the out-of-pocket costs of Medicare Part A and Part B. These plans are offered by private insurance companies.

In most states, Medicare Supplement insurance plan are standardized and assigned lettered names: Medicare Supplement insurance plans A-N. Each plan may cover a different combination of Original Medicares out-of-pocket costs, at different levels. For example, Medicare Supplement insurance Plan F* covers all of the Medicare Part A deductible, while Medicare Supplement insurance Plan K covers 50% of the Part A deductible.

In Massachusetts, Minnesota, and Wisconsin, Medicare Supplement insurance plan are standardized differently.

With most Medicare Supplement insurance plans you can use any doctor, health professional or hospital in the United States that accepts Medicare patients. Only one type of Medicare Supplement insurance plan, called Medicare SELECT, may require you to see doctors and other providers in the plan network.

Veterans May Choose Veterans Affairs Benefits And Medicare

As a Medicare-eligible Veteran or a Disabled Veteran, you have options when it comes to healthcare. You will find information that all Veterans should know when they become Medicare eligible.

Call today to schedule a time to discuss Medicare Supplement Insurance Plan options for:

- Medicare Supplement Insurance Plan,

- Medicare Advantage Plans and

- Medicare Part D Plan Prescription Drug Plans.

Choose from the top Medicare Carriers. See your plan options from Aetna, Humana, AARP and UnitedHealthCare.

Veterans Affair Benefits and Medicare

Although the VA Veterans Affair and Medicare are both Government Health Programs and if you are eligible for both, it is important to know your options.

You can have both Medicare and VA benefits. However, Medicare and VA benefits do not work together. Medicare does not pay for any care that you receive at a VA facility.

- VA plans only cover care at VA facilities,

- Medicare only covers care at Medicare assigned facilities.

- The VA and Medicare plans do not overlap.

Enroll in Medicare Part A If You Have VA Benefits

Medicare Part B If You Have VA Benefits

Although its not absolutely necessary, it is strongly recommended that any Medicare eligible Veterans and Disabled Veterans enroll in Medicare Part B .

Many veterans use their VA health benefits to get coverage for health care services and items not covered by Medicare, such as over-the-counter medications and annual physical exams.

Also Check: Does Medicare Cover Bed Rails

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Advantage Plans Can Be Good Options For Veterans

A Medicare Advantage plan may be worth considering if you are a veteran.

A Medicare Advantage plan will provide all the same coverage as Original Medicare, and some Medicare Advantage plans may cover some additional benefits that Original Medicare doesnt.

Some of these additional benefits can include coverage for:

- Vision

- Prescription drugs

Many Medicare Advantage plans may also come with $0 premiums, though $0 premium plans may not be available in all locations.

What Do Medicare Supplement Plans Not Cover

Medigap policies do not extend coverage beyond Original Medicare.

For instance, they do not cover dental and vision care, hearing aids and non-skilled home care.

Except for plans written before 2006, Medigap also does not cover prescription drugs. Separate plans, called Medicare Part D, are available through private insurers approved by the federal government.

Lastly, Medigap does not cover private-duty nursing or long-term care. Such coverage would have to come from a standalone long-term care insurance policy.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

Best Medicare Supplement Companies

Unlike health insurance, where policies differ among providers, Medicare supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans. Itâs important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

Cigna, similar to UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What Do These Policies Cover

Heres a link to the benefits each type of supplemental insurance provides. As you can see, most of them only cover Medicare deductibles and co-insurance nothing more. Unless otherwise stated in the policy, it will not cover any service not approved by Medicare. These policies also will not pay any healthcare provider a penny more than the amount Medicare approves for a service. That means that a health care provider who sees a patient who has a supplemental plan gets paid the exact same amount as he would from a patient who only has Medicare.

When you buy insurance, any insurance, its purpose is to cover you for unexpected costs you could never cover yourself. You buy homeowners insurance to cover damage done by a fire or a storm or water damage done by a broken pipe. No one buys a homeowners policy that covers utilities or routine maintenance. Most people who own a house are used to paying for the cost of painting it. Homeowners expect to pay for the cost of replacing their roof every 20 years as well, even though the cost of a new roof on most houses would actually exceed the cost a Medicare patient would pay for the treatment for most cancers.

We also dont use our car insurance to fill our gas tank, change the oil or pay for a transmission overhaul. Again, the cost of overhauling your cars transmission is probably more than what you would pay for a major surgery if you have Medicare.

You May Like: Why Is My First Medicare Bill So High

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

Its So Easy To Get A Free Medicare Quote

During Initial Enrollment Period

Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy. However, even if you have health problems, during your Medigap open enrollment period you can buy any policy the company sells for the same price as people with good health.

Recommended Reading: What Does Part B Cover Under Medicare

How Does Medigap Work

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan.

The provider bills Medicare first, then bills your Medigap plan. Depending on the plan, the provider then bills you for what remains, such as the Part B deductible, and your check goes to the provider.

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

State-by-state differences exist in some guarantees and limitations.

Is Medigap Insurance A Waste Of Money

The cost of Medicare Supplement plans is undoubtedly a factor to consider. Medigap premiums range in price, and most people can find an option theyre able to afford. When you assess the amount of money youll save on medical bills in the long run, paying a monthly Medigap premium often makes sense.

Its important to note that Medigap premiums vary per individual. Even if you get the same plan as your next-door neighbor, your premiums likely wont be the same. This range is due to a variety of factors that affect premium rates.

One of the main factors in determining premiums is the letter plan you select.

Each Medigap plan is standardized by the federal government. Further, carriers vary in their rating methods, which is another component in determining your premium rates.

When exploring the different plan options, keep your future needs in mind. If you enjoy traveling, a Medigap plan is a must.

Don’t Miss: How To Compare Medicare Supplement Plans

What Is The Purpose Of Medicare Advantage

When you compare Original Medicare and a Medigap plan with Medicare Advantage, it may seem like theres no purpose. Yet, millions of Medicare beneficiaries join a Medicare Advantage plan every year and they are satisfied with their coverage.

RELATED:How Does Medicare Advantage Work?

The true purpose of Medicare Advantage is choice. Many people want more than just major medical coverage, which is what Original Medicare offers. This is where Advantage plans shine. Many plans offer prescription drug coverage, dental care, vision, hearing, telehealth, SilverSneakers, and much more.

Enroll In Medicare Supplement Plan G

Some plans will allow you to enroll online on their company website. Others may require you to speak with an agent. Regardless, you will need to gather the necessary information to complete your application. There is no option to sign up on the Medicare website.

Every Medicare Supplement Plan G covers the same items. In that way, choosing the best plan is less about coverage than it is about pricing and customer service. After researching the companies offering Plan G in all 50 states , these six companies stood out for their cost structure, website friendliness, and perks.

Recommended Reading: What Is Medicare Part G